Aloha Major John Thomas!

First, thank you for your service! I’m in awe of your ongoing incredible accomplishments and service to your country, your zest for life and nature, your sense of humor, your stories, and all while delivering crushing investment returns. Thank you and well done!

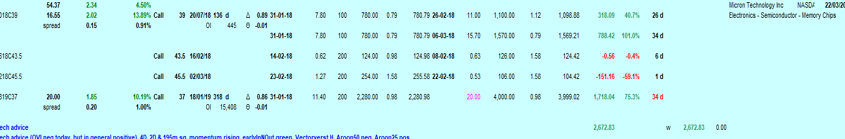

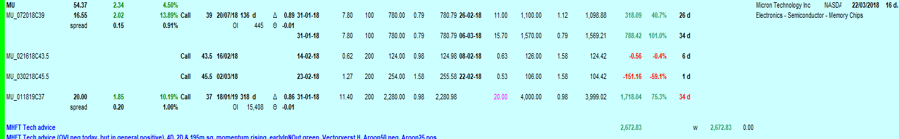

As for me, I became a Mad Hedge Fund Trader Global Dispatch Service subscriber November 2020 and “tested” the service by trading your monthly options spread Trade Alerts in an IRA with $25K. New to call and put spreads, my profits for the first month covered my subscription fee. And I’ve managed to execute almost all Trade Alerts within the suggested price range, usually close to or at your price.

Well, I’ll let you do the math. The Global Dispatch Service Trade Alerts delivered a return of 90.01% in 2021, and 60.98% YTD 2022! Are you kidding me? Absolutely not! Test score? A+! All in!

I may have to get up crazy early for the US stock market open at 3:30 a.m. here in Honolulu, but I’m riding waves by 10:30 a.m., done for the day. I’ve just liquidated all my assets, and recently became Trustee of a Family Trust, which also liquidated all assets. I am now investing approximately $2.75 million in cash. I’m nearly 100% cash with John Thomas in my corner just a phone call away. Of course, I’ve begun purchasing LEAPS, and I’m holding a very large amount of this month’s options spreads. And thank you for your unsolicited phone call last Friday! I look forward to our next call, and hope to see you in person soon.

I’m extremely satisfied and secure in knowing that I can maintain a well-diversified and hedged investment portfolio, earning monster returns in both a long-term barbell portfolio, and a short-term deep-in-the-money options spread portfolio, while maintaining highly risk-averse portfolio management.

REALIZING income for the Family Trust each and every month, while maintaining a large average daily cash position, allows me to lock-in outsized returns, AND remain highly risk-averse. I return to 100% cash every single month, and hold a large percentage of cash most of the year. And earnings are not just on paper, they’re actual earnings…in CASH! Not only is the Family Trust realizing large returns, it’s ready to distribute cash in entirety every month, should the need arise, as the majority of funds sit in cash most of the year. I’m ready to accept my award for Trustee of the Year.

Needless to say, I am renewing your Concierge Service. I’ll earn the subscription fee back, and more, during the first month of renewal.

I’m now ready to get to $10 million ASAP, and look forward to speaking with you again, Obi-Wan!

Mahalo John and the MHFT Team!

Sincerely,

Wilson