The Christmas Rally Got Stopped at the Border

On Sunday, I spent 30 minutes driving around looking for a parking space at Target. Once there, I waited for another half hour while the people in front of me paid for their entire Christmas shopping for the year. You can’t get a restaurant reservation anywhere.

With economic conditions this strong, you would think the stock market would be booming, soaring to new highs daily.

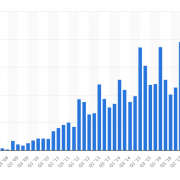

It’s not. In fact, as I write this, the Dow Average is now down 5% in 2018 and off a gut-punching 13% since the beginning of October. Two-month support was shattered yesterday.

In fact, stocks have just suffered their worst quarter in a decade. Technology shares, in particular, have taken the biggest hit since the 2000 Dotcom Bust. We have in effect seen Dotcom Bust 2.0.

I warned readers for years that the top of this bull market may not be defined by any particular economic or geopolitical event. The sheer weight of prices could do it. Some 2 ½ months into a horrific meltdown and it looks like that is what happened. I’ve lost count of the 600 points downdrafts in recent weeks.

All of which I find extremely annoying as I missed one of the greatest short selling opportunities of all time. I feel like such an idiot. I did get off a few shorts. My Tesla short (TSLA) is going gangbusters but I still love the company long term. The bond market (TLT) remains my new rich uncle, writing me generous checks monthly.

The reason I didn’t go short more aggressively is that the risk of a China trade deal was always looming on the horizon. When it happens, markets could rocket 10%. But nine months into the trade war, and it still remains way out there on the horizon. Wasn’t it General Douglas MacArthur who said the US should never get involved in a land war in Asia?

Of course, the reasons are all crystal clear with 20/20 hindsight. The Federal Reserve giveth, and Federal Reserve taketh away. While global liquidity was exploding, stocks could only go one way, and that was up. Fortunately, I was one of the early ones to figure this out. But then, I took former Governor Janet Yellen’s class at UC Berkley.

Now, everywhere you look liquidity is disappearing. The US government will run a $1 trillion budget deficit in 2019. Add in entitlements and that balloons to $1.3 trillion.

The Fed is sucking out another $600 billion next year as part of its quantitative tightening, the long-advertised QE unwind. Did I mention that the Fed has raised interest rates six times in three years and will raise again once more on Wednesday?

As I peruse my charts and run the numbers on possible options combinations, the number of “screaming buys” almost can’t be counted. Apple (AAPL), for example is looking at a potential $10 of downside versus $170 of upside on a five-year view.

But you know, sitting on your hands seems to be working for everyone else. I think I’ll give it a try. It is far easier to buy them on the way up than catch a falling knife. Sure, I’m unchanged on the quarter, but unchanged is not what I’m all about. I think I’ll just lock in my 30% return this year and call it a year. I’ll be a hero again in 2019.