Tech Stock Poised To Move Up

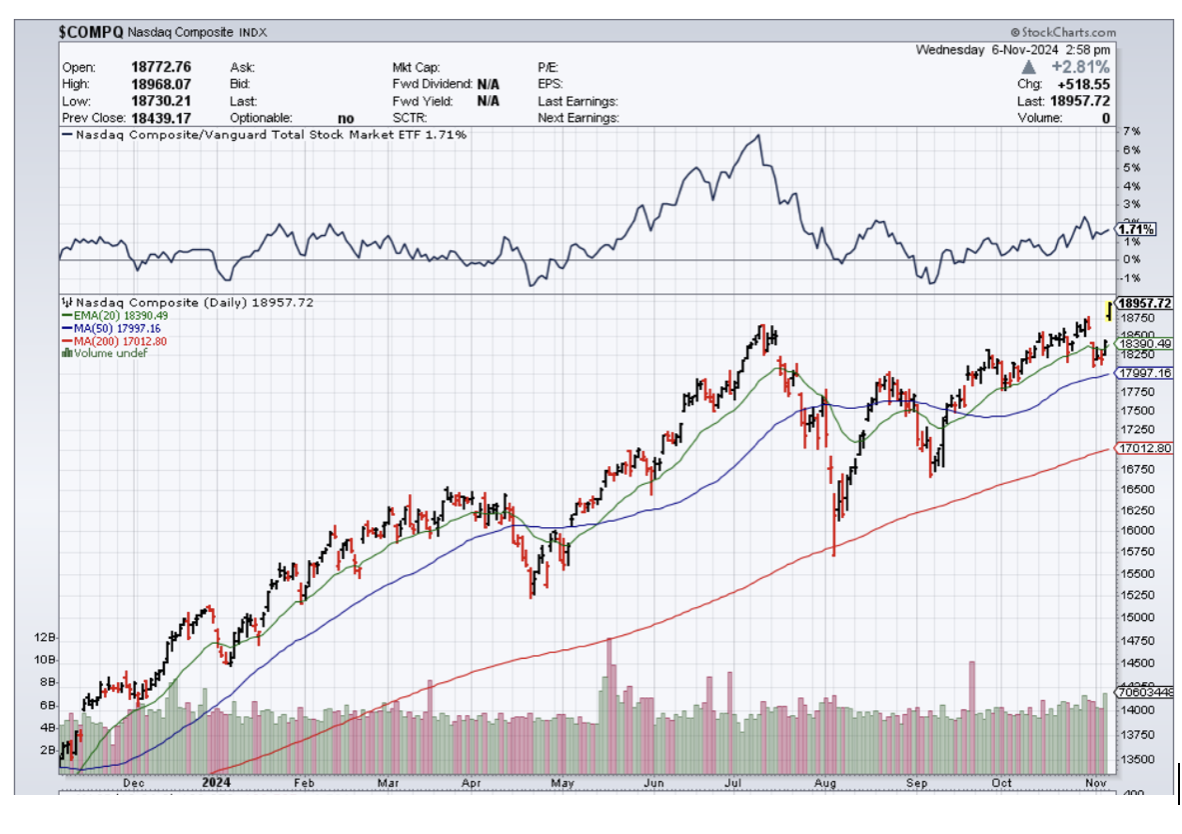

Now that the U.S. election has come and gone with nothing more than a whimper, we are full speed ahead with the last upmove in tech stocks ($COMPQ) for the year 2024.

The beginning of the rally is here, and readers shouldn’t miss it.

A lot of money was waiting on the sidelines, and now we will start seeing institutional money pouring in.

The equity market ripping higher up on the news of a new administration coming to town is a highly bullish signal for the rest of the year for the Nasdaq index.

Chip stocks did quite remarkable today, with the likes of Micron up around 6% at the time of this writing.

I believe that fund managers will hop on and try to achieve the extra alpha now that the biggest risk of an incomplete election is off the table.

The move down in gold by around 3% suggests that fear over the election being inconclusive is off the table.

I don’t envision the new administration starting a witch hunt against tech stocks. Tech stocks still represent a massive motor in the United States economy, which the administration will respect.

Much of the same trends that were occurring before the election continued along the same path, such as a stronger dollar, higher yields, and a weak Japanese yen.

Tech stocks can move higher with all these trends.

In general, a Republican administration should be good for the tech sector, and the corporate taxes will benefit Silicon Valley the most.

First, there's artificial intelligence. The market should expect significant AI initiatives within the U.S. that would be a benefit for Microsoft (MSFT), Amazon (AMZN), Google (GOOGL), and other tech players. Department of Defense AI initiatives would also benefit the likes of Palantir Technologies (PLTR).

Republicans could make major revisions to President Biden's Inflation Reduction Act, which could negatively impact the act's beneficiaries, such as Intel (INTC).

Tesla and its CEO, Elon Musk, will be the biggest beneficiary of a Trump administration. Trump is likely to stop or reduce the electric vehicle rebates and tax incentives. That would be an overall negative for the EV sector but a big positive for Tesla. As will Trump's proposed selective import tariffs.

Tesla has the scale and scope that are unmatched in the EV industry, and this dynamic could give Musk and Tesla a clear competitive advantage in a non-EV subsidy environment, coupled by likely higher China tariffs that would continue to push away cheaper Chinese EV players (BYD, NIO, etc.) from flooding the U.S. market over the coming years.

One of the only few things the Democrats did well was igniting equity prices and, specifically, tech stocks, which is a positive omen moving forward.

Ultimately, a crushing loss by the Democrats revealed another crippling black eye to liberal mainstream media, which should accelerate cord-cutting and the transition to citizen journalism and other independent journalist sources.

Left-wing mainstream media sources wielding radical progressive viewpoints luckily won’t do much collateral damage to tech stocks, and in the backdrop of a strong U.S. economy, I am highly optimistic about tech stocks in the short term.

I believe that the Trump administration will attempt to supercharge tech stocks by cutting red tape and allowing them to flourish.

Reducing taxes will be the bow tie on top to really juice up shareholder returns.

I am bullish on tech stocks going into the end of the year because much of these synergies are still not discounted yet in the price of tech stocks.