Global Market Comments

February 10, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or BATTLING THE CORONAVIRUS),

(SPY), (CCL), (RCL), (WYNN), (DAL), (VIX), (VXX)

Global Market Comments

February 10, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or BATTLING THE CORONAVIRUS),

(SPY), (CCL), (RCL), (WYNN), (DAL), (VIX), (VXX)

I am writing this to you from the first-class cabin of Quantas Airlines on the nonstop flight from Melbourne, Australia to San Francisco, a 14-hour flight. While my flight from the US to the Land Down Under was packed, the return was half empty, great for free upgrades.

It has been a daunting day. I was originally scheduled to transfer on my flight from Perth to Sydney. But my plane there was found to be contaminated with Coronavirus and had to be decontaminated. I quickly rerouted.

I ended up sitting next to a research doctor who worked for San Francisco based-Gilead Sciences (GILD) and was returning from Wuhan, China, the epicenter of the virus. Since all flights from China to the US are now banned, he had to route his return home via Australia.

What he told me was alarming.

The Chinese are wildly understating the spread of the Coronavirus by perhaps 90% to minimize embarrassment to the government, which kept the outbreak secret for a full six months.

Bodies are piling up outside of hospitals faster than they can be buried. Police are going door to door arresting victims and placing them in gigantic quarantine centers. Every covered public space in the city is filled with beds and the roads are empty. Smaller cities and villages have set up barriers to bar outsiders.

He expected it would be many months before the pandemic peaked. It won’t end until the number of deaths hits the tens of thousands in China and at least the hundreds in the US.

The good news is that Gilead Sciences has an antiviral agent it developed for the other Coronaviruses, MERS and SARS, years ago which may be effective against the present epidemic. The company has already sent a planeload of the drug to China for immediate testing, which my new friend escorted.

The world has learned a lot since the West African Ebola outbreak of 2013. The Coalition for Epidemic Preparedness Innovation (CEPI) set up in response to that disease is now leading the charge against Corona.

A lab in Australia was able to isolate the virus in a month. The AIDS virus took ten years. It only required another day to sequence the genome. That has greatly shortened the time for the development of a vaccine and a cure. It will take a year to mass produce enough vaccine to inoculate the world. That will be too late to save the many in China who have already perished.

Needless to say, the impact on the global economy will be immense. As we learned from the trade war, take China out of the equation and many things don’t work anymore.

The country’s GDP growth rate is expected to plunge from 6% to 2% this quarter, and possibly zero. Factories have closed, disrupting supply chains globally. The car industry is most affected, with Hyundai in South Korea already shutting down production for lack of parts.

Travel and tourism shares, like airlines (DAL), casinos (WYNN), and cruise lines (CCL), (RCL) have also been hard hit.

US stocks are taking notice, but slowly. It seems that massive Quantitive Easing by the Federal Reserve is enough to head off even a global pandemic, at least for now. This will not last. We have already seen one 600-point down day and a (VIX) spike to $21. There will be more.

Despite the fact that we may be facing the end of the world, the Mad Hedge Trader Alert Service managed to catapult to new all-time highs.

My long volatility positions I picked up when the Volatility Index (VIX), (VXX) was a lowly $12, brought in a double or a triple for most holders in a mere two weeks.

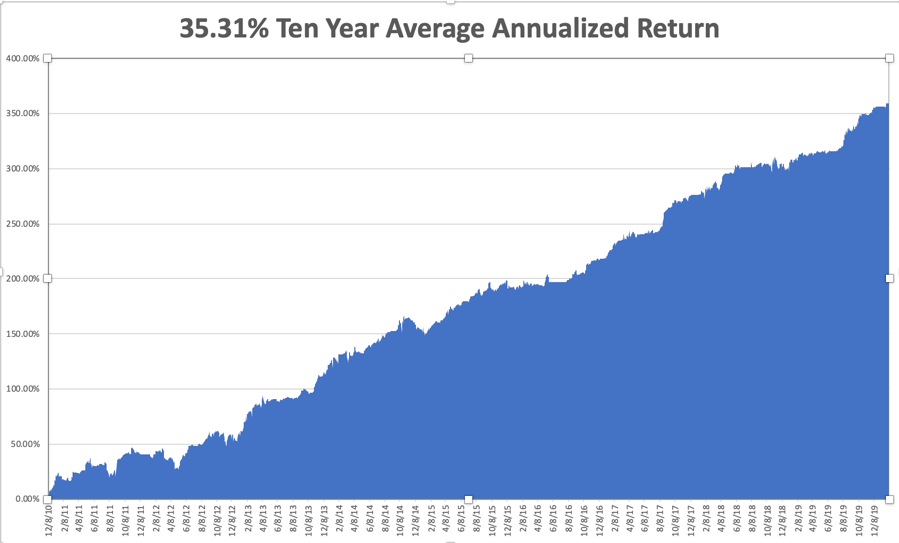

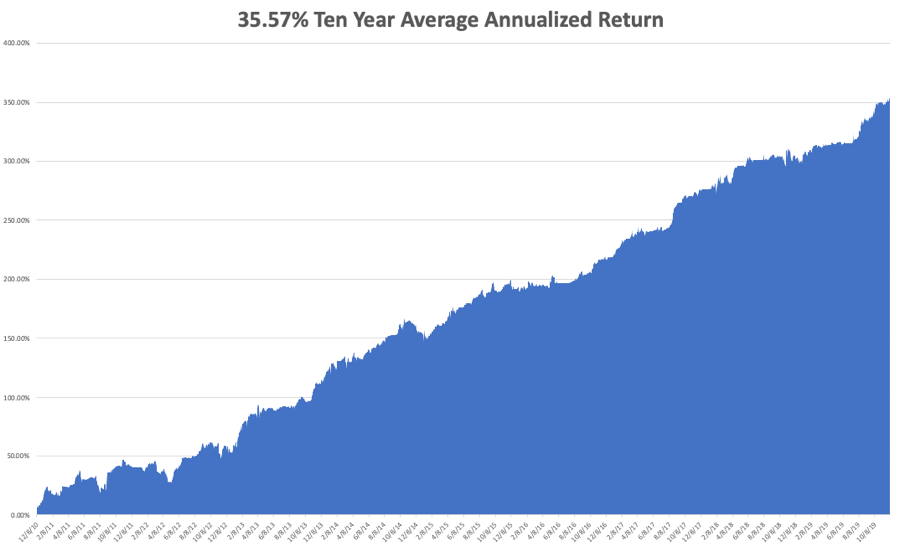

My Global Trading Dispatch performance rose to a new high at +358.96% for the past ten years. My trailing one-year return rose to +48.59%. We closed out January with a respectable +3.11% profit. My ten-year average annualized profit ground back up to +35.31%.

All eyes will be focused on Corona, the virus, not the beer. The weekly economic data are virtually irrelevant now.

On Monday, February 10 at 1:00 PM, US Consumer Inflation Expectations are out.

On Tuesday, February 11 at 12:00 PM, JOLTS Job Openings for December are released.

On Wednesday, February 12, at 12:00 PM, Federal Reserve Chairman Jerome Powell testifies in front of congress.

On Thursday, February 13 at 8:30 AM, Weekly Jobless Claims come out. US Core Inflation for January is published.

On Friday, February 14 at 10:30 AM, Retail Sales for January are printed. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, after my epic voyage home, I’ll be catching up on my sleep, dealing with the 16 hours of jet lag from Western Australia.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

January 10, 2020

Fiat Lux

Featured Trade:

(FRIDAY, FEBRUARY 7 PERTH, AUSTRALIA STRATEGY LUNCHEON)

(JANUARY 8 BIWEEKLY STRATEGY WEBINAR Q&A),

(VIX), (VXX), (TSLA), (SIL), (SLV),

(WPM), (RTN), (NOC), (LMT), (BA), (EEM)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader January 8 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: If the market is doing so well, why is the Fed flooding the market with liquidity?

A: It’s election year, so their primary focus is to get the president reelected and do everything they can to make sure that happens. If we continue at the current rate, the Fed will have zero ability to get us out of the next recession which will make it much deeper than it would be otherwise. Doing this level of borrowing and keeping interest rates near zero with the stock market going up 30% a year is insane, and we will be severely punished for it in the future.

Q: With the Volatility Index (VIX) near a 12-month low and the Mad Hedge Market Timing Index near an all-time high, is this a good time to put on LEAPs for the (VXX)?

A: Yes, in fact, a (VXX) LEAP (Long Term Equity Participation Security, or one-year-plus option spread), is the only LEAP I would put on right now. I get asked about LEAPs every day because returns on them are so huge, but I am holding back on a trade alert on a (VXX) leap because it seems like in January they really want to run this market high and run volatility down low. On the next move to a (VIX) in the $11 handle, you want to put out a one-year LEAP with a $16 strike. And that is essentially a guarantee that you will make money sometime in the coming year on a big down move in the stock market. (VXX) LEAPs are coming, just not yet.

Q: Do you think Iran is done with their attacks against the US or will there be more?

A: The belief there will be no more attacks is to call the end of a 40-year trend. There will be more attacks, and those are going to be your long side entry points. Every geopolitical crisis for the last 10 years has been a great entry point on the long side and the next one will be no different. Just hope you are not one of the victims.

Q: What would a war with Iran mean for the US economy and should I buy defense stocks?

A: You can take the Iraq war, which cost us about $4 trillion, and multiply that by three times to $12 trillion because Iran’s economy is three times the size of Iraq and has a much more sophisticated military. The Iranians are really in a good position because they know the US has no appetite for another Iraq, Afghanistan, or Vietnam. They just want us out of their neighborhood. As far as defense stocks, those really move on very long-term investments and production for government contracts. When you get an attack like this, you get a one-day pop of 5% and then they usually give it all back. So, I wouldn't be chasing defense stocks like Lockheed Martin (LMT), Northrop Grumman (NOC), and Raytheon (RTN) at these high levels—it’s a very high-risk trade.

Q: Will Boeing (BA) take heat from the Ukrainian crash in Tehran?

A: Yes. It’s down about $5, and you might even consider running the numbers on a February call spread. This may be the last chance to get into Boeing at those low levels. The 737 MAX will fly this year, their most important product.

Q: What’s your opinion on Thai Baht?

A: This really is the home here for opinion on all asset classes, large and small. The Thai Baht will rise. It’s a weak dollar play. Money is pouring into all the emerging currencies because of the massive overborrowing that’s going on in the U.S. Countries that overborrow and print money like crazy always debase their currencies over the long term. That makes emerging markets (EEM) a great buy, which are trading at half the valuation levels of US ones.

Q: U.S. hog farmers missed the opportunity of a lifetime last year because of African Swine Flu. Any thoughts on the price of pork and commodities for 2020?

A: They should do better now that we’re at least getting relief from an escalation of the trade war. However, I gave up covering agriculture because the American farmer is just too efficient; every year they just produce more and more crops with fewer and fewer inputs—it’s a loser’s game. They occasionally get bad weather and get a big price spike, but that Is totally unpredictable. I'm staying away from ag stocks. In terms of buying soybeans or Apple, or Google, or Amazon, I’ll take the tech stocks any day over ag’s. Plus, the insiders have a big advantage in ag’s.

Q: What is the ticker symbol for the Silver ETFs?

A: The Silver metal ETF is (SLV), Silver miners is (SIL), and the Silver Royalty Trust, Wheaton Precious Metals, is (WPM).

Q: Why has volatility been so minimal even with massive geopolitical risk going up?

A: Liquidity trumps all. This month, the fed is pumping a record $160 billion into the financial system, and all that money is going into stocks, making them go up and making volatility go down. Until that changes, this trend will continue.

Q: Apple just passed $300, is the next stop $400?

A: Yes, and we could get that this year in the run up to 5G in September. By the way, my average cost on my Apple shares split adjusted is 50 cents. I bought it in the late 1990s when the company was weeks away from bankruptcy.

Q: Any thoughts on Tesla (TSLA)?

A: Yes, go out and buy the car, not the stock. Wait for some kind of pullback. We have just had a fantastic run of good news kicking the stock from $180 up to $490. I think we will make it up to $550 on this run. But you don’t want to get involved unless you’re a day trader because now the risk is very high. The next big move for Tesla is going to be the announcement of a production factory in Berlin, where they will try to take on Mercedes, BMW, VW, and Audi on their home turf. Then, they will own Europe.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

December 20, 2019

Fiat Lux

Featured Trade:

(DECEMBER 18 BIWEEKLY STRATEGY WEBINAR Q&A),

(BA), (CRSP), (BABA), (GLD), (PANW), (VIX), (VXX)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader December 18 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What is the status of Boeing (BA) and when should I buy it?

A: Their 737 production was shut down because they literally ran out of space to park completed planes. They have something like 400 of them now sitting around on tarmacs all around northern Washington state. This is the worst-case scenario so it is a very tempting place to buy; I would do something like a February 2020 $250-$270 vertical bull call spread, make 10% in a month, and be conservative. If it weren't year-end, and I didn't already have my year in the bag, I would probably buy Boeing right here.

Q: Do you recommend CRISPR (CRSP) therapeutics as a buy?

A: Yes, but on a dip. I always hate buying stocks after they doubled. At some point in 2020, we will see correction in biotech stocks, and then you want to load the boat again. Here, I’m buying nothing.

Q: Is Palo Alto Networks (PANW) a buy at these levels?

A: Yes, it’s already had its correction—it's one of the few stocks that are buyable at these levels. But I would do something like a call spread, which is limited risk. As far as a pairs trade with Palo Alto vs Nvidia...I would not touch that with a ten-foot pole, because you can’t know the internal nature of two companies like that well enough to buy one and sell short the other against it. You could really get destroyed on that pairs trade, so don’t make that mistake.

Q: Do you think the US dollar (UUP) will head higher or lower next year?

A: It will go a lot lower, as the chickens from all the government borrowing come home to roost. More borrowing brings a lower dollar, which brings lower everything in the US; all US dollar-denominated assets will get hurt, and this may be what eventually kills off the bull market in stocks. Start buying the Euro (FXE) on dips.

Q: What do you think about Boris Johnson winning the UK election?

A: It is a disaster and will lead to the end of Great Britain. Scotland will go independent, Northern Ireland will join the Republic of Ireland, and even Wales may break off and form its own country. So, England will be reduced to a tiny rump of a country with a much lower standard of living. It may take 10 years to happen, but that’s where it’s going.

Q: Does the recent positive housing data mean we aren’t having a recession in 2020?

A: Yes, in fact the market has been backing out of a 2020 recession for the last three months; and the leading sector in the recovery has been housing, caused partly by extremely low-interest rates but also partly by millions of new millennials pouring into the housing market for the first time. Finally, my basement is empty. That explains why the entry-level and middle level of the market are strong, and the high end is still decreasing in price.

Q: Back in August, the global economy looked to be stalling, yet it was a great time to buy stocks.

A: That is exactly when to buy stocks—when the economy is terrible. If you get used to buying on the bad news and selling on the good news you will do very well as a trader. Most people do the opposite—people were dumping stocks in August. And that of course was when we went with one of our rare 100% longs. By the way, this happens every August, which is why I take my vacations in July.

Q: Do you see a global slowdown during the melt-up?

A: Well, the economy is still slowing down. It never stopped slowing down—we’re probably looking at a 1.5% GDP this quarter. However, in liquidity-driven markets, you don’t look at fundamentals; you look at the amount of cash that is available to buy equities, that’s why you buy equities. That said, if we ever do get a real economic recovery, you might actually have stocks going down because a price-earnings multiple of 20X is not an ideal place to buy stocks.

Q: What do you prefer for a Volatility Index (VIX) trade?

A: An option on the iPath Series B S&P 500 VIX Short Term Futures ETN (VXX) is one. Go long dates, like a year, and deep out-of-the-money, like the $18 strike price, to minimize the hot from Time decay. If your (VIX) goes back up to $25 the (VXX) will soar to $27 and you will make a fortune.

However, if you have the facility to trade futures, then options on the futures in the VIX is how most professionals will trade that.

Q: Should we be worried about the Repo crisis as we approach the end of the quarter?

A: Absolutely, you should be worried—the Fed might have to come through with another round of quantitative easing in order to prevent a surprise overnight pop in interest rates to 5%. That’s what happened last quarter; it could certainly happen again. The basic problem is that the structure of the US debt markets aren't built to handle the volume of borrowing that’s coming through from the US government, so with debt at an all-time high, we’re kind of in new territory here in terms of whether or not markets can actually handle that amount of borrowing. Total government borrowing next year will probably be $1.75 trillion dollars.

Q: What do you make of gold (GLD) at these levels?

A: Cheap but getting cheaper. You want to buy it the day the stock market peaks out in Q1 2020.

Q: Are Chinese equities a buy after the phase one trade deal?

A: Yes, and Alibaba (BABA) is probably your first pick in the Chinese area. During the whole trade war, the Chinese took significant action to stimulate their economy in order to offset the drag on trade. That stimulus is still out there, so we could see a reacceleration in the economy now that the trade war is no longer worsening.

Global Market Comments

December 16, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE GOOD NEWS IS OUT)

(FXI), (AAPL), (FXB), (VIX), (USO), (BABA), (NSC), (MSFT), (GOOGL)

After a China trade deal, UK election and a NAFTA 2.0 are announced, what is left to drive the stock market?

That is a very good question and explains why the Dow Average was up only a microscopic 3.33 points on Friday. It had spent much of the day down.

It’s not a pretty picture.

Not only is the market running out of drivers, the economic data is still decelerating, with the GDP running a 1.5% rate, inflation rising, and corporate earnings growth at zero, with earnings multiples at 17-year high.

A Wiley Coyote moment comes to mind.

And while we are finishing a great 27% year (56% for the Mad Hedge Fund Trader), we are in effect getting three years of performance packed into one. Not only did we pull forward a good chunk of 2020’s performance, we borrowed heavily from 2018 as well, coming in at such a low start as we did.

Thus 2019 might well get bookended by an 8% gain in 2018 and another 8% year in 2020, with dividends. Blame it all on the massive liquidity burst we got from the Fed that started last December and continues unabated.

Stocks have been floated by a tidal wave of new money creation worldwide. Globally, new money creation is running at a $1 trillion a month rate and much of that is ending up in the US stock market, especially in technology shares.

The rush was enough to drive Apple (AAPL) to a new all-time high at $275, pushing its market capitalization up to a staggering $1.2 trillion. It could surpass Saudi ARAMCO’s $2 trillion valuation in a year or two.

Steve Jobs’ creation now accounts for a mind-blowing 6% of the S&P 500 and 4% of total US stock market capitalization. It’s the best argument I’ve ever heard for becoming a hippy and dropping out of college after one quarter.

Which leads us to paint a picture for the 2020 stock market. Even the most optimistic outlook for next year, that of Ed Yardeni, is calling for only a 10% gain. Many prognostications are calling for negative numbers next year.

You might be better off parking your money in a 2% CD and taking a cruise around the world. I’ve done that before, and it works fantastically well.

You’re only going to have one shot at making money in 2020. Wait for a 10%-20% nosedive to go long. My guess is that happens when it becomes clear that the Democrats are dominating in the polls (Joe Biden is currently 14 points ahead in swing state Pennsylvania). No matter who wins, less borrowing, less spending, and higher taxes will prevail.

Then stocks will rally 10% AFTER the election because the uncertainty is gone. That will get you a 20%-30% profit in 2020, but only of you are a trader and follow the Mad Hedge Fund Trader. After basking in their own brilliance in 2019, 2020 might be a year when indexers wish they never heard of the term.

In the end, corporate earnings growth always wins, especially in tech, which is still growing at 20% a year. Remember, my 2030 forecast for the Dow Average is 125,000.

China (FXI) won big in mini trade deal. We rolled back a tariff increase that was never going to happen and the Chinese buy $50 billion worth of soybeans they were going to buy anyway, except at half the price that prevailed two years ago. All of it will come out of stockpiles built up during the trade war. Only the ag sector is affected, which is 2% of the US economy. The ag markets aren’t buying it. If this were a real trade deal, stocks would be up 1,000 points, not 89.

Conservatives won big in UK election. The British pound (FXB) is up 2% and stocks are soaring. A hard Brexit is coming, so look for Scotland to secede and Northern Ireland to join the Republic. The UK will be gone as we know it. Britain’s standard of living will plummet. Great Britain will no longer be great, and the Russians financed the whole thing.

Volatility crashed, as complacency rules supreme. Don’t buy (VIX) until we see the $11 handle again.

Chinese copper purchases hit a 13-month high, up 12.1% in November, to 483,000 metric tonnes. It explains the 78% move up in Freeport McMoRan (FCX) since October, the world’s largest producer. Obviously, someone believes a trade deal is coming. My long LEAP players love it.

US Consumer inflation expectations rebounded, up 0.1% to 2.5%, accounting to the New York Fed. That’s crawling up from a five-year low, a slightly positive economic note.

Saudi ARAMCO went public, with a 10% pop in the shares on the first two days, providing a $24 billion fund raise. This is one of the top three largest IPOs in history after Alibaba (BABA) and Softbank. It values the company at $1.88 trillion. Oil (USO) is down a dollar on the news, no longer needing artificial support to get the deal done. This could be one of the seminal shorts of our generation.

NAFTA 2.0 was signed, removing a potential negative from the market. It is 90% of the original NAFTA, not the “greatest trade deal in history” as claimed. Buy the main North/South railroad, Norfolk Southern (NSC) on the news.

Weekly Jobless Claims soared to a two-year high, by 49,000 to 252,000. Are stores laying people off from Christmas early this year, or did they never hire in the first place because the retail businesses are gone? Peak jobs are in. US job growth is now far slower than in the Obama era, as is GDP growth.

Most US companies will have fewer staff in 2020, except Mad Hedge Fund Trader. More automation and algos mean fewer humans. Only a capital spending freeze caused by the trade war kept a low of low-skilled people in their jobs.

This was a week for the Mad Hedge Trader Alert Service to catapult to new all-time highs.

My long positions have shrunk to my core (MSFT) and (GOOGL), which expire with the coming December 20 option expiration.

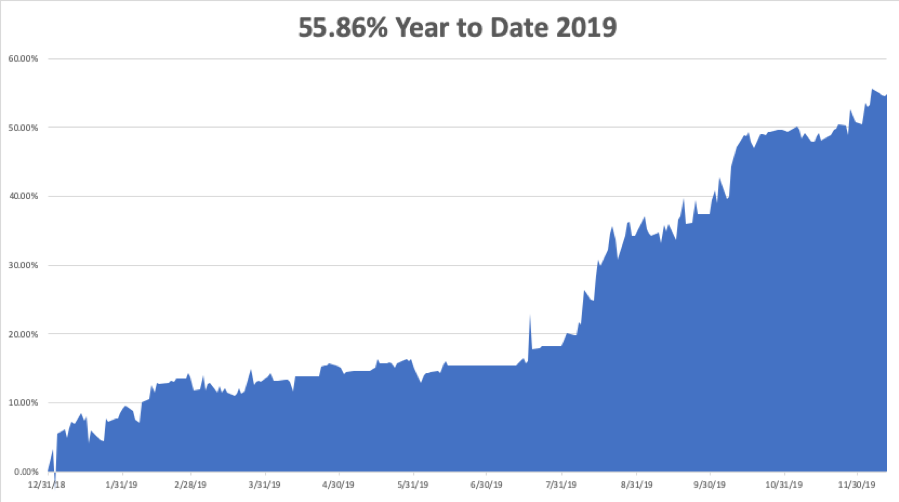

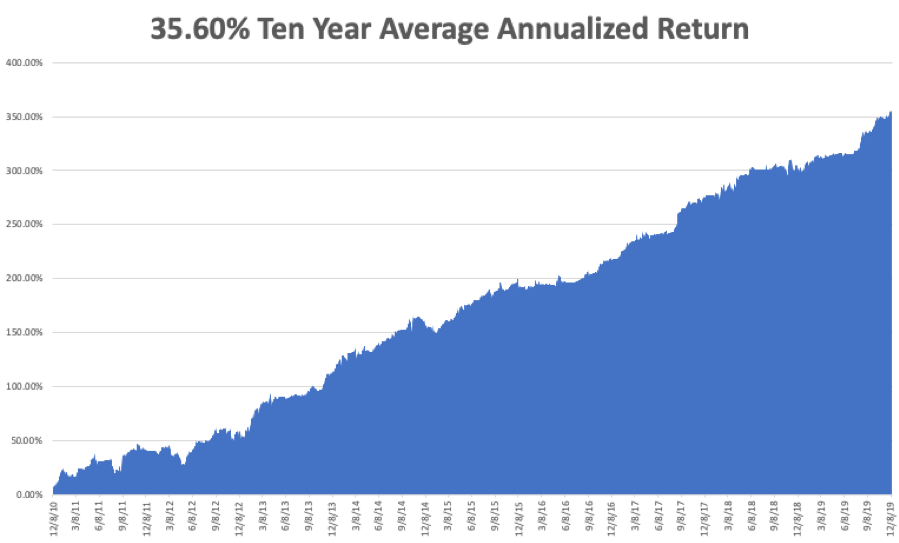

My Global Trading Dispatch performance ballooned to +356.00% for the past ten years, a new all-time high. My 2019 year-to-date catapulted back up to +55.86%. December stands at an outstanding +4.85% profit. My ten-year average annualized profit rebounded to +35.59%.

The coming week will be a noneventful one on the data front, with some housing data and the Q3 GDP on the menu. Anyway, everyone else will be out Christmas shopping or attending parties.

On Monday, December 16 at 9:30 AM, New York Empire State Manufacturing Index for December is out.

On Tuesday, December 17 at 9:30 AM, Housing Starts for November are released.

On Wednesday, December 18 at 11:30 AM, US EIA Crude Stocks for the previous week are announced.

On Thursday, December 19 at 8:00 AM Existing Home Sales are published. At 8:30 AM, we get Weekly Jobless Claims.

On Friday, December 20 at 9:30 AM, the final read on US Q3 GDP is printed. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, after blowing out 1,200 Christmas trees, the Boy Scouts will be taking down the tree lot for the year. And who do they turn to when it comes to wielding a chain saw or sledge hammer?

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

December 9, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE MELT-UP CONTINUES),

(SPY), (TLT), (VIX), (FXI)

I can tell you that the way to NOT start writing a newsletter is to first swing a 20-pound sledgehammer for three hours. That's what I did this morning helping the Boy Scouts mount 700 trees on rebar stands as part of the annual Christmas tree fundraiser.

Nor is it advisable to start writing a newsletter by hauling 50-pound trees on to car rooftops and tying them down.

However, I am a man of my commitments, so here I am with the aid of a long hot bath and some Epsom salts.

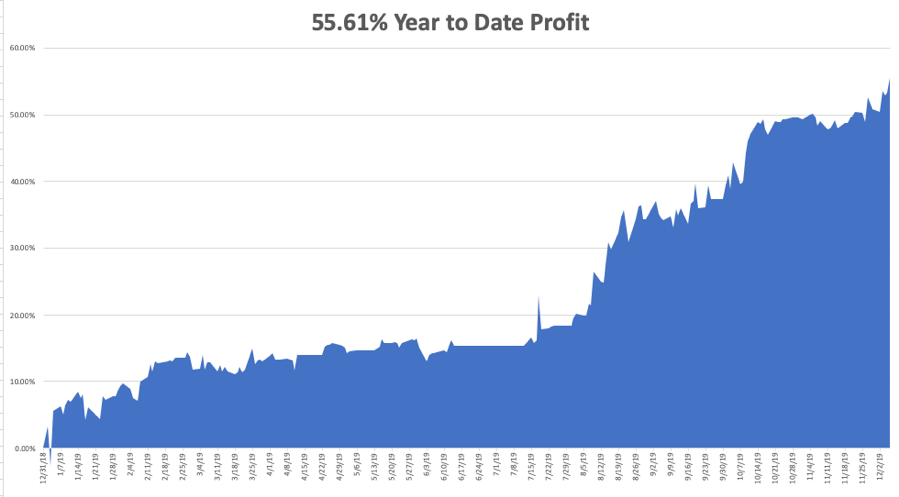

With that said, I have only one number to announce: 55.61%. That is the profit that followers of the Mad Hedge Fund Trader have earned so far in 2019, and I know many of you are up a lot more than that.

All it took for me to achieve a new all-time high was to turn aggressive at the bottom of last week’s 900 selloff in the Dow Average.

With super liquidity flooding the financial system and ultra-low interest rates fanning the flames, I didn’t believe my Mad Hedge Market Timing Index would not fall below 60, where it held.

I also thought that, with so many buyers clamoring to get into the market, no pullbacks would go beyond 3%, which also turned out to be true.

This prompted me to increase my “RISK ON” positions from 20% to 50%, the timing of which turned out to be perfect. That enabled me to coin a breathtaking +4.81% in performance last week, quite a big bite for this normally sedentary time of the year.

A sledgehammer of a different sort was taking to the shorts last week as a robust November Nonfarm Payroll Report sent share flying, up 266,000, a ten-month high. The Headline Unemployment rate dropped to 3.5%.

It was not entirely a rosy report, with 50% of the gains by those 55 and overtaking second jobs at paltry minimum $8-$12 an hour minimum wages to put food on the table during the Christmas season. On the other hand, only 25% of the gains were accounted for my Millennials who now make up 50% of the population.

The other sobering fact is that 100% of America’s economic growth is currently debt-driven. If the government were running a balanced budget as it should at this point in the economic cycle, the country’s GDP growth rate would be zero, and stocks would be in free fall.

As a result, risk in the market is at century highs. The second the government starts to reduce its gargantuan deficit, the stock market will crash.

Trump said the China (FXI) Trade Deal may have to wait until the 2020 election. I told you so. The Volatility Index (VIX) jumped 40% providing a great entry point for one more bite of the apple (AAPL).

Bonds (TLT) soared, opening up one of the best short-selling opportunities of 2019, which I took. The Chinese aren’t going to lift a finger to help Trump get reelected. Farmers are going to have to endure a third year of depression.

The November Nonfarm Payroll blew it away with a 266,000 report, a ten-month high. I’m hiring, that’s for sure. Maybe trade doesn’t matter after all.

China banned US warship visits in response to the US human rights stand on Hong Kong. It’s not exactly a step towards a trade deal, which is why the Dow is diving. The very long overdue correction in the US stock market is starting. Is the marketing finally starting to notice the still weak economic data?

Cyber Monday sales soared by 19% to an all-time record of $9.4 billion. Some 49% of sales were on smartphones, which to me who can bare read one is amazing. The internet was barely functioning on Monday, slowed to a snail’s pace by a glut of business. Now, if I can only get the Victoria’s Secret website to open….

A bigger oil glut looms as OPEC+ went into the Vienna meeting last week. If they don’t cut production substantially, oil prices will crash….again. High prices now are artificially high in front of the Saudi ARAMCO IPO. Avoid all energy plays on pain of death. The end of carbon-based energy forms has begun.

This was a week for the Mad Hedge Trader Alert Service to catapult to new all-time highs.

My long positions have shrunk to my core (MSFT) and (GOOGL).

My Global Trading Dispatch performance held steady at +352.76% for the past ten years, pennies short of an all-time high. My 2019 year-to-date catapulted back up to +52.62%. We closed out November with a respectable +3.07% profit. My ten-year average annualized profit ground back up to +35.28%.

The coming week will be a noneventful one on the data front.

On Monday, December 9 at 9:00 AM, Consumer Inflation Expectations for November are out.

On Tuesday, December 10 at 2:30 PM, the NFIB Business Optimism Index is released.

On Wednesday, December 11, at 6:15 AM, US Core Inflation is announced.

On Thursday, December 12 at 8:30 AM, Weekly Jobless Claims come out.

On Friday, December 13 at 9:30 AM, November US Retails Sales are printed.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be wrapping presents and doing some last-minute Christmas shopping. Only 200 Christmas trees left to sell.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.