The Euro Breaks Down

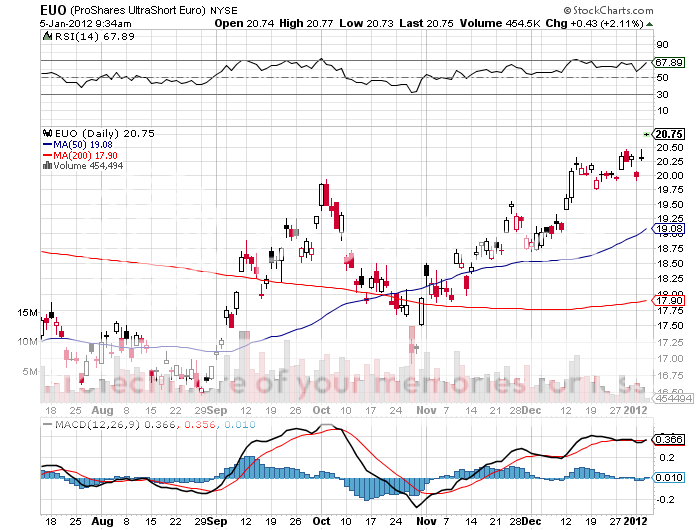

(Note to Newsletter only subscribers: This trade alert went out to paying customers of my Trade Alert Service last Thursday morning.) I am going to start the New Year with a 25% allocation to the double leveraged short ETF (EUO). It?s time to do the hard trade, sell on weakness, and sell the breakdown. The Euro is so weak that it just won?t give new entries a decent entry point.

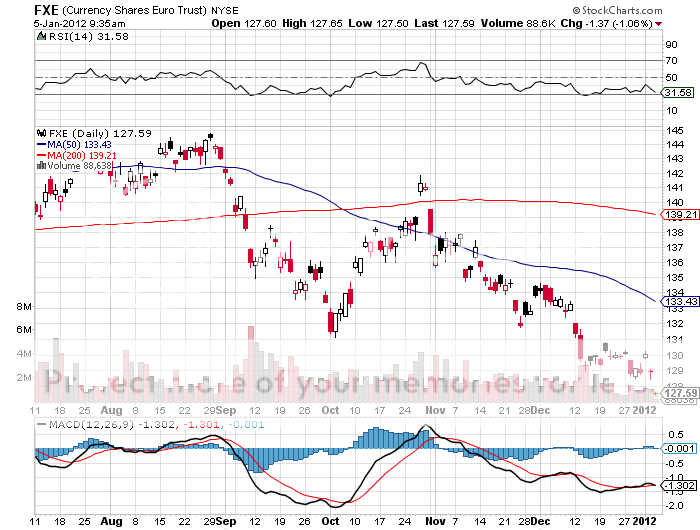

The really impressive thing about the way Euro traded in the closing weeks of December is how it failed to rally when all other risk assets were doing well. That ultimate arbiter of risk appetite, the S&P 500 (SPX) saw ten days of gains, posting a healthy 5.4% increase. The European currency managed no gain whatsoever. So many hedge funds are ready to add to their Euro shorts that it isn?t able to breathe at all.

I don?t know how long it will take the Euro to fall. The big 3%-4% daily declines are well behind us, occurring back when the currency was peaking in April just short of $1.50.? Existing shorts in the Euro are at all-time highs. So what we may see from here might be more of a slow grind than a sudden crash, as existing shorts increase positions and Johnny Come Latelies and neophytes join the game for the first time.

To use American football terminology, this will be a running game, not a passing one. The bigger moves won?t come until you see a broader ?RISK OFF? trade take hold in the global financial markets, where everyone runs towards the security of the greenback. That may happen sooner than you think.

Somewhere down the road, we should get a dramatic worsening in the fiscal and monetary conditions on the continent. The disagreement now is whether Europe is in a recession, where the economy is shrinking at a 1%-2% rate, or is in a full blown depression decelerating at a 5% or more rate. When the data hits the tape it is assured to trigger more selling of Euros than buying, driving the (EUO) trade in our favor.

Of course, European Central Bank president, Mario Draghi, will fight the valiant fight to slow the Euro?s decline. But at this stage, he only has words to use as weapons. Everyone knows that he is going to cut Euro interest rates by 25 basis points at the next meeting to head off the coming deflation. That will chop the interest rate differential between the Euro and the dollar in Uncle Buck?s favor, triggering further Euro selling.

My only concern here is that Europe?s long term structural problems are extremely well known, so this is not exactly a new trade. When my cleaning lady, gardener, and masseuse are already heavily short the Euro you have to beware. The smart money has been shorting Euros for the last eight months from $1.49 down, and smacking every rally. We are probably half way through a multiyear plunge in the Euro, from $1.50 to $1.10, so the risk of a snap back short covering rally will be ever present.

This is why I have chosen the leverage ETF instead of put options on the (FXE). Without time decay we can afford to wait this one out. The cost of carry is only a couple percent a year. The reduced leverage compared to an option will soften the impact on my daily P&L. And entering the New Year with a flat book, I have cash to burn.

If the Euro hits $1.20, a reasonably conservative downside target, the (EUO) should appreciate from $20.73 to $23.5. That would add 3.25% to our annual return. If we get a first class run on this despised currency and it drops to a more aggressive $1.10, the (EUO) should make it to $26.5, creating a 7% profit.

For risk control purposes, I shall use a stop on this position of $1.34 in the underlying Euro, or $19.50 in the (EUO).

This is How We Get to $1.10