UPS cutting back their logistics agreement by 50% with Amazon (AMZN) is not a bug, but a feature of what is to come in 2025 and beyond.

I believe we are at an inflection point where anything and everything that these big tech companies can source in-house, they will do.

That means Amazon going full-on 100% with their own transport, logistics, and everything else.

They already steal popular 3rd party product designs and manufacture them themselves under their own brand and then sell it on their own website.

This type of behavior will go into overdrive and beyond in 2025.

The writing is on the wall for many small businesses and the leanness in tech companies is also reflected in their aggressive job cuts that started at the end of 2023.

UPS and FedEx will need to find a different source of volume moving forward because e-commerce packages will be operated by tech couriers.

This big pullback in Amazon deliveries sent UPS’s stock off a cliff.

The news has translated into their stock diving from $136 per share to $114 today.

That is just the beginning for many of these tech and non-tech partnerships and I believe we will see more severing off the cord in 2025.

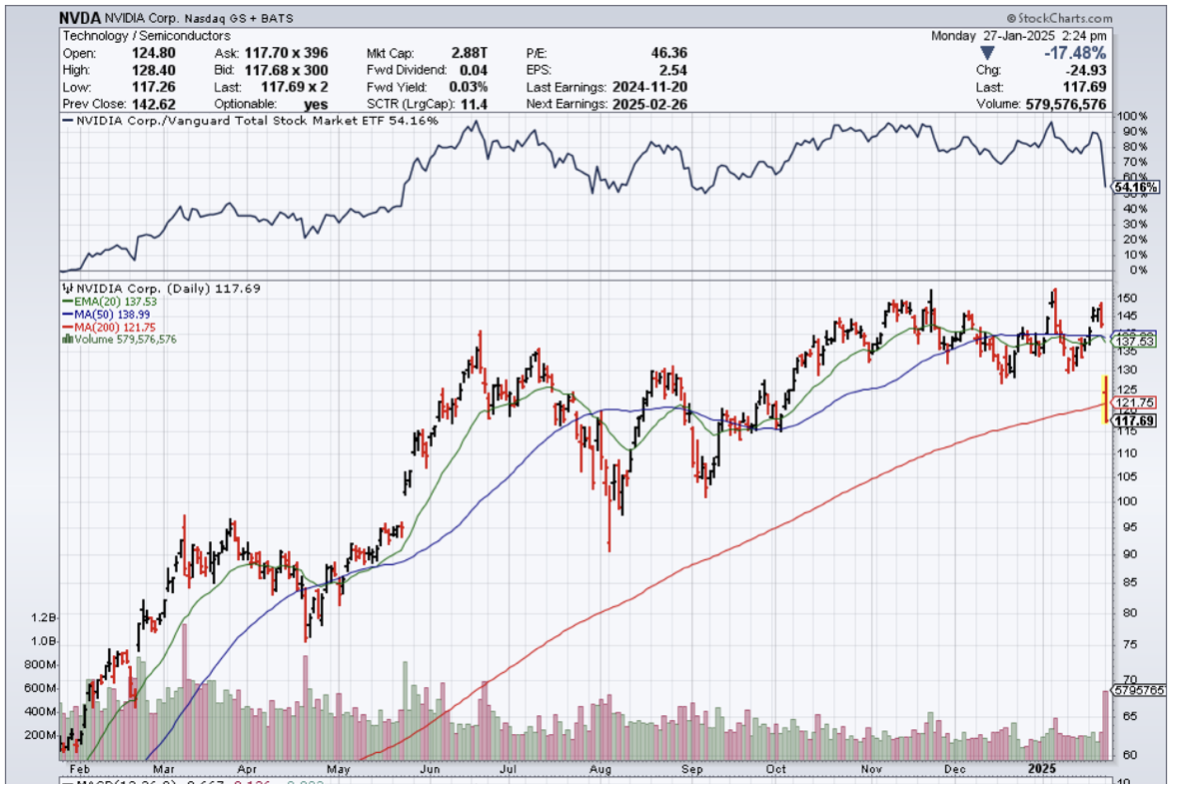

One big trend is also semiconductor chips with the likes of Apple producing their mobile chips themselves.

A deal to cut business with its largest customer will be hard to make up for UPS, and for Amazon, it is great long-term news for the stock.

UPS said it reached an agreement in principle with its largest customer to lower its volume by more than 50% by the second half of 2026. In UPS's latest annual report, the company singled out Amazon and its affiliates, saying they represented about 12% of its revenue, nearly all in its U.S. package business.

Insourcing allows you to have more control over the tasks you have to do. It often involves adding more people to the company’s workforce or investing in training for people already in the company. It also requires new technologies that would otherwise have to be outsourced.

It is the opposite of outsourcing, where services or job functions are contracted from a third party, this is, a company or freelance outside of the organization.

The benefits outweigh the cons.

Amazon will have more control over processes and communication.

There is sensitive information that Amazon is giving out to third parties and these are trade secrets. Ending the partnership will go a long way to keeping data private.

By keeping things in-house, security and information leakage risks are reduced.

The exchange of new knowledge and social capital are positive impacts that insourcing can have. With insourcing strategies where people are trained and more synergies will occur, Amazon will revolutionize the concept of work.

I can envision the day when most of Amazon’s business isn’t outsourced. I mean sure, they cannot insource NFL streaming, but Amazon can produce the video instead of paying an outside contractor to do it.

After 2020, product quality is a real issue and Amazon taking back the initiative while going real lean with operations will ensure they beat quarterly earnings for the foreseeable future.

After hitting a short-term low of $160 last August, the stock has risen to all-time highs of $240 per share today.

I expect traders to continue to buy the dip in Amazon stock.