I must confess, innovation can't be taught.

You are innovative, or you aren't. Don't pretend otherwise.

Innovation drives companies to outperform.

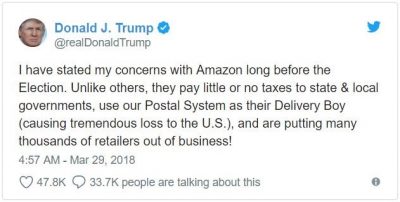

The economic environment becomes more cutthroat by the day rendering complacent companies obsolete.

Top-quality innovation leading to outstanding entrepreneurship is a well-traversed theme transcending industries across the American economic landscape.

The reservoir of innovation in 2018 is primarily flowing from one narrow source - the tech sector.

This is the primary motive for many adjacent industries to incorporate tech expertise into existing and commonly ancient legacy systems.

Tech promises laggards a ride atop the gravy chain.

In many instances, these companies are grappling with existential threats from all directions.

The best example is Walmart (WMT), which effectively mutated into the next FANG with its majority stake in Indian e-commerce juggernaut Flipkart. This deal followed its purchase of Jet.com in 2016, which was its first foothold in the e-commerce world.

Traditional companies are becoming tech companies because of the ability to innovate all leads through the fingertips of talented coders.

When all roads lead to Rome, you will have to go through Rome.

The hunger for innovation has had major implications to the financial side of technology.

The story picks up from a recent report disclosing the 2017 remuneration of co-founder and CEO of Instagram competitor Snapchat (SNAP) Evan Spiegel.

The $637.8 million he received in 2017 was the third-highest annual compensation ever to be collected by a CEO.

Snapchat has tanked following its 2017 IPO and the main reason is Facebook is stealing its lunch and leaving Snap the crumbs on which to nibble.

Instagram, using a cunning strategy of cloning Snap's best features, single-handedly bludgeoned Snap's share price cutting it by half after the successfully launched IPO.

Snap has been an unequivocal sell on the rallies stock since the inception of the Mad Hedge Technology Letter and the disastrous redesign did no favors either.

My first risk off recommendation was Snapchat and at the time it was trading at $19. To revisit the story, please click here.

Microsoft (MSFT) is a great stock because it posts accelerated revenue and earnings, while Snapchat is a terrible company because it produces accelerated losses and lousy user growth.

A company almost 100 times smaller than Microsoft should not be struggling to grow.

It's a failure of epic proportions.

Small companies expand briskly because the law of numbers is leveraged in their favor and the tiniest bump of additional business has a larger effect on the bottom line.

As it stands, Snapchat lost $373 million in 2015, and followed that up with a disastrous $514 million loss in 2016, and a gigantic $3.45 billion loss in 2017.

Losses accelerated by 800% but annual revenue only doubled last year.

It was no shocker that the poor relative performance resulted in the sacking of 100 Snapchat developers.

Smart people would assume an annual salary of this magnitude (Spiegel's) would be the result of excellent performance.

Why else would a CEO get a lavish payout?

I'll explain.

The demand for tech knows no bounds.

In this environment, venture capitalists will pay up for brilliant ideas.

The problem is that brilliant ideas don't grow on trees.

The few cutting-edge ideas have stacks of money thrown at them.

In this sellers' market, founders can cherry-pick the best financing deal that will enrich them the quickest and empower them the most.

Multiple offers have become the norm just as with the Silicon Valley housing market.

The consequences are the premium for these brilliant ideas keeps rising and investors keep paying higher prices without a second thought.

Therefore, founders and CEOs are opting for the financial packages that offer them bulletproof voting shares, allowing the innovators to control operations to the very last detail.

The founders are responsible for leading innovation, and investors are offering glorious pay terms for this innovation because it can't be substituted. Low-quality tech has less of a premium because the technology can easily be rebranded and substituted.

Technology from the ground up is slowly being automated away leaving runaway valuations the norm.

Giving the keys to the Ferrari makes sense as tech companies formulate long-term strategies based on scale. And securing job security without the threat of an activist takeover offers peace of mind for CEOs who are focused on the daily grind.

Knowing their baby won't get stolen from the carriage goes a long way in tech land.

Venture capitalists are reticent about following through with proper governance because they do not want to alienate the innovators who could choose to stop innovating.

These investors also know that tech is the least regulated industry in the world, so it's better to turn a blind eye to cunning growth strategies that push the border of regulation.

The competition to fund these emerging tech companies is borderline criminal.

Uber declined a $3 billion investment by no other than the Oracle of Omaha Warren Buffett.

Buffett described himself as a "great admirer" of Uber CEO Dara Khosrowshahi.

Uber is one of the most unlikely Warren Buffett investments because it doesn't create anything and burns cash faster than a Kardashian.

Buffett's faith in Uber underscores the reliance on tech to fuel the stock market to new heights.

Buffett also admitted mistakes on missing out on Alphabet (GOOGL) and Apple (AAPL).

Rightly so.

Then add in the mix of SoftBank's $100 billion vision fund that just announced an upcoming sequel with another $100 billion vision fund.

Where is all this money flowing into?

Of the tech companies that went through an IPO last year backed by venture capitalist money, 67% relinquished superior voting rights to key founders, a rise of 54% since 2010.

Compare that to non-tech companies that only allow 10% to 15% of CEOs to institute a voting structure that will put them in charge indefinitely.

In many instances, the persona of these ultra-famous tech CEOs has taken on a life of its own.

Elon Musk, CEO of Tesla, is the most prominent example of a celebrity tech innovator milking every possible penny from his shareholders and is not shy about flaunting it.

News has it that Musk needs to go back to the well for another stage of financing later this year.

Don't worry, the money will be there in this climate.

Buffett's rejection was due to losing out to SoftBank, which beat out Buffett to invest in Uber.

SoftBank just announced a $3.35 billion investment into GM's (GM) autonomous driving unit called Cruise enhancing the best big data portfolio in the world.

At this pace, CEO of SoftBank Masayoshi Son will have a piece of every major big data company in the world.

This all bodes well for tech equities as the insatiable hunt for emerging, innovative tech spills over into daily equity market driving up the prices for all the top innovating public companies such as Salesforce, Amazon, Microsoft and Netflix.

Buffett, down on his luck after being shafted by Uber, picked up more Apple shares.

He sold all his IBM (IBM) shares after reading the Mad Hedge Technology Letter advising him to stay away from legacy companies.

Smart move, Warren. You can pick up the tab for our next lunch date.

If you have a few billion to throw around, expect multiple offers over the asking price for any high-grade tech innovation.

The going rate is shooting through the roof and you might NEVER be able to sack the founder.

Caveat emptor.

_________________________________________________________________________________________________

Quote of the Day

"We knew that Lyft was going to raise a ton of money. And we went (to their investors): 'Just so you know, we're going to be fund-raising after this, so before you decide whether you want to invest in them, just make sure you know that we are going to be fund-raising immediately after.' " - said former CEO and founder of Uber Travis Kalanick when asked how he copes with competition.