Oracle plans to increase their amount of AI data centers from its current 85 to 2,000.

That is the most important number to take away from an analysts meeting with Oracle management.

Readers should ride on the coattails of this AI data center firm as throw billions upon billion at increasing the amount of AI infrastructure.

Readers absolutely need to know that a great swath of tech is dead and not innovating - growth rates collapsing faster than the U.S. birth rate.

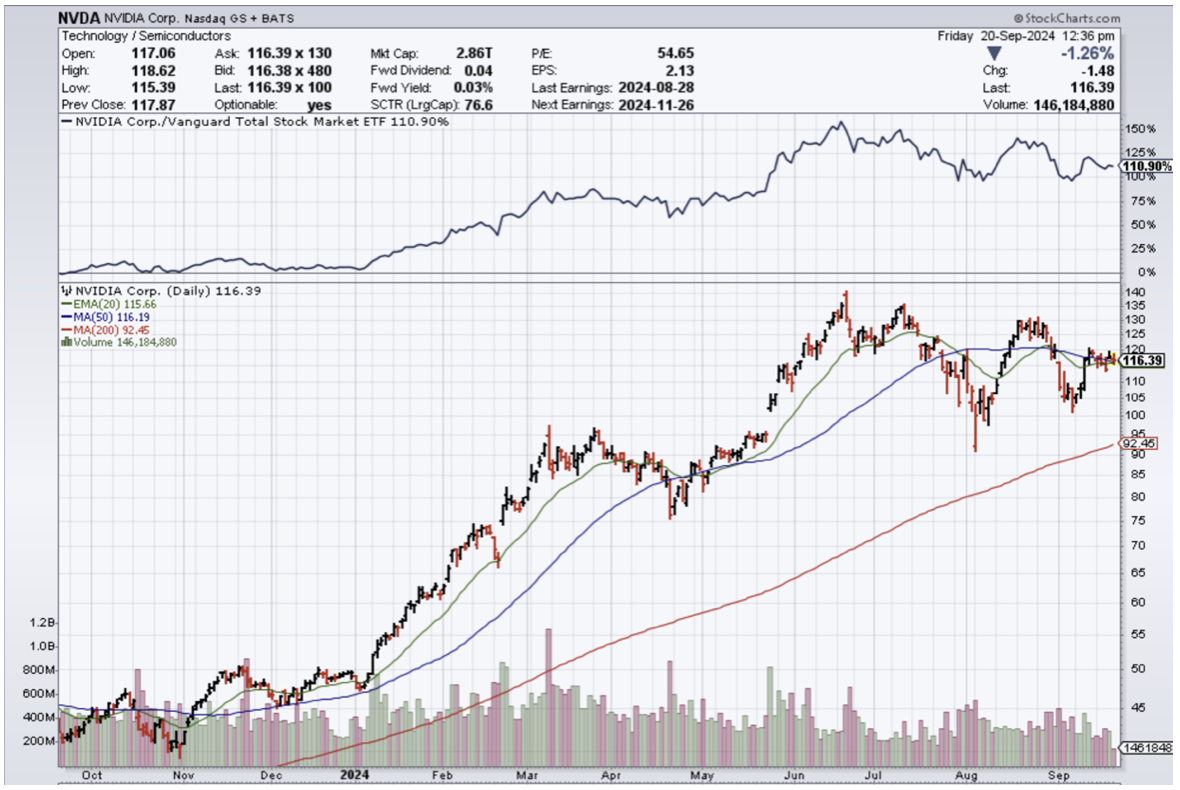

It is important to position yourself at the cutting edge of innovation and growth and that is precisely companies who are knee deep in AI data center infrastructure investments that includes chip companies that produce GPUs like Nvidia.

In fact, Nvidia supplies Oracle and most other tech companies with data center chips called graphics processing units (GPU).

Nvidia has experienced an eye-popping surge in its revenue over the past year, and GPU demand continues to outstrip supply.

Oracle's data centers are unique because they are automated. Each one is operationally identical regardless of its size, and since they don't require human workers, it allows the company to build them quickly. Plus, Oracle's RDMA (random direct memory access) GPU networking technology allows data to flow from one point to another more quickly than traditional Ethernet networks.

Oracle has 85 data centers up and running with 77 more under construction as of the end of August.

Next year, Oracle intends to offer a cluster of 131,072 GPUs, which is a big step up from its largest clusters now, at around 32,000 GPUs. But there's another difference:

The new cluster will use Nvidia's latest Blackwell chips, which can perform AI inference at 30 times the pace of its flagship H100, which Oracle currently uses. Theoretically, it's going to allow developers to build the largest AI models in history.

In fact, Oracle spent $6.9 billion on data center infrastructure in 2024.

Oracle is going after the best technology in Nvidia’s Blackwell chip which is a solid reason to get interested in Oracle stock.

I don’t believe AI infrastructure spend will dissipate anytime soon and as the rest of the tech sub-sector growth falters, this one little area of AI will hold up the rest of tech.

This is why we are seeing extreme concentration of outperformance in just a handful of tech names and I don’t believe we will experience a scenario of spreading the wealth around to the less growth oriented subsectors.

In fact, I think the concentration will become even more outsized in a handful of names as a winner takes all mentality wins out in the tech sector.

We are just scratching the surface in what will become a massive explosion of AI data centers everywhere to satisfy the extreme demand of computing that it will require to pull this off.

Nothing indicates that this would be the wrong trend to follow and that assumption follows through to the astronomically high stock prices of the companies involved.

Oracle is one of these companies that readers should not dismiss.

It is at the heart of the AI infrastructure story that has legs.