At the once-per-year shareholder meeting for Berkshire Hathaway (BRK/A) in Omaha, Nebraska, the shindig has become a caricature of itself.

A company that does so well, but the leader has self-proclaimed to understand nothing about technology.

It was fascinating to see the Oracle of Omaha Warren Buffett dabble in the cooler talk that is talk about artificial intelligence.

Ironically enough, his pep talk about AI was littered with negatives about the consequences of AI.

Warren Buffett's warning about AI’s potential harm has everything to do with his conservative risk tolerance to not beeline straight to the front of the most modern developments in the tech industry.

He’s late on most stocks but he’s right on them in the end.

It wasn’t too far back when Buffett only would invest in a company as complicated as Coca-Cola, because he famously stated that he doesn’t invest in companies that he doesn’t understand.

Insurance also made Buffett a killing pouring capital into companies like Aflac.

He finally came around to Apple which for better or worse is known as the iPhone company.

His risk tolerance of tech increasing to the almighty smartphone was quite a jump for Buffett that took many years, so don’t expect another leap of faith anytime soon.

In fact, Buffett claiming he doesn’t understand AI too well means there is a lot of capital sitting on the sidelines waiting to enter once they finally do “understand.”

I should also just note the general stockpile of money that has been waiting on the sideline since the Covid-era is enormous.

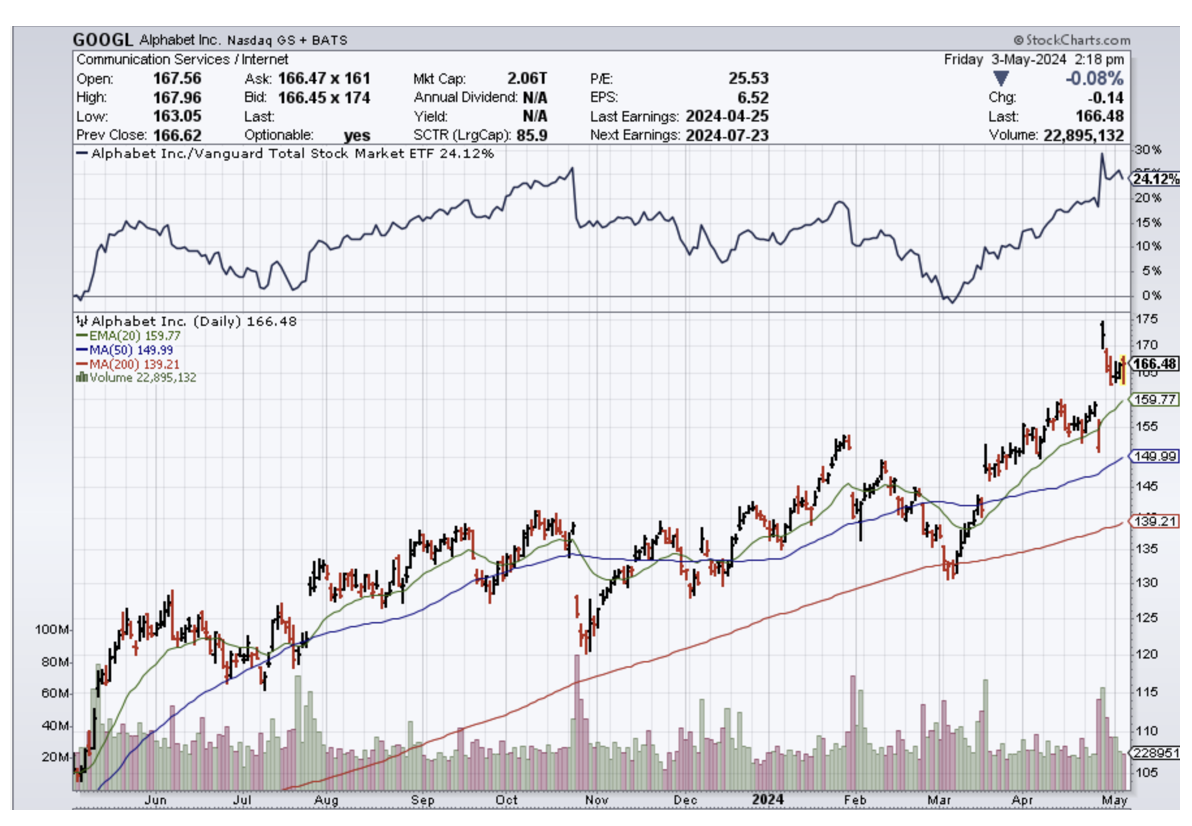

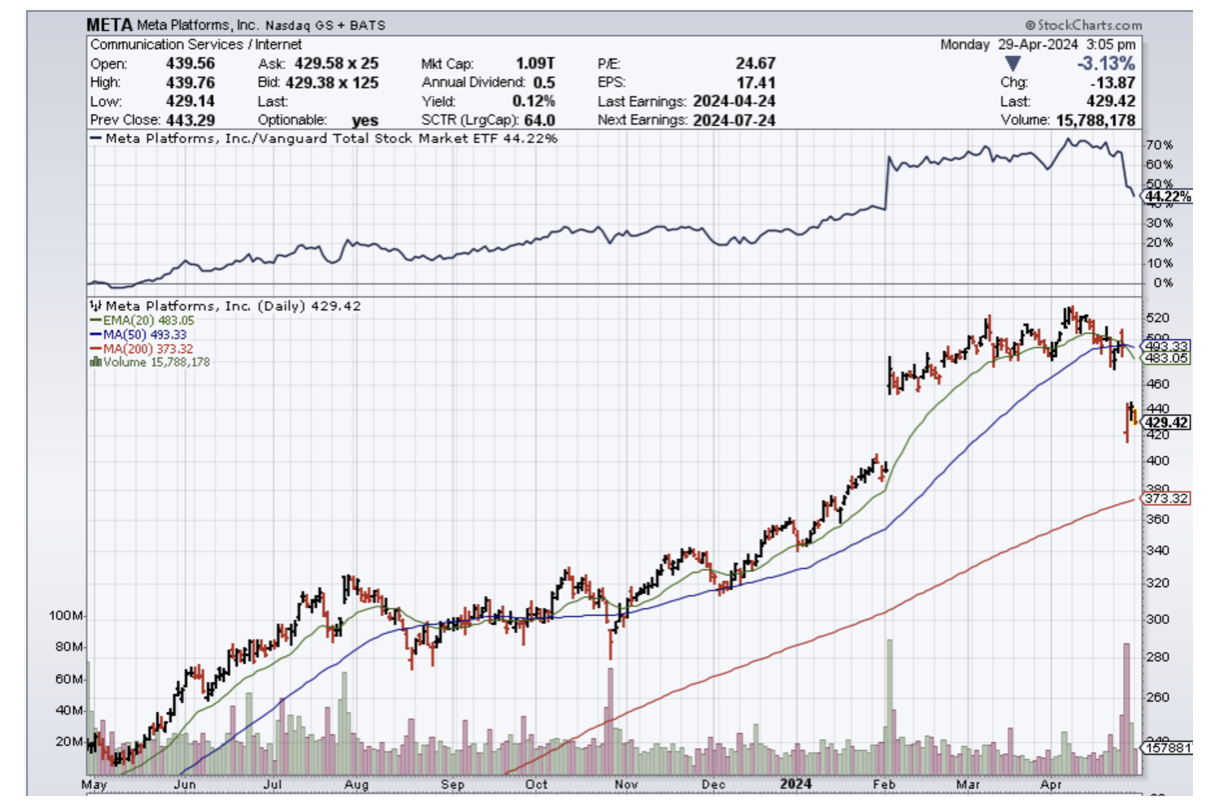

Any meaningful dip in any meaningful tech company will be met by a torrent of new buying demand.

That’s exactly what happens when the number of great tech companies can be counted on 2 hands.

Almost like what is happening with American restaurants – it’s not that American restaurants are going through a generational renaissance, no, they are packed because so many small restaurants closed after COVID.

Tech is experiencing the same playbook with investor money.

The past 7-12 years have seen the spurring on competition squelched, and the tech industry has never been closer to a full-blown monopoly in some sub-sectors.

Once the bulls get back in control, we are off to the races again, because a few companies move markets now.

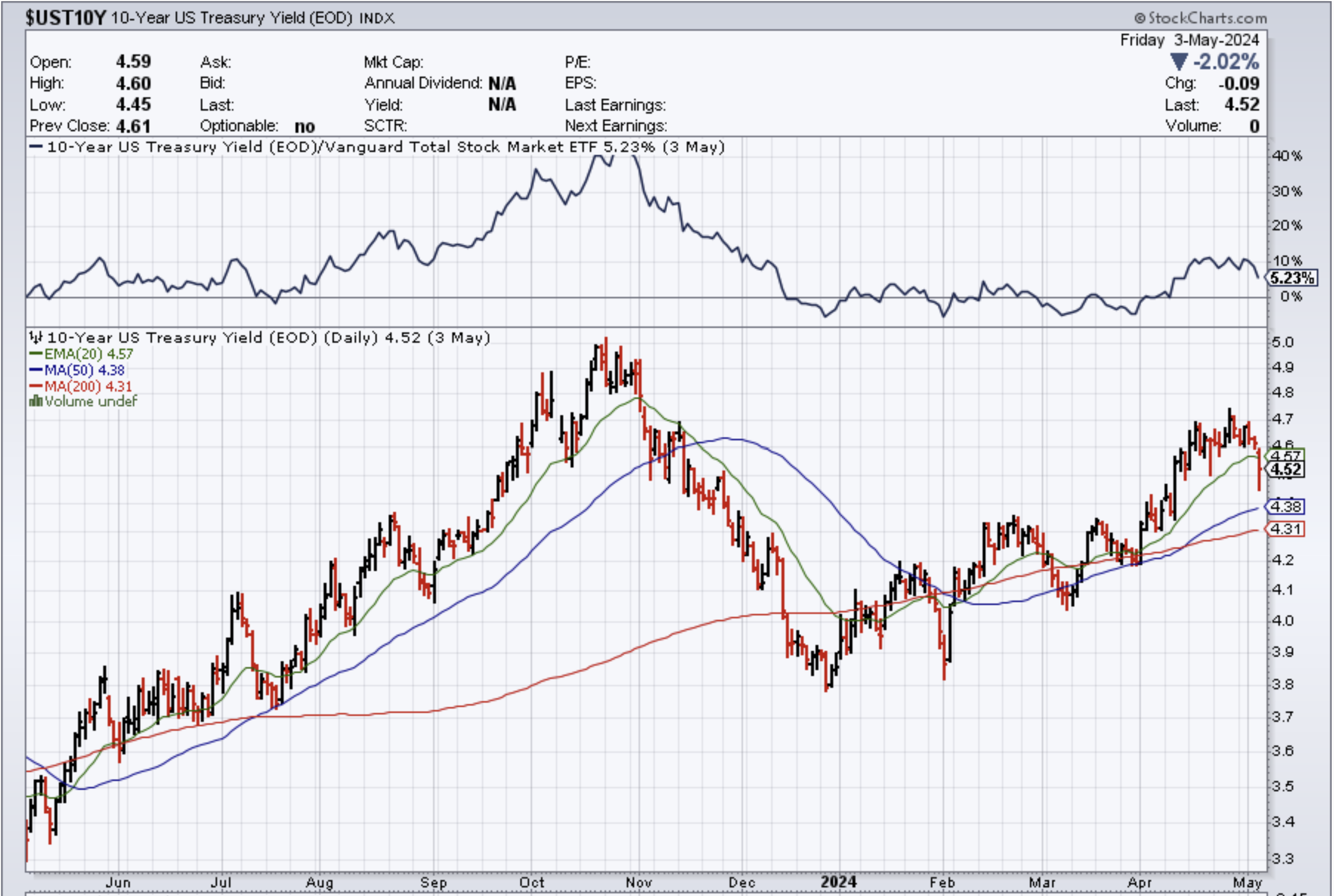

That’s what I believe we are seeing in the short-term with the US 10-year inching up only for Central Bank Fed Chair Jerome Powell to deliver us a monumental dovish speech to the sticky inflation we are seeing in numbers now.

Buffett chose to talk about the darker side of AI and the potential for scamming people.

He said that scamming using AI will become a “growth industry of all time.”

Buffett pointed to the technology’s ability to reproduce realistic and misleading content in an effort to send money to bad actors.

Just because we don’t like it, we cannot write it off or afford it as investors.

Readers must deal with AI and the manifestations of it.

One of the big side effects is that it accelerates the winner-takes-all dynamics of tech.

If I were a newbie investor, Super Micro Computers (SMCI) would be on the radar as a powerful growth stock with bountiful potential and exposure to AI.

More tech companies will fail, and they will fail faster, without a trace of even existing sometimes.

It also puts extreme pressure on tech management to implement AI, lose funding, or lose the momentum the business model.

It almost makes tech management over-reliant on AI to fix any and every mess.

The reality is that there will be a lot of losers from AI and punishes companies that never figure out AI.

It is best to identify them before the stock goes to 0.

I don’t necessarily share the same dark outlook as Buffett and I commend him for doing so well on his performance, but when it comes to technology stocks, he shows up late, but it is better than never showing up.