The China Trade War Turns Hot

The trade war with China has suddenly gone from small beer to a big deal. In just two months, we have gone from campaign promises to threats, to an increase in duties from $50 billion to $250 billion worth of Chinese imports.

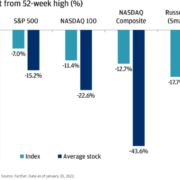

The risk of destroying the current strength of the economy and the stock market is now on the table. Already, the Dow Average has given up all its 2018 gains and is now down 1.1% on the year.

All we will be left with is a big tax cut for corporations, $3 trillion in new government debt, and a recession.

As a result, the current rally in the stock market will fail, and a test of the 2018 lows is on the menu. My 2018 range for stocks until the midterm election lives!

Of the past 10 years, China has generated 50% of global economic growth, the U.S. 35%, and the rest of the world the balance. Imports from the U.S. to China were already on a sharp upswing, and it is now our third largest trading partner.

Imports of U.S. autos has soared from 125,356 units in 2011 to 267,473 in 2017, and that doesn't count American cars, such as the GM Buick, built in China. It now looks like all of this will suddenly grind to a halt.

Not only will Chinese middle-class consumers buy European and Japanese going forward, the American brand has been destroyed by our open hostility and insults. Apple (AAPL) sells more iPhones in China than the U.S., but I'm not sure that will last either.

China only imported $150 billion worth of goods from the U.S. last year. That means to implement a tit-for-tat, dollar-for-dollar retaliation China will have to hit the U.S. services sector hard. Similarly, you can bet that Chinese investment in the U.S. will be sharply curtailed.

The true cost of the trade war isn't in the dollar amounts involved ... yet. But the impact on business confidence has been catastrophic.

Investment globally is slowing because nobody knows if their industry, or their company will get hit next by American off-the-cuff policies. Just ask any soybean (SOYB) farmer who is looking at a de facto ban on Chinese purchases of their products. The price of their commodity has collapsed by 16% in a week.

In the end, Trump will get what he wants, a lower U.S. trade deficit. But it will come in the form of collapsing demand from U.S. consumers generated by the next recession. That is the only way the American trade deficit has fallen for the past century.

Be careful what you wish for.