It’s pretty obvious that when the Consumer Price Index was released last Tuesday, the data point was lying through its teeth. The 0.4% increase in the Core CPI brought the YOY gain to a heart-palpitating 3.9%, much higher than expected. The stock market thought it was telling God’s home truth by plunging 740 points at its low.

Interest rate sensitives, like bonds, utilities, real estate, precious metals, energy, and foreign currencies were particularly hard hit.

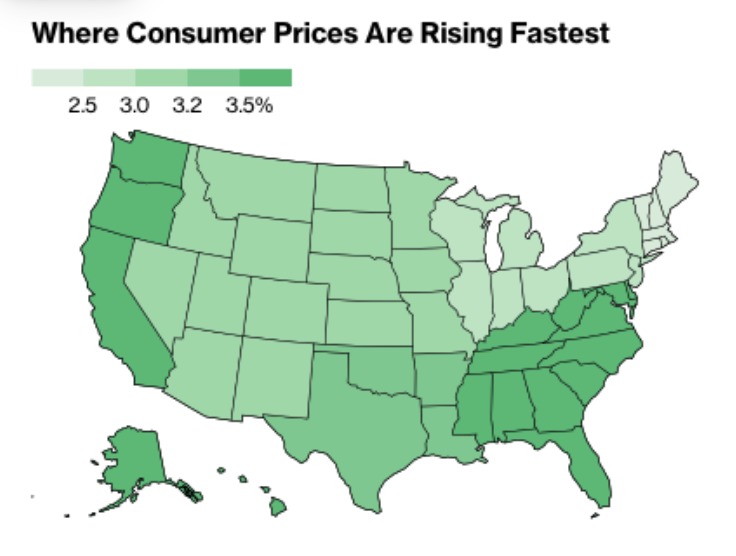

I have been in the financial markets quite a long time now and as a result, am pretty used to being told porky pies (lies in London’s East End). Take the CPI for example. The reported number came in at a sizzling 3.3% for January. That is enough to kill off any hopes of a Fed interest rate cut in 2024, thus the ensuing wreckage in the market.

However, back out a single number, the 6.0% rise in housing rental costs, and the inflation rate drops all the way to 2.0%, bang on the Fed’s long-term inflation target. In other words, interest rates should be cut RIGHT NOW!

That is clearly the view that the markets came around to on Wednesday, which saw the Dow Average recover 151 points.

Unfortunately, lying is a fact of life in the stock market at every conceivable level. But learn to tolerate it and you can make millions of dollars. That works for me. Like my old college statistics professor used to tell me: “Statistics are like a bikini bathing suit; what they reveal is fascinating, but what they conceal is essential.”

In fact, we may see the stock market bouncing back and forth like a ping pong ball between big technology and the interest rate sectors, depending on what the bond market is doing that day driving traders nuts. After all, it was YOU who wanted to be in show business!

In the meantime, complacency rules all. Cash flows into stocks are near all-time highs. Market strategists have been ratcheting up their yearend targets on a daily basis, even me (I’m now at SPX 6,000). The option put/call ratio is about as low as it gets, meaning there is a universal belief that stocks will continue to appreciate. That’s with the S&P 500 earnings multiple trading at a rich 20.5.

I would be remiss in my duties as a financial advisor if I did not also warn you that these are all market-topping signals, at least for the short term.

Double Yikes, and Heavens to Betsy!

Of course, all eyes will be on the Q4 NVIDIA earnings this week, out after the close on Wednesday and probably the most important data release of the year. Everything else this week is essentially meaningless.

If earnings come in anything less than perfect, up 100% YOY, it could trigger a long overdue correction in the stock market in general and (NVDA) in particular. On the other hand, earnings just might come in more than perfect.

I have been covering (NVDA) for more than a decade back when it was just a video game play and I describe it today as a monopoly on the world’s most valuable product. Their top-end H100 graphics cards are now selling for a breathtaking $30,000 each and Meta (META) just ordered 450,000 of these babies, partly so their competitors can’t get their hands on them. For those who don’t have a calculator that is a single order worth a mind-blowing $13.5 billion.

That is why the stock is up 224% in a year and 50X since the first Mad Hedge trade alert on the company went out at a split-adjusted $2.00. Those who think they can clone (NVDA) and their products overnight can dream on. Most employees have golden handcuffs in the form of vested options at the same $2.00 strike price or lower.

The Magnificent Seven are still cheap relative to the rest of the market. Their price-to-growth ratio (PEG Ratio) is still only half the rest of the market. The Mag Seven will see earnings grow 20% this year with a price-earnings multiple of 30X giving you a PEG of 1.5X. The Unmagnificent 493 are selling at a PEG ratio of 3.0X, meaning they are twice as expensive.

Just thought you’d like to know.

So far in February, we are up +3.42%. My 2024 year-to-date performance is also at -0.86%. The S&P 500 (SPY) is up +4.72% so far in 2024. My trailing one-year return reached +59.62% versus +24.57% for the S&P 500.

That brings my 15-year total return to +675.77%. My average annualized return has retreated to +51.32%.

Some 63 of my 70 trades last year were profitable in 2023.

I am maintaining a double long in, you guessed it, (NVDA). My longs in (MSFT), (AMZN), (V), (PANW), and (CCJ) all expired at their maximum potential profits with the February option expiration.

CPI Smacks Market, coming in at 0.3% in January instead of the expected 0.2%. The highflyers took the biggest hit. Bonds were destroyed, taking ten-year US Treasury yields up to 4.30%. Is the falling interest rate story dead, or just resting? Rising rents were the big villain here.

US Retail Sales Dive 0.8% in January, a shocking decline from the blowout in December. Consumers didn’t bite on those New Year Sales because they actually started in November. Winter storms as well as technical factors had distorted the data.

Weekly Jobless Claims Dropped to 212,000, an improvement of 8,000 from the previous week. Continuing claims rose to 1,895,000.

https://www.dol.gov/ui/data.pdf

Here are Dan Niles’ Tech Shorts, Apple (AAPL), (TSLA), and Alphabet (GOOGL). He is long Microsoft (MSFT), (AMZN), (META), and of course NVIDIA (NVDA). Sounds like a good call to me. Dan knows what he is doing.

Uber Announces First Ever Share Buy Back, some $7 billion. In the meantime, they have to cope with a driver strike. Buy (UBER) on dips.

$929 Billion in US Commercial Real Estate Loans are Due this Year or 20% of the total. Will there be widespread defaults or will borrowers get rescued by falling interest rates in the second half? Will they extend and pretend? Avoid regional banks like the plague, which lack the capital to cope with this.

US Dollar (UUP) Hits Three Month High, on the hot CPI. You need a falling CPI to get a weak buck. The Euro plunged to $1.07, the British pound to $1.25, the Australian dollar to 65 cents, and the Japanese yen to ¥151.

NVIDIA Now Tops Amazon in Market Value, at $1.2 trillion now the fourth most valuable company in the US. It could eventually top Microsoft’s (MSFT) market cap as it is growing much faster. Those (NVDA) LEAPS are looking pretty good. The shares are up 50% so far in 2024. Buy (NVDA) on dips.

Biden to Ban Chinese EV Car Imports. The measures would apply to electric vehicles and parts originating from China, no matter where they are assembled, in a bid to prevent Chinese makers from moving cars and components into the United States through third countries such as Mexico. Chinese cars will never meet US safety standards. Try driving in China.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, February 19, the markets are closed for Presidents Day.

On Tuesday, February 20 no data of importance is released.

On Wednesday, February 21 at 2:00 PM EST, the Minutes from the previous Federal Open Market Committee meeting are published. NVIDIA earnings are released after the market closes.

On Thursday, February 22 at 8:30 AM EST, the Weekly Jobless Claims are announced. Existing Home Sales are Released.

On Friday, February 23 at 2:30 PM the Baker Hughes Rig Count is printed.

As for me, the first thing I did when I received a big performance bonus from Morgan Stanley in London in 1988 was to run out and buy my own airplane.

By the early 1980s, I’d been flying for over a decade. But it was always in someone else’s plane: a friend’s, the government’s, a rental. And Heaven help you if you broke it!

I researched the market endlessly, as I do with everything, and concluded that what I really needed was a six-passenger Cessna 340 pressurized twin turbo parked in Santa Barbara, CA. After all, the British pound had just enjoyed a surge against the US dollar so American planes were suddenly a bargain. It had a maximum range of 1,448 miles and therefore was perfect for flying around Europe.

The sensible thing to do would have been to hire a professional ferry company to fly it across the pond. But what’s the fun in that? So, I decided to do it myself with a copilot I knew to keep me company. Even more challenging was that I only had three days to make the trip, as I had to be at my trading desk at Morgan Stanley on Monday morning.

The trip proved eventful from the first night. I was asleep in the back seat over Grand Junction, Colorado, when I was suddenly awoken by the plane veering sharply left. My co-pilot had fallen asleep, running the port wing tanks dry and shutting down the engine. He used the emergency boost pump to get it restarted. I spent the rest of the night in the co-pilot’s seat trading airplane stories.

The stops at Kansas City, MO, Koshokton, OH, and Bangor, ME proved uneventful. Then we refueled at Goose Bay, Labrador in Canada, held our breath, and took off for our first Atlantic leg.

Flying the Atlantic in 1988 is not the same as it is today. There were no navigational aids and GPS was still top secret. There were only a handful of landing strips left over from the WWII summer ferry route, and Greenland was still littered with Mustangs, B-17s, B24s, and DC-3s. Many of these planes were later salvaged when they became immensely valuable. The weather was notoriously bad. And a compass was useless, as we flew so close to the magnetic North Pole the needle would spin in circles.

But we did have NORAD, or America’s early warning system against a Russian missile attack.

The practice back then was to call a secret base somewhere in Northern Greenland called “Sob Story.” Why it was called that I can only guess, but I think it has something to do with a shortage of women. An Air Force technician would mark your position on the radar. Then you called him again two hours later and he gave you the heading you needed to get to Iceland. At no time did he tell you where HE was.

It was a pretty sketchy system, but it usually worked.

To keep from falling asleep the solo pilots ferrying aircraft all chatted on a frequency of 123.45 MHz. Suddenly, we heard a mayday call. A female pilot had taken the backseat out of a Cessna 152 and put in a fuel bladder to make the transatlantic range. The problem was that the pump from the bladder to the main fuel tank didn’t work. With eight pilots chipping in ideas, she finally fixed it. But it was a hair-raising hour. There is no air-sea rescue in the Arctic Ocean.

I decided to play it safe and pick up extra fuel in Godthab, Greenland. Godthab has your worst nightmare of an approach, called a DME Arc. You fly a specific radial from the landing strip, keeping your distance constant. Then at an exact angle, you turn sharply right and begin a decent. If you go one degree further, you crash into a 5,000-foot cliff. Needless to say, this place is fogged 365 days a year.

I executed the arc perfectly, keeping a threatening mountain on my left while landing. The clouds mercifully parted at 1,000 feet and I landed. When I climbed out of the plane to clear Danish customs (yes, it’s theirs), I noticed a metallic scraping sound. The runway was covered with aircraft parts. I looked around and there were at least a dozen crashed airplanes along the runway. I realized then that the weather here was so dire that pilots would rather crash their planes than attempt a second go.

When I took off from Godthab, I was low enough to see the many things that Greenland is famous for polar bears, walruses, and natives paddling in deerskin kayaks. It was all fascinating.

I called into Sob Story a second time for my heading, did some rapid calculations, and thought “damn”. We didn’t have enough fuel to make Iceland. The wind had shifted from a 70 MPH tailwind to a 70 MPH headwind, not unusual in Greenland. I slowed down the plane and configured it for maximum range.

I put out my own mayday call saying we might have to ditch, and Reykjavik Control said they would send out an orange bedecked Westland Super Lynch rescue helicopter to follow me in. I spotted it 50 miles out. I completed a five-hour flight and had 15 minutes of fuel left, kissing the ground after landing.

I went over to Air Sea Rescue to thank them for a job well done and asked them what the survival rate for ditching in the North Atlantic was. They replied that even with a bright orange survival suit on, which I had, it was only about 50%.

Prestwick, Scotland was uneventful, just rain as usual. The hilarious thing about flying the full length of England was that when I reported my position, the accents changed every 20 miles. I put the plane down at my home base of Leavesden and parked the Cessna next to a Mustang owned by rock star Randy Newman.

I asked my ferry pilot if ferrying planes across the Atlantic was always so exciting. He dryly answered “Yes.” He told me in a normal year about 10% of the planes go missing.

I raced home, changed clothes, and strode into Morgan Stanley’s office in my pin-stripped suit right on time. I didn’t say a word about what I just accomplished.

The word slowly leaked out and at lunch, the team gathered around to congratulate me and listen to some war stories.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Flying the Atlantic in 1988

Looking for a Place to Land in Greenland

Landing on a Postage Stamp in Godthab Greenland

On the Ground in Greenland

No Such a Great Landing

Flying Low Across Greenland

Gassing Up in Iceland

Almost Home at Prestwick

Back to London in 1988