Ten Stocks to Buy Before You Die

A better headline for this piece might have been “Ten stocks to Buy at the Bottom”.

At long last, we have a once-a-decade entry point for the ten best stock in America at bargain basement prices.

Coming in here and betting the ranch is now a no-lose trade. If I’m right, the pandemic ends in three months, stocks will soar. If I’m wrong and the global epidemic explodes from here, you’ll be dead anyway and won’t care that the stock market crashed further.

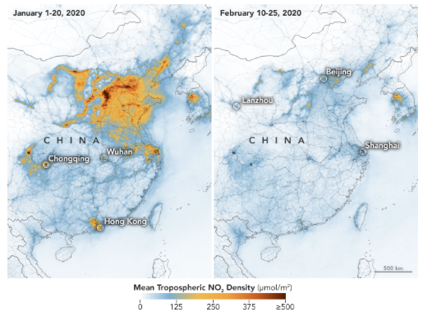

Needless to say, I have a heavy tech orientation with this list, far and away the source of the bulk of earnings growth for the US economy for the foreseeable future. If anything, the coronavirus will accelerate the move away from shopping malls and towards online commerce as consumers seek to avoid direct contact with the virus.

What would I be avoiding here? Directly corona-related stocks like those in airlines, hotels, casinos, and cruise lines. Avoid human contact at all cost!

Microsoft (MSFT) – still has a near-monopoly on operating systems for personal computers and a huge cash balance. Their inroads with the Azure cloud services have been impressive. (MSFT) just reported an impressive $8.9 billion in Q4 earnings. It’s now yielding a respectable 1.26%.

Apple (AAPL) – Even with the Coronavirus, Apple still has a cash balance of $225 billion. Its 5G iPhone launches in the fall, unleashing enormous pent-up demand. Apple’s rapid move away from a dependence on hardware to services continues. It’s now yielding a respectable 1.13%.

Alphabet (GOOGL) – Has a massive 92% market share in search and remains the dominant advertising company on the planet. (GOOGL) just announced an incredible $8.9 billion in Q4 earnings.

QUALCOMM (QCOM) – Has a near-monopoly in chips needed for 5G phones. It also recently won a lawsuit against Apple over proprietary chip design.

Amazon (AMZN) – The world’s preeminent retailer is growing by leaps and bounds. Dragged down by its association with the world’s worst industry, (AMZN) is a bargain relative to other FANGs.

Visa (V) – The world’s largest credit company is a free call on the growth of the internet. We still need credit cards to buy things. And guess what? Coronavirus will accelerate the move of commerce out of malls, where you can get sick, to online.

American Express (AXP) – Ditto above, except it charges high fees, its stock has lagged Visa and Master Card in recent years and pays a 1.58% dividend.

NVIDIA (NVDA) – The leading graphics card maker that is essential for artificial intelligence, gaming, and bitcoin mining.

Advanced Micro Devices (AMD) – Stands to benefit enormously from the coming chip shortage created by the coming 5G.

Target (TGT) – The one retailer that has figured it out, both in their stores and online. It can’t be ALL tech.

Good Luck and Good Trading

John Thomas