The Fat Lady is Singing Again for the Bond Market

You have just been adopted by a new rich uncle.

I doubled my short position in the US Treasury bond market last week (TLT).

Furthermore, I'll be using any subsequent price rise to sell more bonds, roll forward put options, put spread options positions, buy LEAPS, sell short bond futures, and buy the ProShares Ultra Short 20+ Treasury Bond Fund (TBT).

It is undoubtedly the cleanest trade out there in the world today.

Of all the momentous changes in the prospects for asset classes as a result of the presidential election, bonds absolutely top the list.

And not just US bonds, but German, Japanese, British, and every other kind of bond out there in the world as well are exiting a 30-year bull market and entering a 20-year bear market.

Fixed income instruments are totally toast for the next four and possibly eight years. Indeed, the list of reasons is so long that I'll have to list them one by one.

1) The hallmark of Trump's economic policy revealed so far is to run the economy hot by launching a massive round of deficit spending.

Independent analysis predicts that the US national debt could rise by as much as $10 trillion over the next decade.

That's what a massive tax cutting, spending rises gets you.

Call it Reagan 2.0, without the jokes.

Even if the Federal Reserve does nothing, this unprecedented issuance of new government paper will crowd out private borrowers and drag interest rates upward, to the detriment of bond prices and borrowers everywhere.

2) The bond market was already in trouble well before the election. Prices peaked in July 2015, and have been steadily eroding since. Every bond position I have strapped on since then has been from the short side.

This was because the world was assigning a growing probability of a long series of Fed interest rate hikes.

You could see this in the way bank shares traded, which started moving off of multiyear bottoms during the same time period.

All the election did was pour gasoline on a small fire that was just starting to build.

3) After hiding in a deep cave for the past ten years, inflation is about to make a dramatic comeback. It was already starting to edge up with recent economic reports.

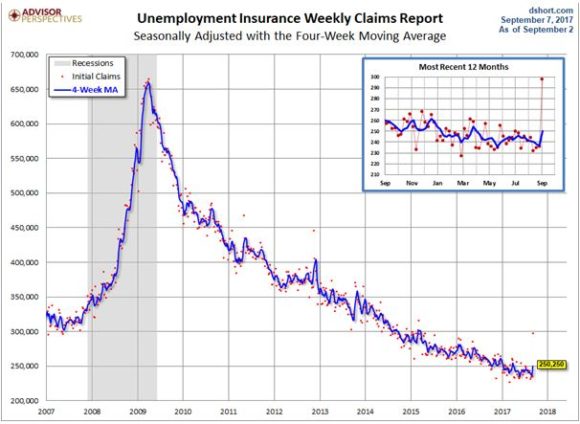

And here is the problem. If you initiate a huge new jobs program with weekly jobless claims already at a 43-year low, wages will take off like a scalded chimp.

Oh, and by the way, wages are the largest component in any inflation calculation.

4) Years of zero, or subzero, interest rate policies from central banks around the world have created a substantial mal investment bubble in all fixed income assets. As a result, the relative valuations have reached ludicrous levels.

However, that government liquidity flow will turn negative by October 2018, thanks to simultaneous and coordinated QE wind downs.

The S&P 500 is now trading at 20 times earnings, and possibly 18 times 2018 earnings. US Treasury bonds at a 2.37% yield are trading at an amazing 45 times earnings.

This sets up the mother of all asset reallocations, out of the worst yielding financial instruments in the world, into the best.

5) After spending 50 years in the financial markets, I can describe to you a problem that I have noticed from the very start.

Institutional investors keep their foot firmly on the gas pedal while only looking in the rear-view mirror.

Call it the herd instinct, safety in numbers, or the lack of imagination, but portfolio managers, by definition, ALWAYS overweight the wrong asset classes at market tops, and underweight the right ones at market bottoms.

Making matters worse is the fact that these institutions move with the speed of molasses in the dead of a High Sierra winter.

Some entertain changes in sector and asset weightings only once a quarter, while others do it annually.

Yes, this means they can minimize tax bills. But it also assures that they are perpetually behind the curve.

When the memo gets out and real changes DO occur, they unfold over years, if not decades.

Every institution in the world is now overweight bonds and underweight stocks.

Guess what happens next?