Tarrifs Come For Tech Stocks

Tech stocks have felt the full effect of the volatile nature of the new federal government in charge in Washington.

Tech stocks aren’t looking too pretty today.

The new admin levied a 25% tariff on goods from Mexico only to give the Mexicans a 1-month reprieve.

Like a game of high-stakes poker, but Trump is wielding the American economy at the poker table with reckless abandon.

Tech stocks whipsawed and most stocks opened up in the red, however, a stock like Meta was able to ride out the instability by surging at the open.

Not all tech stocks are created equal.

If many investors thought Trump wouldn’t follow through with his sabre-rattling, then think again.

He is hell-bent on going full throttle and pushing allies to the brink whether they can tolerate it or not.

The surge in interest rates because of the perception of higher inflation and higher geopolitical risk was the reason tech stocks were jolted at the beginning of this week.

Indeed, tech stocks are in for a sideways correction if American government policy becomes constantly aggressive and brutal.

Tech stocks will have a narrow path to go higher, but not like the prior 10 years when stocks were cheered higher by almost everyone.

Trump said this will boost US manufacturing.

The tariffs will grow the US economy, protect jobs, and raise tax revenue, he argues.

Canada’s Trudeau declared retaliatory 25% tariffs on $107 billion dollars worth of US goods on Saturday.

Mexican President Claudia Sheinbaum has directed the Secretary of Economy to impose a plan including "tariff and non-tariff measures in defense of Mexico's interests".

Together, China, Mexico, and Canada accounted for more than 40% of imports into the US last year.

Most goods from Mexico don’t affect tech stocks such as fruits like avocado, vegetables, tequila, and beer.

Canadian goods such as steel, lumber, grains, and potatoes are also likely to get pricier.

It is expected that the car manufacturing sector could see the brunt of the effects of the tariff.

It’s not like Trump is only going after Mexico and Canada, he also has the U.K. and Europe in his crosshairs.

Do tariffs cause inflation?

In the short term, tariffs will hit consumers in the U.S. with corporations front-running price increases by passing on the higher inputs to the end buyer.

The market also senses higher inflation and interest rate yields will get bid up, which is negative for tech stocks.

It is naïve to think that tech stocks will go up in a straight line like the past 10 years – they certainly will not.

If the government is hell-bent on this type of tactic, global markets will feel the pain.

Even if this doesn’t directly affect tech stocks, the American consumer will not go unscathed.

Interest rates exploding higher will certainly mean tech stocks opening up Monday mornings 3% down.

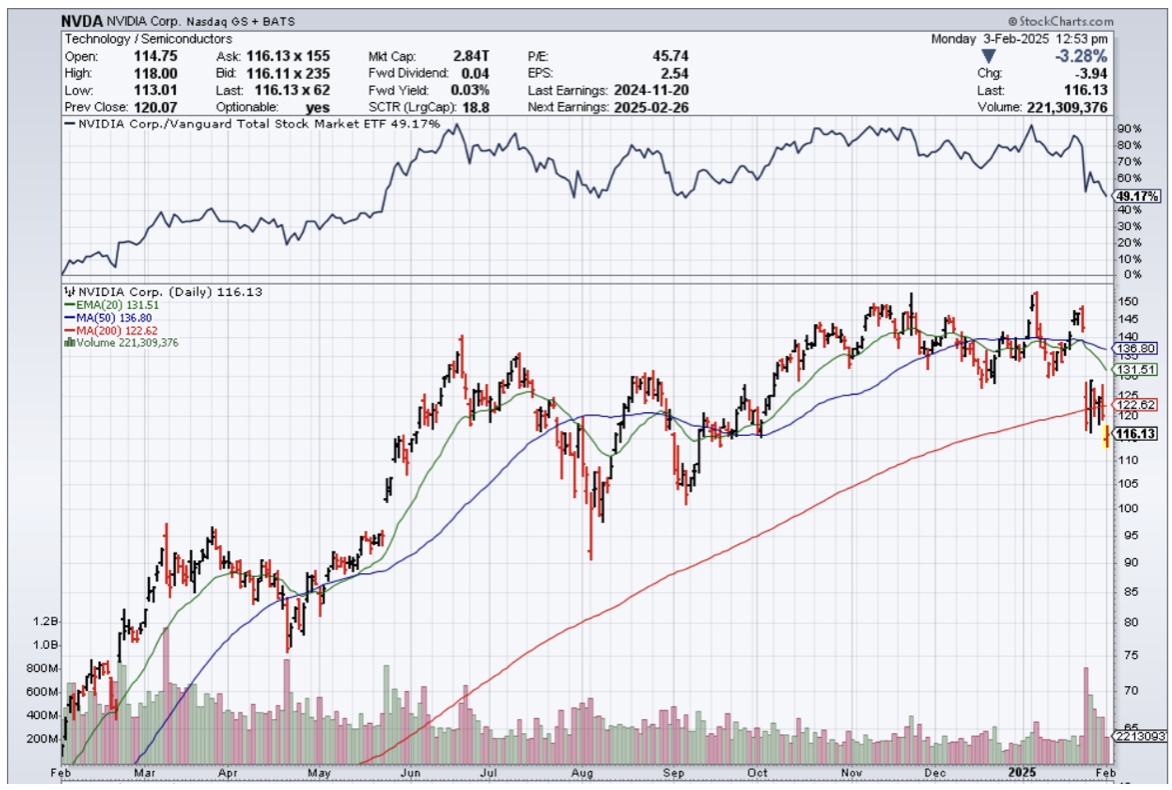

That is not a good starting point for the week and explains why the bellwether Nvidia (NVDA) is down 15% year to date.

Then throw in the chaos from the Deepseek fiasco that threatens the valuations of many AI stocks.

It’ll be tough sledding from here on out and tech investors need to be mindful to not get caved in out of nowhere.