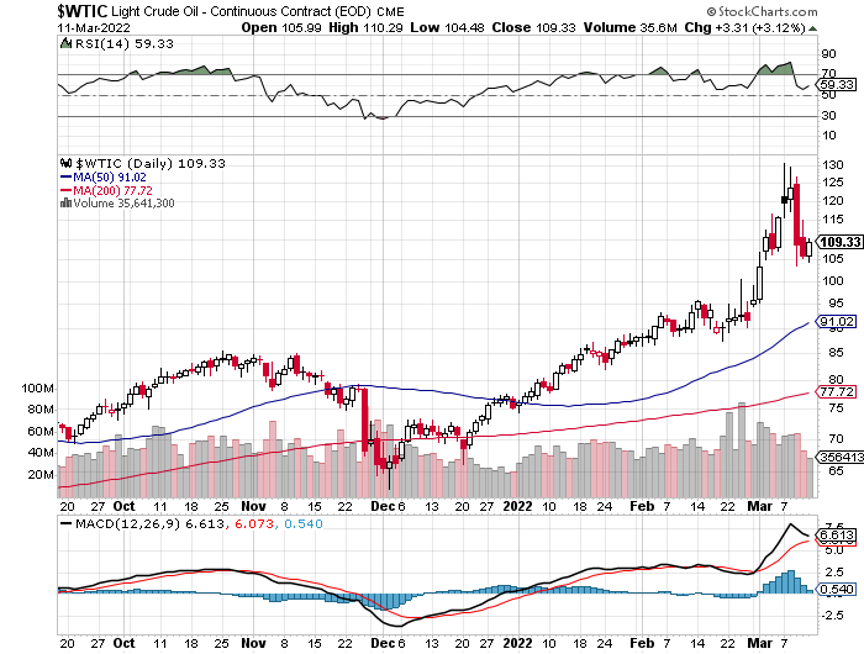

I hate to be the bearer of bad news, but the US is now looking at the ugly face of recession. Both oil shocks of the last 50 years promptly delivered serious recessions and the third one could well do the same.

Q1 is now Looking Like a Write Off, as analysts rush to pare forecasts. Some are cutting predictions from 5% growth to zero, or even negative numbers. There will be no sustainable stock market rally until this situation reverses in H2. Keep selling those rallies.

There is no denying that oil at $132 is starting to seriously drag on the economy. Here in San Francisco, gasoline has topped $7.00 a gallon. The good news is that high prices will pay for the enormous losses big oil will take writing off hundreds of billions of Russian investments. It will also greatly accelerate the move to electric vehicles. No wonder Tesla (TSLA) is holding up so well.

We may duck the bullet this time because the number of barrels needed to produce a unit of GDP has dropped by half since over the past half-century, thanks to conservation, improved technology, and the advent of electric vehicles. That old Lincoln Continental that guzzled 8 miles a gallon now gets 27.

The big issue will be how long it will take Germany to replace Russian gas. The US can do it easily, but it will take years to build out the infrastructure and build the ships. The big Russian strategic mistake is that they launched their war in the spring, just when German gas needs decline dramatically.

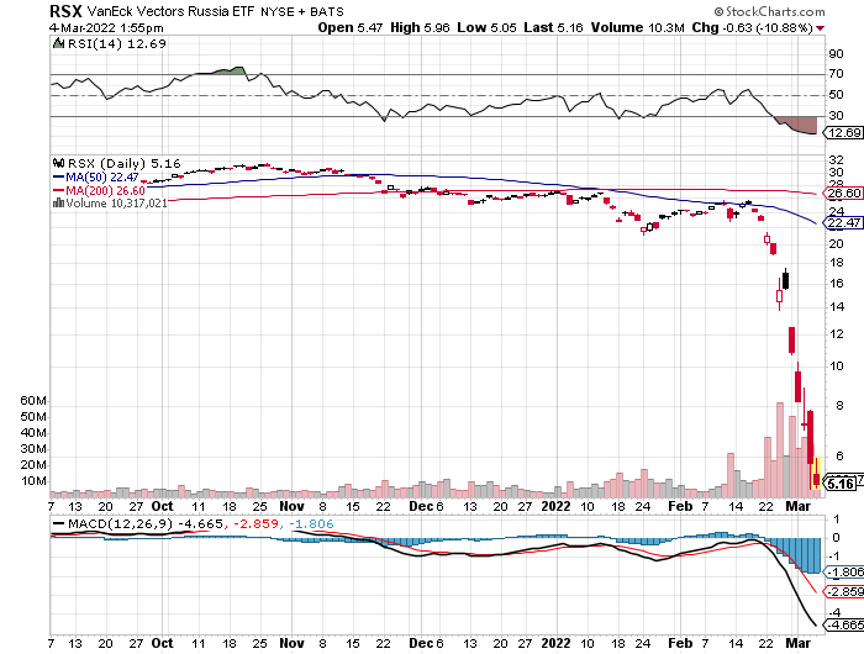

A second Cold War, a third oil shock, and a hot shooting war are a lot for markets to take in in only three weeks. It all means lower share prices….for now. It makes my down 20% target look pretty good.

There is one other matter that may save our bacon. The real economy is still hot, and the world is running out of everything. Oil was going to $130 anyway, even without the war.

Food, housing, materials, commodities, aluminum, steel, lumber, you name it. All are in short supply. And you already own the things these commodities make, like your home, you already have a hedge and a great long-term play.

This is not what recessions are made out of.

The US Bans Russian Oil Imports, and the rush is on to see how fast we can replace German imports. It’s also looking like several hundred billion dollars of Russian investment in illiquid long-term investments will be trapped in the US, such as in real estate, joint ventures, and venture capital. I keep pinching myself to see this WWII replay unfold. The Mad Hedge Market Timing Index just hit a one-year low at 13. Defense stocks are soaring.

Commodity Prices are soaring anywhere Russia is a major supplier. Nickel prices are up 90% and oil hit $133 a barrel. It all throws gasoline on the inflation fire.

Gold breaks $2,000, a new 18-month high, on a massive flight to safety bid. Next stop could be $3,000.

Nickel Prices soar 250%, to $100,000 a metric tonne, with Russia as a major producer. Futures trading is halted on the London Metals Exchange. Who is the biggest user of nickel? China at 59% and the rest of Asia for a further 23%, mostly to produce stainless steel. More supply disruptions to come. US automakers are scrambling, the biggest end-users of stainless steel. Car prices are about to rocket accelerating the move to carbon fiber.

Europe to Cut Russian Gas Purchases by Two Thirds This Year, some 45% of their current gas supply. They will essentially bring their renewable targets forward by a decade, which is moving forward much faster than the US. Oil is just too unreliable to depend on. Some are untried on a mass scale, such as using wind and solar power to electrolyze water to make clean hydrogen. It’s great if they can pull it off.

CPI Inflation Data comes in at a Red Hot 7.9% YOY, a new cycle high and a new 40-year high, and 0.8% for the month of February. Wars are highly inflationary, especially when they come on top of already chronic supply shorts and supply chain disruptions. Bonds are getting crushed. Too bad I’m triple short.

Weekly Jobless Claims come in at 227,000, with Continuing Claims at 1,494,000. Hot jobs demand downplays the risk of the Ukraine war creating any real recession. Repatriation of jobs from abroad will accelerate.

Amazon Splits 20:1, mimicking NVIDIA’s and Tesla’s earlier moves. Although it should make no difference, such splits are always a positive, as more retail investors can buy Alphabet at $145 than $2,900. Option traders too. The split takes place in July

Rents Rise at fastest rate in 30 years. The index for rentals of primary residences as collected by the Bureau of Labor Statistics is now the highest since 1987. Rents accounted for 40% of the big jump in the CPI in February. Inflation will get worse before it gets better.

Russian Credit Default Swaps Hit 34% Yields, indicating an extremely high probability of default. Some $100 million in interest payments are due next week, but with virtually all bank accounts frozen and kicked out of SWIFT, they have no means to pay.

The largest holders of Russian debt, like Pimco, Voya, and Capital Group, are taking big hits this morning. Who knows, they might be a BUY here. After all, those defaulted Chinese railroad bonds paid off, pennies on the dollar and 100 years after issue. Are confederate state bonds next?

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

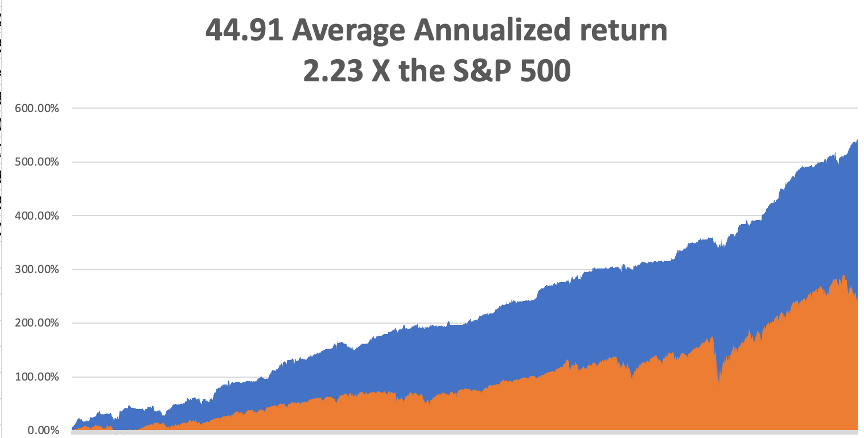

With near-record volatility, my February month-to-date performance catapulted to a blistering 15.56%. My 2022 year-to-date performance ended at a chest-beating 30.15%. The Dow Average is down -7.6% so far in 2022. It is the great outperformance on an index since Mad Hedge Fund Trader started 14 years ago.

My only new trade this week was to use a $4.00 dive in the (TLT) to go from a single to a double long in the bond market. That leaves me 60% invested and 50% in cash, waiting for the next capitulation selloff. So, I am 3X short the (TLT), 2X long the (TLT), and 1X long Tesla.

That brings my 13-year total return to 538.24%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.54%, easily the highest in the industry. Five of six of these positions expire on March 18, in four days.

We need to keep an eye on the number of US Coronavirus cases that's close to 80 million and deaths of around 970,000, which you can find here. Growth of the pandemic has virtually stopped, with new cases down 96% in a month.

On Monday, March 14 at 7:00 AM EST, US Consumer Inflation Expectations for February are printed.

On Tuesday, March 15 at 7:30 AM, the Producer Price Index for February is released.

On Wednesday, March 16 at 10:00 AM, the Federal Reserve will announce the first interest rate rise in five years, almost certainly a quarter point.

On Thursday, March 17 at 7:30 AM, Weekly Jobless Claims are published. Housing Starts and Building Permits for February are published.

On Friday, March 18 at 7:00 AM, the Existing Home Sales for February are announced. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, someone commented that I walk kind of funny the other day, and the memories flooded back.

In 1975, The Economist magazine in London heard rumors that a large part of the population was getting slaughtered in Cambodia. We expected this to happen after the fall of Vietnam, but not in the Land of the Khmers. So my editor, Peter Martin, sent me to check it out.

Hooking up with a right-wing guerrilla group financed by the CIA was the easy part. Humping 100 miles in 100-degree heat wasn’t.

We eventually came to a large village that was completely deserted. Then my guide said, “Over here.” He took me to a nearby cave containing the bodies of over 1,000 women, children, and old men that had been there for months.

I’ll never forget that smell.

With the evidence and plenty of pictures in hand, we started the trek back. Suddenly, there was a large explosion and the man 20 yards in front of me disappeared. He had stepped on a land mine. Then the machine gun fire opened up. It was an ambush.

I picked up an M-16 to return fire, but it was bent, bloody, and unusable. I picked up a second rifle and fired until it was empty. Then everything suddenly went black.

I woke up days chained to a palm tree, covered in shrapnel wounds, a prisoner of the Khmer Rouge. Maggots infested my wounds, but I remembered from my Tropical Diseases class at UCLA that I should leave them alone because they only eat dead flesh and would prevent gangrene. That class saved my life. Good thing I got an “A”.

I was given a bowl of rice a day to eat, which I had to gum because it was full of small pebbles and might break my teeth. Farmers loaded their crops with these so the greater weight could increase their income. I spent my time pulling shrapnel out of my legs with a crude pair of plyers.

Two weeks later, the American who set up the trip for me showed up with cases of claymore mines, rifles, ammunition, and antibiotics. My chains were cut and I began the long walk back to Thailand.

It’s nice to learn your true value.

Back in Bangkok, I saw a doctor who attended to the 50 caliber bullet that grazed my right hip. It was too old to sew up so he decided to clean it instead. “This won’t hurt a bit,” he said as he poured in hydrogen peroxide and scrubbed it with a stiff plastic brush.

It was the greatest pain of my life. Tears rolled down my face.

But you know what? The Economist got their story and the world found out about the Great Cambodian Genocide, where 3 million died. There is a museum in Phnom Penh devoted to it today.

So, if you want to know why I walk funny, be prepared for a long story. I still set off metal detectors.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader