The Market Outlook for the Week Ahead

Talking to hedge fund managers, financial advisors, and portfolio managers around the country de-risking seems to be the name of the game. It’s like they expect a category five hurricane to hit the markets tomorrow.

Even my friend, hedge fund legend David Tepper, says that the stock market is fairly valued and that he is cutting back his equity exposure. However, he is hanging onto his position in Micron Technology (MU), which he believes is deeply oversold. Will the last person to leave Dodge please turn out the lights?

You can expect a real hurricane, Florence, to impact the coming economic data. The usual pattern is for GDP growth to take an initial hit when the big storms hit, and then make back more as reconstruction and government spending kicks in. The scary thing is that there are three more hurricanes on the way.

The big event of the week was Apple’s (AAPL) roll out of its new product line, which will beat the daylights out of competitors. Think better and more expensive across the board, with the top iPhone now costing an eye-popping $1,499.

If you are Life Alert, the private company that sells safety devices to seniors, Apple just ate your lunch. Welcome to the cutthroat world of technology investing.

The drama at CBS (CBS) played out with the departure of CEO Les Moonves. He basically generated virtually all the profits for the company for the past two decades. But in this modern age not keeping your zipper zipped carries a heavy price.

A happier departure was seen by Alibaba’s (BABA) Jack Ma, China’s richest man to focus on philanthropic activity.

Emerging markets (EEM) continued their relentless meltdown, only given a brief respite by profit taking in the U.S. dollar (UUP) on Friday.

A coming strike by the United Steelworkers may mark the onset of new wage demands by labor nationwide. In the meantime, the JOLTS report hit a new all-time high with 650,000 job openings.

For the final “screw you” of the week, Trump indicated he was going forward with tariffs on another $200 billion in Chinese imports. Consumer goods will dominate the new black list in the lead up to the Christmas shopping season. Beat the Grinch and shop early!

With the Mad Hedge Market Timing Index ranging from 50 to 78 last week the market keeps trying and failing to reach new all-time highs on small volume. Volatility (VIX) hit a one-month low.

Thank goodness I took profits on my iPath S&P 500 VIX Short Term Futures ETN (VXX) long. The January $40 call options have cratered from $3.60 to only $1.96. Still, there was enough price action to allow us to take nice profits on our bond short (TLT) and Microsoft (MSFT) long. Microsoft was the top-performing Dow stock last and we got in early!

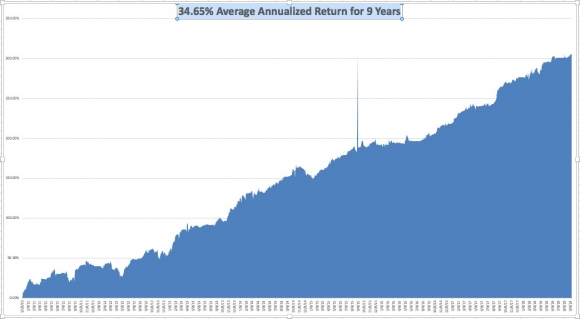

Last week, the performance of the Mad Hedge Fund Trader Alert Service forged a new all-time high. September has given us a middling return of 2.42%. My 2018 year-to-date performance has clawed its way back up to 29.43% and my trailing one-year return stands at 41.35%.

My nine-year return appreciated to 305.90%. The average annualized Return stands at 34.65%. The more narrowly focused Mad Hedge Technology Fund Trade Alert performance is annualizing now at an impressive 29.41%. I hope you all feel like you’re getting your money’s worth.

This coming week is pretty flaccid in terms of economic data releases.

On Monday, September 17, at 8:30 AM, we learn the August Empire State Manufacturing Survey.

On Tuesday, September 18, at 10:00 AM, the National Association of Homebuilders Home Price Index is released. August Home Sales is out at 10:00 AM EST.

On Wednesday September 19, at 8:30 AM, the August Housing Starts is published.

Thursday, September 20 leads with the Weekly Jobless Claims at 8:30 AM EST, which dropped 1,000 last week to 204,000.

On Friday, September 21, at 8:30 AM, we learn August Retail Sales. The Baker Hughes Rig Count is announced at 1:00 PM EST. Last week saw a gain of 7.

As for me, the harvest season in nearby Napa Valley is now in full swing, so I’ll be making the rounds picking up my various wine club memberships. Screaming Eagle check, Duckhorn check, Chalk Hill check.

Good luck and good trading.