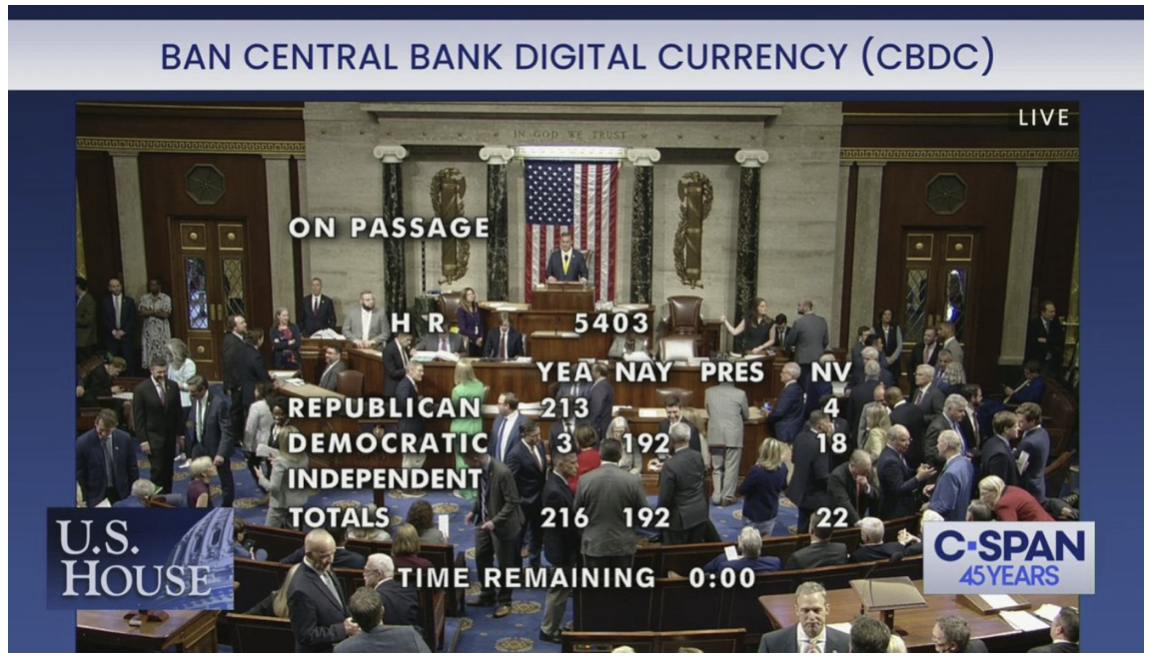

The US House of Representatives passed a bill effectively banning the Federal Reserve from creating a digital version of the dollar.

Even though this action doesn’t specifically target the tech sector, the tech sector ($COMPQ) has a lot at stake in this bill.

First, the irony here is how polarized the US Central Bank has become in Washington to the point the Federal government wants to ban something from them.

It’s like taking away a dangerous toy from a baby.

It signals there has been a massive failure at the Fed with its blown “transitory inflation” call that has lasted over 4 years.

The Fed could equally screw up the onboarding of the digital dollar, if it ever happens, the U.S. financial system might never recover.

The vote passed but it still would need approval from the Senate and then signed by the President for it to become US law.

Still, as one of the chief opponents of the Bill, Rep. Maxine Waters, put it, "In fact, if this bill becomes law, we would be the only country in the world to ban a CBDC." Prohibiting "innovation" on the central bank digital currency front seems like a policy miss at first sight.

Waters has this backward.

The U.S. adopting a digital dollar would stifle tech innovation.

Money earmarked for innovation would likely go into capital that isn’t tightly controlled and tracked.

Innovation usually happens when big risk-takers deliver big ideas and the implementation of CBDCs would mean that tracking technology could shut down any “big idea” from the top.

China has tried the e-Yuan which has been a massive disaster with little uptake in the project.

Innovation thrives in an environment that offers freedom for the big picture thinkers, and a 3rd party tracking and monitoring apparatus isn’t good enough.

In fact, if CBDC were implemented, it would be the end of US-led tech innovation in modern history.

Few would take risks because it wouldn’t be worth innovating in this type of currency when there are others that would step over the line of privacy.

Scamming would be off the charts as well in this scenario.

Inserting unparalleled surveillance and individualized control would choke off free business and ideas become sterilized.

Anything new laid out would face a gauntlet of obstacles before getting anywhere near a consumer.

Think about all the middlemen on the way nickel and diming you the death as well. We already have that with the blown transitory inflation call by the Fed.

I am a believer that the less government, the better for tech business.

Europe is the poster boy for government-led innovation stifling.

There are no competitive tech companies in Europe that can compete with Silicon Valley because a tech innovator would be crazy to start and grow a company in Europe.

Europe is hostile to free business and tech innovation. They know how to tax and do it highly.

I could easily see how an integration of digital currency could end up in a dystopian situation if carried out by the wrong government.

Of course, the banning of CBDCs at the House level is a good sign that America is open for business, but it will need to become enshrined in law to have some bite.

If CBDCs are implemented by the Fed in the future, 90% of the Nasdaq market would fail leaving just 7 tech stocks.

It would in fact amplify the lack of competition that we are facing these days in the US tech sector.

I am bullish on the tech sector if integration of CBDCs by the Fed and Congress are banned.