The Market Outlook for the Week Ahead, Is the Bull Market Back?

During the Christmas Eve Massacre, a close friend sent me a research report he had just received entitled “30 Reasons Equities Will Fall in 2019.” It was laughable in its extreme negativity.

I thought this is it. This is the bottom. ALL of the bad news was there in the market. Stocks could only go up from here.

If I’d had WIFI at 12,000 feet on the ski slopes and if I’d thought you would be there to read them, I would have started shooting out Trade Alerts to followers right then and there. As it turned out, I had to wait a couple of days.

Two weeks later, and here I am basking in the glow of the hottest start to a new year in a decade, up 6.45%. So far in 2019, I am running a success rate of 100% ON MY TRADE ALERTS!

Don’t expect that to continue, but it is nice while it lasts.

I can clearly see how the year is going to play out from here. First of all, my Five Surprises of 2019 will play out during the first half of the year. In case you missed them, here they are.

*The government shutdown ends quickly

*The Chinese trade war ends

*The House makes no moves to impeach the president, focusing on domestic issues instead

*Britain votes to rejoin Europe

*The Mueller investigation concludes that Trump has an unpaid parking ticket in Queens from 1974 and that’s it.

*All of the above are HUGELY risk-positive and will trigger a MONSTER STOCK RALLY.

After that, the Fed will regain its confidence, raise interest rates two more times, and trigger a crash even worse than the one we just saw. We end up down on the year.

My long-held forecast that the bear market will start on May 10, 2019 at 4:00 PM EST is looking better than ever. However, I might be off by an hour. Those last hour algo-driven selloffs can be pretty vicious.

I make all of these predictions firmly with the knowledge that the biggest factors affecting stock prices and the economy are totally unpredictable, random, and could change at any time.

It was certainly an eventful week.

Fed governor Jay Powell essentially flipped from hawk to dove in a heartbeat, prompting a frenetic rally that spilled over into last week.

On the same day, China cut bank reserve requirements, instantly injecting $200 billion worth of stimulus into the economy. That’s the equivalent of spending $400 billion in the US. The last time they did this we saw a huge rally in stocks. It turns out that the Middle Kingdom has a far healthier balance sheet than the US.

Saudi Arabia chopped oil production by 500,000 barrels a day, sending prices soaring. It's not too late to get into what could be a 40% bottom to top rally to $62 (USO).

Macy's (M) disappointed, crushing all of retail with it, and taking down an overbought main market as well. It highlights an accelerating shift from brick and mortar to online, from analog to digital, and from old to new. Online sales in December grew 20% YOY. Will Amazon sponsor those wonderful Thanksgiving Day parades?

Home mortgage rates hit a nine-month low with the conventional 30-year fixed rate loan now wholesaling at an eye-popping 4.4%. Will it be enough to reignite the real estate market? It is actually a pretty decent time to start picking up investment properties with a long view.

My 2019 year to date return recovered to +6.45%, boosting my trailing one-year return back up to 31.68%. 2018 closed out at a respectable +23.67%.

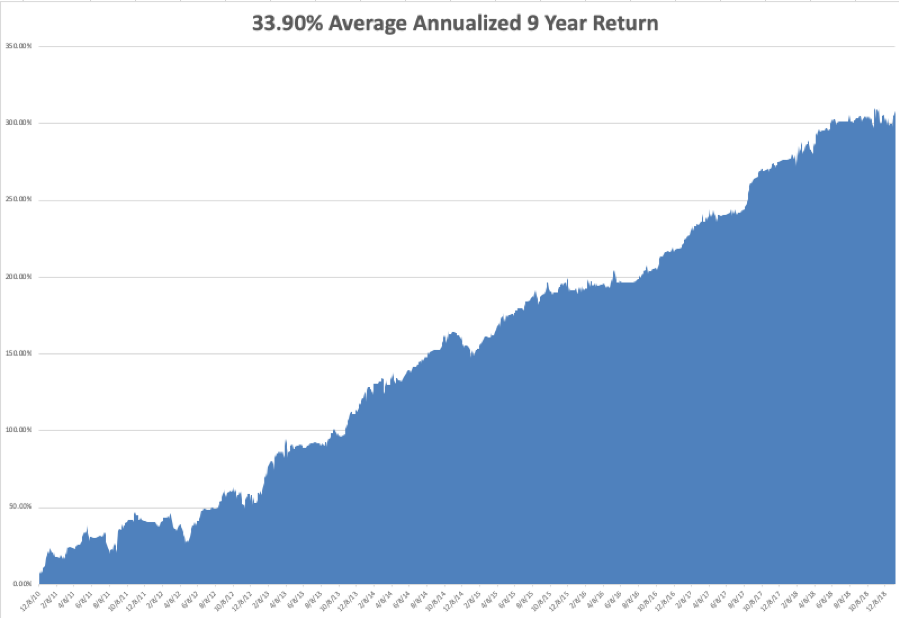

My nine-year return nudged up to +307.35, just short of a new all-time high. The average annualized return revived to +33.90.

I analyzed my Q4 performance on the chart below. While the (SPY) cratered -19.5% in three short months, my Trade Alert Service hung in with only a -4.9% loss. The quarter was all about defense, defense, defense. It was the hardest quarter I ever worked.

While everything failed last year, everything has proven a success this year. I came back from vacation a week early to pile everyone into big tech longs in Salesforce (CRM), Microsoft (MSFT), and Amazon (AMZN). I doubled up my short position in the bond market.

I even added a long position in the Euro (FXE) for the first time in years. If Britain votes to stay in Europe, it is going to go ballistic.

I also top ticketed a near-record rally by laying out a few short positions in Apple (AAPL) and the S&P 500 (SPY). I am now neutral, with “RISK ON” positions “RISK OFF” ones.

The upcoming week is very iffy on the data front because of the government shutdown. Some data may be delayed and other completely missing. All of the data will be completely skewed for at least the next three months. You can count on the shutdown to dominate all media until it is over.

On Monday, January 14 Citigroup (C) announces earnings.

On Tuesday, January 15, 8:30 AM EST, the December Producer Price Index is out. Delta Airlines (DAL), JP Morgan Chase (JPM), and Wells Fargo (WFC) announce earnings.

On Wednesday, January 16 at 8:30 AM EST, we learn December Retail Sales. Alcoa (AA) and Goldman Sachs (GS) announce earnings.

At 10:30 AM EST the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

Thursday, January 17 at 8:30 AM EST, we get the usual Weekly Jobless Claims. At the same time, December Housing Starts are published. Netflix (NFLX) announces earnings.

On Friday, January 18, at 9:15 AM EST, December Industrial Production is out. The Baker-Hughes Rig Count follows at 1:00 PM. Schlumberger (SLB) announces earnings.

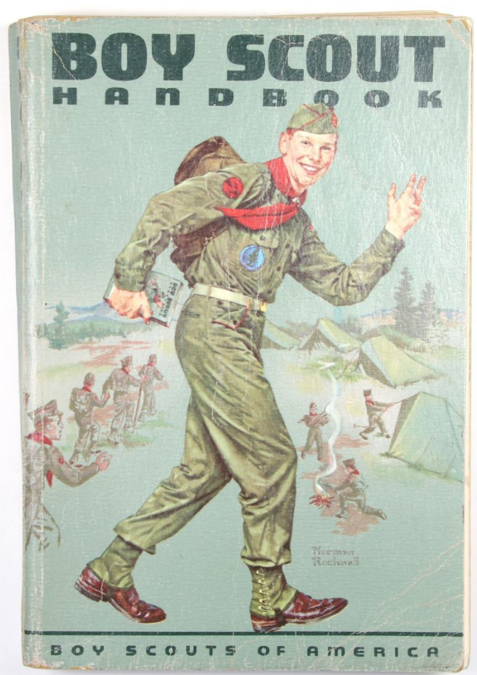

As for me, my girls have joined the Boy Scouts which has been renamed “Scouts.” Their goal is to become the first female Eagle Scouts.

So, I will retrieve my worn and dog-eared 1962 Boy Scout Manual and refresh myself with the ins and outs of square knots, taut line hitches, sheepshanks, and bowlines. Some pages are missing as they were used to start fires 55 years ago. I am already signed up to lead a 50-mile hike at Philmont in New Mexico next summer.

As for the Girl Scouts, they are suing the Boy Scouts to get the girls back, claiming that the BSA is infringing on its trademark, engaging in unfair competition, and causing “an extraordinary level of confusion among the public.”

Is there a merit badge for “Frivolous Lawsuits”?

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader