Below please find subscribers’ Q&A for the April 3 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Key West, Florida.

Q: What’s going on with gold (GLD)?

A: Well it’s simple; gold hasn’t moved in a year and people want to rotate out of big tech into something that hasn’t moved. Gold has a great long-term story if interest rates fall and if central banks continue to accumulate gold. We could go up quite a lot from here; my goal right now is 3,000/oz by the end of next year.

Q: Are ETFs or single stocks a better buy right now?

A: ETFs are baskets, tend to have high fees, and tend to move at half the rate of single stocks. Single stocks can go up a lot faster and have a lot more risk. So if I have a strong feeling about a particular asset class like gold or silver, I'll go ahead and buy single stock names directly like Barrick Gold (GOLD) and Wheaton Precious Metals (WPM) because I know I’ll get a multiple of the performance of a basket of gold companies.

Q: Ford Motor Co. (F) seems like a better play than Tesla (TSLA) this year. What is your opinion?

A: You’re absolutely wrong, Tesla is a fantastic buy down here, once the EV nuclear winter ends. Tesla could rise a multiple from here—Ford probably not so much. Notice also that GM saw sales fall by 1.5% in the first quarter of this year. Tesla just has the technology; Ford and GM don’t. The long-term outlook for the ICE companies is grim. They have millions invested in internal combustion engine factories, which very soon will be worth nothing more than scrap metal.

Q: Do you have a long-term target on the downside for Tesla (TSLA)?

A: Well I’m currently long the April $140-$150 vertical bull call debit spread that expires in 10 days. To get a price lower than $140, you need to get drastically worse news, which I don't think we’ll get. I think we’re bottoming out right around here; Tesla’s already down 62% from an all-time high. During the pandemic, it dropped 80%.

Q: What is the chance that inflation returns, and what happens if it does?

A: Interest rates rise, and the Fed postpones interest rate cuts even further. However, I don’t think that’s going to happen, because technology and artificial intelligence are having such a huge deflationary impact on the economy that any bad news about inflation will be short-term, and we are in a long-term trend going down.

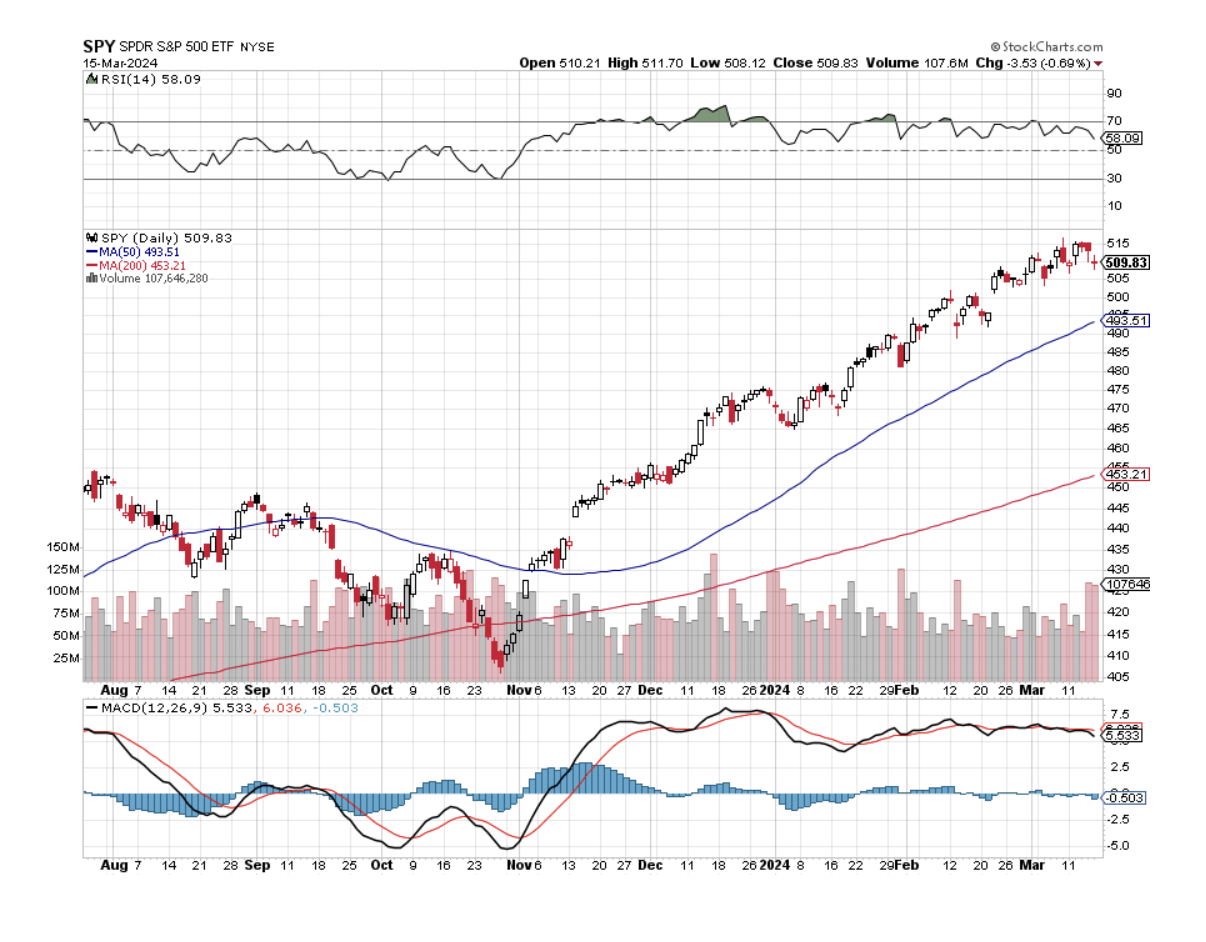

Q: How does falling Fed QT affect interest rates?

A: It causes them to go down because it means the Fed is selling less of its bond holdings into the market. This means they’re taking less money out of the financial system, meaning liquidity is increasing, which is good for all risk assets. I think the stock market has noticed this by going up almost every day so far this year. So, just as quantitative easing was great for the economy and the stock market, the quantitative tightening was terrible, and the fact that they’re ending it is good for all risk assets.

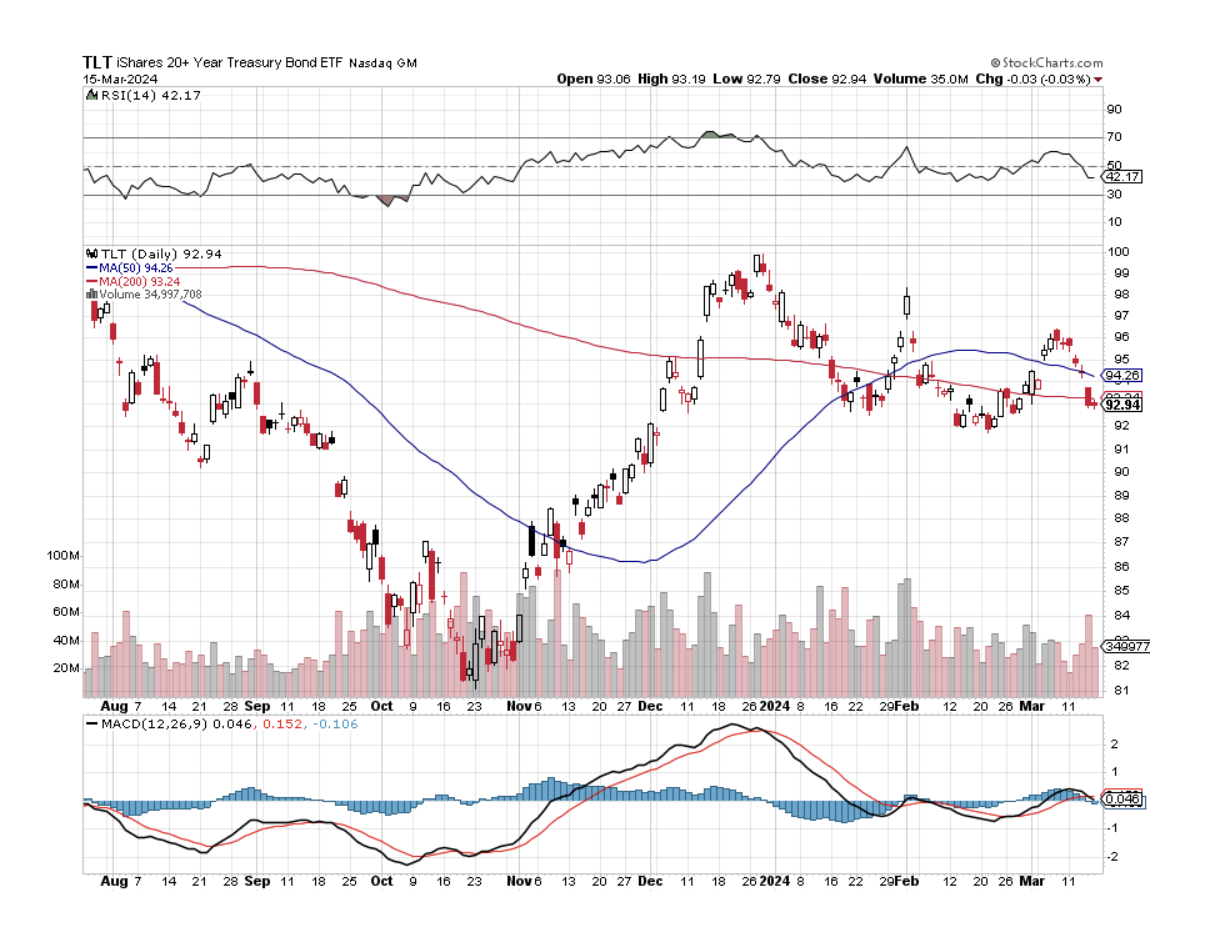

Q: Where do you see the price rising for iShares 20+ Year Treasury Bond ETF (TLT)?

A: 110 by the end of the year, but we might have another $1.00 or $2.00 of downside first. If you get down to $90 or so, I’ll be knocking out the trade alerts to buy call spreads as fast as I can write them. But first let’s let (TLT) find its new level, and interest rates find their new high.

Q: What is a barbell?

A: A barbell is where we have overweight sections in two parts of the market; one is technology and one is domestic recovery plays. We have nothing in most sectors in between. That’s what we’ve been doing for years, and it works pretty well because you always have something that’s going up. That’s why it’s called a barbell.

Q: If you were doing a new LEAP on Wheaton Precious Metals (WPM), what would you do?

A: I would do an at-the-money, which at this point would be June 2025 $50-$53 verticals bull call spread LEAPS, and I would go out at least a year, probably a year and a half because we’ve just had a very big run in Wheaton Precious Metals—about 25%. LEAPS are things you do at market bottoms, not at market tops. A reversal can be very expensive—they can literally go to zero on you.

Q: What do you think will be the next asset class investors will rotate into after commodities?

A: Big technology. We’re going to be going back and forth between the two sectors probably for years. So, I think tech needs a time correction of several months, where commodities and precious metals and energy will run free, and eventually, they’ll get overbought and want to take a rest, and then everyone rotates back into big tech. In the meantime, big tech and AI are moving forward with their technology.

Q: Why has Carnival Corp (CCL) had such a terrible stock performance, even though they’re having record sales and full ships?

A: They have huge amounts of debt leftover from the pandemic, which they got both from the government and the private sector. If they hadn’t done that, they’d have gone bankrupt, and it’s going to take a long time to pay off all that debt, even though it was at interest rates that were quite low. Plus, if they have to refinance any of that, that can get expensive too because the old loans are at zero or 1%, and the new loans are going to be like 6%, 7%, or 8%. So that has been a drag on Carnival Cruise Lines.

Q: What is a time correction?

A: A time correction is when the stock goes sideways for a period of time without going anywhere because nobody wants to sell it, everyone is bullish, and they’re willing to wait for the next leg up in the bull market. In the meantime, money rotates into other stocks that are moving, like commodities, precious metals, and energy.

Q: Should we take profits off of Barrick Gold (GOLD) after the recent runup, or does it have some more room to go into the upside?

A: Only if you’re a short-term trader do you want to take advantage of the recent run-up in Barrick Gold. I, however, think the stock could go up another $10 or $20 by the end of the year. I am quite happy to hold on. In fact, on any dips or weak days, I am adding to my position, not looking to run it down.

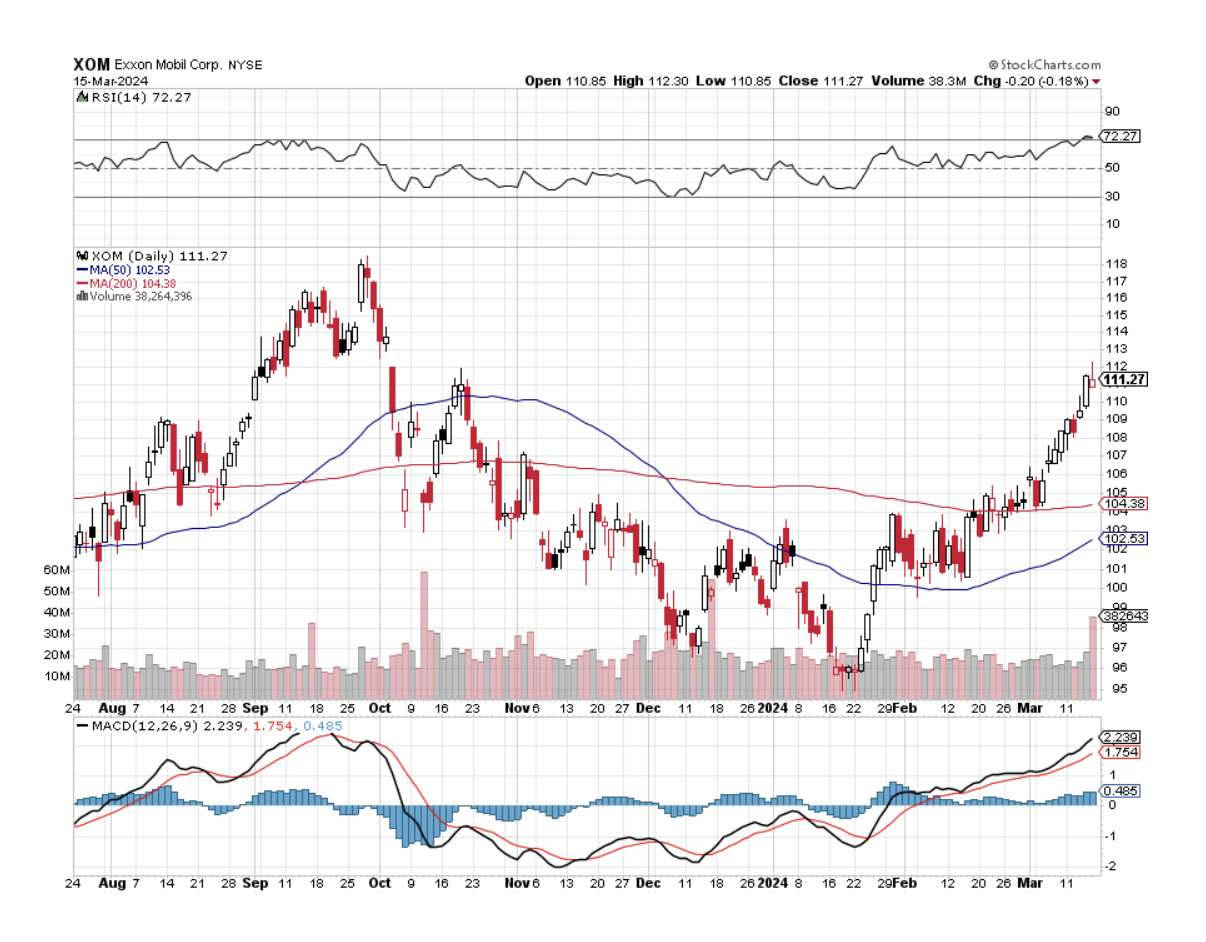

Q: What do you expect for oil prices?

A: I think we go to the top of the multi-year $62-$95 range and I’m going to run my longs in (XOM) and (OXY) until then.

Q: What do you think of Ken Griffin’s criticism of the US national debt growing at such a fast pace?

A: I’ve been hearing about the national debt for my entire life, since I was 3 years old and my grandfather would lecture me about the national debt, back when it was a pittance compared to what it is now. The fact is, growing national debt seems to have zero impact on any risk asset whatsoever. Stocks are at all-time highs, real estate is at all-time highs and rising, and the dollar is at all-time highs when rising debt was supposed to crush the dollar. The actual fact is that 80% of all the national debt was run up by Republican presidents, so to see Republicans complain about rising debt, especially our most recent president who increased it by $10 trillion is somewhat ironic. The fact s that the national debt is the result of four big tax cuts for billionaires that took place under Kennedy (1960), Reagan (1984), Bush (2002), and Trump (2017), so it’s also ironic that billionaires like Griffin and Paul Tudor Jones are complaining the loudest. They all sound like Cassandras—warning that the sky is falling, but it never seems to happen. In the meantime, I would buy bonds, because they’re not worried about national debt either.

Q: Can Bitcoin go higher after the halving in April?

A: No, the halving is in the price. All of the Bitcoin marketers have been selling you Bitcoin based on that halving for a year now. So the actual halving is going to be a classic “buy the rumor, sell the news” type move.

Q: What do you consider a dip?

A: It’s different for every stock depending on its volatility. It could be 5% for a boring stock, or 20% for something like Nvidia (NVDA).

Q: Does commercial real estate present a systematic risk to the financial markets?

A: No, commercial real estate is only 5% of the loan portfolios of the big banks, and maybe 1% of that will go under. It’s just a normal year of losses for the banks. As for regional banks, they’re the ones that will get hit; they’ll have to do deals to get bought up by the big banks. This is why I think we’re in the process of going from 4,000 banks in the United States to only 6.

Q: Is $100/barrel for oil back in play?

A: No, but $95 is, which is why I went long ExxonMobil (XOM) and Occidental Petroleum (OXY). So, it’s kind of late to get involved here on this trade, but if you are long oil, I would keep it and squeeze the last bit of juice out of those lemons.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader