Mad Hedge Technology Letter

September 26, 2022

Fiat Lux

Featured Trade:

(DARLING TO DEMOTED)

(ARKK), (SARK), (PRNT), (IZRL), (ZM), (DNA), (TSLA)

Mad Hedge Technology Letter

September 26, 2022

Fiat Lux

Featured Trade:

(DARLING TO DEMOTED)

(ARKK), (SARK), (PRNT), (IZRL), (ZM), (DNA), (TSLA)

ARK Innovation ETF (ARKK) and its infamous CEO Cathie Wood was the poster boy for tech growth as the 10-year bull market in technology shifted into high gear.

That was then and this is now.

Oh, how one full year makes a world of difference in the tech universe.

ARKK is not touted anymore as the tech fund that could do no wrong.

We, as investors, cannot recreate the world we desire by a click of a button but must roll with the punches and embrace a paradigm shift into a new normal of economic uncertainty, stagnation, de-globalization, supply chain bottlenecks, weak emerging currencies, and most important, higher interest rates.

It just so happens that the best trade out there all along has been long the US dollar to the detriment of tech stocks. Tech usually does well when the US dollar is weak.

ARK’s underperformance is finally creating a change as Wood is relinquishing her role as portfolio at 3D Printing ETF (PRNT) and ARK Israel Innovative Technology ETF (IZRL).

Recent criticism has been fierce accusing the fund of being a one-woman show with much of the hopes and dreams pinned on Wood.

Much of this has to do with her earlier success in Tesla (TSLA) which I would like to give her credit for.

However, since then, she has ridden the coattails of popularity to become a tech growth evangelist no matter what conditions.

She has often cut a polarizing figure in the world of tech investing.

ARK’s centralization of management could prove to be their downfall.

The demotion for Wood won’t be taken lightly and this also could be a way to throw the next guy under the bus as tech stocks go from bad to worse.

There have been headscratchers lately.

ARKK bought more of Zoom Video Communications Inc. (ZM) last month and I find that more of a beggar’s belief than anything else.

A pandemic darling shouldn’t be confused with a small company with no competitive advantages against big tech.

Another bizarre decision was to buy Ginkgo Bioworks Holdings Inc. (DNA), which has fallen 69% this year. The company invests in early-stage biotech companies and has lost around $1.5 billion in the first half of 2022. The company in 2021 lost $1.8 billion as well, but Wood continues to pour capital into this start-up.

The Nasdaq is now rescinding the premium they used to generously deliver for loss-making companies but fast-growing companies.

Woods hypers herself up as investing in disruptive tech, but many of her companies aren’t that disruptive and she is not aware of market cycles or market timing.

For the past year, she has proved that she is a specialist in being wrong.

ARKK needs to be careful of a meltdown instead of flashing the cash on pandemic darlings because they are cheap today.

There is a reason that many of these speculative tech firms are now cheap, it’s because they aren’t growing enough or making enough money. She still doesn’t understand that.

Expect more demotions for Wood as her pixie dust has run dry.

Buy the inverse of ARKK called AXS Short Innovation Daily ETF (SARK) after bear market rallies.

Global Market Comments

September 26, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HOW TO TRADE THE 4TH QUARTER)

(SPY), (TLT), (AAPL), (TSLA), (RIVN)

In a mere six months, the Federal Reserve has morphed from Dr. Jekyll into Mr. Hyde.

It has changed from the stock market’s best friend to its worst enemy. Not only has the punch bowl been taken away, but it has also been smashed on the floor in a thousand pieces. A regime change has taken place in risk.

Welcome to a hostile Fed, one that utterly hates the stock market and loves cash. In fact, it loves cash so much it has raised its bid for overnight money from nothing to 4.2% in only six months. It is the fastest rise in interest rates in history.

To say that conditions have changed for the stocks would be the understatement of the century. This makes stocks less valuable, especially anything connected with growth, like technology stocks, and big borrowers, such as cruise lines.

Which raises the important question of the day: How the HECK are we going to trade the stock market in Q4?

It was in September of 2020 when 34 of my clients became millionaires buying TESLA at precisely the right time…

Well, the stars have aligned once again!!!!

In my TESLA free report, I list 10 reasons I’d tell my grandmother to mortgage her house and go all in.

Go to madhedgeradio.com and download my “Tesla Takes Over the World” free report.

Let me give you the good news first.

Q4 is likely to establish the final low for the bear market in stocks for this cycle. I don’t buy the endless years of suffering or the “lost decade” theories. Technology is just evolving too fast. It really makes no difference whether that low is at (SPX) $3,600, $3,300, or even $3,000. The best entry point for stocks in a decade will soon be at hand.

Keep in mind that with an (SPX) at $3,000 the market will be down a horrific 37.5% in a year. That is a worst-case scenario. A collapse this rapid has not happened since 1929.

This is for an economy that has seen no financial stresses whatsoever, except in crypto. This time, there are no banks going under, brokers going bust, housing crashes, or other similar stresses that drove the (SPX) down 52% by 2009.

There is nowhere near the misallocation of capital and malinvestment that we saw 15 years ago. Down 37.5% sounds like a screaming bargain to me.

The early “tell” that we are approaching the end came on Friday when the Volatility Index (VIX) hit $32.31. With any luck, it could top $40 in the coming weeks. Friday, when the Dow Average was down 800 points, we saw the largest put option buying in market history.

At that point, it will be possible for me to construct positions for you that are mathematically impossible to lose money with and offer the upside potential return of 10:1.

Once a handful of other technical indicators kick in, we’re there. This is what you should be looking for:

The (VIX) tops $40

Volume spikes

Down stocks top up ones by 90:10

The put:call ratio hits 2:1

A big intraday reversal that closes higher, like down $100 for the (SPX), up $150

Technology stocks, the most volatile sector in the market, also deliver a major turnaround

We get a dramatically lower report for the Consumer Price Index (and the next one is out October 13)

The Mad Hedge Market Timing Index falls below 10

So, what to buy this time?

With the Midterm elections now only 43 days away on Tuesday, November 8, it’s time to contemplate the implications for your retirement portfolio. The play of the decade is setting up.

Let me give you the good news first.

Whoever wins, and at this point, it really could be anyone, markets will rally after the election and power on until the end of 2022, some 10%-20%. The mere fact that the election is over is a huge market positive.

That’s the easy part.

But what if the election was held today?

The polls are telling us that the Democrats could pick up 2-3 seats in the Senate. The House now looks like a 50/50 split. Control could literally hinge on a handful of battleground states.

Suburban housewives now appear to be the great deciders.

So, what happens if the Democrats keep control of both houses, and the status quo is maintained?

For a start, taxes will be going up a lot, especially for the wealthy. Carried interest might finally make the ultimate sacrifice after coming back from the dead countless times. SALT taxes might get a break, but it is not likely. Once the government gets its hands on a revenue stream, it is loath to give it up.

It’s spending where we will see some important changes. Think more of the last two years, but in larger amounts.

Support for the Ukraine War will continue. So far, the US is getting great value for money. To eliminate the major military threat to the US and Europe for only $50 billion is the deal of the century. I’d pay ten times that.

So far, the Ukrainians are doing all the dying and we only write the checks. I greatly prefer that to a Vietnam-style commitment that bleeds us white (and by the way, I did some of that bleeding). Believe me, I’m doing everything I can to help by advising the Joint Chiefs of Staff.

The real game changer will be an alternative energy bill much larger than the last $733 billion bill. The goal will be to accelerate the decarbonization of the US, and ultimately the global economy. Of course, the free market will drive this anyway. No major automaker will be building internal combustion engines after 2030. What the government can do is to make it happen fast.

A year ago, climate change was an “it might happen someday after I’m long gone” kind of possibility. After a summer of 116 degrees in California and 114 degrees in France, “someday” has become “Yikes, it’s happening now!”

The last bill was truly misnamed as the “Inflation Reduction Act.” It really should have been called the “Tesla Shareholder Enrichment Bill”. Virtually every aspect of the bill somehow impinges on Elon Musk’s creation positively, which has been an overwhelming market leader in national electrification, enhanced EV subsidies, mass construction of charging stations, solar panels, and power walls, and decarbonization.

Since I am a major shareholder in (TSLA) and have been since the shares traded at $2.35, that’s fine with me. That probably explains why the shares are in the process of engineering a major upside breakout well before the election.

It isn’t just Tesla that will cash in. There is a broadening new leadership developing for the market to replace my technology stocks. Call it the “decarbonization sector”.

It includes EVs like Tesla (TSLA) and Rivian (RIVN), commodity stocks like copper miner Freeport McMoRan (FCX), uranium stocks like Cameco (CCJ) and the Uranium ETF (URA), solar companies like First Solar (FSLR) and SunPower (SPWR), alternative utilities like NextEra Energy (NEE), the world’s largest generator of electricity from wind and the sun, and silver plays like the iShares Silver Trust (SLV) and Wheaton Precious Metals (WPM), essential for high-efficiency wiring.

I will be adding more names to this list as I find them. Watch your research inbox.

Of course, 43 days in the political world is a couple of lifetimes in the real world, so anything can happen. A boatload of October surprises is probably just around the corner.

As for me, I’m putting more of my money into Tesla.

It all raises a new risk that we haven’t dealt with before.

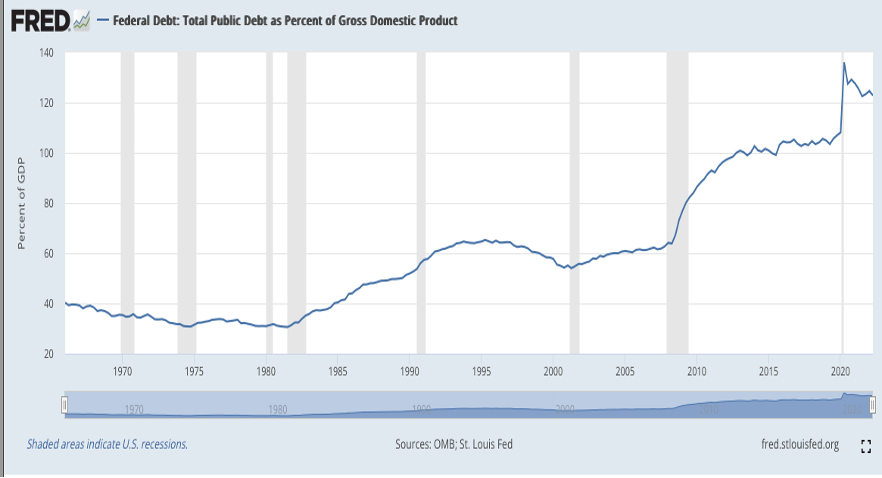

What if the US government can’t afford to pay its own debt? When the last financial crisis and recession began in 2007, the US national debt was only a paltry $9 trillion, or 60% of GDP. It has since risen to $30 trillion, or 140% of GDP. Holy smokes!

That was all well and good while interest rates were dropping from 7% to zero. What happens when rates go back up from zero to 7.0%? The cost of carry for the US Treasury more than doubles as well, taking a much bigger bite of government spending, more than it can afford.

Just thought you’d like to know.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility in market history, my September month-to-date performance maintained at +1.68%.

I used last week’s extreme volatility to add shorts in Apple (AAPL), the S&P 500 (SPY), and the United States US Treasury bond fund (TLT). That takes me to 30% long, 30% short, and 40% cash. I am holding back my cash for a truly cataclysmic market selloff.

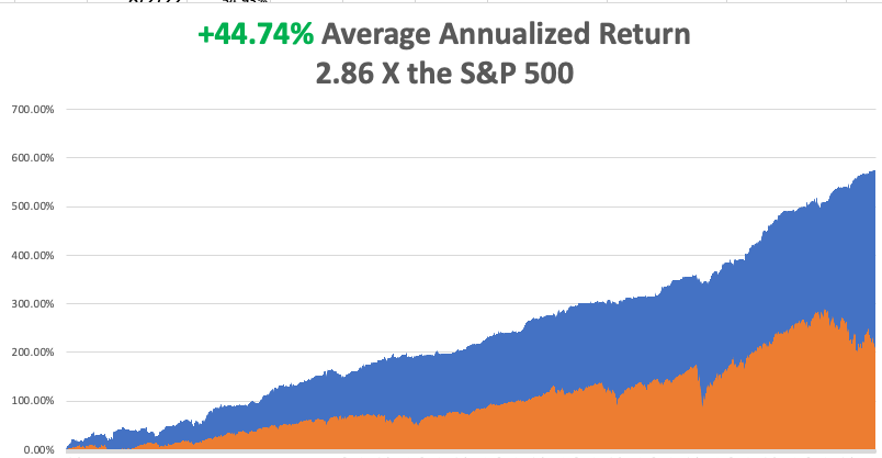

My 2022 year-to-date performance ballooned to +61.64%, a new high. The Dow Average is down -18.48% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +72.06%.

That brings my 14-year total return to +574.20%, some 2.86 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +44.74%, easily the highest in the industry.

On Monday, September 26 at 8:30 AM, the Chicago Fed National Activity Index for August is released.

On Tuesday, September 26 at 7:00 AM, the Durable Goods Index for August is out. New Home Sales are also printed.

On Wednesday, September 28 at 7:00 AM, Pending Home Sales for August are published.

On Thursday, September 29 at 8:30 AM, Weekly Jobless Claims are announced. We also learn the final report for US Q2 GDP.

On Friday, September 30 at 7:00 AM, the Personal Income and Spending are disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, I’ve found a new series on Amazon Prime called 1883. It is definitely NOT PG rated, nor is it for the faint of heart. But it does remind me of my own cowboy days.

When General Custer was slaughtered during his last stand at the Little Big Horn in 1876 in Montana, my ancestors spotted a great buying opportunity. They used the ensuing panic to pick up 50,000 acres near the Wyoming border for ten cents an acre.

Growing up as the oldest of seven kids, my parents never missed an opportunity to farm me out with relatives. That’s how I ended up with my cousins near Broadus, Montana for the summer of 1966.

When I got off the Greyhound bus in nearby Sheridan, I went into a bar to call my uncle. The bartender asked his name and when I told him “Carlat”, he gave me a strange look.

It turned out that my uncle had killed someone in a gunfight in the street out front a few months earlier, which was later ruled self-defense. It was the last public gunfight seen in the state, and my uncle hasn’t been seen in town since.

I was later picked up in a beat-up Ford truck and driven for two hours down a dirt road to a log cabin. There was no electricity, just kerosene lanterns and a propane-powered refrigerator.

Welcome to the 19th century!

I was hired as a cowboy, lived in a bunk house with the rest of the ranch hands, and was paid the princely sum of a dollar an hour. I became popular by reading the other cowboys newspapers and their mail since they were all illiterate. Every three days we slaughtered a cow to feed everyone on the ranch. I ate steak for breakfast, lunch, and dinner.

On weekends, my cousins and I searched for Indian arrowheads on horseback, which we found by the shoe box full. Occasionally, we got lucky finding an old rusted Winchester or Colt revolver just lying out on the range, a remnant of the famous battle 90 years before. I carried my own six-shooter to help reduce the local rattlesnake population.

I really learned the meaning of work and developed callouses on my hands in no time. I had to rescue cows trapped in the mud (stick a burr under their tail and make them mad), round up lost ones, and sawed miles of fence posts. When it came time to artificially inseminate the cows with superior semen imported from Scotland, it was my job to hold them still. It was all heady stuff for a 15-year-old.

The highlight of the summer was participating in the Sheridan Rodeo. With my uncle being one of the largest cattle owners in the area, I had my pick of events. So, I ended up racing a chariot made from an old oil drum, team roping (I had to pull the cow down to the ground), and riding a brahman bull. I still have a scar on my left elbow from where a bull slashed me, the horn pigment clearly visible.

I hated to leave when I had to go home and back to school. But I did hear that the winters in Montana are pretty tough.

It was later discovered that the entire 50,000 acres were sitting on a giant coal seam 50 feet thick. You just knocked off the topsoil and backed up the truck. My cousins became millionaires. They built a modern four-bedroom house closer to town with every amenity, even a big screen TV. My cousin also built a massive vintage car collection.

During the 2000s, their well water was poisoned by a neighbor’s fracking for natural gas, and water had to be hauled in by truck at great expense. In the end, my cousin was killed when the engine of the classic car he was restoring fell on top of him when the rafter above him snapped.

It all gave me a window into a lifestyle that was then fading fast. It’s an experience I’ll never forget.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

September 23, 2022

Fiat Lux

Featured Trade:

(SEPTEMBER 21 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (INTC), (NVDA), (AMD), (MU) (TBT), (TLT), (AMGN),

(VIX), (CHPT), (TSLA), (GS), (BAC), (MS), (JPM), (USO), (TLT)

Below please find subscribers’ Q&A for the September 21 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: What would cause you to look for a lower bottom than $330 on the (SPY)?

A: Nuclear war with Russia would certainly do the trick—they’re now threatening to use tactical nuclear weapons in Ukraine—and higher-than-expected interest rates. If we get another 75 basis points after this one today, then I think you’re looking at new lows, but we won’t find that out until November 2. So, the market may just bounce along the bottom here for a while until it sees what the Fed is going to do, not on this rate hike but the next one after that. Other than that, a few dramatically worse earnings from corporations would also allow us to test a lower low.

Q: Is it time to nibble on Nvidia Corporation (NVDA)?

A: Nvidia is one of the most volatile stocks in the market. You don’t want to go into it until you’re absolutely sure the bottom is in. If that means you miss the first 10% of the following move up, that’s fine because when this thing moves, you get a double or triple out of it. I would wait for the indecision in the market to resolve itself before you get too aggressive on the most volatile stocks in the market. The same is true for the rest of the semiconductor sector.

Q: What does a final capitulation look like?

A: The Volatility Index (VIX) ever $40. We’ve had a high of VIX at $37 so far this year. If really get over $40, that would be a new high for the year. That would signal people that are throwing in the towel, giving up the market, selling everything—of course that is always the best time to buy.

Q: How do we get LEAPS guidance?

A: We send our LEAPS recommendations first to our concierge members—we only have a small number of those—and then after that, they go out to all subscribers to the Mad Hedge Global Trading Dispatch. Everyone gets exposure to the LEAPS. By the way, with LEAPS, you can take up to a month to execute a position. What I do is literally buy 1 contract a day, so I get a nice average over the period of a month when the market is most likely bottoming.

Q: Do you see Intel Corporation (INTC) as a good candidate for a Taiwan invasion hedge?

A: Well, first of all, China’s not going to invade Taiwan. I’ve been waiting for this for 70 years and it’s not going to happen. Also, Intel’s new management has yet to prove itself. You have a salesman running the company; I never like companies run by a salesman. I’d prefer to have an engineer run an engineering company. The court is still out on Intel and whether they can turn that company around or not; so, I would much rather buy the market leaders, Nvidia (NVDA), Advanced Micro Devices (AMD), and Micron Technology (MU) in the semiconductor space.

Q: You talked dollar/cost averaging before. Should we pause on averaging in?

A: No, that's why I say buy one contract a day and put it in order to buy at the bid side of the market. That way, any sudden swoosh down in the market and you’ll get filled. The spreads on these LEAPS are quite wide, so you want to try to buy as close to the middle or bottom end of the spread, and putting in single contract orders over a month, of course, will do that to you.

Q: Does that mean it’s time to sell the ProShares UltraShort 20+ year Treasury Yield (TBT)?

A: I would say yes; (TBT) hit $30.30 yesterday, which is a new multi-year high. I would be taking profits on that because on the next turnaround in bonds, you could get a very rapid move in (TBT) from $30 back down to $20. I’d rather have you keep that profit than try to squeeze the last dollar out of it. Remember, the (TBT) has a negative cost of carry now of 8% a year and that is a big nut to cover.

Q; Market outlook for mid-2023?

A: We could hit my $4,800 target by mid-2023; that is up 28% from here.

Q: Can we buy LEAPS on Amgen (AMGN)?

A: Absolutely yes, you can. Go for the highest listed strike prices on the call side with the longest possible maturity. I would do the January 17, 2025 $350-$360 vertical bull call spread which you can buy now for $1.00. That gives two years and four months to get a tenfold return. That’s enough time for a full-bore recession to happen and then a recovery where markets take off like a rocket. The call spread you bought for $1.00 becomes worth $10.00.

Q: Is there a long position on the beneficiary of government plans to build EV charging stations?

A: There is, but I'm not recommending EV charging stations because it’s a low value-added business. You buy electric power from the local utility, add 10 cents and resell it. The margins are small, the competition is heating up. There are much smarter ways to play EVs than the charging station. ChargePoint (CHPT) is certainly one of them, but it’s not a great investment idea. Look at how ChargePoint (CHPT) has performed over the last six months compared to Tesla (TSLA) and you see what I mean.

Q: Given the very poor investor sentiment, why don’t we get a testing of the lows and result in a (VIX) pop?

A: Absolutely yes—that is what everybody in the market is waiting for. And it could happen as soon as this afternoon. If it doesn’t happen this afternoon, allow for a little rally and then a meltdown on the next piece of bad news.

Q: I’m not able to get an email response from customer support.

A: Try emailing filomena@madhedgefundtrader.com. If that doesn’t work, you can try calling at (347) 480-1034. Filomena will always be happy to take care of you.

Q: What maturity of US Treasury securities would you buy now?

A: I would buy the 30-year. You’re getting close to a 4% yield on that—that is starting to look attractive to people who don’t want to work for a living picking stocks on a daily basis. We are about to see the rebirth of bond investing.

Q: What about banks?

A: Banks will be a screaming buy and a three-year double once recession fears end, which could be in a couple of months. We now have sharply rising interest rates, which banks love, but the bear market in stocks has killed off the IPO business, credit risk is rising, and of course, the Bitcoin business has gone to zero also. So, I would wait for fears of credit quality to end, and then you’ll get a double in the banks very quickly, and notice how they’re all flatlining at a bottom, they’re not actually going down anymore.

Q: Which banks are good choices?

A: Goldman Sachs (GS) and Bank of America (BAC) are two great ones, along with Morgan Stanley (MS) and JP Morgan (JPM).

Q: Do you think the market will bottom by the midterms?

A: I do, I think we will bottom a few weeks before the midterms, or the day after. Sometimes that’s the way it goes, and then it will be off like a rocket for the rest of the year. If we can do this from a much lower level in the SPYs, so much the better. Remember, the next Fed meeting is six days before the election. Yikes!

Q: If OPEC cuts production (USO), won’t the supply/demand cause oil prices to start rising again, increasing inflation and people’s prices at the pump?

A: Yes, but OPEC needs the money. Not necessarily Saudi Arabia, but all the other members of OPEC are starved for cash, and that is always how these shortages end. The smaller members cheat on quotas and bust the price. That's clearly what’s driven us down $50 since the February high, small member cheating. And that will continue. It is a cartel with some serious internal conflicts that will never resolve.

Q: Does it cost $17,000 to mine a Bitcoin?

A: It did four months ago. My guess is it’s more expensive now because of the higher cost of electricity around the world. We may even be up to $20,000 cost, which is why it tends to hang around the $20,000 level on the low side. Below that, miners lose money and the supply dries up, just like you see in the gold market.

Q: Do you have an opinion on Real Estate Investment Trusts (REIT)?

A: Yes; credit risk is rising, as are the yields. In a real estate recession, you start to get more defaults on REITS, but the yields on them are very high; so if you are going to play, buy a basket to spread your risk.

Q: Would you buy ProShares UltraShort 20+ year Treasury Yield (TLT) calls spreads now?

A: Yes, but I would go farther in the money, like the mid $90s, because I don’t think we’ll get that low in this cycle. I would also go out another month; instead of a one-month call spread in the mid $90s, I would do a two-month maturity. You could probably take in about $2,000 on a $10,000 position in the mid $90s.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Back at Lake Tahoe

Global Market Comments

September 22, 2022

Fiat Lux

Featured Trade:

(THE MAD HEDGE SEPTEMBER 13-15 SUMMIT REPLAYS ARE UP),

(TESTIMONIAL)

Global Market Comments

September 21, 2022

Fiat Lux

Featured Trade:

(EXPLORING THE WORLD OF EXTREME LEAPS),

(TSLA)

Global Market Comments

September 20, 2022

Fiat Lux

Featured Trade:

(EXPLORING THE WORLD OF EXTREME LEAPS),

(TSLA)

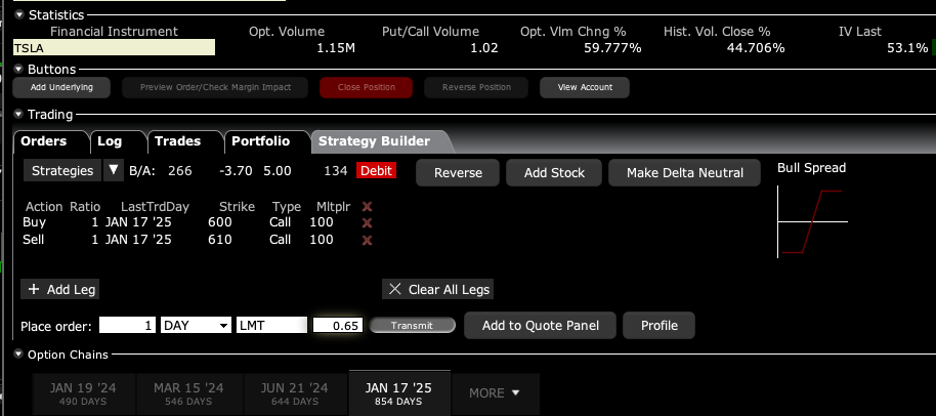

I sent out a trade alert last week to my concierge members to buy Tesla LEAPS. What came back surprised me. I wasn’t taking on enough risk, there wasn’t enough leverage. In short, I wasn’t being extreme enough.

So, I thought “OK, I can do leverage. You want leverage? Here is an extreme LEAPS.

I sent them back the following trade alert:

Trade Alert - (TSLA) – BUY

BUY the Tesla (TSLA) January 2025 $600-$610 out-of-the-money vertical Bull Call spread LEAPS at $2.00 or best

Opening Trade

9-16-2022

expiration date: January 17, 2025

Number of Contracts = 1 contract

If you are looking for a lottery ticket, then here is a lottery ticket.

While the chance of winning a real lottery is something like a million to one, this one is more like 2:1 in your favor. And the payoff is 14:1. That is the probability that Tesla shares will double over the next two years and four months.

You may not have noticed, but we have just entered the golden age of the electric vehicle, thanks to climate change and massive government support.

Tesla is the world’s largest electric vehicle manufacturer and will produce over 1.4 million cars this year. Demand is overwhelming supply, with the waiting list for the Model X stretching out over a year. The company is growing at 40% a year and plans to boost annual production to 20 million units by 2030.

Tesla is a far and away the most profitable automaker in the world with 30% profit margins, compared to only 10% for its competitors. Lithium-ion batteries are about to see a 20-fold improvement in cost per mile as the company moves towards solid-state technology. The effects on profits should be the same.

To learn more about the company (and to order a car), please visit their website at https://www.tesla.com

I am therefore buying the Tesla (TSLA) January 2025 $600-$610 very deep out-of-the-money vertical Bull Call spread LEAPS at $0.65 or best

Don’t pay more than $1.00 or you’ll be chasing on a risk/reward basis.

January 2025 is the longest expiration currently listed. If you want to get more aggressive with more leverage, use a pair of strike prices higher up. This will give you a larger number of contracts at a lower price.

Please note that these options are illiquid, and it may take some work to get in or out. Start at my price and work your way up until you get done.

Look at the math below and you will see that a 101% rise in (TSLA) shares will generate a 1,438% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 14.4:1 across the $600-$610 space.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

You don’t need to buy your entire position on day one. The day-to-day volatility of LEAPS is miniscule as the time value at two years plus is so great, so you have the luxury of picking up a new position over days, if not weeks.

I tend to buy just one or two a day every day until I have a full position. That way, I won’t get THE bottom, but I will get close to the bottom.

This is a bet that Tesla will not fall below $610 by the January 17, 2025 options expiration in 2 years and 4 months.

Here are the specific trades you need to execute this position:

Buy 1 January 2025 (TSLA) $600 calls at………….………$50.00

Sell short 1 January 2025 (TSLA) $610 calls at………..…$49.35

Net Cost:………………………….………..…………............….....$0.65

Potential Profit: $10.00 - $0.65 = $9.35

(1 X 100 X $9.35) = $935 or 14.35% in 2 years and 4 months.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

A New Theory of Tesla, or Why I’m Raising My Target to $1,000

I’ve been battling shorts in Tesla for a decade….and you won.

Look at the price of Tesla shares today and I have to laugh. From the $2.35 I paid for the shares after its IPO bombed in 2010, the price is up more than 100 times. Back then, even Elon Musk gave the company only a 10% chance of surviving.

My first Tesla, chassis no 125, was scrapped for parts a long time ago, thanks to a drunk driver in a GM Silverado on Christmas Eve. A lot of people talk about Tesla, but few have completely taken them apart, as I have…. twice.

Yes, it’s still true that if you buy the stock, you get the car for free, possibly a fleet of them.

I set my target at $1,000 a decade ago. My assumption was that the company would take over a large part of the global car market, about 90 million vehicles a year, and 15 million in the US alone. Tesla’s own plans have it manufacturing about 20 million units a year by 2030.

Add in an eye-popping $15,000 upgrade for fully autonomous street-to-street driving, and Tesla should be making tons of money by then.

That looks on track to happen and is already reflected in the current share price. But what if there is more to Tesla? A lot more?

In fact, after making the rounds in Silicon Valley, it’s clear that Tesla is just getting started. Tesla will become the largest publicly listed company in the world, surpassing Apple, and account for an important share of US GDP.

It might even become the world’s first $10 trillion company.

Yes, it will even grow larger than Saudi Aramco, which manages the kingdom’s oil riches. The irony is rich.

Let’s say that it reaches its ambitious 2030 goal of 20 million units. Then what?

For a start, when Tesla goes solid-state, battery efficiencies will increase 20-fold, costs will drop by 95%, and vehicle ranges will double. This could happen in as soon as two years. They already have the solid-state batteries. All they need now is to understand economical mass production.

The company has already said it is dropping the price of its cars to $25,000 in three years, but much more is possible.

Converting the car bodies from aluminum to carbon fiber, which the wheel wells are made of now, will further cut costs, increase ranges, and improve safety. Carbon fiber is five times stronger than steel at one-tenth the weight.

To reach that goal, the total Tesla fleet will have grown from 1.5 million units today to 100 million by 2030 and account for one-third of all the cars on the road. Those cars are going to need one heck of a lot of electricity to run.

Step in Tesla.

The company already has 20,000 superchargers in the US and that figure is doubling every year. No place in the country today is more than 100 miles away from a supercharger.

A Tesla Model 3 with a 100W battery pack driving 20,000 miles a year costs $720 to power at current prices. The entire fleet would cost $54 billion a year to run at a national average price of 12 cents/kWh.

Ring the cash register for Tesla….again.

Let’s say that rather than paying for electricity at an external charger at some distant shopping mall, you’d rather get the power at home for free.

Enter Tesla.

Finally, after a decade of waiting, Solar City, a Tesla subsidiary, is manufacturing cost-competitive solar roof tiles, or photovoltaic tiles. I have several readers already installing them at this moment. With a 15-year head start in silicon and battery technology, there is no reason why Tesla shouldn’t dominate in this industry as it already has with cars.

To keep the calculations simple, if 75 million homeowners buy solar roofs at an average of $36,000 each, the gross sales would reach $2.7 trillion. Kaching! To get a quote for your new solar roof, please click here.

To get the most out of your solar roof, you really need to buy a couple of 13.5W Tesla Powerwall storage batteries which would cost $25,000 installed. That way, the solar tiles will charge the batteries during the day, which will then power your house at night. You will become grid independent forever, as I have been for years.

Where do Powerwalls come from? Not the stork. They are recycled batteries from old Tesla cars. You can recycle silicon. You can’t recycle CO2.

That will protect you from soaring electric power costs driven by coming cascading bankruptcies of public utilities around the country, all caused by global warming. You also have your own power supply for the ten days a year the grid is down from wildfires on the west coast, or hurricanes on the east coast.

When the neighborhood lights go out, I charge my neighbors a bottle of wine for a cell phone charge. It’s not a bad racket, but I’m getting more than I can drink. In fact, I am producing enough excess electricity to power my entire neighborhood, about 20 houses.

Under the current law, the federal government will pay for 30% of your cost with alternative energy tax credits.

Naturally, you are going to want highspeed WIFI so all of the elements of your integrated solar solution can talk to each other and upgrade whenever they want. So, you’re going to need a Tesla Starlink satellite connection. The system now in beta testing will eventually deliver a 500 megabyte a second WIFI connection anywhere in the world. Starlink is already running the Internet in Ukraine….for free.

The global WIFI market is expected to grow to $7.2 trillion by 2025 (click here for the link). Give half of that to Tesla and you get another $3.6 trillion in sales. Oh, and if you want to sign up as a beta tester for Starlink, please click here.

Did I mention that Musk also owns a rocket company, Space X, which can launch satellites into space at one-tenth the cost of all competitors? Elon’s goal is to cut costs 100-fold. Musk has already taken over a lot of launch business from Europe which used to go to Russia.

Looking at Elon’s big picture as an engineer and scientist, I am amazed to find so many 10X and 100X improvements going on all at the same time!

Add all this together and you might get a market capitalization for Tesla of $10 trillion. Elon Musk would become worth $2 trillion. Then he really can afford that trip to Mars.

This prompts me to raise my target for Tesla shares to $1,000.

That’s not a particularly bold prediction. It’s only 3.6X the current share price, compared to the 117X gain seen since the IPO.

Hey, I got the last 117X right, what’s another 3.6X?

Nobody ever accused me of thinking small.

And if Tesla really does become a $10 trillion company, you’d be right to raise antitrust concerns. But as anyone who has done the math on breaking up these big companies can tell you, such a move would double their value. Tesla at $2,000 a share, anyone?

And as incredible as it may seem, Elon Musk outlined all of his grand global vision to me personally in great detail when I first met him in 1999 pitching me for an investment in X.com, which later became PayPal (PYPL).

Then the bright-eyed, fresh-faced overconfident kid was only 27 and worth a mere $10 million. But he had a nice car, a million-dollar 618 hp McLaren F-1 with a V-12 engine.

A pittance really.

I passed, which is why I am still working today.

No kidding.

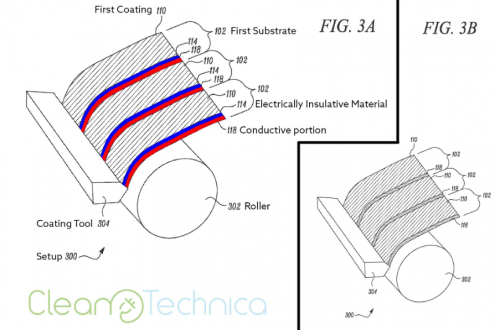

Tesla’s Solid State Batter Design

What its Modeled After

Chassis No. 125….R.I.P.

My Latest Set of Wheels

Like-Minded Found in Chicago

At the Pebble Beach Car Show

Going All-Electric

13.5 kWh Powerwall, Enough Juice to Run My House for a Day

This Lot of 300 Cars in Fremont Gets Filled and Emptied Out Three Times a Day

Back in 2010, the First Tesla They Had Ever Seen

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.