We are getting some tantalizing tastes of the new America that will soon arise from the wreckage of the pandemic.

Companies are evolving their business models at an astonishing rate, digitizing what’s left and abandoning the rest, and taking a meat cleaver to costs.

The corporate America that makes it through to the other side of the Great Depression will earn far more money on far fewer sales. That has been the pattern of every recession for the past 100 years.

While the pandemic may take earnings down from $162 per S&P 500 share in 2019 to only $50 in 2020, it sets up a run at a staggering $500 a share during the coming Roaring Twenties and Golden Age. All surprises will be to the upside and anything you touch will make you look like a genius.

For example, Target’s online sales have exploded 153%, allowing customers to order their groceries online and pick them up at curbside. (TGT) pulled this off in a mere three weeks. Without a pandemic, it would have taken three years to implement such a radical idea, if ever.

Survival is a great motivator.

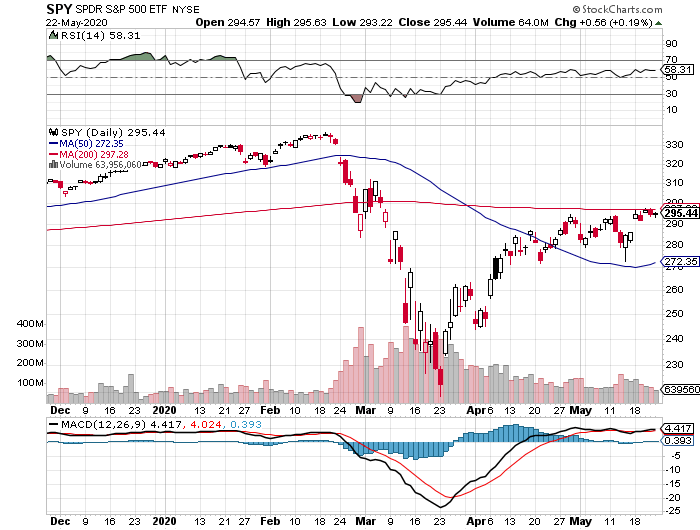

The (SPY) has been greatly exaggerating the public’s understanding of the stock market. Five FANGs and Tesla (TSLA) with 50%-200% moves off the bottom have made the index look irrationally strong.

The fact is that the majority who have shares have not even made a 50% retracement of this year’s losses. A lot of stocks, especially the reopening ones, are still crawling back of subterranean bottoms.

Investors now have the choice of chasing wildly expensive stocks that have already had spectacular runs, or cheap ones that will go bankrupt by the end of the year. It is a Hobson’s choice for the ages. I expect 10% of the S&P 500 to go under by the end of 2020.

I am spending a lot of time on the ground talking to businesses in California and Nevada and have come to two conclusions. They cannot fathom the true depth of the Depression we are now in and are greatly underestimating the length of time it may take to recover. We may not see the headline unemployment rate under 10% for years unless the government redefines the statistics, which they always do.

The S&P 500 is not the economy. It only employs 25% of America’s private sector labor force accounting for 20% of its total costs. Real estate accounts for another 15%. That leaves 35% of costs that can be completely eliminated or reengineered. This creates enormous share price upside possibilities.

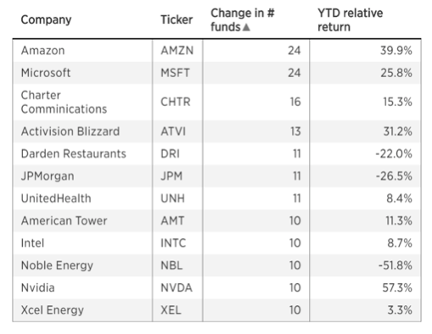

The concentration of the market is the most extreme I have ever seen, with five stocks getting most of the action, (FB), (AAPL), (NFLX), (GOOGL), and (MSFT).

There is a staggering $3.6 trillion in equity allocations sitting on the sidelines in cash. All those who got out at the March bottom are now desperately trying to get back in at the May top. Algorithms are making sure you get out cheap and get back expensive.

It will all end in tears.

One of the stunning developments of the crash has been the near doubling of retail stock trading. Options trading has increased even more. Millions of stimulus check recipients have poured their newfound wealth into the stock market instead of spending it on consumer goods, like they were supposed to.

This explains the over-concentration on the five FANG stocks, (FB), (AAPL), (NFLX), (GOOGL), and (MSFT), the greatest momentum stocks are out age, but in high speculative ones like Tesla (TSLA). The lowest cost online platforms like Robin Hood (click here).

All of this is completely irrevocably changing the character of the stock market, perhaps permanently. This may also explain why the Volatility Index remains stuck above$26.

Fed Governor Jerome Powell said no recovery without vaccine, and that’s without a second wave. It could be a long wait. In the meantime, the Atlanta Fed said Q2 US GDP will be down -42%, the weakest quarter in American history. We find out mid-July.

Housing Starts collapsed by 30.2% in April, in the sharpest drop on record. But prices aren’t falling. There is still a massive bid under the market from still-employed millennials. Your home could be you best performing asset this year. The 30-year fixed rate mortgage at 3.0% is a big help.

Weekly Jobless Claims topped 2.4 million, taking the two-month total to a breathtaking 39 million. One out of four Americans is now unemployed, matching the Great Depression peak. US deaths just topped 98,000, 21 times China’s fatality rate where the disease originated and with four times our population. People will keep losing jobs until the death rate peaks, which could be many months, or years.

Leading Economic Indicators crashed by 4.4% for April, showing the economy is still in free fall. So, how much more stock do you want to buy here?

Up to 60% of mall tenants aren’t paying rent, with $7.4 billion skipped in April alone. See my earlier “Death of the Mall” piece. It’s another harsh example of the epidemic accelerating all existing trends.

The market is not reflecting the long-term damage to the economy, says my old buddy and Morgan Stanley colleague David Gerstenhaber. When the bailouts run out, the economy could go into free fall. It could take years to get below 10% unemployment rate again, as many of the layoffs and furloughs are permanent. Keep positions small. Anything could happen. I spent the 1987 crash with David.

Existing Home Sales cratered an incredible 17.8% in April to an annualized 4.88 million units, the largest one-month drop since 2010. Inventory dropped to an all-time low of only 1.7 million, down 19.7%, presenting a 4.1-month supply. Sellers failed to list and those who had a home took them off. Unbelievably, this pushed median home prices to a new all-time high of 286,000, up 7.4% YOY. The biggest sales fall in the west, where the US epidemic started.

China took over Hong Kong, suspending most civil liberties in response to Trump’s multiple attacks. And you know what? There is nothing we can do about it that hasn’t already been done. Talk about going into battle with no dry powder. I’m sure the US 7th Fleet will be out there soon to provoke an attack. Anything to distract attention from the 100,000 Americans who died from Covid-19 on Trump’s watch. As if markets didn’t already have enough to worry about.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $0 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

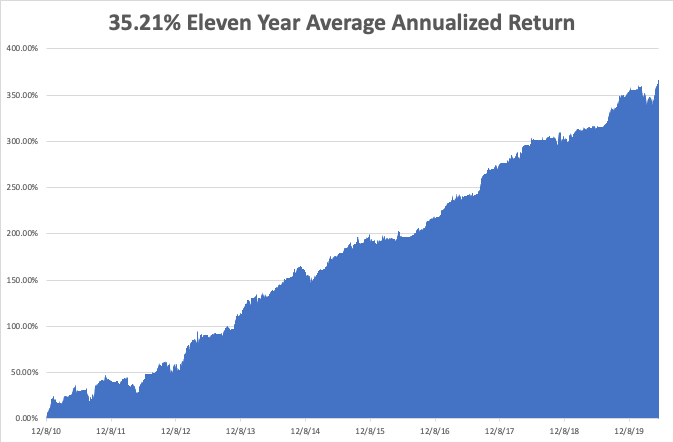

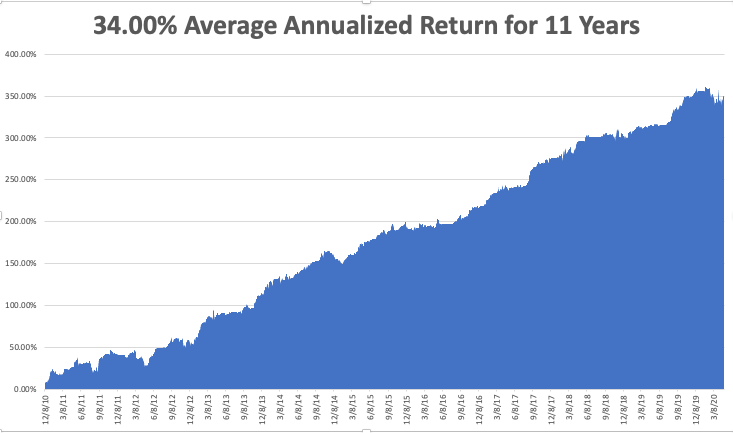

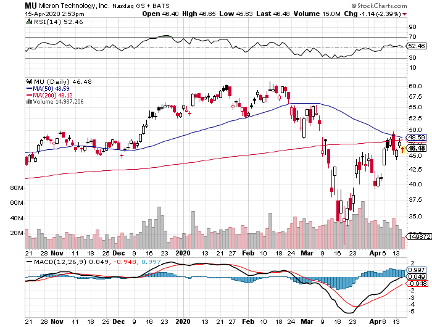

My Global Trading Dispatch performance had another fabulous week, up an awesome +4.97%, and blasting us up to a new eleven-year all-time high of 77%. It has been one of the most heroic performance comebacks of all time.

My aggressive short bond positions really delivered some nice profits, despite the fact the bond market went almost nowhere. That’s because time decay for the June 19 expiration is really starting to kick in. I also got away with a small long in the bond market for the second time in two weeks.

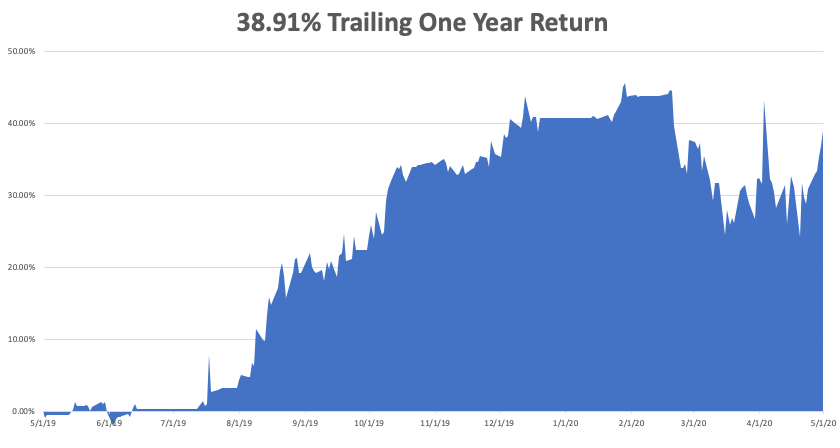

That takes my 2020 YTD return up to +10.86%. That compares to a loss for the Dow Average of -12.6%. My trailing one-year return exploded to 50.85%, nearly an all-time high. My eleven-year average annualized profit exploded to +35.21%.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here at https://coronavirus.jhu.edu.

On Monday, May 25, I’ll be leading the neighborhood veterans parade for Memorial Day. Markets are closed.

On Tuesday, May 26 at 9:00 AM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, May 27, at 4:30 PM, weekly EIA Crude Oil Stocks are published.

On Thursday, May 28 at 8:30 AM, Weekly Jobless Claims are announced. We also get the second estimate for the Q1 GDP is printed. At 10:00 AM, April Pending Home Sales are announced.

On Friday, May 29, at 2:00 PM, the Baker Hughes Rig Count follows at 2:00 PM.

As for me, I will be hitting the town beaches at Lake Tahoe for the first time this spring, mask in hand, where waitresses serve you mixed drinks on order. Outdoors will be the only safe place this year.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader