Tesla Is In A Pickle

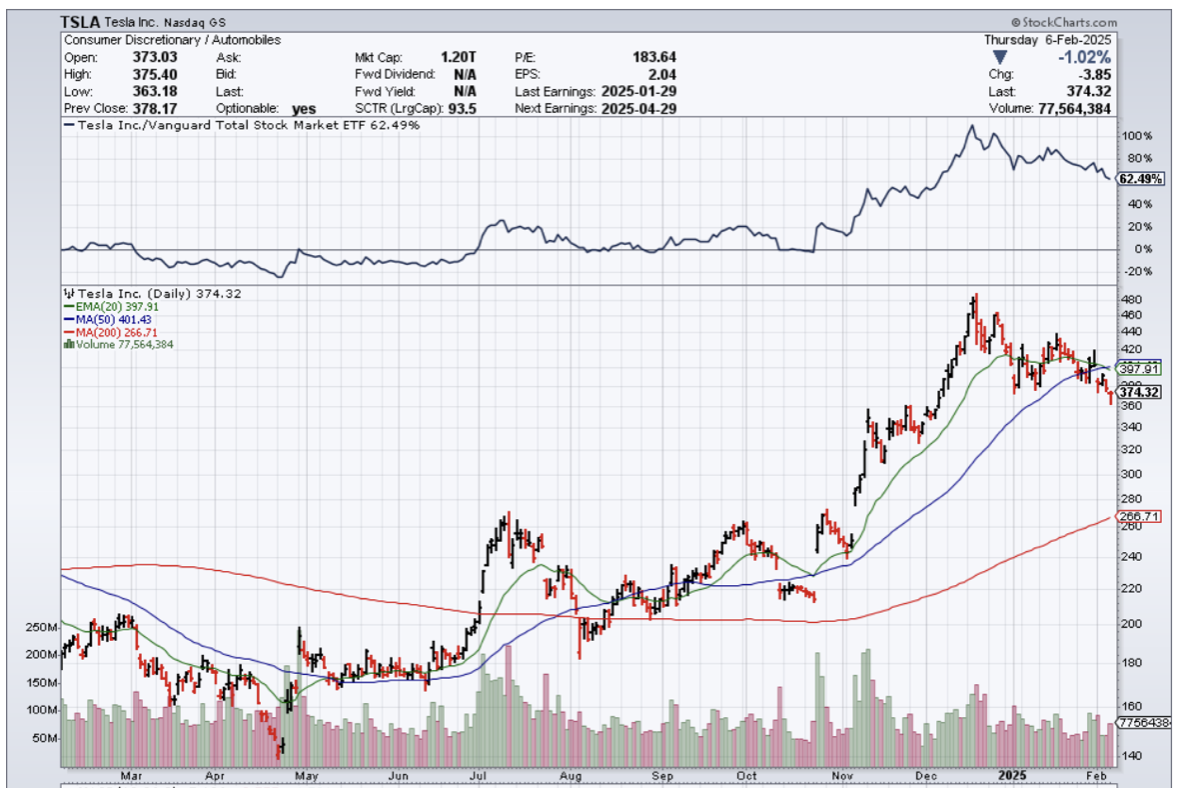

Tesla stock has been falling since the mid of last December, and I expect the short-term trajectory of the stock to be a real slippery slope.

There are a variety of factors causing the stock to struggle.

I won’t ignore the issue that the eccentric and strongly opinionated CEO Elon Musk has aggressively inserted himself into European politics and turning off the political establishment in Europe, which has always been radically left, is just asking for trouble.

It’s my opinion that he has essentially written off doing business in Europe and is throwing his efforts on making political inroads in the old continent.

Long term, I am not sure Musk can compete against the Chinese pricing power, and securing political gains in Western government will help his empire grow.

His sights have shifted away from EVs to rockets, and the stock will likely suffer from this.

Don’t forget that Europeans are facing a stark and grueling cost of living crisis that is degrees of magnitudes worse than what is happening in the United States.

Interesting that Americans complain that rental costs consume half the salary, but in Europe, tenant obligations via leases consume 100% of the average white-color job salary.

The end result is that young Europeans cannot afford to buy cars, whether it be gas powered or electric.

How bad are things for Tesla?

Sales of its EVs dropped 13% in the European Union in 2024.

They are also facing growing pressure as Chinese and Euorpean rivals launch a wave of cheaper electric vehicles.

Tesla saw big drops in sales in major markets dominated by ultra-progressive politics like Germany, France, and Italy.

In Germany, the hub of Europe's auto industry and the home of Tesla's Berlin gigafactory, sales of Tesla vehicles fell by 41% in 2024, outstripping the 27% sales decline in the general battery EV market.

Swedish brand Volvo, which is owned by Chinese conglomerate Geely, saw its sales rise nearly 30% in the EU last year, driven by the popularity of its $40,000 EX30 electric crossover.

Several German companies have announced they will stop buying Tesla vehicles over Musk's political and social comments in recent months.

This trend is likely to grow in 2025.

Musk has also become entangled in UK politics, feuding with British Prime Minister Keir Starmer.

I expect Musk's active political involvements to have a damaging impact on Tesla's European sales for the foreseeable future, and rivals would likely reap the benefit of disgruntled Tesla owners ditching their vehicles.

Tesla makes a great car – I don’t deny that.

Musk has already sold 2 to 3 EVs to every Western progressive that could ever want an EV. Conservatives aren’t interested in EVs. Try selling a Tesla in rural Poland to a Polish milk farmer where it would be almost impossible to find a charging station. EVs are almost entirely reserved for an urban environment where EV infrastructure is beefy and widespread.

Since Musk cannot get that EV sales growth boost in the short-term, he is riding on the coattails of the global populist movement to secure political victories, and it is working to his benefit.

At the end of the day, consumers would ultimately be more concerned about factors such as price and performance, rather than Musk's politics, but with people who can afford buying multiple EVs in Europe, they care about the name on your passport, the university you went to, and especially your political views.

Europe is just like that, and Musk is going ahead and alienating the European market.

In the short-term, I don’t see a lot of individual catalysts that could boost Tesla in the short-term, although after the Deepseek black swan, Tesla could ride a general tech market revision to the mean rally.

Let’s hope the general tech market heals itself from the Deepseek nuclear bomb, but I would stay away from Tesla in the short-term and opt for something more attractive in tech like Meta or Netflix in 2025.