Jobs Report A Tailwind For Tech Shares

Don’t forget that we are still in the middle of a good-news-is-bad-news paradigm.

This paradigm could be positive for tech stocks in 2023.

Why is that?

Tech shares and the investors that participate in the trading of these shares are betting that the Fed doesn’t have the gall to lower inflation to the mandated 2%.

The incessant desire for the Fed pivot would result in the Fed changing directions and reversing its quantitative tightening.

The Fed will delay the much-awaited easing of monetary policy if there is too much good news.

Sure, this all seems counterintuitive, and that isn’t your fault.

The Fed isn’t too interested in killing inflation because it could instigate a stock market crash or an economic depression.

The verbiage the Fed uses is a “soft landing.” That’s what they want opposed to a “hard landing.”

Why did tech shares skyrocket on the latest jobs report?

The headlines were fantastic therefore based on the above description, tech shares must have sold off, but the inverse happened and tech markets went gangbusters this morning.

The economy added 223,000 jobs in December, beating expectations, but most of these jobs weren’t white-collar or full-time jobs.

The US gained 4.5 million jobs in 2022, making it one of the best years of job growth ever, but the tech market doesn’t care about that one because the stock market trades on forward-looking valuations.

In fact, the US tech sector has been leading the charge in layoffs with many tech executives saying they overhired during the arbitrary lockdowns.

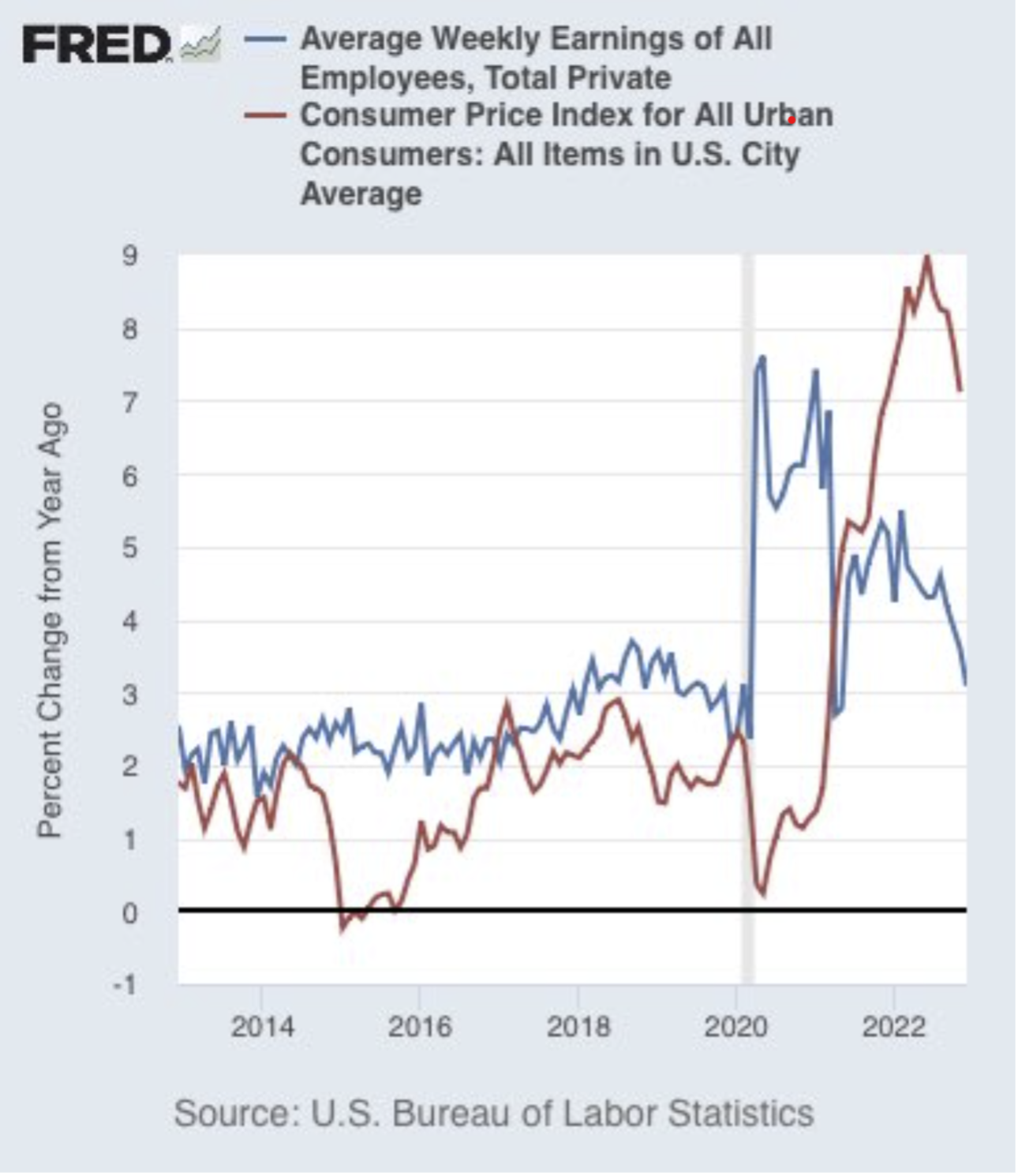

The tech market clung to one number and naturally the one that has a direct influence on the high inflation rate - wage growth at 3.4% year over year.

This was also the smallest job gains in the past 2 years.

Today's jobs report is a stark reminder that wage growth is being smothered by Bidenflation.

More folks have to take on a second job just to make ends meet.

Sometimes even a darn third job if time allows.

Lately, wage growth has come in incredibly high, because for quite some time, those high-paying full-time jobs were still on the table.

Ultimately, broad-based job losses are what will lead to a Fed pivot and not just tech jobs losses.

Tech is way ahead of the game executing broad-based layoffs and they will be rewarded for it. These are also great entry points to buy the dip.

It’s natural to observe many tech firms tightening up operations. Money isn’t free anymore and earnings are falling apart as we speak.

Tesla is cutting the price of Tesla EVs in China.

Amazon is cutting a more-than-expected 18,000 workers.

Many tech firms are slimming down their model to prepare for a recession.

The endpoint here is low rates and a lot of pain will occur to get to that end.

Tech in early 2023 will merely be a high-volatility trader’s dream until we get the green light for easy money again.

Buy big dips and sell large rallies – rinse and repeat. There is no way that tech stocks will go up in a straight line because earnings simply aren’t accelerating – they will be lucky to just pass the sniff test at this point so position accordingly.