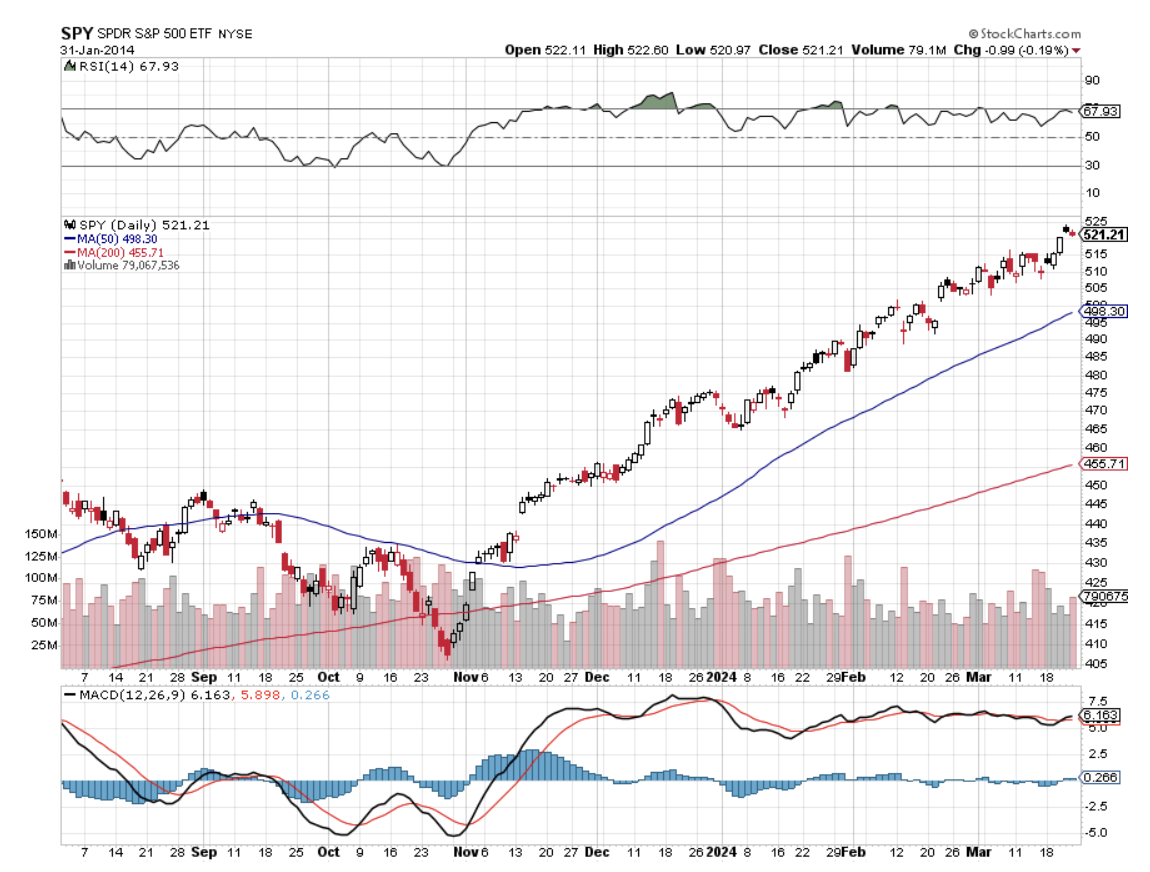

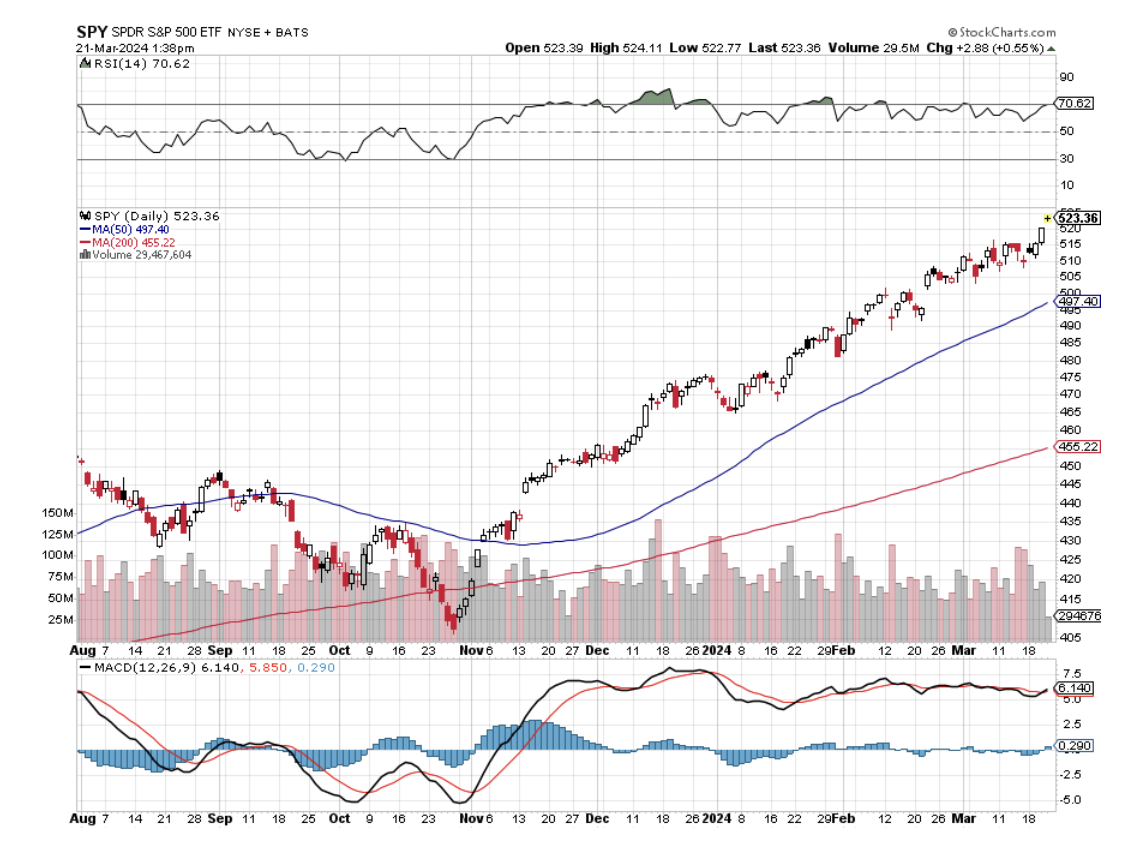

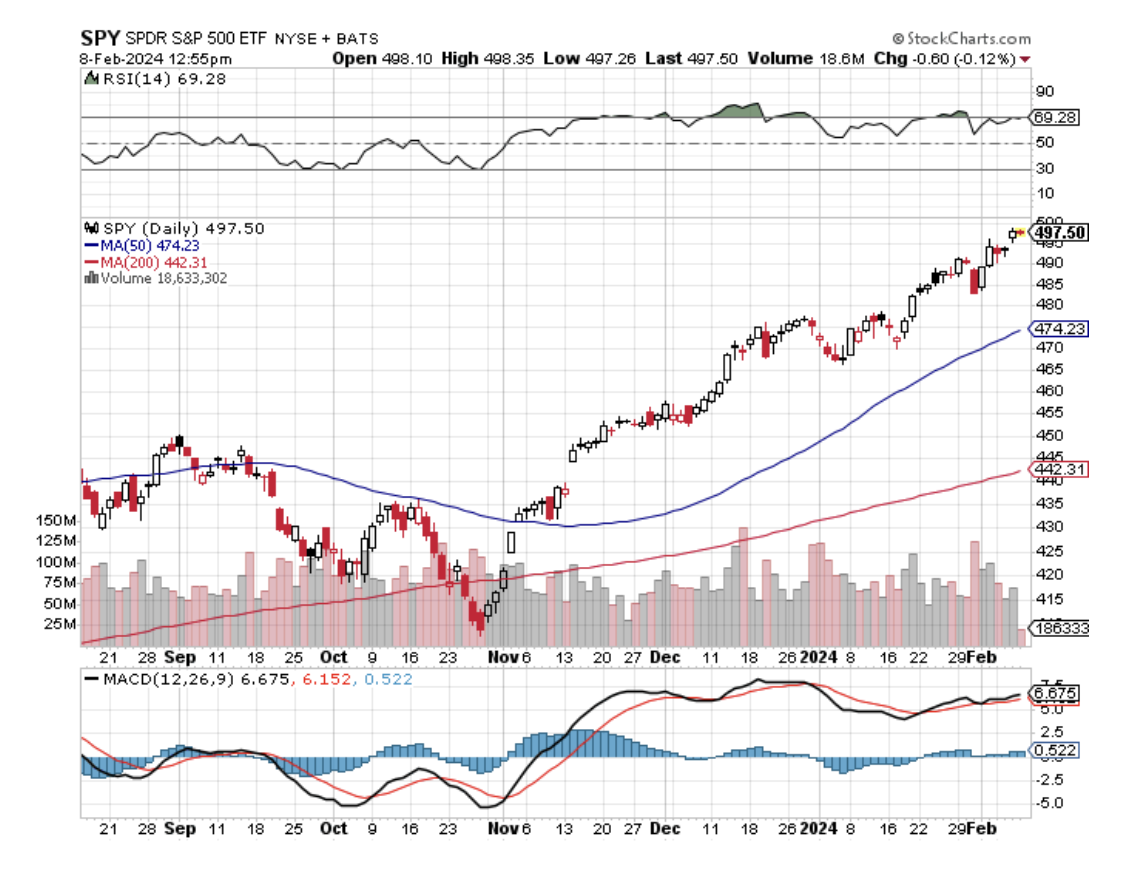

You need to have a sense of humor and a strong dose of humility to work in this market. After predicting last week that the market would NOT crash but grind sideways, it then posted the next week of the year. Stocks are actually accelerating their move to the upside.

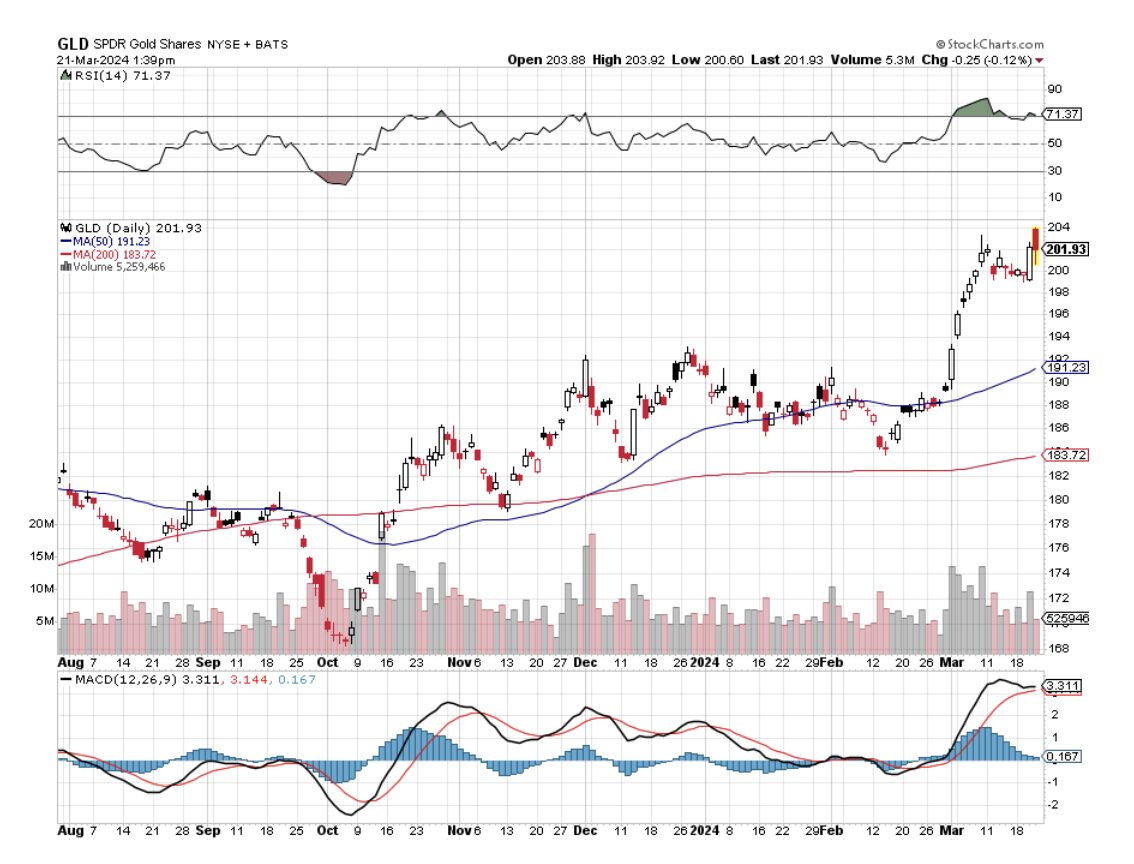

Of course, we got a big assist from Fed Governor Jay Powell who practically wrote in his own blood a promise that interest rates would be cut at least three times by the end of the year. That is quite a gesture, and all risk assets loved it, even the ones that have been asleep for a year, like gold (GLD) and silver (SLV).

Miraculously, this does happen and there has been a big one over the last two years that nobody knows about.

Cheniere Energy (LNG) shipped 640 tankers full of natural gas (UNG) to Europe last year and 630 in 2022. One tanker provides enough gas to heat one million homes for a month. You can do the math. In total, it has sent out 3,400 tankers since 2016, mostly to China.

When Russia invaded Ukraine in 2022, Europe was totally dependent on Vladimir Putin for gas. Any doubt about the Russian supply was ended when the Nordstream undersea pipeline was mysteriously blown up. A total cut-off would have been an economic disaster and caused the collapse of NATO.

Two years ago, it was believed that even if we could get the gas to Europe, there were no facilities to liquefy natural gas as it is shipped back into natural gas. Then 16 floating de-liquefaction plants showed up out of nowhere.

Natural gas demand has been soaring in the US as well. Over the past 20 years, coal has dropped from generating 50% of the US electric power supply to only 19% (the unused American share of the coal was sold to China). That has eliminated 500 million tons of carbon dioxide from entering the atmosphere.

If you noticed that the skies over American cities are getting clearer, this is the reason.

Much has been made over Biden’s “pause” of permitting for new natural gas facilities. The reality is that it will take four years to build the 16 new gas export facilities that have already been approved. By then, we’ll have a new president. All Biden did was throw a bone at the environmental wing of his party. Such are the ways of Washington.

By the way, the Republican Party now has an environmental wing too. Who knew? It’s all proof that if you live long enough, you see everything.

One of the reasons I have been in love with cybersecurity stocks like Palo Alto Networks (PANW) for the past decade is that hacking is the ultimate growth industry. It never goes out of style, is recession-proof, and is growing at an exponential rate.

It is also getting more sophisticated. The big hackers are franchising their business models, inviting in criminals with minimal computer knowledge, vastly increasing their numbers. They are attacking small vendors to large companies to get access to the big ones. They are also picking targets too poor to afford the big cybersecurity companies. The City of Oakland is a classic example, which was prevented from paying its teachers for six months. And now they have AI.

Spending on cybersecurity is expected to grow from $188 billion in 2023 to $215 billion this year, a gain of 14.36%. The number of data breaches has rocketed by 78% over the past two years. Buy (PANW) on dips, which we are seeing right now.

“We’re going to need a bigger GPU” to borrow a famous line from Stephen Spielberg’s blockbuster Jaws.

If you want a peak at the future, both of our own and NVIDIA stock, check out the company’s latest entry into the chip wars, the $50,000 Blackwell GPU, available in a few months. In layman’s terms, it offers four times the computing ability but requires only one-quarter of the electric power, which is increasingly becoming an AI issue. It also uses deep learning to write its own software.

The chip was introduced by CEO Jensen Huang at the Developers conference in San Jose, which I attended in a venue normally occupied by rock stars. Huang started the conference by warning he was not there to sing. But perform he did, accompanied by a group of dancing robots powered by AI.

And while NVIDIA’s sales have tripled over the past year, you ain’t seen anything yet. When I recommended (NVDA) for the millionth time at $400 a share last October, my long-term target was $1,000. It recently hit $975, now stands at $943, and shows no sign of abating. NVIDIA could well keep powering on until the actual release of the Blackwell chip.

As in Jaws, I sense a feeding frenzy coming and (NVDA) shorts are the bait.

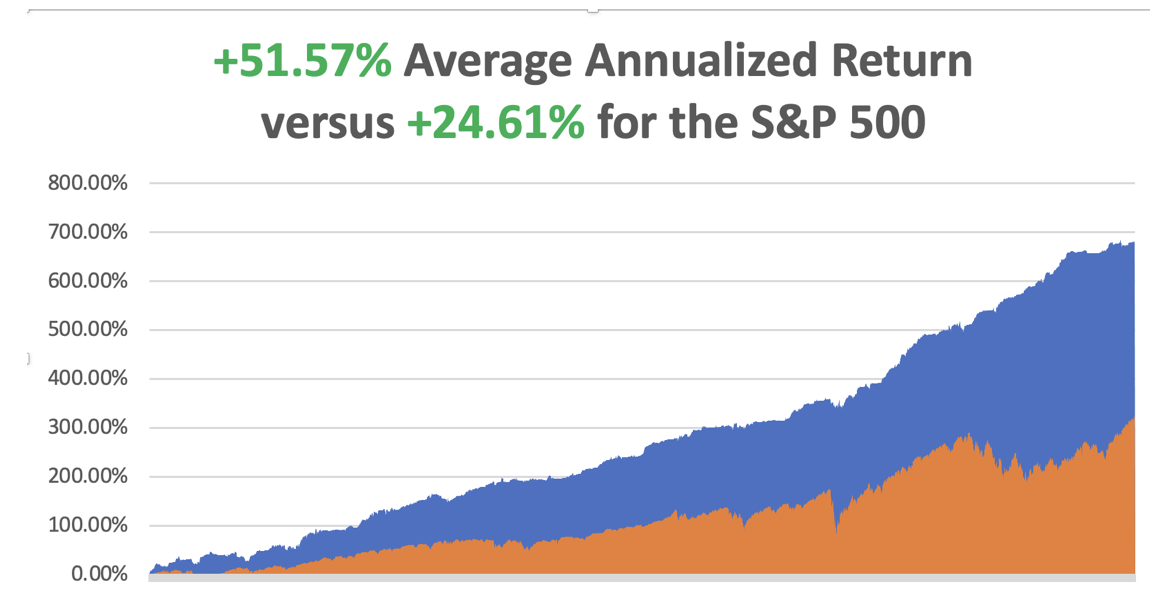

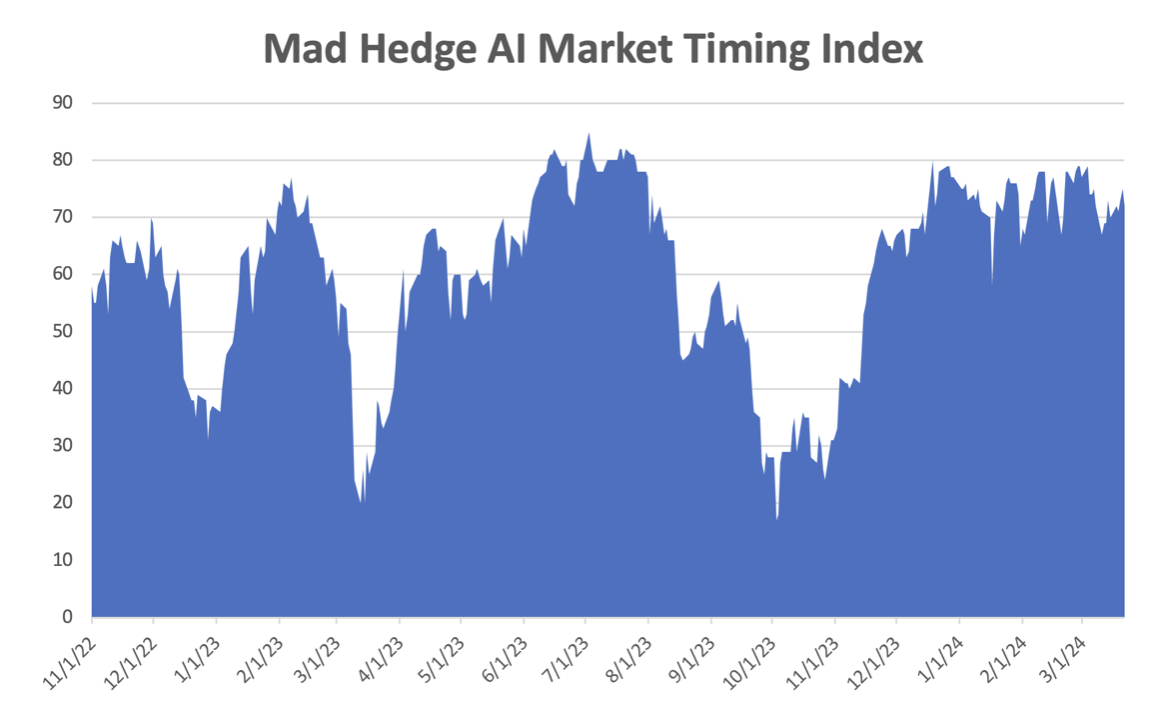

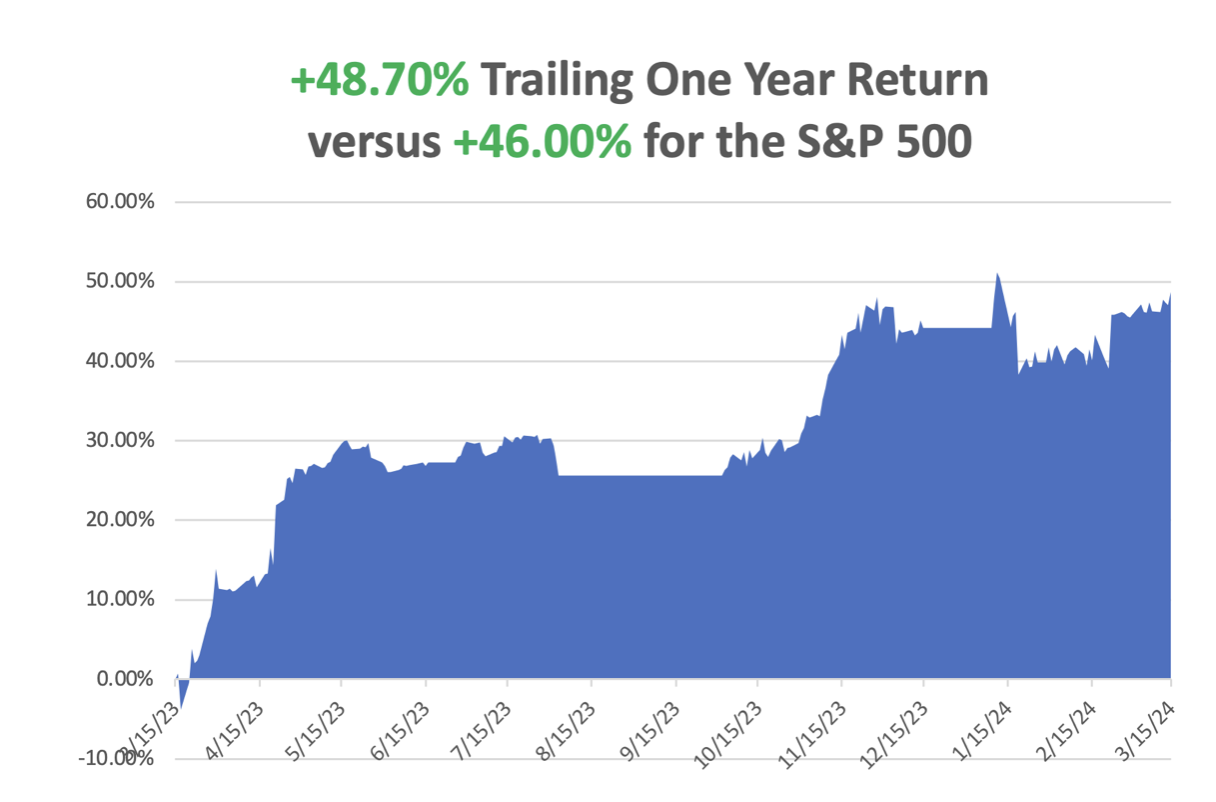

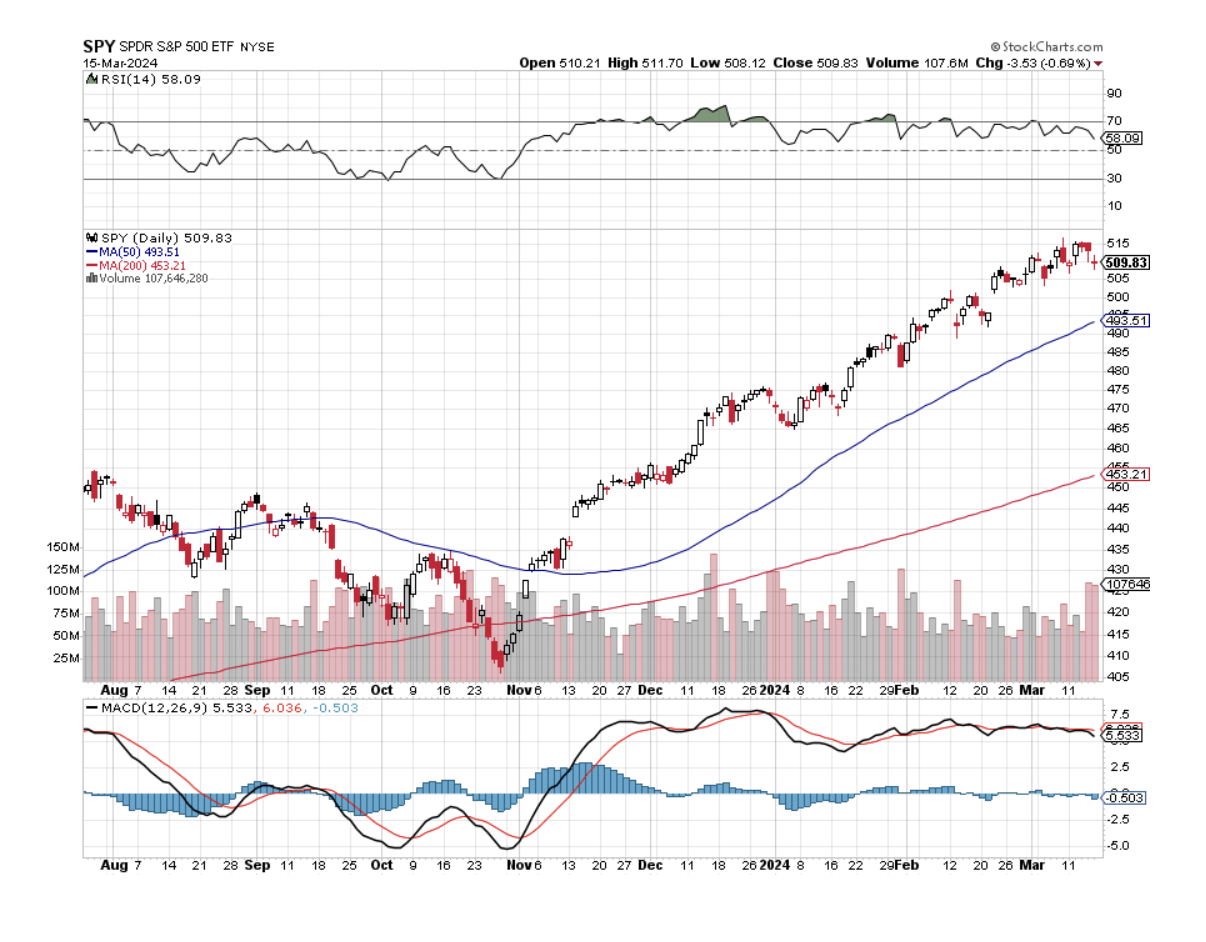

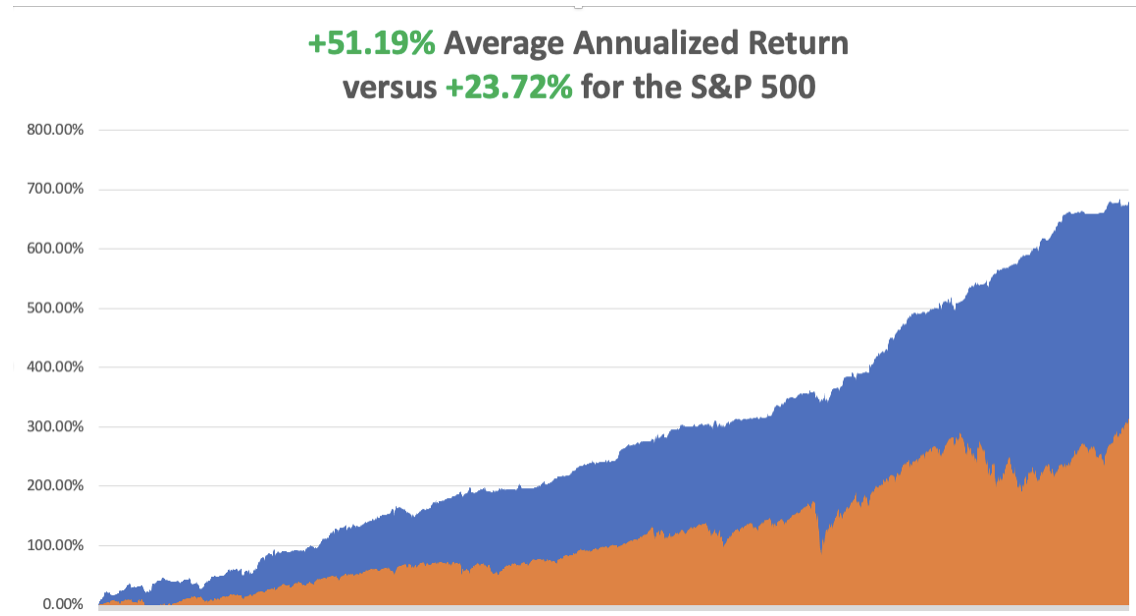

In February we closed up +7.42%. So far in March, we are up +3.53%. My 2024 year-to-date performance is at +6.67%. The S&P 500 (SPY) is up +9.22% so far in 2024. My trailing one-year return reached +56.98% versus +52% for the S&P 500.

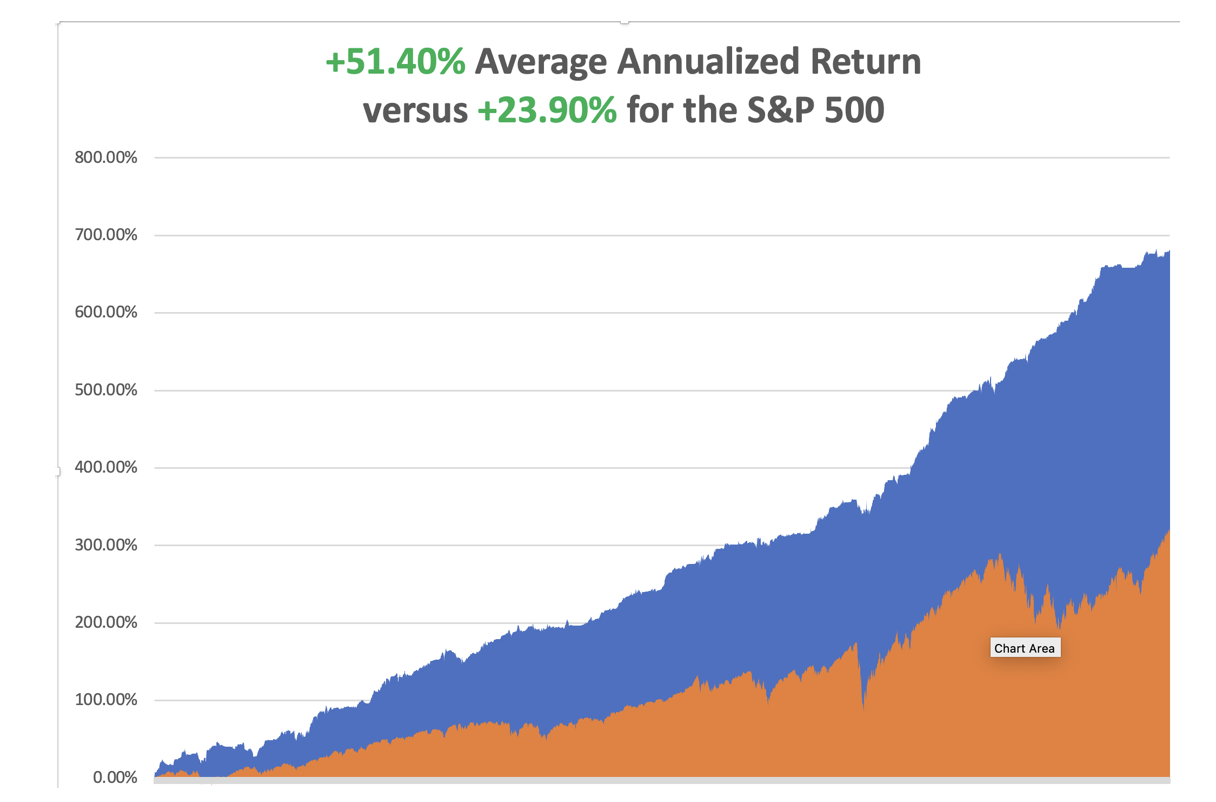

That brings my 16-year total return to +683.30%. My average annualized return has recovered to +51.57%.

Some 63 of my 70 round trips were profitable in 2023. Some 11 of 19 trades have been profitable so far in 2024.

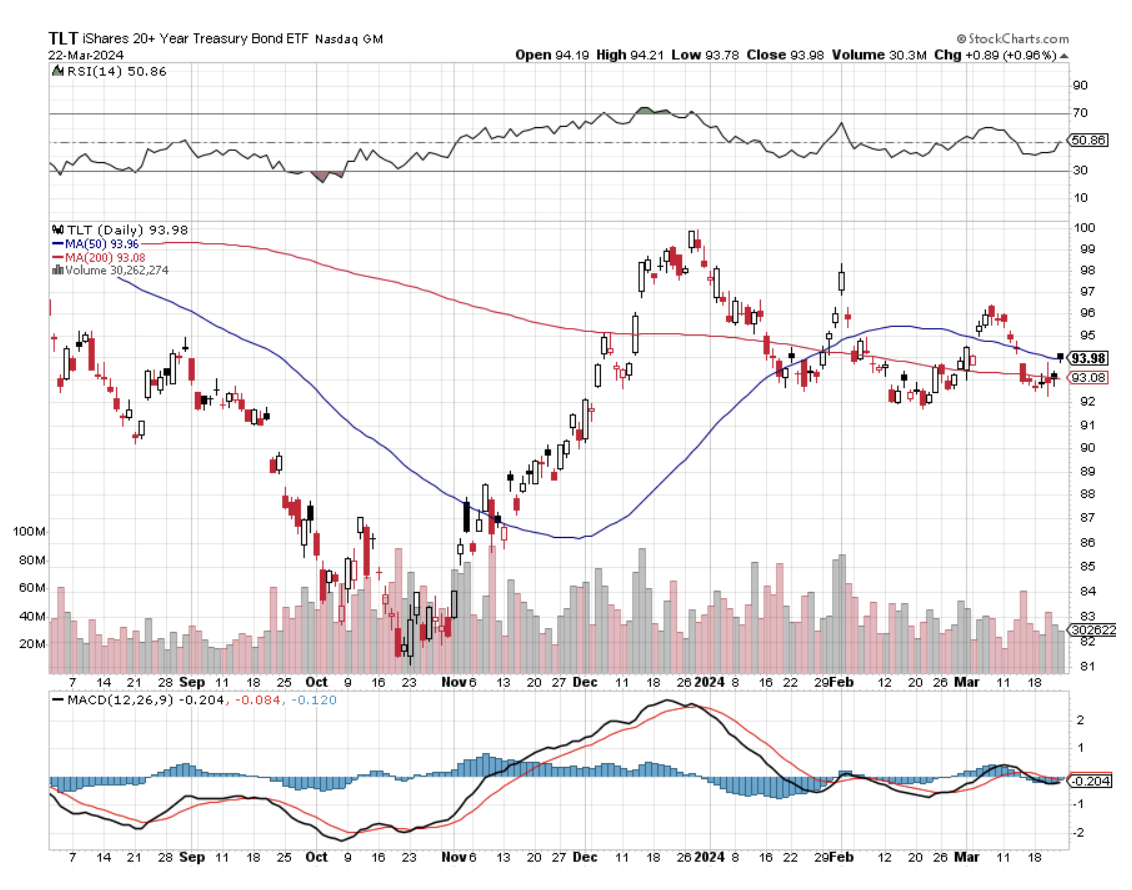

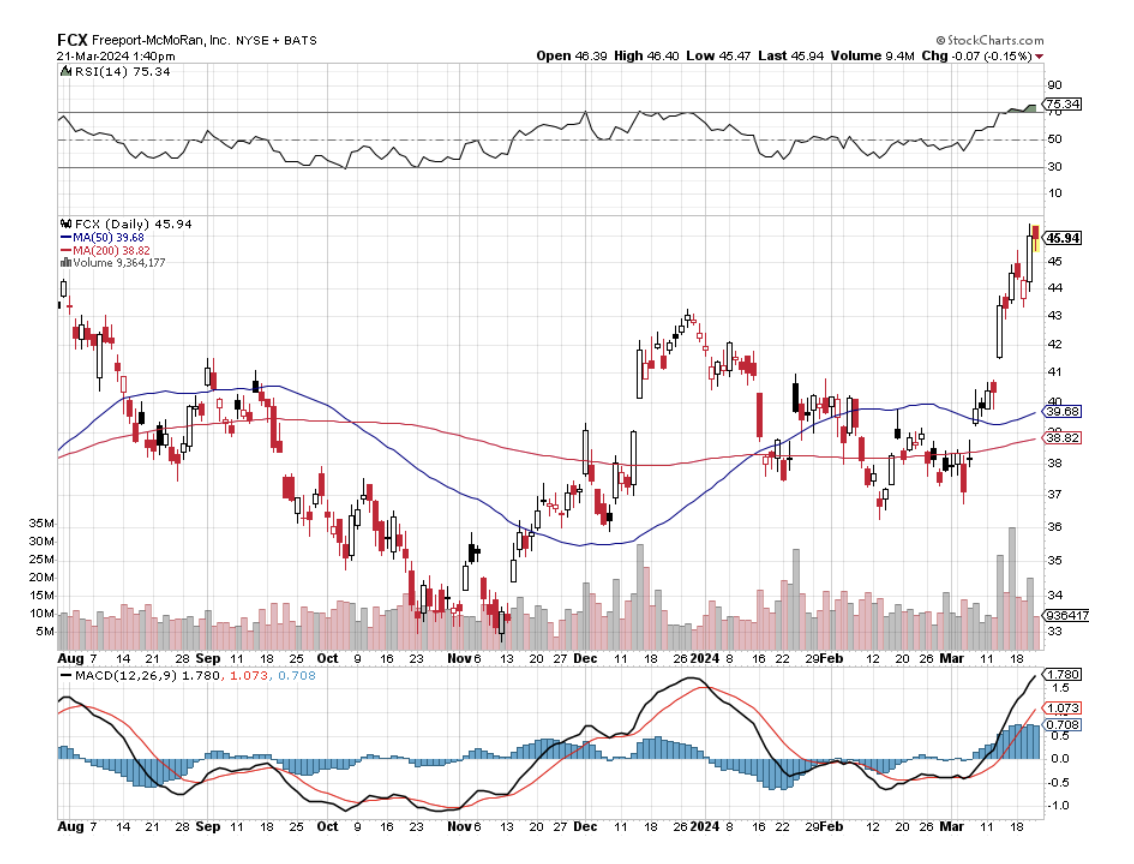

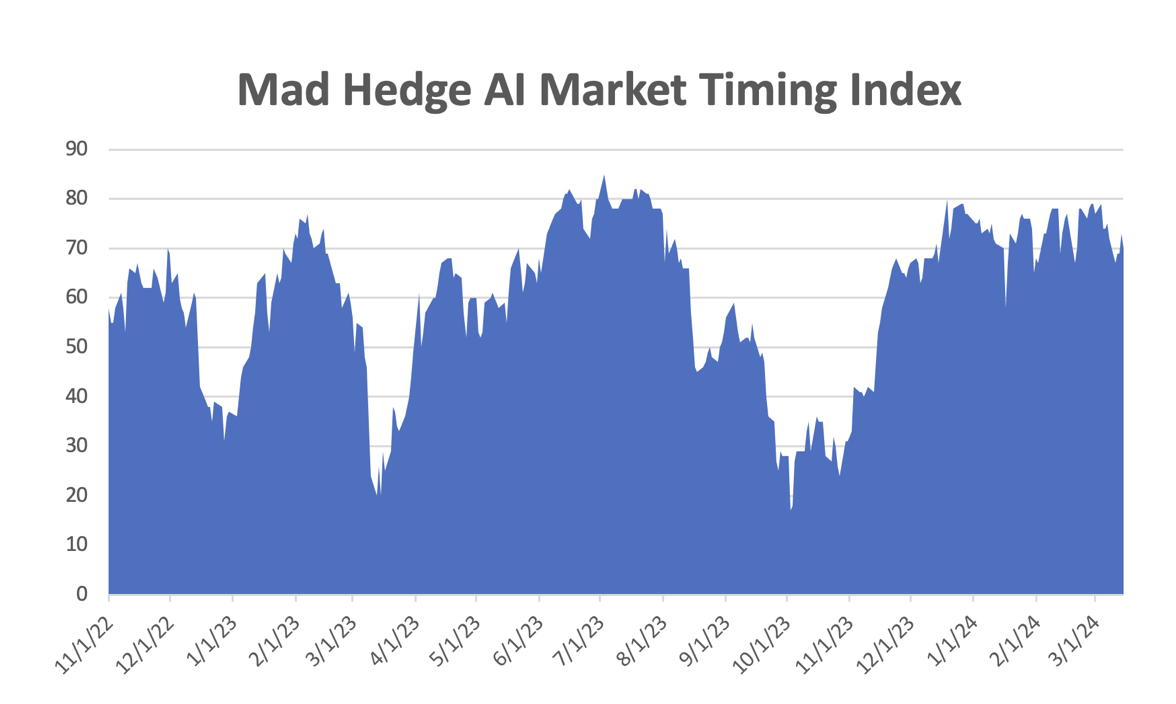

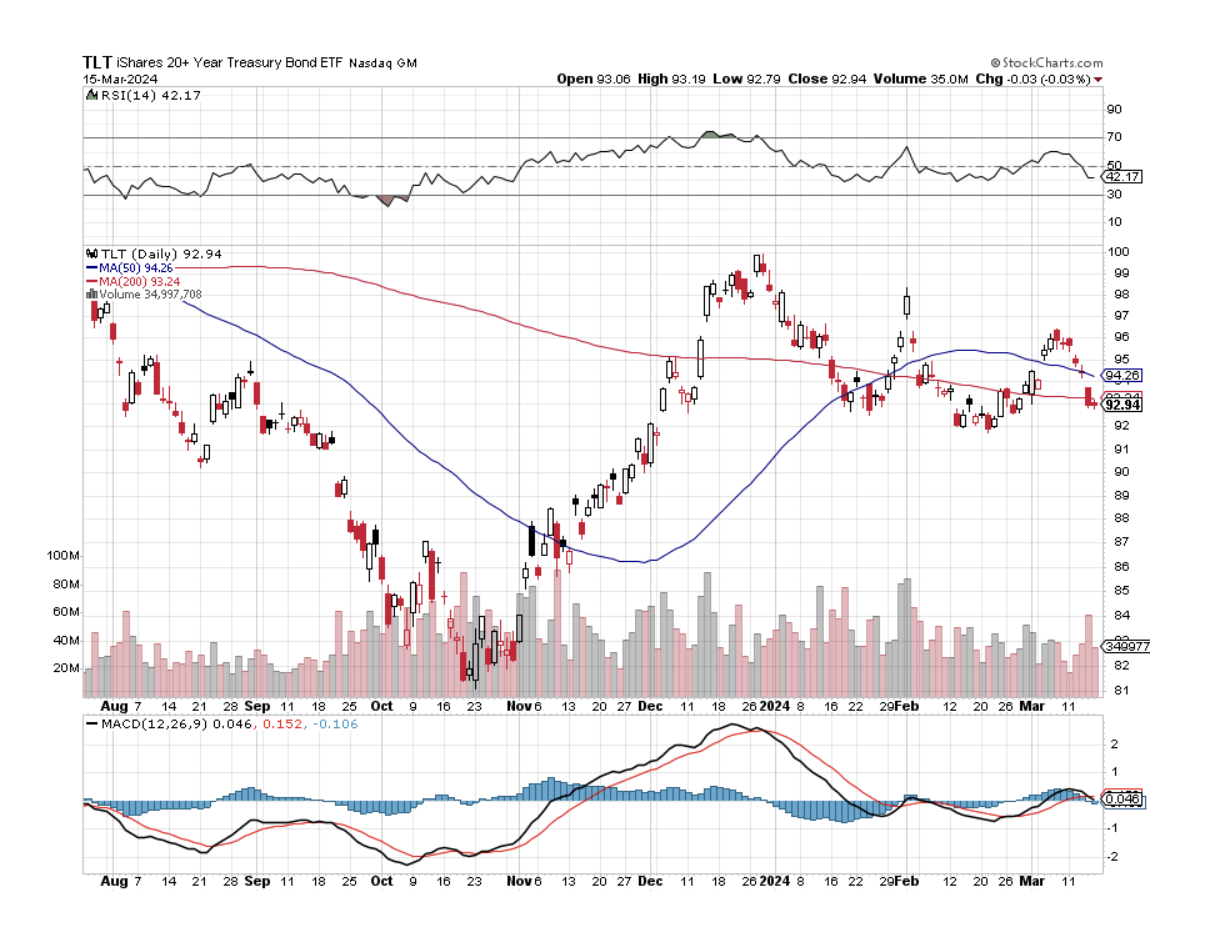

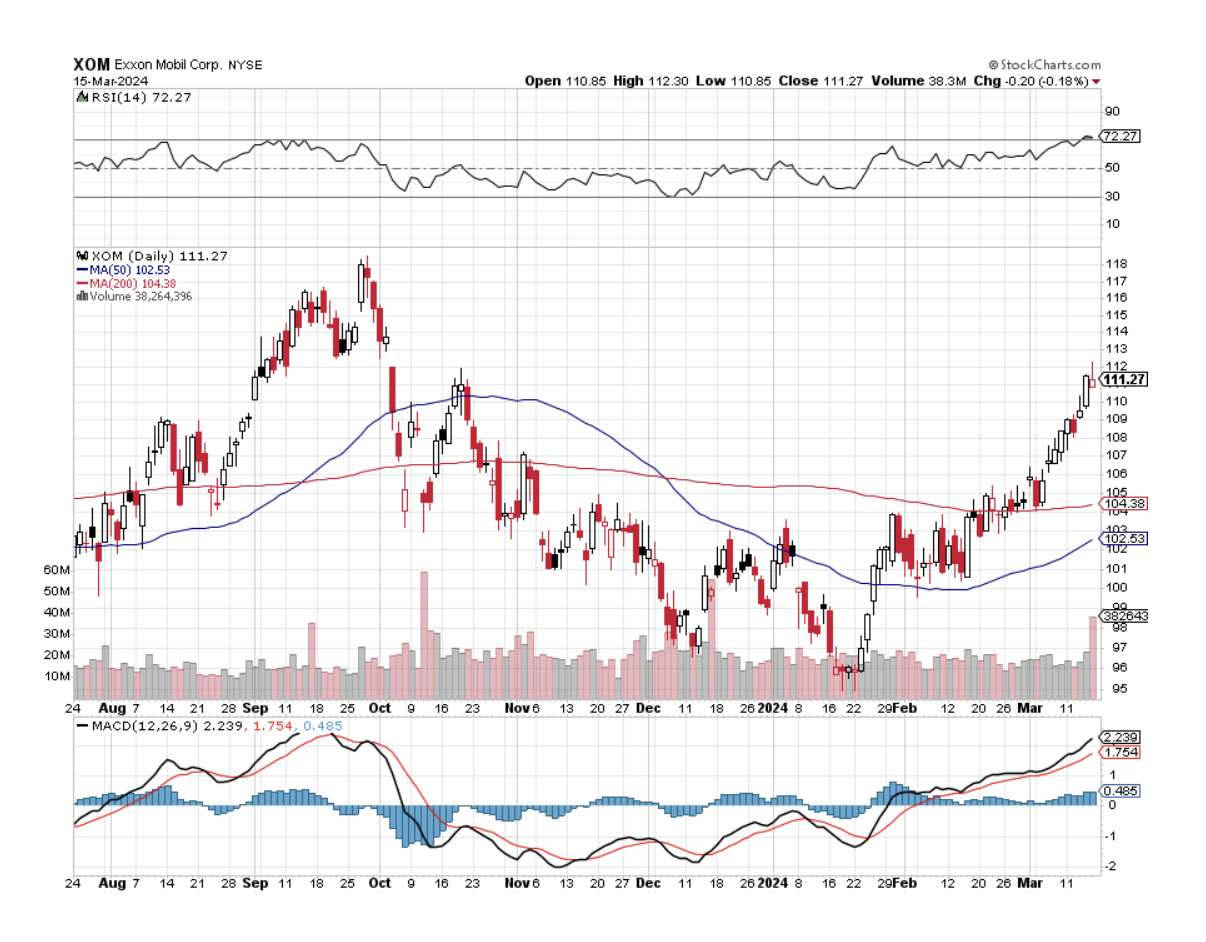

I miniated no new longs last week, content to let my existing longs run in Freeport McMoRan (FCX), bonds (TLT), and ExxonMobile (XOM). I am 70% in cash given the elevated state of the market and am looking for new commodity and energy plays to pile into.

Fed Chair Jay Powell Promises Three Interest Rate Cuts of 25 basis points each, at his press conference on Wednesday. Powell said he did not see "cracks" in the labor market, which he described as "in good shape," noting that "the extreme imbalances that we saw in the early parts of the pandemic recovery have mostly been resolved." These are very pro-risk statements. Buy the dips in everything.

Fed to Dial Back Quantitative Tightening, or QT from the current $120 billion a month. It’s a huge plus for risk assets and explains why the most liquidity-driven ones like gold and silver had such a great day. Buy (GLD) and (SLV) on dips.

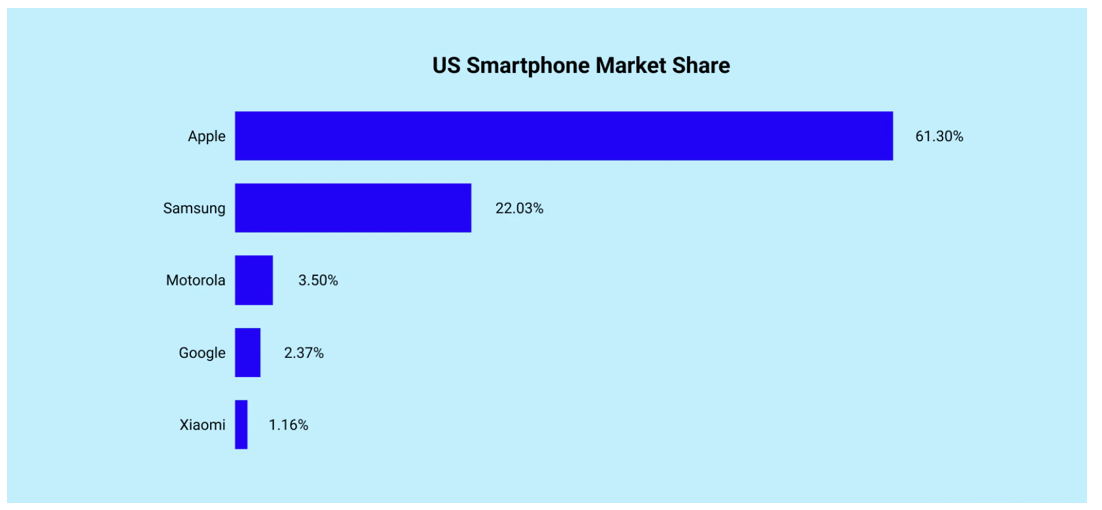

The Dept of Justice Goes After Apple on Antitrust, on its 61.3% share of the US smartphone market. It accused the iPhone maker of blocking rivals from accessing hardware and software features on its popular devices. Google’s (GOOG) Android actually has a bigger global market share at 70.3% with Apple at only 24%. This is another waste of time that will last ten years and go nowhere.

Bank of Japan to Cut Interest Rates as Early as April, bringing to an end a 34-year stimulus program that was a dismal failure. The Japanese yen (FXY) should rocket, but Japanese stocks not so much.

MicroStrategy (MSTR) Dives 18%, the largest owner of Bitcoin, on a crypto correction. MicroStrategy is the largest corporate owner of Bitcoin. (MSTR) just completed a massive borrowing to buy more crypto at the top. After SEC approval of ETFs and the imminent halving, what is left to drive crypto? Avoid (MSTR) which was blindsided by the last 90% crypto correction.

Existing Homes Sales Soar 9.7% in February to 4.38 million units, on a seasonally adjusted annualized basis. Inventory rose 5.9% year over year to 1.07 million homes for sale at the end of February. That represents a still low 2.9-month supply at the current sales pace. Higher demand continued to push the median price higher, up 5.7% from the year before to $384,500.

Home Prices Have Risen by 2.4 Times the Inflation Rate Since 1960. The cost of a typical house in the U.S. is nearly half a million dollars: the median price for a home in the U.S. is $412,778, according to Redfin data. That’s what successful demographic tailwinds leading to a chronic housing shortage get you.

Boeing is Leasing 36 Airbuses, to meet its own unfilled orders caused by production delays. Another panel fell off an airborne plane last week in Medford, OR. Looking for missing parts has become a regular part of every Boeing landing. This is an act of desperation. Avoid (BA)

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, March 25, at 7:00 AM EDT, the US Building Permits are announced.

On Tuesday, March 26 at 8:30 AM, S&P Case Shiller for February is released.

On Wednesday, March 27 at 11:00 AM, the MBA Mortgage Data is published

On Thursday, March 28 at 8:30 AM, the Weekly Jobless Claims are announced. The final read of the Q2 US GDP is also out.

On Friday, March 29 at 2:00 PM, Personal Income and Spending is out. The Baker Hughes Rig Count is printed.

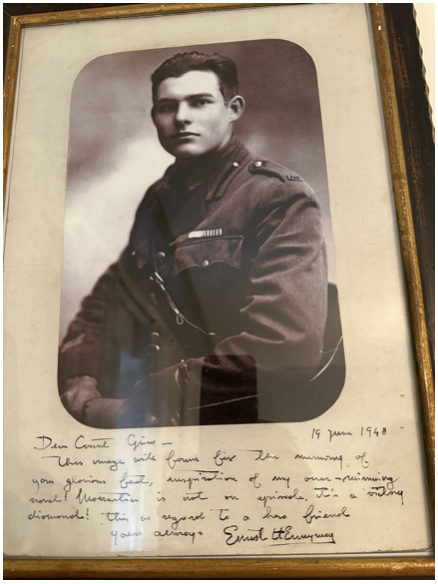

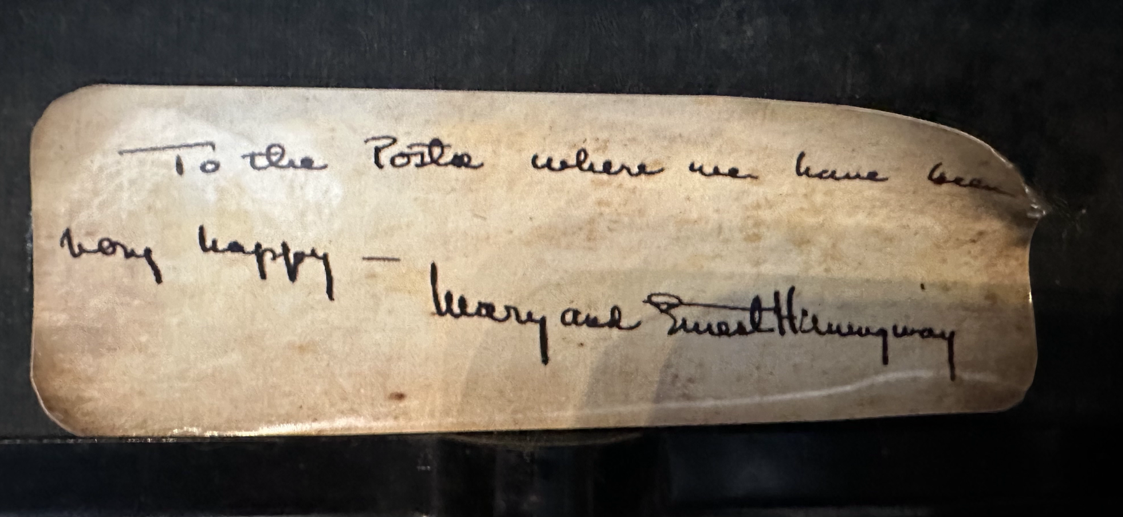

As for me, as I am about to take off for Cuba to visit Finca Vigia (Lookout Farm), the home of Earnest Hemingway and Martha Gellhorn I thought I’d review my long history with this storied family. This is where he finished For Whom the Bells Toll, his epic novel about the Spanish Civil War.

My grandfather drove for the Italian Red Cross on the Alpine front during WWI, where Hemingway got his start, so we had a connection right there going back over 100 years.

Since I read Hemingway’s books in my mid-teens, I decided I wanted to be him and became a war correspondent. In those days, you traveled by ship a lot, leaving ample time to finish off his complete work.

I visited his homes in Key West and Ketchum Idaho. In 2023, he stayed at his Hotel Poste room in Cortina, Italy where he lived for five months during the 1950s. His Cuban residence was high on my list, now that Castro is gone.

I used to stay in the Hemingway Suite at the Ritz Hotel on Place Vendome in Paris where he lived during WWII. I had drinks at the Hemingway Bar downstairs where war correspondent Ernest shot a German colonel in the face at point-blank range. I still have the ashtrays.

Harry’s Bar in Venice, a Hemingway favorite, was a regular stopping-off point for me. I have those ashtrays too.

I even dated his granddaughter from his first wife, Hadley, the movie star Mariel Hemingway, before she got married, and when she was still being pursued by Robert de Niro and Woody Allen. Some genes skip generations and she was a dead ringer for her grandfather. She was the only Playboy centerfold I ever went out with. We still keep in touch.

So, I’ll spend the weekend watching Farewell to Arms….again, after I finish this newsletter.

Oh, and if you visit the Ritz Hotel today, you’ll find the ashtrays are now glued to the tables.

Hemingway in 1917

At Work on Hemingway’s Typewriter

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader