Below please find subscribers’ Q&A for the November 30 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: You keep mentioning December 13th as a date of some significance. Is this just because the number 13 is unlucky?

A: December 13th at 8:30 AM EST is when we get the next inflation report, and we could well get another 1% drop. Prices are slowing down absolutely across the board except for rent, which is still going up. Gasoline has come down substantially since the election (big surprise), which is a big help, and that could ignite the next leg up in the bull market for this year. So, that is why December 13 is important. And we could well flatline, do nothing, and take profits on all our positions before that happens, because whatever it is you will get a big move one way or another (and maybe both) on December 13.

Q: I’m a new subscriber, and I am intrigued by your structuring of options spreads. Why do you do debit spreads instead of credit spreads?

A: It’s really six of one and a half dozen of the other—the net profit is pretty much the same for either one. However, debit spreads are easier to understand than credit spreads. We have a lot of beginners coming into this service as well as a lot of seasoned old pros. And it’s easier to understand the concept of buying something and watching it go up than shorting something and watching it go down. Now, doing the credit spreads—shorting the put spread—gives you a slight advantage in that it creates cash which you can then use to meet margin requirements. However, it’s only a small amount of cash—only the potential profit in that position. And guess what? All the big hedge funds actually kind of like easy-to-understand trade alerts also, so that’s why we do them.

Q: I have a lot of exposure in NVIDIA (NVDA), so is it worth trading out of it and coming back in at a lower rate?

A: NVIDIA is one of the single most volatile stocks in the market—it’s just come up 50%. But it could well test the lower limits again because it is so volatile, and the chip industry itself is the most volatile business in the S&P 500. If your view is short-term, I would take profits now, and look to go back in next time we hit a low. If you’re long-term, don’t touch it, because NVIDIA will triple from here over the next 3 years. I should caution you that if you do try the short-term strategy, most people miss the bottom and end up paying more to get back into the stock; and that's the problem with all these highly volatility stocks like Tesla (TSLA), NVIDIA (NVDA) and Advanced Micro Devices (AMD) unless you’re a professional and you sit in front of a screen all day long.

Q: Would you buy now and step in to make it long-term?

A: I think we get a couple more runs at the lows myself. We won’t get to the old lows, but we may get close. Those are your big buying points for your favorite stocks and also for LEAPS. And I’m going to hold back on new LEAPS recommendations—we’ve done 12 in the last two months for the Concierge members, and maybe half of those went out to Global Trading Dispatch before they took off again. So, that would be my approach there.

Q: How much farther can the Fed raise interest rates until they reverse?

A: 1%-2%, unless they get taken over by the data—unless suddenly the economy starts to weaken so much that they panic and reverse like crazy. I think that's actually what’s going to happen, which is why we went hyper-aggressive in October on the long side, especially in bonds (TLT). You drop rates on the ten-year from 4.5% to 2.5% in six months—that’s an enormous move in the bond market. That is well worth running a triple long position in it; I think that’s what's going to happen. That’s where we will make out the first 30% in 2023.

Q: Should I short the cruise lines here, like Royal Caribbean (RCL)?

A: They do have their problems—they have massive debts they ran up to survive the pandemic when all the ships were mothballed, so it is an industry with its major issues. The stock has already doubled since the summer so I wouldn’t chase it up here. I’m not rushing to short anything here right now though unless it’s really liquid or has horrendous fundamentals like the oil industry, which everyone seems to love but I hate—right now the haters are winning for the short term, until December 16, which is all I care about.

Q: Is the diesel shortage going to affect farmers and all other industries like the chip?

A: As the economy slows down, you can expect shortages of everything to disappear, as well as all supply chain issues, which is a positive for the economy for the long term.

Q: What about the 2024 iShares 20 Plus Year Treasury Bond ETF (TLT) 95—is that not a trade?

A: That’s a one-year position with a 100% potential profit. That is worth running to expiration unless we get a huge 20-point move up in the next 3 months, which is possible, and then there won’t be anything left in the trade—you’ll have 95% of the profit in hand at which point you’ll want to sell it. So, with these one-year LEAPS or two-year LEAPS, run them one or two years unless the underlying suddenly goes up a lot, and then grab the money and run; that's what I always tell people to do. Because if you sell your position, they can’t take the money away from you with a market correction.

Q: Is the current US economy the best economy in the world?

A: It is. If you look at any other place in the world, it’s hard to find an economy that's in better shape, and it’s because we have the best management in the world and hyper-accelerating technology which everyone else begs and borrows. Or steals. People who are predicting zero return on stocks for 10 years are out of their minds. You don’t short the best economy in the world. If anything, technology is accelerating, and that will take the stock market with it in the next year or so.

Q: Do you see the Dow ($INDU) outperforming the other indexes until the Fed positive pivots?

A: Absolutely yes, because the S&P 500 (SPY) has a very heavy technology weighting and technology absolutely sucks right now. That would probably be a good 3-month trade—buy the Dow, and short the S&P 500 in equal amounts. Easy to do—you might pick up 10% on a market-neutral trade like that.

Q: Do you see a Christmas rally this year?

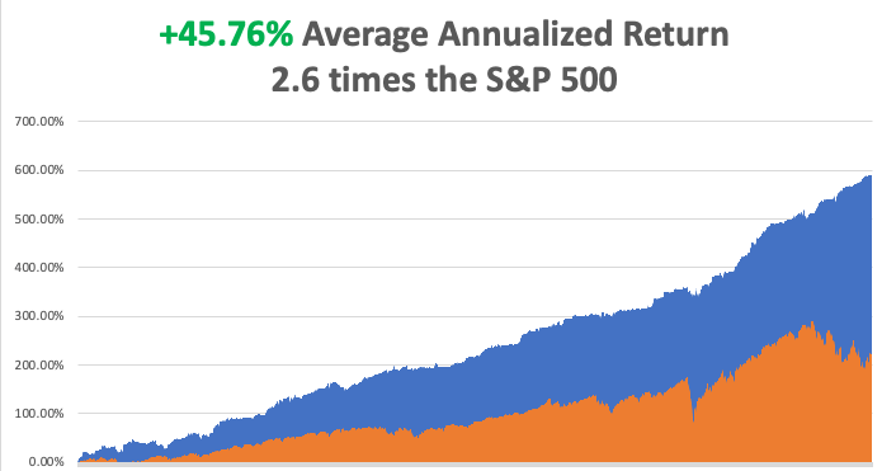

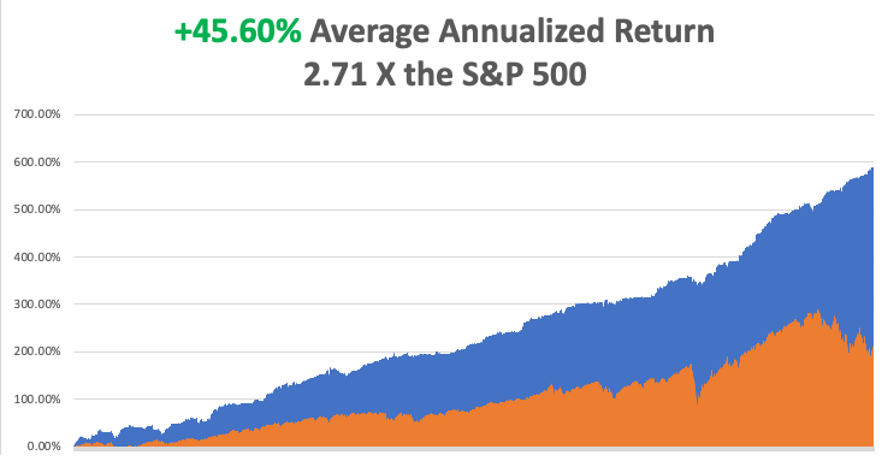

A: Actually, I do, but it won’t start until we get the next inflation report on December 13, at which point I'm going 100% cash. I’ve made enough money this year, and this is a problem I had when I ran my hedge fund: when you make too much money, nobody believes it, so there's really no point in making more than 50% or 60% a year because people think it’s fake. This is true in the newsletter business as well. Markets also have a nasty habit of completely reversing in January; this year, we had one up day in January, and then it was bombs away and we just piled on the shorts like crazy, so you have to wait for the market to first give you the fake move for the year, and then the real one after that. The best way to take advantage of that is to be 100% cash, and that’s why I usually do.

Q: What indicators do you see that give you the most confidence that inflation has peaked?

A: There's one big one, and that’s real estate. Real estate is absolutely in a recession right now and has the heaviest weighting of any individual industry in the inflation calculation. If anybody thinks house prices are going up, please send me an email and tell me where, because I’d love to know. The general feeling is they’re down 10-15% over the last six months. New homes are only being sold with massive buydowns in interest rates and free giveaways on upgrades. It is an industry that is essentially shut down, with interest rates having gone from 2.75% to 7.5% in a year, so there’s your deflation, but unfortunately, real estate is also the slowest to price in in the Fed’s inflation calculation, so we have to go through six months of torture until the Fed finally sees proof that inflation is falling. So, welcome to the stock market because it's just one of those factors. Just for fun, I got a quote on financing an investment property. The monthly payment would have been double for half the house that I already have.

Q: Are LEAPS a buy with the CBOE Volatility Index (VIX) this low?

A: No, you want to look at stocks first, and then the VIX; and with all the stocks sitting on top of 30-50% rises, it’s a horrible place to do LEAPS. LEAPS were an October play—we bought the bottom in a dozen LEAPS in October, and those were great trades, except for Tesla (TSLA) and Rivian (RIVN) which still have two years left to run. Up here, you’re basically waiting on a big selloff before you go into these one to two-year options positions.

Q: Why does Biden keep extending student loans? Will this catch up at some point?

A: He’s going to take it to the Supreme Court, and if he loses at the Supreme Court, which is likely, then he’ll probably give up on any loan extensions. At this point, the loan extensions on student loans are something like 2 or 2.5 years. The reason he’s doing this is to get 26 million people back into the economy. As long as you have giant student loan balances, you can’t get credit, you can’t get a credit card, you can’t buy a house, you can’t get a home loan. Bringing that many new people into the economy is a huge positive for not only them but for everyone else because it strengthens the economy. That has always been the logic behind forgiving student loans—and by the way, the United States is virtually the only country in the world that makes students pay back their loans after 30 or 40 years. The rest give college educations away either for free or give some interest-free break on repayments until they can get a salary-paying job.

Q: Does the budget deficit drop impact the stock market?

A: Yes, but it impacts the bond market first and in a much bigger way. That’s one of the reasons that bonds have rallied $13 points in six weeks because less government borrowing means lower interest rates—it’s just a matter of supply and demand. This has been the fastest deficit reduction since WWII, and markets will discount that.

Q: Will the US dollar (UUP) crash?

A: Yes, it will. You get rid of those high interest rates and all of a sudden nobody wants to own the US dollar, so we have great trades setting up here against everything, except maybe the Yuan where the lockdowns are a major drag.

Q: Is silver (SLV) a buy now?

A: No, it’s just had a big 10% move; I would wait for any kind of dip in silver and gold (GOLD) before you go into those trades. And when/if you do, there are better ways to do it.

Q: How is the Ukraine war going?

A: It’ll be over next year after Ukraine retakes Crimea, which they’ve already started to do. Russia is running out of ammunition, and so are we, by the way. However, the United States, as everybody learned in WWII, has an almost infinite ability to ramp up weapons production, whereas Russia does not. Russia is literally using up leftover ammunition from WWII, and when that’s gone, they’ve got nothing left, nor the ability to produce it in any sizable way. All good reasons to sell short oil companies ahead of a tsunami of Russian oil hitting the market. By the way, oil is now down for 2022.

Q: What's the number one short in oil (USO)?

A: The most expensive one, that would be Exxon Mobile (XOM).

Q: What’s going to happen to the markets in January?

A: After this Christmas rally peters out, I’m looking for profit-taking in January.

Q: When is a good time to buy debit spreads on oil?

A: Now. Look at every short play you can find out there; I just don’t see a massive spike up in oil prices ahead of a recession. And by the way, if the war in Ukraine ends and Russian oil comes back on the market, then you’re looking at oil easily below $50.

Q: What is the best way to invest in iShares Silver Trust (SLV) in the long term?

A: A two-year LEAP on the Silver (SLV) $25-$26 call spread—that gets you a 100%-200% return on that.

Q: Is lithium a good commodity trade?

A: Lithium will move in sync with the EV industry, which seems to have its own cycle of being popular and unpopular. We’re definitely in the unpopular phase right now. Long term demand for lithium will be increasing on literally hundreds of different fronts, so I would say yes, lithium is kind of the new copper. Look at Albemarle (ALB), Societe Chemica Y Minera de Chile (SQM), and FMC Corp. (FMC).

Q: If we do a LEAPS on Crown Castle Incorporated (CCI), you won’t get the dividend right?

A: No, you won’t, it’s a dividend-neutral trade because you’re long and short in a LEAPS. You have to buy the stock outright and become a registered shareholder to earn the dividend which, these days, is a hefty 4.50%. That said, if you’re looking for a high dividend stock-only play, buying the (CCI) down here is actually a great idea. For the stock-only players, this would be a really good one right now.

Q: Do you know people who are selling because of large capital gains?

A: The only people I know who are selling have giant tax bills to pay because of all the money they made trading options this year. I happen to know several thousand of those, as it turns out. So yes, I do know and that could affect the market in the next couple of weeks, which is why I went with the flatlined scenario for the next two weeks. Most tax-driven selling will be finished in the next two weeks, and after that, it kind of clears the decks for the markets to close on a high note at the end of the year.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING or DISPATCH TECHNOLOGY LETTER as the case may be, then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader