Tesla Special Report: From Here to Infiniti

OK, let me take my victory lap.

Since I sent out my trade alert to buy Tesla on August 5, Tesla shares have exploded upward by a breathtaking $110, or 61%, to $290, a new 2024 high.

And the best is yet to come!

Of course, we got an assist from several fronts. The Tesla Model Y became the world’s top-selling car, just edging out the Toyota Corolla. Then, both Ford (F) and General Motors (GM) signed on to use Tesla’s national supercharger network, giving it an effective monopoly.

Now Elon Musk has a Trump administration to look forward to, where Musk donated hundreds of millions of dollars. What Elon will get in exchange is the elimination of regulation from his many companies, which until now have been very heavily regulated. It was a bargain at the price. Full Self Driving in the US, until now only available in unregulated China. No problem!

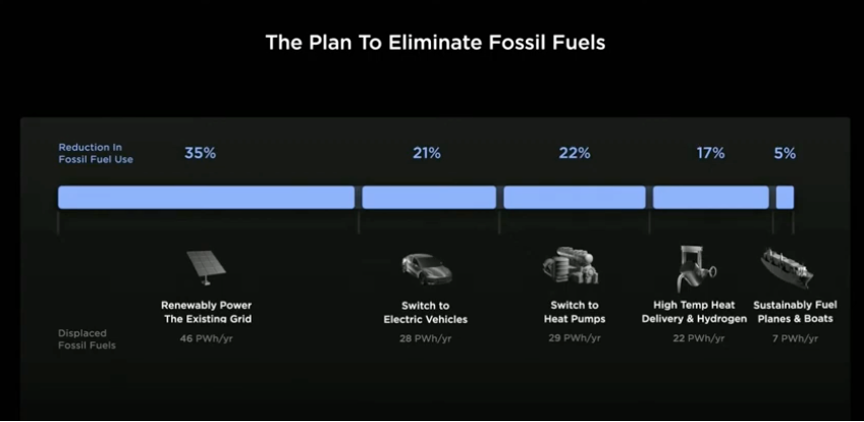

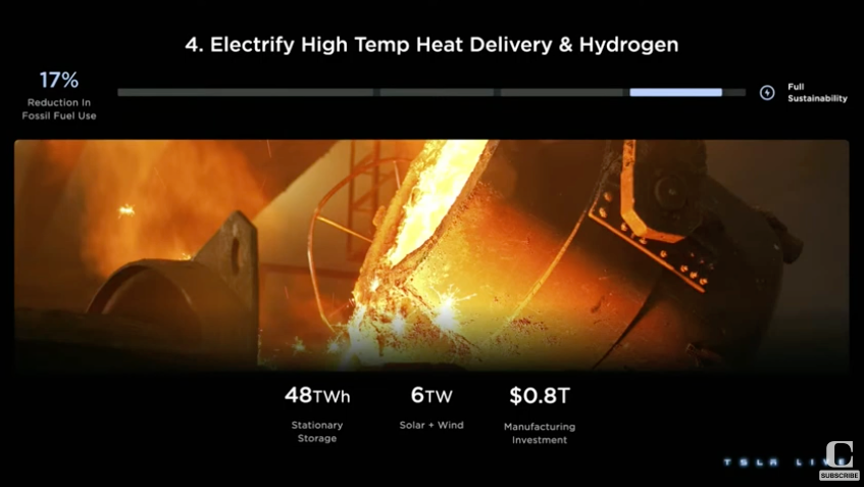

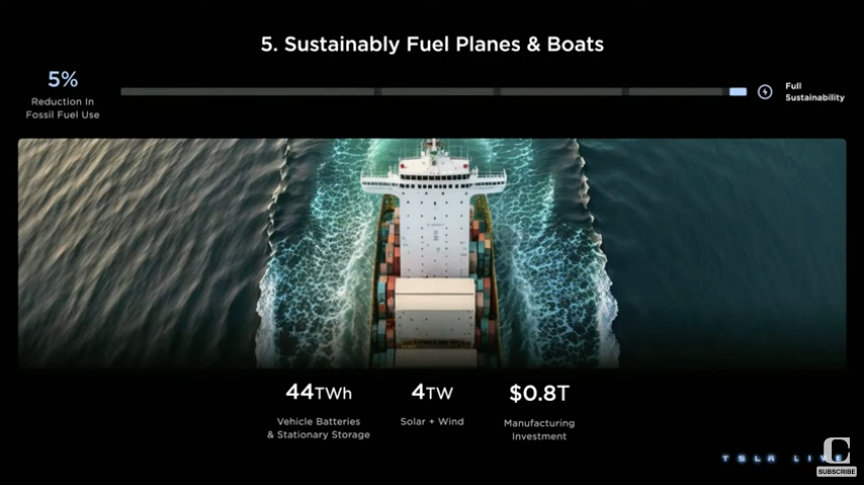

Elon Musk unveiled his Master Plan 3 and unleashed a cornucopia of new data that only an immense amount of research can produce. This will require all forms of transportation to be electric-powered within 20 years, except for interplanetary rockets.

As anyone who has been through an advanced physics course can tell you, internal combustion engines are woefully inefficient, converting only 25% of their energy into forward motion and 20% if you include materials energy costs. But then, that was the best the 19th century could do, and it worked for 152 years (Nicolaus Otto built the first gasoline-powered internal combustion engine in Germany in 1872).

Electric motors in Teslas operate closer to a 50% efficiency rating, cutting energy demand by half right there.

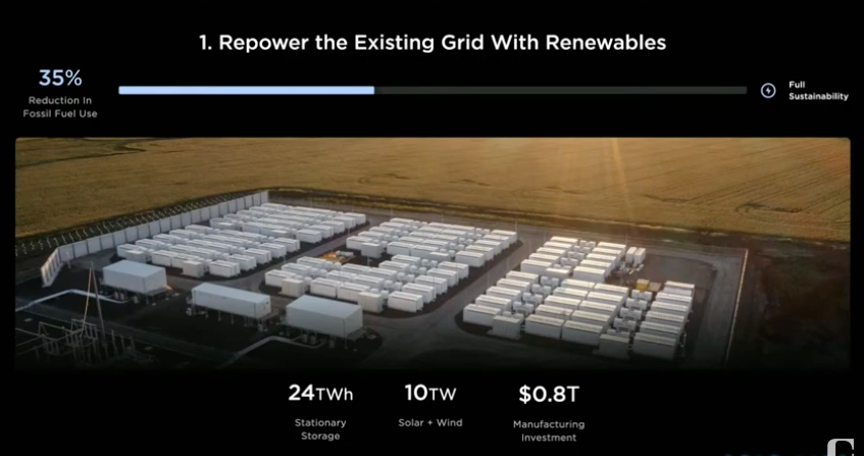

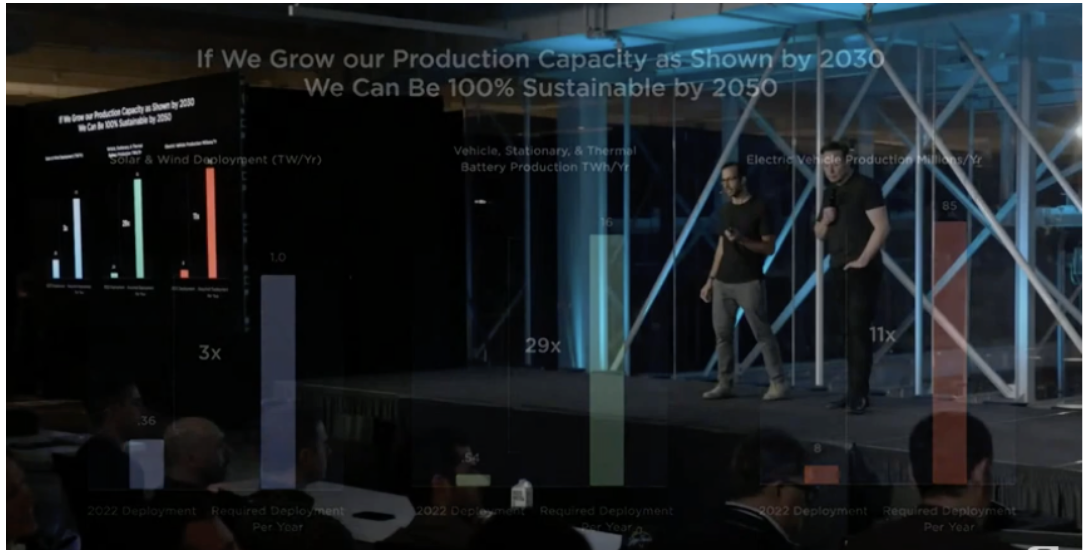

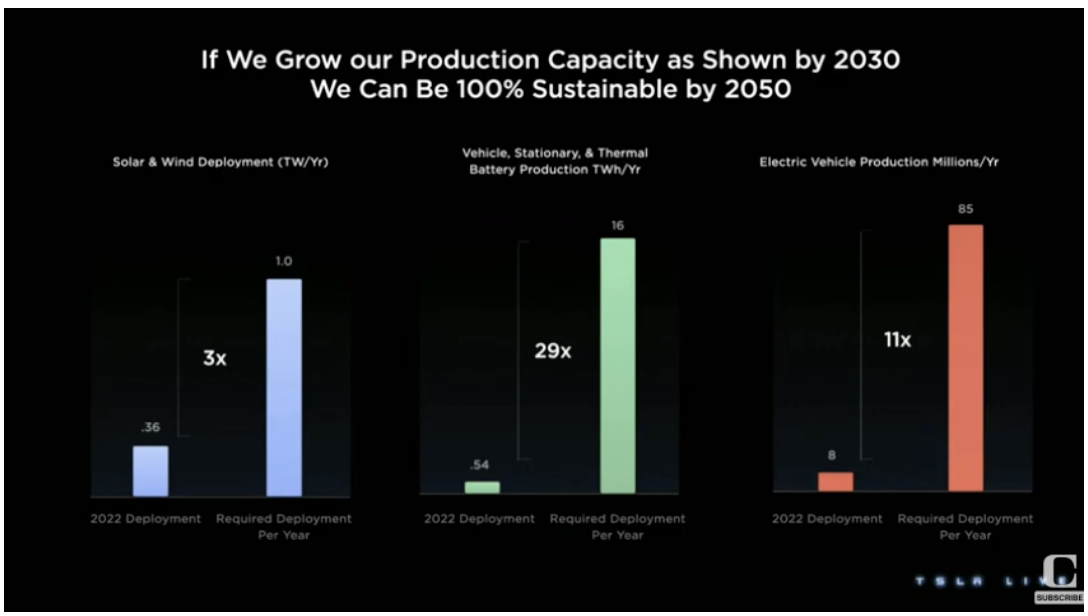

To move the world to an all-electric economy will cost about $10 trillion, or about 10% of world GDP. Average that out at 0.5% per year, and it will take about 20 years. Adding up car and storage batteries means 24 terawatts worth of batteries will need to be manufactured. There are one trillion watts per terawatt.

By comparison, the sun produces 1 gigawatt of energy per square kilometer per day or 509,600 terawatts. That means an all-electric economy dependent on batteries equivalent to less than 0.1% of the sun’s daily output. In other words, it’s miniscule.

In fact, the world is already decarbonizing far faster than people realize.

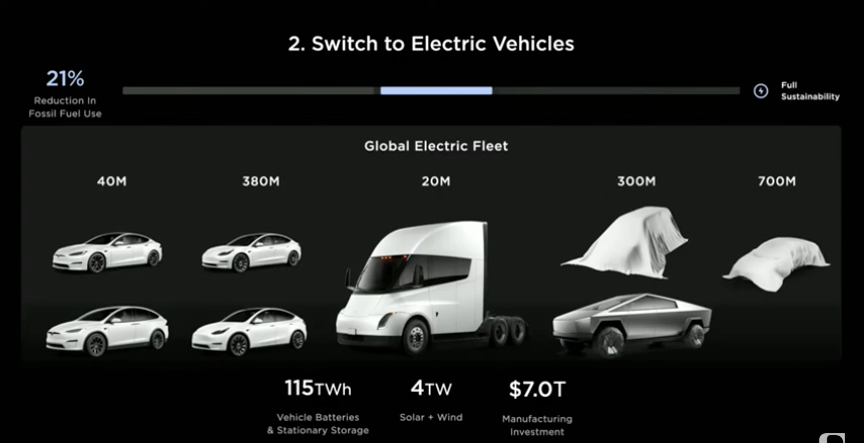

There are currently 2 billion cars and trucks in the world, 85 million a year are manufactured, and some 16 million in the US. Global EV production came to 10.6 million vehicles in 2023, an increase of 22%.

Some 60% of new electricity generation installed last year came from alternatives. That’s because, in terms of power output, alternatives are 40% cheaper than oil, coal, or natural gas. That’s being generous as it does not include the health care costs of carbon-based energy, which make several hundred thousand people per year ill in the US alone (asthma, lung cancer, etc.).

This means that a heck of a lot of lithium is going to be needed. Soft, white lithium is number three on the period table (you’re talking to a chemist here), is a great oxidizer, and is anything but rare. What IS rare is the lack of environmental controls and cheap labor.

This is why the bulk of lithium is produced in China and South America, where it literally sits on the surface. This is all easily scalable to meet future demand. In fact, moving to an alternative-based world uses far less mining than the existing conventional one.

The shortage is not in lithium supply but in lithium processing. The world’s largest lithium consumer should know. This is why Musk recently moved into lithium processing last year.

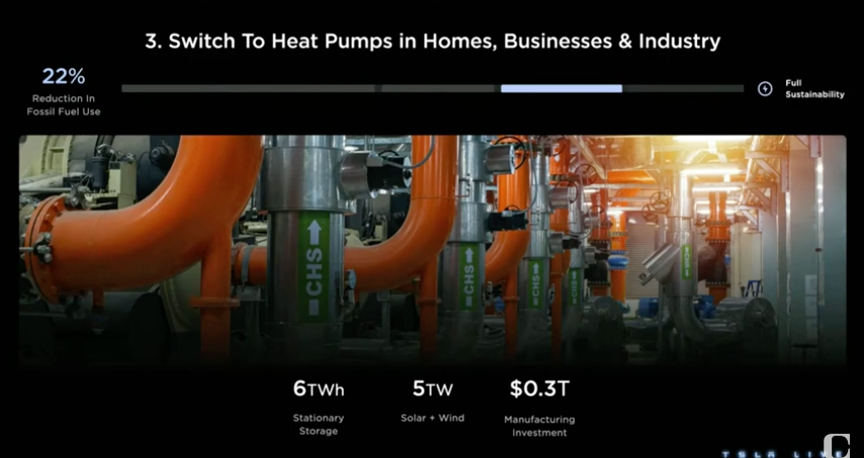

Home heating is another challenge. Existing heat pumps, which I have, do a great job heating in winter and cooling in summer in southern and western states where the weather is mild. These use only one-third of the energy used to heat homes with oil and natural gas. States facing subzero temperatures are another story. This problem can be solved with a fundamental redesign of the heat pump hardware.

Here was a big surprise for me. EV’s are not going to create an exponential demand for lithium. Otherwise, lithium stocks would be a lot higher. Once you get up to a total installed base of 40 million batteries, recycling becomes the primary sources of lithium as batteries age out. They can then be reprocessed into new batteries. This eventually caps lithium demand. Future cars will use far less silicon carbide, further reducing its demand by 75%, saving $1,000 a car.

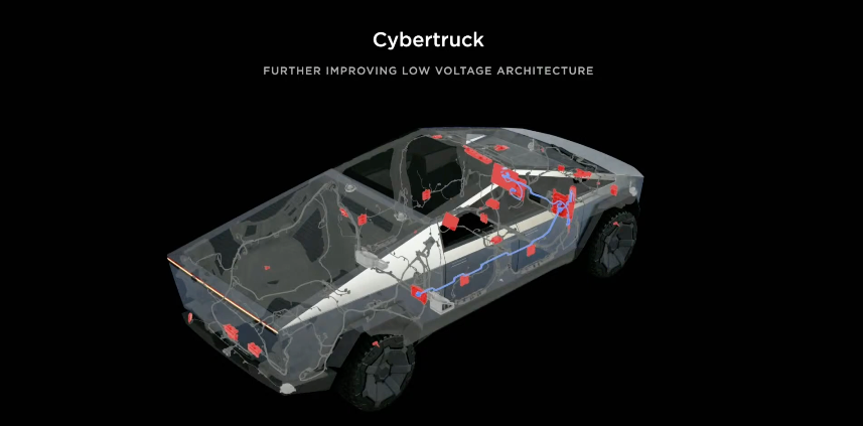

Musk is dumping the traditional 12-volt lead acid battery all Teslas have now, which accounts for 87% of all start failures. Instead, he is adding a second small lithium-ion one and redesigning the electrics to take 48 volts. This means lighter-weight cables can handle more power at less cost. Musk hopes to force the entire auto industry to move to a 48-volt standard, which should have been done decades ago.

The world’s 7 million Teslas now drive 123 million miles a day and represent the largest AI neural network on the planet. If a car in Florida makes a left turn, all the cars in the rest of the country learn from that experience.

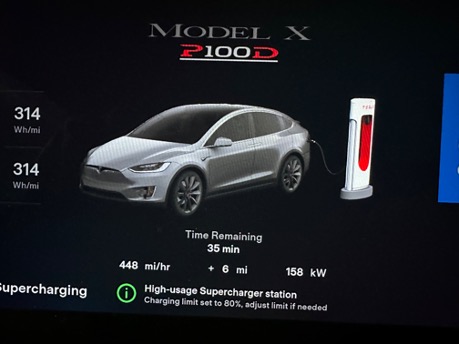

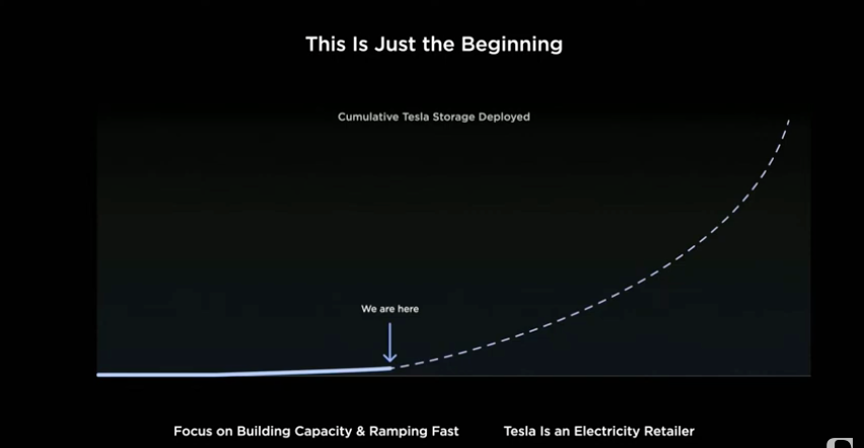

Tesla now has 80,000 chargers in the US, including 40,000 superchargers, which can charge up to 450 miles per hour and give you a full charge from zero in 40 minutes. Tesla charged cars with ten terawatts of power in 2023, and per kilowatt costs have dropped by 40%, with charge times down 30%. Tesla is well on its way to becoming the largest electric power utility in the United States.

Tesla’s current manufacturing capacity is 2 million cars a year across four factories (Fremont, CA; Austin, TX; Berlin, Germany; and Shanghai, China). While it took Tesla 12 years to make its first million vehicles, the 4th million took only seven months. As of today, it is cheaper to own a Tesla than the world’s biggest formerly biggest-selling car, the Toyota Corolla, given their total lifetime costs. Work out the cost of charging a Tesla, and you are paying the equivalent of 25 cents a gallon for gasoline unless you charge at my house, in which case it is free.

The Gigafactory in Sparks, NV, which mass produces lithium-ion battery packs, is currently being doubled in size. In Texas, Tesla is buying wind power from the grid and offering Tesla owners a flat rate for charging of $30 a month because the cost is so low.

There are great hopes for the Cybertruck, for which Tesla has 2 million orders, myself included. The current price for the three-motor version will be about $80,000, the same as for a model X. The Cybertruck has a brand new third-generation platform on which all future Tesla models will be based. It will also include a 48-volt electrical design.

Tesla’s huge price cuts have been wildly successful, allowing it to gain market share at its competitor's expense. Tesla is really just passing on the recent collapse in commodity prices. So far in 2024, Lithium prices have fallen by 20% and copper by 15%. Tesla prices will continue to fall, especially when the new $25,000 Model 2 is brought to market in 2026. That will really decimate the competition.

Tesla has also taken the plunge into the insurance industry, charging drivers on their actual driving history, which they already collect. If you drive like a little old lady, it can run as little as $125 a month. If you drive like Mad Max, it’s more, but not as much as a conventional car insurance company.

Rates change monthly depending on your driving record. Parked in a garage gives you a perfect score of 90, and it drops from there. It’s all about reducing the total cost of a Tesla car. Not such a bad deal if you let their computer do all the driving.

What will Tesla disrupt next?

All in all, it was a breathtaking presentation, which Elon delivered coolly and calmly. It is with the greatest enthusiasm that I reiterate my $1,000 per share price target.

To watch the Tesla Investor Day in its entirety on YouTube, please click here.

6 X 13.5 kw Tesla Powerwall’s