Mad Hedge Technology Letter

February 23, 2024

Fiat Lux

Featured Trade:

(SILICON VALLEY INVADES THE USED CARS MARKET)

(CVNA)

Mad Hedge Technology Letter

February 23, 2024

Fiat Lux

Featured Trade:

(SILICON VALLEY INVADES THE USED CARS MARKET)

(CVNA)

Even tech’s red-headed stepchild such as Carvana is making money in Bidenflationary times showing the deep momentum of the tech sector in early 2024.

Tech stocks are hot and Carvana (CVNA) is joining in on the action.

The Nasdaq has ignited early this year rallying around the hype of AI.

In turn, investors are coming off the sidelines to pour money into tech stocks and that has also had a strong effect on the lower tranche of tech firms like Carvana.

Carvana sells used cars on a digital platform. They charge a commission for this service.

The business model poorly scaled and incurs high costs yet they were able to turn their first profit in the history of the company.

They also forecasted core current-quarter profit "significantly above" $100 million helped in part by cutting costs.

To strengthen its balance sheet and attain positive cash flow, Carvana has been trimming inventory and slashing advertising and other expenses.

The company became popular during the healthcare pandemic, as people opted for readily available used cars instead of buying newer vehicles, which were in short supply due to a global chip crunch.

Carvana said it expects retail units sold in the first quarter of 2024 to be "slightly up" from last year.

Carvana said it expects first-quarter retail gross profit per unit to be similar to the fourth quarter, with an upside potential.

It reported retail gross profit per unit of $2,812, representing a nearly seven-fold increase from the fourth quarter of 2022.

Carvana also said it expects to reduce expenses per retail unit sold from the $5,769 it reported in the fourth quarter, on a sequential basis.

The company reported net income of $450 million for the year 2023. It had reported a loss of $1.59 billion in 2022.

The company’s gross profit per unit rose to more than $5,500 from $3,022 in 2022.

The online car seller has lowered costs in recent quarters and restructured some debt to lower interest payments. Carvana has sought to regain its financial footing and resume growing after an ill-fated expansion several years ago.

Carvana offers a unique insight into the health of the American economy.

The US is a car-reliant country and car costs are one unavoidable input. Good news for CVNA.

The accelerating profit in used cars shows the impact of Bidenflation and increase in goods which has led to many tech firms reporting profits like Uber.

If the price of cars sold continues to increase, the future augurs well for Carvana.

I fully expect inflation to stay sticky for many types of goods in the US economy and used cars are one of them.

I fully believe an ample volume of supply won’t be dumped in the car market because consumers know they’ll have to pay a higher price for something similar.

This won’t reverse anytime soon.

Carvana is poised to be a serious tech player selling a product that will likely see increasing prices for the short to medium term.

Carvana would be a great buy the dip candidates on big dips of 10 or 20%.

“Longevity in this business is about being able to reinvent yourself or invent the future.” – Said Microsoft CEO Satya Nadella

Mad Hedge Technology Letter

February 21, 2024

Fiat Lux

Featured Trade:

(THE HIRING QUAGMIRE IN TECH)

(GENZ)

A slightly worrisome trend is emerging from the tech world and it has to do with the future of the American tech worker.

These employees could pose quite a conundrum to tech companies in the near future that could drastically affect the results they desire.

Something needs to change or there could be many open gaps that cannot be filled.

As the baby boomers age out of the job market and are replaced, it’s not necessarily the Millennial generation that is the big problem, it’s Gen Z.

Gen Z is more or less having a hard time committing to even an interview based on fresh data from digital recruitment sites.

As tech companies vow to make leanness mandatory, this doesn’t bode well for the volume of tech hiring for Gen Z who are in their 20s.

Remember when friends of friends could get Facebook management jobs only to sip on lattes all day at the in-house coffee bar, well, that job doesn’t exist anymore because even Facebook is ridding itself of the slack. Those jobs were mainly dominated by Millennials up until the pandemic and have vanished with the pressure of higher inflation.

No more hiring to make it look like tech companies are bigger than they are. Tech firms can’t afford it anymore.

Results matter now and the up-and-coming generation who were extremely coddled as teenagers are having a hard time coming to terms with reality.

Now Gen Z is treating their would-be employers like bad first dates and not showing up for scheduled job interviews or even their first day on the job without as much as a phone call.

Employment website Indeed found that job ghosting is rampant by Gen Z, with 75% of workers saying they’ve ignored a prospective employer in the past year.

A head-spinning 93% of Gen Zers told the global recruitment platform that they’ve flaked out of an interview.

Worse still, a staggering 87% managed to charm their way through interviews, secure the job, and sign the contract, only to leave their new boss stranded on the very first day.

Unsurprisingly, it’s having the opposite effect on businesses left high and dry: More than half of businesses surveyed have said that ghosting has made hiring a harder and costlier process.

Almost half of those surveyed said they plan on pulling a disappearing act again, with a third deeming it acceptable to do so before an interview.

However, unlike Gen Z who feel emboldened, older workers say they instantly regret it.

What’s more, while more than half of Gen Zers are repeat offenders, the researchers found that a candidate’s likelihood to ghost again decreases with age.

For many employers, Indeed’s data will finally confirm their suspicions that Gen Z has commitment issues.

Indeed found that the cost-of-living crisis has exacerbated ghosting, with around 40% of those surveyed admitting that they're more likely to ghost if they find a job offering better pay or a cheaper commute.

Tech companies are in a race against time to automate using AI, because dipping into the Gen Z talent pool could be not being able to fill staff numbers.

Even if Gen Z employees do get hired, they do tend to disappear without a trace quite quickly.

Either way, tech companies will need to find a solution for a young US workforce that isn’t Silicon Valley material.

AI is arriving at just the right time to save their bacon.

Mad Hedge Technology Letter

February 16, 2024

Fiat Lux

Featured Trade:

(THE RIDE SHARING KING OF TECH)

(UBER), (LYFT)

It’s hard to believe that Uber (UBER), the ride-sharing company, is where it’s at now and by that, I mean delivering profits.

It was just only a few years ago when burning money was something they were known for and beginning the next lender to fund them was a common request.

That was the era of cheap money where 0% interest rates created companies like Uber and this capital was the oxygen they needed to keep trying until they could make it work.

Much of the early years were characterized by a fierce competition with competitor Lyft (LYFT) offering subsidies to drivers.

Fast forward to today and they also have a sparkling food delivery business and are projected to continue to grow in the first quarter of 2024.

The company carved out a profit of $1.43 billion in the final three months of 2023, which included a $1 billion benefit from its equity investments as well as income from its operations.

The company has turned an annual profit once before, in 2018 on the back of its investments, but it wasn’t earning money from its operations until now.

The company’s performance in the last three months of 2023 suggests that demand for its ride-sharing and food-delivery services remains robust.

From 2016 through the first quarter of 2023, Uber bled cash close to $30 billion in operating losses.

The company posted its first quarterly operating profit in the second quarter of 2023. The company was founded in 2009.

It was also better than Lyft at responding to a sudden driver shortage after the economy reopened from lockdowns. That helped Uber gain market share.

Lyft is still twisting in the wind of mediocrity and has yet to post its first operating profit.

Uber expanded advertising on its app over the past year. It says it has continued to become more disciplined about spending on discounts to consumers and incentives to drivers. It says it has also become better at combining deliveries and reducing errors, which has improved its operational efficiency.

In the last three months of 2023, the company’s mobility revenue grew 34% and its delivery revenue expanded 6%, while its revenue from freight declined 17%.

After bottoming around $19 per share in the middle of 2022, the stock has been on a rampage and now sits nicely at over $81 per share.

No doubt the stock benefited from last year's slew of capital betting on the Fed to drop interest rates.

I even anointed Uber as my number 1 stock of 2023 and their performance delivered in spades.

What we are witnessing is the maturity of the company and I am not saying they are going to deliver profit back to the shareholder like a FANG, but the conversation will start and that should carry momentum.

The US economy is still going strong growing a few percentage points per quarter and that means US consumers are still spending and that is good for ride-sharing and food delivery.

Uber is sitting nicely as they are a monopoly in this area of technology services.

I am bullish Uber.

Mad Hedge Technology Letter

February 14, 2024

Fiat Lux

Featured Trade:

(A BIG RISK WITH AI)

($COMPQ)

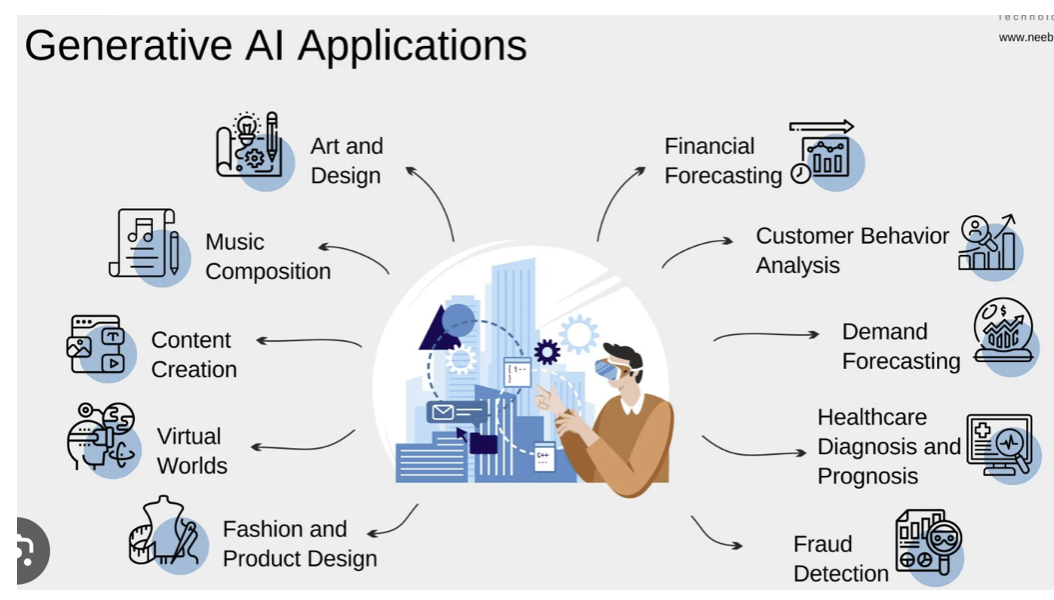

What makes AI mesmerizing and, at the same time, weird is the fact that the technology is accessible to everyone.

Remember when computers were so expensive only a handful of people like Bill Gates had one.

This time it’s different.

AI isn’t like that since it’s a piece of software used on a laptop and the cost of computers has trended lower over the generations.

From simple text or image-generating bots to highly sophisticated machine learning algorithms, people now have the power to create large volumes of realistic content at their fingertips which is one manifestation of AI.

The problem with this is that it underpins illegal activities and encourages scams.

With the help of natural language generation tools, fraudsters can put out vast quantities of texts containing false information quickly and efficiently.

This AI-generated content with false or inaccurate data manages to find its way into places that matter.

In fact, it's possible to create entire websites populated by fake news that drive massive organic traffic and, thus, generate massive ad revenue.

One notch down from straight-up scams is a public feeding frenzy over artificial intelligence companies and stocks that encourage some companies to make hyped-up claims.

I would be extremely reticent of overseas companies that have a history of not protecting tech companies from IP theft like China.

China and digital media don’t go too well together, because much of the content is “borrowed” and from now on it will be AI-produced.

It could be the case that many of these scams will originate from the East.

That’s one part of the world that will use AI to take corporate shortcuts and when they can take an inch, they usually take a million miles.

If a company is raising money from the public, though, it needs to be truthful about its use of AI and associated risks.

They also shouldn’t lie about whether they use an AI model or how they use AI in specific applications.

The media has consistently been highlighting AI as an existential threat and that means at the business level too.

As nefarious actors deploy AI in ways that create reckless or knowing disregard for the risks to investors, this could increase the cost of doing business

It also could have a knock-on effect where people just don’t trust what is on the internet at all anymore and will simply remove themselves from it.

By that time, this might turn out to mean removing themselves from their VR headsets in 2030, but the impact is the same.

Tech firms ($COMPQ) can only spin profits if the consumer spends half their time on a device and if that goes away, these companies go away too.

Ultimately, tech companies need to be careful how they deploy AI and how the spread of AI affects them at the business level, but also at an existential level.

There’s still a chance that AI could destroy a lot of what has made American corporations so strong after the 2nd world War.

In fact, it could end up like a virus gutting the spirit in which tech firms can do business and obviously, the most to lose are the biggest and most successful tech firms.

On the flip side, AI could become a force of good and boost profits 100-fold if used in the right way, but there is still a real chance AI will ruin Silicon Valley.

“Startups on the inside are always badly broken.” – Said CEO of ChatGPT Sam Altman

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.