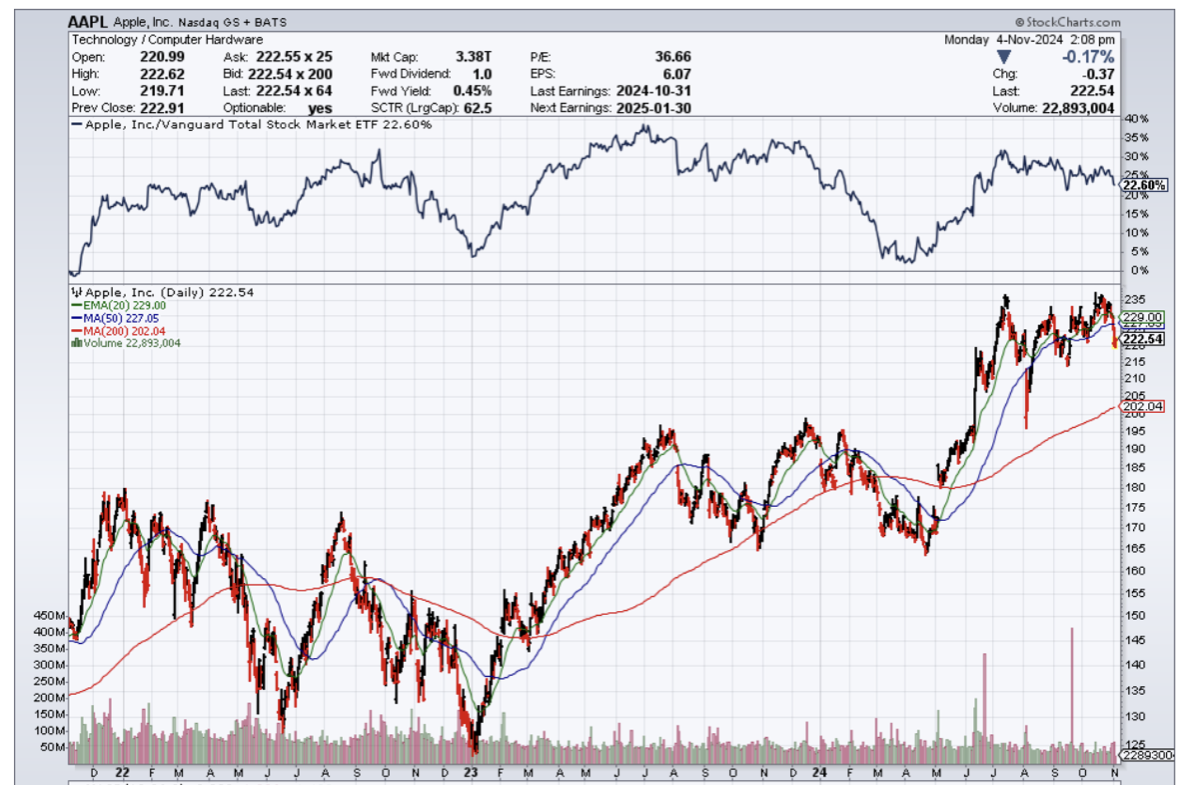

Warren Buffett shedding millions of Apple (AAPL) stock, and the stock to subsequently avoid a meaningful dip is an inherent victory for Apple and big tech.

In almost any other stock, the price action would be sharp and damaging to the underlying stock, and Apple had a wave of buyers to pick up all the shares Buffett unloaded.

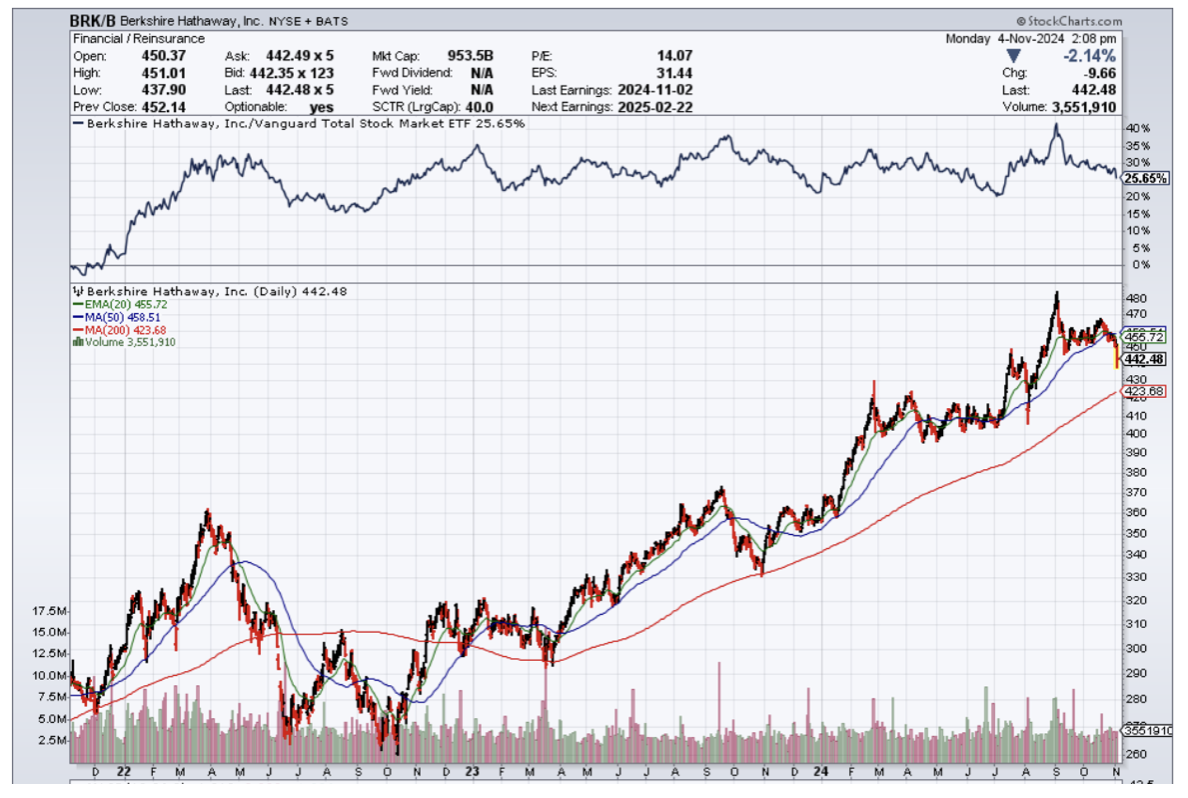

Buffett and his flagship investment company, Berkshire Hathaway (BRK-B), did really well in their Apple investment, where they loaded the boat with Apple stock.

Taking profits is never a bad thing, but I do believe Buffett had a feeling that Apple started getting too ahead of itself.

The company still has not done enough since creating the iPhone, and Buffett certainly was not impressed by the latest “upgrade” to the flagship device.

Apple shares are flat over the past 4 months after a sharp 22% rise in the summer starting from May.

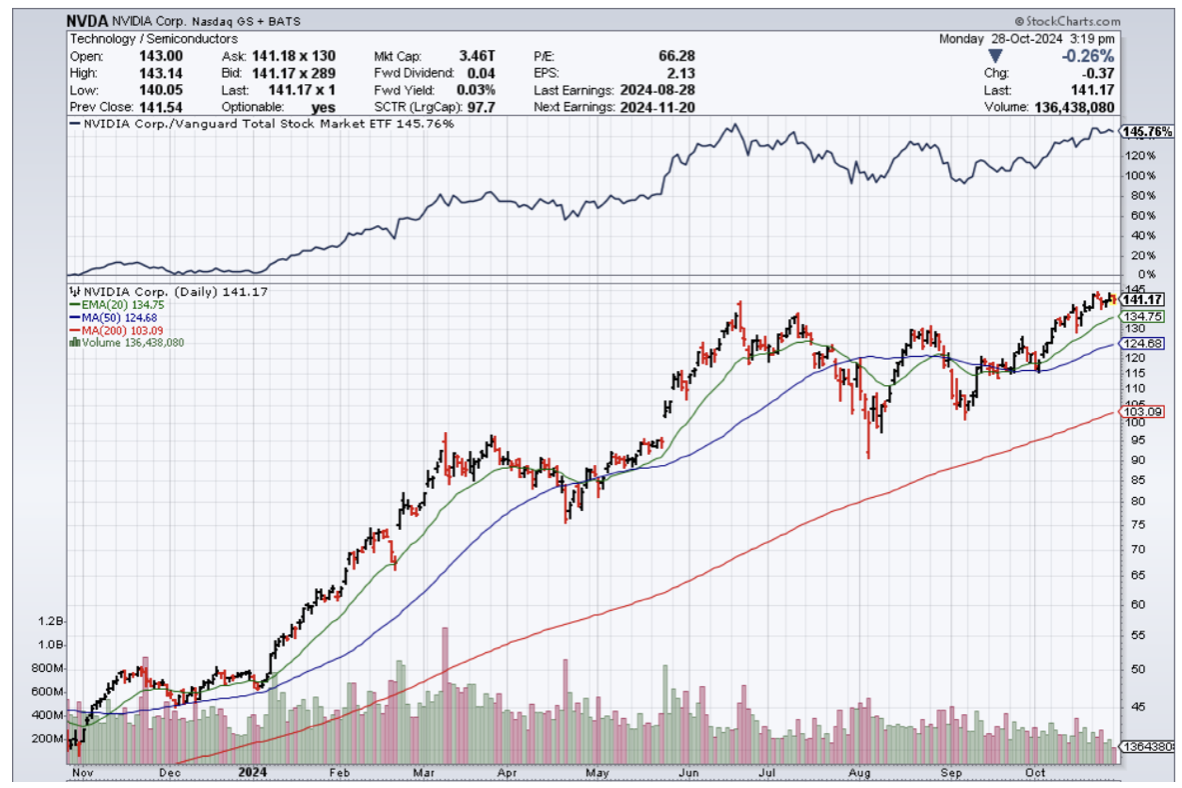

I believe that the sideways price corrections will start to drag out even longer for many big tech companies as their growth engines start to fizzle out.

AI is also due another sideways correction after gangbuster returns.

It is becoming quite evident that “corrections” in big tech aren’t that damaging, and as long as investors can ride out the sideways move, the next move after that is usually to the upper right-hand corner.

Buffett has sent over 515 million shares of Apple to the chopping block since October 2023

Amid Warren Buffett's selling spree, top-holding Apple has been meaningfully reduced. In a three-quarter period from Oct. 1, 2023 through June 30, 2024, Berkshire's stake in Apple declined by more than 515 million shares, or 56%, to precisely 400 million shares.

During Berkshire Hathaway's annual shareholder meeting in early May, he opined that the corporate tax rate would likely climb in the future. With his company sitting on a mammoth unrealized gain in Apple, he suggested that locking in some gains now at a lower tax rate would, eventually, be viewed favorably by Berkshire Hathaway's shareholders.

Apple has done well to engineer the stock higher with its heavy involvement in shareholder returns, particularly buybacks.

Since initiating share repurchases in 2013, Apple has bought back $700.6 billion worth of its common stock and reduced its outstanding share count by 42.2%. This has had a decisively positive impact on the company's earnings per share (EPS).

Sales of its physical devices, including iPhone, iPad, and Mac, have been weak for much of the last two years. If a growth company's sales stall, it can expose its valuation premium.

The Oracle of Omaha's broad-based selling also alludes to the lack of value on Wall Street. This is one of the priciest stock markets in history, and Berkshire's record cash pile of $276.9 billion plainly suggests that Buffett and his team are struggling to find attractive deals.

Big tech is increasingly finding it hard to move the needle.

Anti-trust has also been a thorn in their sides lately as the Fed close it on them from a litigious angle.

In the short term, even without its next growth engine, I do believe Apple and certain big tech companies have the opportunity to experience a winter rally into yearend.

First, we need to get through the election, but the US economy is still running hot at 3%, and tech will do like it usually does, harvest the majority of the gains from the overall economic expansion in the United States.