Sometimes tech trends start and stop and then start again.

It certainly feels that way for the EV industry when the Chairman of Toyota Akio Toyoda threw a damp towel on the progress of EVs taking over the world.

The Japanese Chairman told the world that he thought EVs would never account for more than a third of the market and that consumers should not be forced to buy them.

These ideas definitely go against the grain of the liberal democratic order.

Listen to the bureaucrats in Brussels and the left-wing establishment in Washington and it almost seems as if they want to ban oil and gas products.

Of course, the ban is certainly hyperbole, but the green movement towards lithium battery-powered cars has become quite political and partisan.

Akio Toyoda, chairman of the world’s biggest carmaker by sales, said that electric vehicles (EVs) should not be developed to the exclusion of other technologies such as the hybrid and hydrogen-powered cars that his company has focused on.

He said he believed battery EVs will only secure a maximum of 30% of the market – less than double their current share in the UK – with the remaining 70% taken by fuel cell EVs, hybrids, and hydrogen cars.

Mr. Toyoda argued that electric cars’ appeal is limited because one billion people in the world still live without electricity, while they are also expensive and need charging infrastructure to operate.

The chairman also pointed to Toyota’s recent announcement that it was working on a new combustion engine, saying it was important to give engine factory workers a role in the green transition.

Koji Sato, the car maker’s chief executive, last year promised Toyota would sell 1.5 million battery EVs a year by 2026, and 3.5 million by 2030.

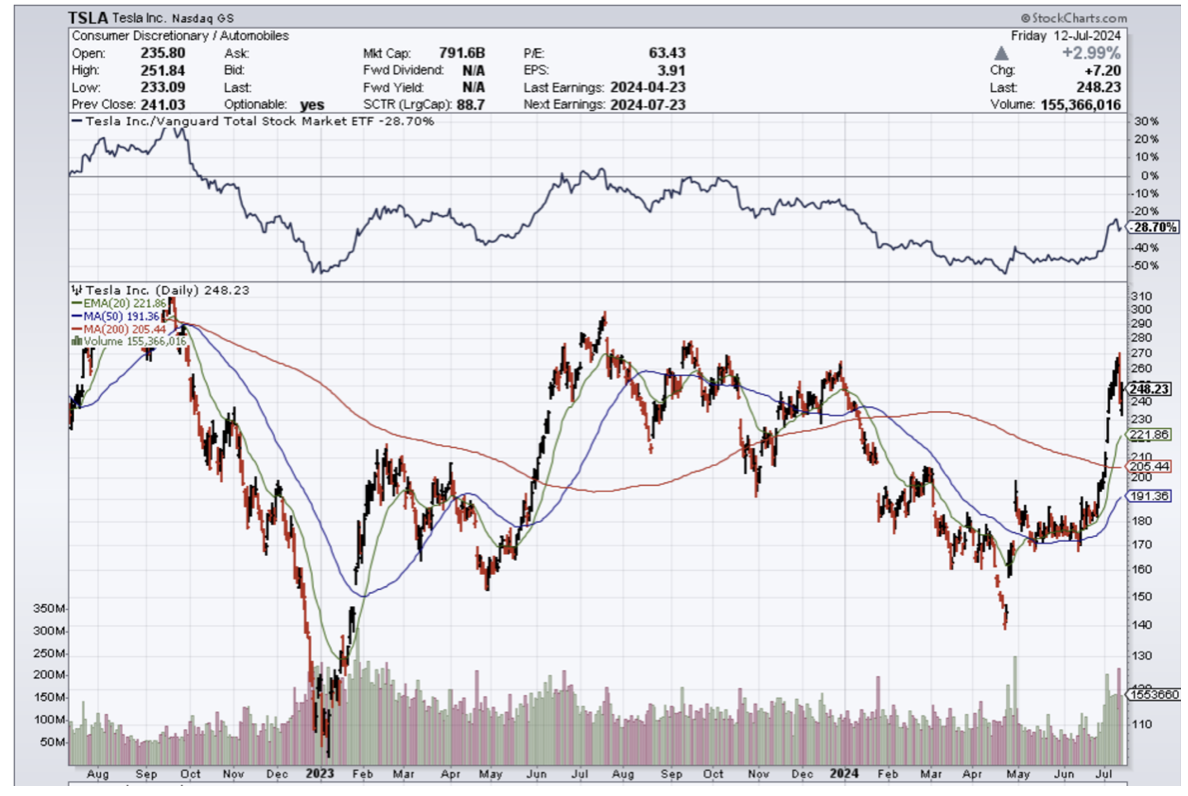

Tesla, the world’s biggest EV producer on an annual basis, reported 1.8 million deliveries last year.

Mr. Toyoda’s two cents come after electric car sales have slowed in the Western world slowed in 2024.

I am of the notion that in the short term, all the low-hanging fruit has been plucked by the EV buyers.

To find the next incremental buyer, it won’t be impossible, but that same type of excitement won’t exist.

The truth is that many consumers are still tied to the combustible engine.

On a recent trip to Japan, almost no local drove an EV and I witnessed almost no charging points.

If one of the biggest economies in the world isn’t convinced, then there is still a lot of work to do and I don’t believe that the Japanese will give up gas-powered engines so quickly.

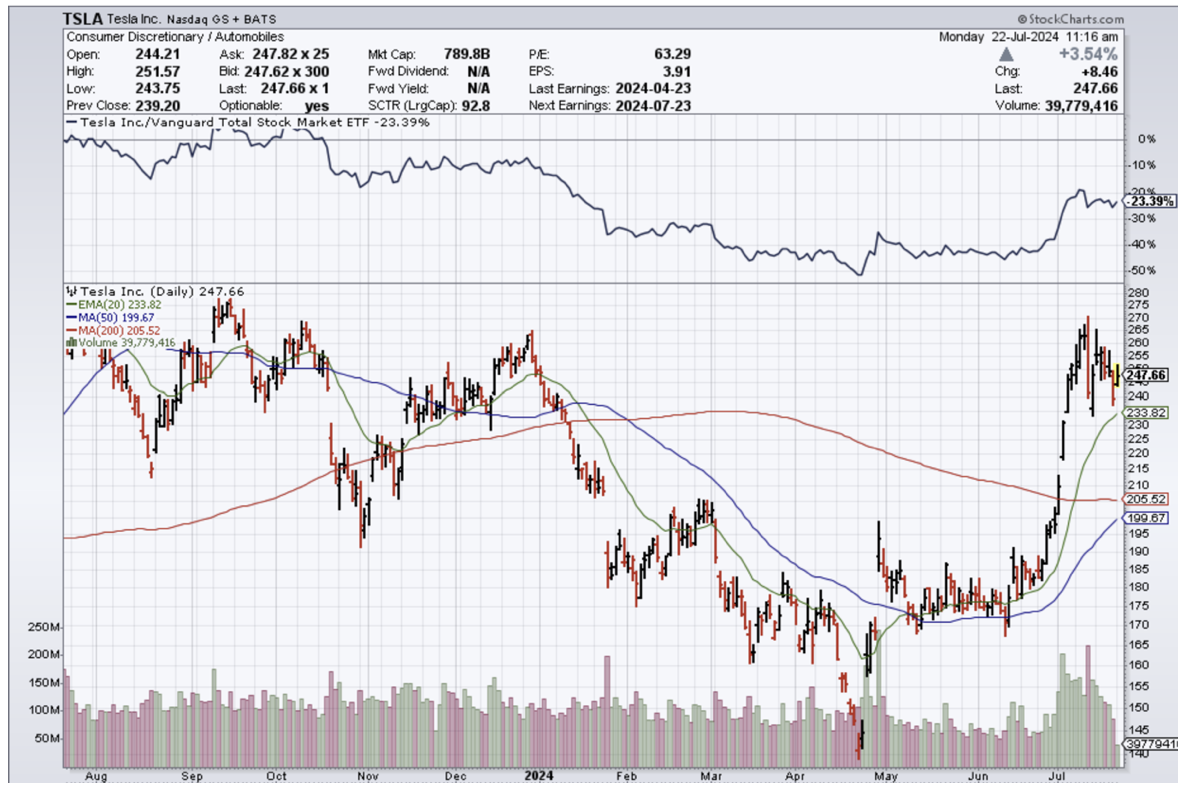

In the short term, the demand weakness in EVs bodes ill for EV stocks like Tesla or Rivian.

Throw in the fact that EVs aren’t cheap and the cost of living crisis is forcing consumers to migrate to necessities which unfortunately doesn’t include a brand new Tesla.

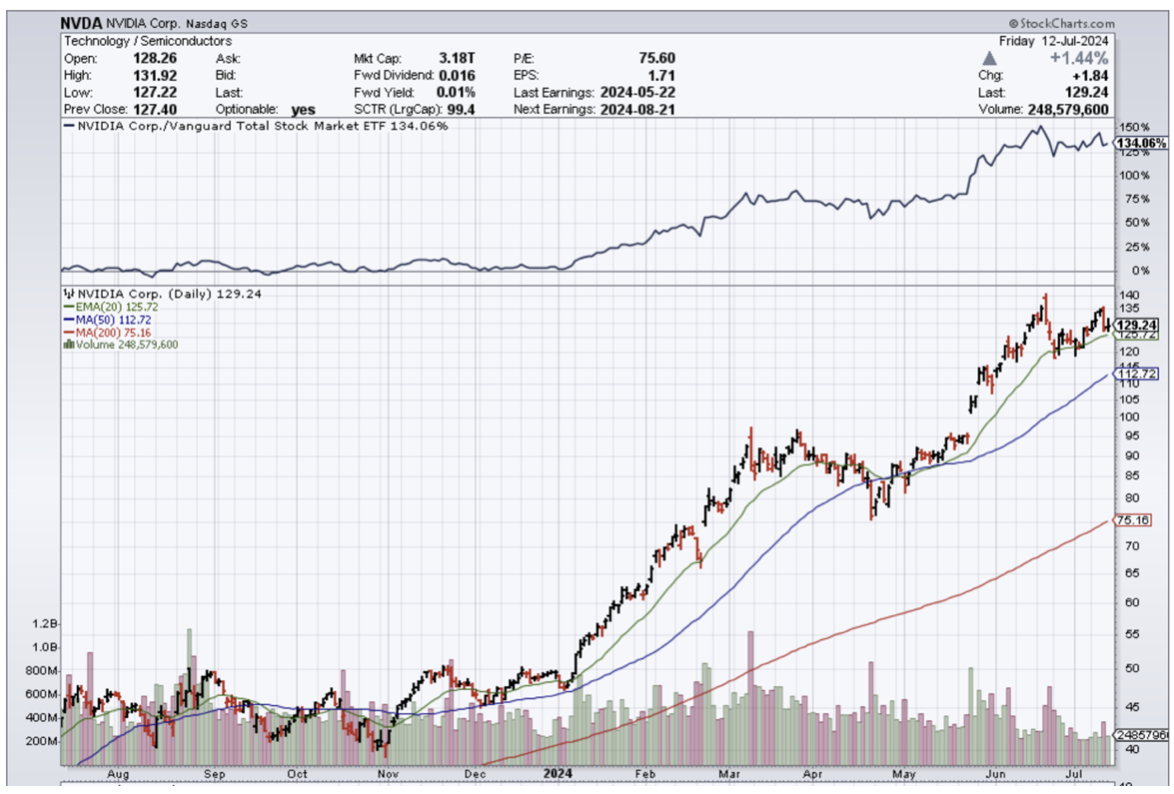

Stay away from EV stocks in the short term and pile into the AI narrative.