Thank You Janet Yellen

Email sent to Federal Reserve Governor Janet Yellen, 9-17-2015 2:30 PM EST:

Dear Janet,

A great big thank you to you!

All is forgiven!

I apologize for those snarky questions I used to ask at your San Francisco Fed press conferences years ago.

And I don?t regret for a second all those times I walked you to your car after your night economics class at UC Berkeley because you were afraid you would get mugged.

The insights I gained to your thinking have been worth their weight in gold.

A few minutes before your interest rate decision, I placed bets with some hedge fund friends of mine.

I went for NO INCREASE, citing your insistence to me on many occasions that you needed to ?see the whites of inflation?s eyes? before you?d make a move.

I am also averse to betting against nine year long trends.

So, I won! BIG TIME!

It?s clear that you have subscribed to Verizon?s new international dialing plan. It?s such a great deal, as I found myself traveling last summer in Europe.

That would explain your newly heightened sensitivity to economic conditions abroad, with a weak Europe and a China slowdown.

A strong dollar was also clearly in your thinking, as it is a big drag on the earnings of large US multinationals.

And the massive collapses in oil and commodity prices obviously indicate that inflation is nowhere to be seen.

So being the central banker to the 50 United States is not enough? You want to take on the world?

If anything, deflation is accelerating. So why rush to head off non-existent inflation?

I suspected as much.

That?s why I went into your meeting with no positions whatsoever. That is very rare for a person like me who has to be making money all the time. The risk/reward was just lousy.

What you have done is set up one of the greatest ?BUY THE RUMOR AND SELL THE NEWS? markets in recent memory.

In a few days, once the smoke clears, we should go back down and retest the recent lows, even if we don?t get very close.

That will give me the entry point for me and my many new followers to buy stocks once again.

If you really do need to see inflation before you raise interest rates, you might not raise them for three more years!

What we now have to look forward to is three more months of uncertainty, speculation, and prognostication about a December rate rise. I can?t imagine a more ideal trading environment.

But you have to go into this with dry powder, which I, with a 100% cash position, have plenty of.

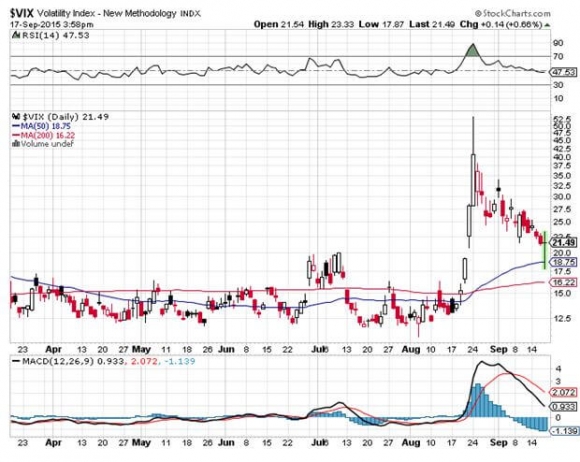

While I have your attention, let me tell you about this neat little trade I discovered in the Velocity Shares Daily Inverse VIX Short Term ETN (XIV), which is a bet that S&P 500 volatility will fall.

I made two round trips on this baby in the past two weeks, getting followers in as low as $23.20. It hit $32.40 after the announcement, an unbelievable two week gain of 39.66%.

A few more trades like this, Janet, and you will more than make up for the pitiful pension that the government pays former Federal Reserve governors.

You won?t have to do any TV gigs at all!

Just let me know and I?ll get you set up. You see, I know this broker?

So once again, thank you Janet. The box of See?s candy is in the mail.