Dear John,

Remember me from the QE2? You don’t miss much, but I’m forwarding this AI story, in case you find it interesting. You are the best financial advisor I have ever found.

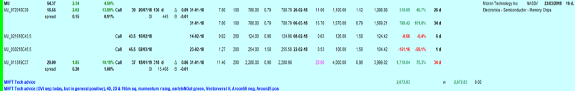

I know you’ve been a big believer in NVIDIA (NVDA) for years. When I read this, I really understand that (NVDA) is only going to get bigger. They and Microsoft (MSFT) MSFT are the two biggest investors in AI startups.

I hope you have a great 2024, thanks for all the hard work and great newsletters. |

Bill

Santa Barbara, CA