The Eight Worst Trades in History

As you are all well aware, I have long been a history buff. I am particularly fond of studying the history of my own avocation, trading, in the hope that the past errors of others will provide insights for the future.

History doesn’t repeat itself, but it certainly rhymes.

So after decades of research on the topic, I thought I would provide you with a list of the eight worst trades in history. Some of these are subjective, some are judgment calls, but all are educational. And I do personally know many of the individuals involved.

Here they are for your edification, in no particular order. You will notice a constantly recurring theme of hubris.

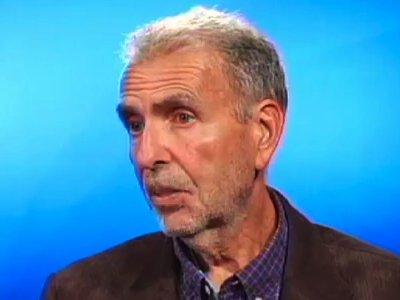

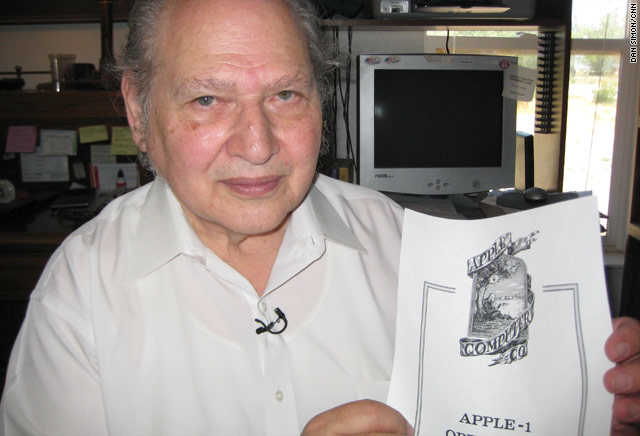

1) Ron Wayne’s sales of 10% of Apple (AAPL) for $800 in 1976

Say you owned 10% of Apple (AAPL) and you sold it for $800 in 1976. What would that stake be worth today? Try $120 billion, making it undoubtedly one of the history's worst trades. That is the harsh reality that Ron Wayne, 78, faces every morning when he wakes up, one of the three original founders of the consumer electronics giant.

Ron first met Steve Jobs when he was a spritely 21-year-old marketing guy at Atari, the inventor of the hugely successful “Pong” video arcade game.

Ron dumped his shares when he became convinced that Steve Jobs’ reckless spending was going to drive the nascent startup into the ground and he wanted to protect his own assets in a future bankruptcy.

Co-founders Jobs and Steve Wozniak each kept their original 45% ownership. Today, Jobs’s widow, Laurene Powel Jobs, has a 0.5% ownership in Apple worth $4 billion, while the value of Woz’s share remains undisclosed.

Today, Ron is living off of a meager monthly Social Security check in remote Pahrump, Nevada, about as far out in the middle of nowhere as you can get, where he can occasionally be seen playing the penny slots.

2) AOL's 2001 Takeover of Time Warner

Seeking to gain dominance in the brave new online world, Gerald Levin pushed old-line cable TV and magazine conglomerate, Time Warner, to pay $164 billion to buy upstart America Online in 2001. AOL CEO, Steve Case, became chairman of the new entity. Blinded by greed, Levin was lured by the prospect of 130 million big spending new customers.

It was not meant to be.

The wheels fell off almost immediately. The promised synergies never materialized. The Dotcom Crash vaporized AOL’s business the second the ink was dry. Then came a big recession and the Second Gulf War. By 2002, the value of the firm’s shares cratered from $226 billion to $20 billion.

The shareholders got wiped out, including “Mouth of the South” Ted Turner. That year, the firm announced a $99 billion loss as the goodwill from the merger was written off, the largest such loss in corporate history. Time Warner finally spun off AOL in 2009, ending the agony.

Steve Case walked away with billions, and is now an active venture capitalist. Gerald Levin left a pauper, and is occasionally seen as a forlorn guest on talk shows. The deal is widely perceived to be the worst corporate merger in history.

Buy High, Sell Low?

3) Bank of America's Purchase of Countrywide Savings in 2008

Bank of America’s CEO Ken Lewis thought he was getting the deal of the century picking up aggressive subprime lender, Countrywide Savings, for a bargain $4.1 billion, a “rare opportunity.” Little did he know he would make it on the worst trades in history list.

Because unfortunately, as a result, Countrywide CEO Angelo Mozilo pocketed several hundred million dollars. Then the financial system collapsed, and suddenly we learned about liar loans, zero money down, and robo-signing of loan documents.

Bank of America’s shares plunged by 95%, wiping out $500 billion in market capitalization. The deal saddled (BAC) with liability for Countrywide’s many sins, ultimately, paying out $40 billion in endless fines and settlements to aggrieved regulators and shareholders.

Ken Lewis was quickly put out to pasture, cashing in on an $83 million golden parachute, and is now working on his golf swing. Mozilo had to pay a number of out-of-court settlements, but was able to retain a substantial fortune, and is still walking around free.

The nicely tanned Mozilo is also working on his golf swing.

4) The 1973 Sale of All Star Wars Licensing and Merchandising Rights by 20th Century Fox for Free

In 1973, my former neighbor George Lucas approached 20th Century Fox Studios with the idea for the blockbuster film, Star Wars. It was going to be his next film after American Graffiti which had been a big hit earlier that year.

While Lucas was set for a large raise for his directing services – from $150,000 for American Graffiti to potentially $500,000 for Star Wars – he had a different twist ending in mind. Instead of asking for the full $500,000 directing fee, he offered a discount: $350,000 off in return for the unlimited rights to merchandising and any sequels.

Fox executives agreed, figuring that the rights were worthless, and fearing that the timing might not be right for a science fiction film. In hindsight, their decision seems ridiculously short-sighted.

Since 1977, the Star Wars franchise has generated about $27 billion in revenue, leaving George Lucas with a net worth of over $3 billion by 2012. In 2012, Disney paid Lucas an additional $4 billion to buy the rights to the franchise.

The initial budget for Star Wars was a pittance at $8 million, a big sum for an unproven film. So, saving $150,000 on production costs was no small matter, and Fox thought it was hedging its bets. They certainly never imagined they were making one of the worst trades in history.

George once told me that he had a problem with depressed actors on the set while filming. Harrison Ford and Carrie Fisher thought the plot was stupid and the costumes silly.

Today, it is George Lucas who is laughing all the way to the bank.

$150,000 for What?

5) Lehman Brothers Entry Into the Bond Derivatives Market in the 2000s

I hated the 2000s because it was clear that men with lesser intelligence were using other people’s money to hyper leverage their own personal net worth. The money wasn’t the point. The quantities of cash involved were so enormous they could never be spent. It was all about winning points in a game with the CEOs of the other big Wall Street institutions.

CEO Richard Fuld could have come out of central casting as a stereotypical bad guy. He even once offered me a job which I wisely turned down. Fuld took his firm’s leverage ratio up to 100 times in an extended reach for obscene profits. This meant that a 1% drop in the underlying securities would entirely wipe out its capital.

That’s exactly what happened, and 10,000 employees lost their jobs, sent packing with their cardboard boxes with no notice. It was a classic case of a company piling on more risk to compensate for the lack of experience and intelligence. This only ends one way.

Morgan Stanley (MS) and Goldman Sachs (GS) drew the line at 40 times leverage and are still around today but just by the skin of their teeth, thanks to the TARP.

Fuld has spent much of the last five years ducking in and out of depositions in protracted litigation. Lehman issued public bonds only months before the final debacle, and how he has stayed out of jail has amazed me. Today he works as an independent consultant. On what I have no idea.

Out of Central Casting

6) The Manhasset Indians' Sale of Manhattan to the Dutch in 1626

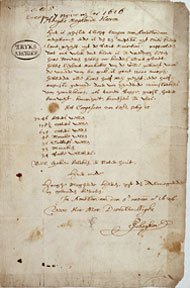

Only a single original period document mentions anything about the purchase of Manhattan. This letter states that the island was bought from the Native Americans for 60 Dutch guilders worth of trade goods which would consist of axes, iron kettles, beads, and wool clothing.

No record exists of exactly what the mix was. Native Americans were notoriously shrewd traders and would not have been fooled by worthless trinkets.

The original letter outlining the deal is today kept at a museum in the Netherlands. It was written by a merchant, Pieter Schagen, to the directors of the West India Company (owners of New Netherlands) and is dated 5 November 1626.

He mentions that the settlers “have bought the island of Manhattes from the savages for a value of 60 guilders.” That’s it. It doesn’t say who purchased the island or from whom they purchased it, although it was probably the local Lenape tribe.

Certainly one of the worst trades in history, though historians often point out that North American Indians had a concept of land ownership different from that of the Europeans. They regarded land, like air and water, as something one could use but not own or sell. So, it has been suggested that the Native Americans thought they were sharing, not selling.

It is anyone’s guess what Manhattan is worth today. Just my old two-bedroom 34th-floor apartment at 400 East 56th Street is now worth $2 million. Better think in the trillions.

7) Napoleon's 1803 Sale of the Louisiana Purchase to the United States

Invading Europe is not cheap, as Napoleon found out, and he needed some quick cash to continue his conquests. What could be more convenient than unloading France’s American colonies to the newly founded United States for a tidy $7 million? A British naval blockade had made them all but inaccessible anyway.

What is amazing is that president Thomas Jefferson agreed to the deal without the authority to do so, lacking permission from Congress, and with no money. What lies beyond the Mississippi River then was unknown.

Many Americans hoped for a waterway across the continent while others thought dinosaurs might still roam there. Jefferson just took a flyer on it. It was up to the intrepid explorers, Lewis and Clark, to find out what we bought.

Sound familiar? Without his bold action, the middle 15 states of the country would still be speaking French, smoking Gitanes, and getting paid in Euros.

After Waterloo in 1815, the British tried to reverse the deal and claim the American Midwest for themselves. It took Andrew Jackson’s (see the $20 bill) surprise win at the Battle of New Orleans to solidify the US claim.

The value of the Louisiana Purchase today is incalculable. But half of a country that creates $17 trillion in GDP per year and is still growing would be worth quite a lot.

Great General, Lousy Trader

8) The John Thomas Family Sale of Nantucket Island in 1740

Yes, the investments of my own ancestors are to be included among the worst trades in history. My great X 12 grandfather, a pioneering venture capitalist investor of the day from England, managed to buy the island of Nantucket off the coast of Massachusetts from the Indians for three ax heads and a sheep in the mid-1600s. Barren, windswept, and distant, it was considered worthless.

Two generations later, my great X 10 grandfather decided to cut his risk and sell the land to local residents just ahead of the Revolutionary War. Some 17 of my ancestors fought in that war including the original John Thomas who served on George Washington’s staff at the harsh winter encampment at Valley Forge during 1777-78. Maybe that’s why I have an obsession with not wasting food?

By the early 19th century, a major whaling industry developed on Nantucket fueling the lamps of the world with smoke-free fuel. By then, our family name was “Coffin,” which is still abundantly found on the headstones of the island’s cemeteries.

One Coffin even saw his ship, the Essex, rammed by a whale and sunk in the Pacific in 1821. He was eaten by fellow crewmembers after spending 99 days adrift in an open lifeboat. Maybe that’s why I have an obsession with not wasting food?

In the 1840s, a young itinerant writer named Herman Melville visited Nantucket and heard the Essex story. He turned it into a massive novel about a mysterious rogue white whale, Moby Dick, which has been torturing English literature students ever since. Our family name, Coffin, is mentioned seven times in the book.

Nantucket is probably worth many tens of billions of dollars today as a playground for the rich and famous. Just a decent beachfront cottage there rents for $50,000 a week in the summer.

The 2015 Ron Howard film, The Heart of the Sea, is breathtaking. Just be happy you never worked on a 19th-century sailing ship.

Yes, it’s all true and documented.

Hi Grandpa!