Below please find subscribers’ Q&A for the Mad Hedge Fund Trader May 15 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Where are we with Microsoft (MSFT)?

A: I think Microsoft is really trying to bottom here. It’s only giving up $8 from its recent high, that's why I went long yesterday, and you can be hyper-conservative and only do the June $110-$115 vertical bull call spread like I did. That will bring in a 13.68% profit in 28 trading days, which these days is pretty good. This morning would have been a great entry point for that spread if you couldn’t get it yesterday.

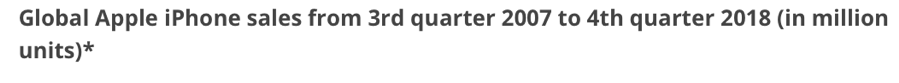

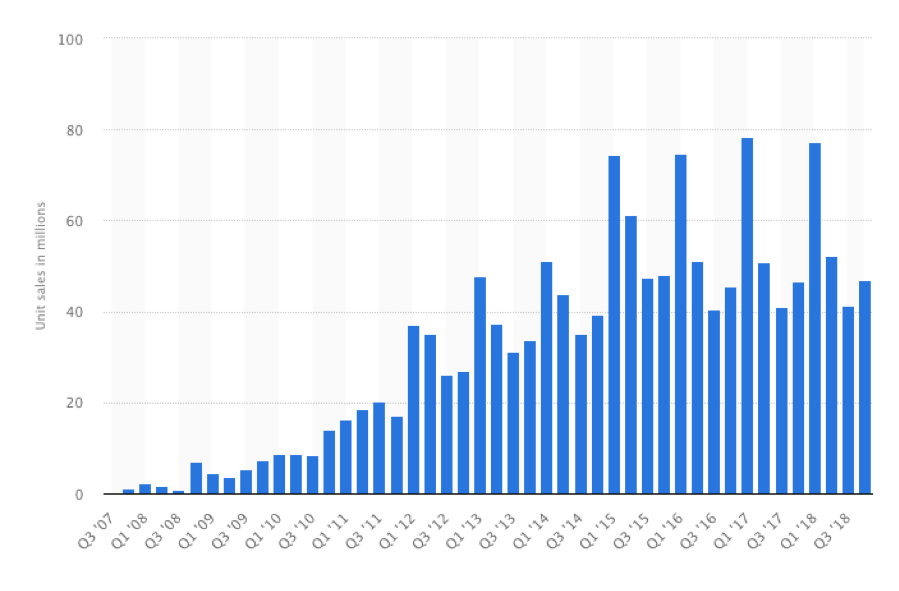

Q: How will tariffs affect Apple (AAPL) when they hit?

A: The price of your iPhone goes up $140—that calculation has already been done. All of Apple's iPhones are made in China, something like 220 million a year. There’s no way that can be moved, they need a million people for the production of these phones. It took them 20 years to build that facility and production capacity; it would take them 20 years to move it and it couldn't be done anywhere else in the world. So, that's why Apple led the charge on the downside and that's why it will lead the charge to the upside on any trade war resolution.

Q: How bad is the trade war going to get?

A: The market is betting now by only going down 1,400 Dow points it will be resolved on June 28th in Osaka. If that doesn’t happen it could get a lot worse. It could get down to my down 2,250-point target, and if it continues much beyond that, then we’ll get the whole full 4,500 points and be back at December lows. After that, you’re really looking at a global recession, a global depression, and ultimately nearing 18,000 in Dow, the 2016 low.

Q: Will global trade wars force US Treasuries down to around 2.10% on the ten year?

A: Yes. Again, the question is how bad will it get? If we resolve the trade war in six weeks, treasuries will probably double bottom here at around a 2.33% yield. If we go beyond that, then 2.10% is a chip shot and we go into a real live recession. The truth is no one knows anything, and we really don’t have any influence over what happens.

Q: How will equities digest and increase in European tariffs for cars?

A: It would completely demolish the European economy—especially that of Germany (EWG) which has 50% of its economy dependent on exports (primarily cars) and mostly to the U.S. And if we wipe out our biggest customer, Europe, then that would spill over here very quickly. Anybody who sells to Europe—like all the big Tech companies—would get slaughtered in that situation.

Q: Is it time to buy the Volatility Index (VIX)?

A: It’s too late to buy (VIX) now. I don’t want to touch it until we get down to that $12-$13 handle again because the time decay on this is enormous. Time decay is more than 50% a year, so your timing has to be perfect with trading any (VIX) products, whether it’s the (VXX), the (VIX) futures, the (VIX) options, or so on. There are countless people shorting (VIX) here, and they will short it all the way down to $12 again.

Q: What should I do about Boeing at this point?

A: We went long, got out, took our profit and caught this rally up to $400 a share. Then (BA) gave it up and it broke down. It’s a really tempting long here. Along with Apple, Boeing has the largest value of exports to China of any company. They have orders for hundreds of airlines from China, so they are an easy target, especially if there is a ramp up in the intensity of the trade war. That said, something like a June $270-$300 vertical bull call spread is very tempting, especially with elevated volatility up here, so I’m watching that very closely. We’re looking for the recertification of the 737 MAX bounce which could happen in the next few weeks; if that does happen it should rally at least back up to 380.

Q: Are your moving averages simple or exponential?

A: I just use the simple. I find that the simpler a concept is, the more people can understand it, and the more people buy it; that’s why I always try to keep everything simple and leave the algorithms for the computers.

Q: What stocks are insulated from a US/China trade war?

A: None. When the whole market goes risk off, people sell everything. Remember that an overwhelming portion of the market is now indexed with passive investment funds, so they just go straight risk on/risk off. It makes no difference what the fundamentals are, it makes no difference who has a lot of Chinese business or a little—everyone gets hit and everyone will get boosted when the trade war ends. There is no place to hide except cash, which is why I went 100% cash going into this. People seem to forget that cash has option value and having a lot of cash going into one of these situations is actually worth a lot of money in terms of opportunities.

Q: Do you have any thoughts on Uber’s (UBER) bad performance?

A: Yes, the whole sector was wildly overvalued, but no one knew that until they brought it to market and found out the real supply and demand for the issue. The smartest company of the year has to be Lyft (LYFT), which got a nice valuation by doing their issue first and keeping it small. So, they kind of rained on Uber’s parade; at one point, Uber was down 25% from their IPO price. That’s awful.

Q: Is Trump forcing the Fed to drop rates with all this tariff threat?

A: Yes, and if you remember, Trump really ramped up the attacks on the Fed in December. And my bet is at the first sign the trade talks were in trouble, they wanted to lower rates to offset the hit to the U.S. economy. There was no economic reason to suddenly demand huge interest rate cuts last December other than a falling stock market. The tariffs amount to a $72 billion tax increase on the American consumer, felt mostly at the low end, and that is terrible for the economy in that it reduces purchasing power by exactly that much.

Q: Would you buy the dollar as a safe haven trade?

A: No, I would not. The dollar may actually go down some more, especially with the collapse in our interest rates and European interest rates bottoming at negative levels. The best thing in the world in a high-risk environment like this is cash—don’t try to get clever and buy something you think will outperform. You could be disappointed.

Q: Why is healthcare (XLV) behaving so badly?

A: You don’t want to get into political football ahead of an election. That said, they're already so cheap that any kind of recovery could very well take healthcare up big, especially on an individual company basis. This is a sector where individual stock selection is crucial.

Q: Would you buy deep in the money calls on PayPal (PYPL)?

A: Yes, I would. Wait for a down day. Today we’re up slightly, but if we have a weak afternoon and a weak opening tomorrow morning, that would be a good time to add more longs in technology. PayPal is absolutely at the top of the list, as are names like Adobe (ADBE) and Alphabet (GOOGL).

Q: Should I be buying LEAPS in this environment?

A: No; a LEAP is a one-year long term deep out-of-the-money call spread. That was a great December bottom trade. The people who bought leaps then made huge fortunes. We’re too high here to consider leaps for the main market unless it's for something that’s just been bombed out, like a Tesla (TSLA) or a Boeing (BA), where you had big drops—then I would look at LEAPS for the super decimated stocks. But the rest of the market is still too high for thinking about leaps. Wait a couple of months and we may get back to those December lows.

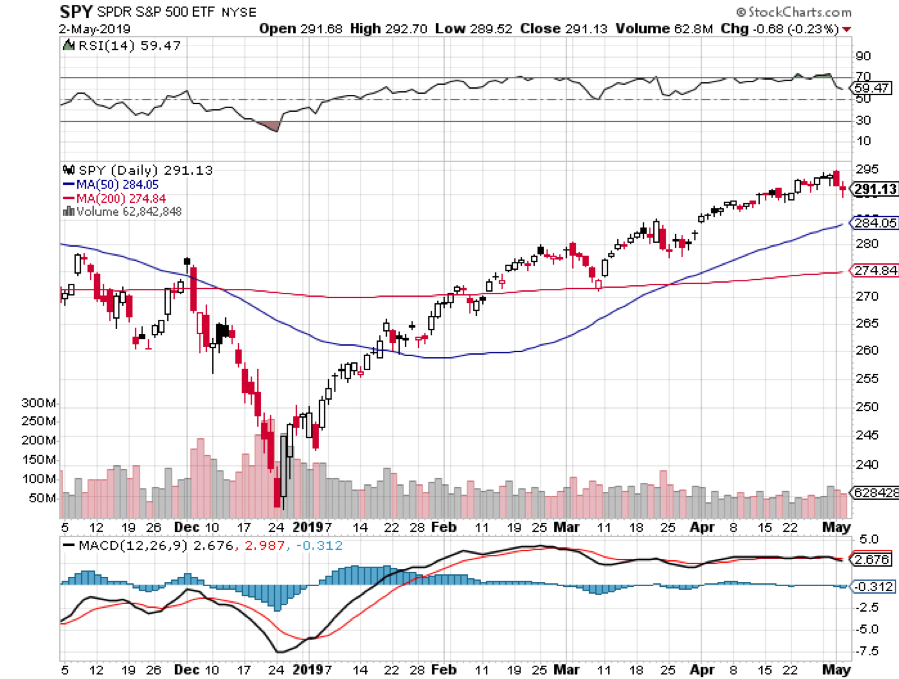

Q: What happened to your May 10th bear market call?

A: Actually, it’s kind of looking good. It’s looking in fact like the market topped on May 2nd. If saner heads prevail, the trade war will end (or at least we’ll get a fake agreement) and the market will go to a new high. If not, then that May 10th target forecast I made two years ago IS the final top.

Q: You’re saying today we’re at a bottom?

A: We’re at a bottom for a short-term trade with a June 21st target. That was the expiration date of the options spreads I did this week. Whether this is the final bottom in the whole down move for a longer term, no one has any idea, even if they try to say differently. This is totally dependent on political developments.

Q: What do you have to say about Lockheed Martin (LMT)?

A: This sector usually does well with a wartime background. Expect that to continue for the foreseeable future. But at a certain point, the defense stocks which have had fantastic runs under Trump will start to discount a democratic win in the next election. If that does happen, defense will get slaughtered. I would be using any future strength to sell out of the whole defense area. Peace could be fatal to this sector.