The Market Outlook for the Week Ahead, or 25 or 50?

25 or 50?

It's Fed Week, and futures markets are already indicating that overnight funds will drop from 5.25% to 3.0% by June. That amounts to two 50 basis point cuts and five 25 basis point cuts over the next seven Fed meetings.

If you think that’s overdone, when reality kicks in, you could get a good selloff in stocks and bonds you can buy into. I think the warm CPI and PPI last week were dagger in the heart for the 50-basis point cut.

There is a good likelihood that the bottom for the stock market is in for the year, given the heroic move we saw on Wednesday. What is happening is that the market is backing out of the uncertainty of the presidential election, the font of so much uncertainty this year, in the wake of the Tuesday night debate. The weekend opinion polls confirmed that.

This was not exactly a bargain basement bottom. The S&P 500 (SPY) is now trading at 21.1X and the Magnificent Seven at 28X. But when there is $8 trillion in cash sitting the sideways and trillions more coming in the form of new AI profits, stocks tend to get expensive and stay expensive.

Expect stocks to rally into the Wednesday Fed announcement, and then you might get a “Sell on the news.” That is the dip you want to buy into. Remember, this rate cut is the first of many to come.

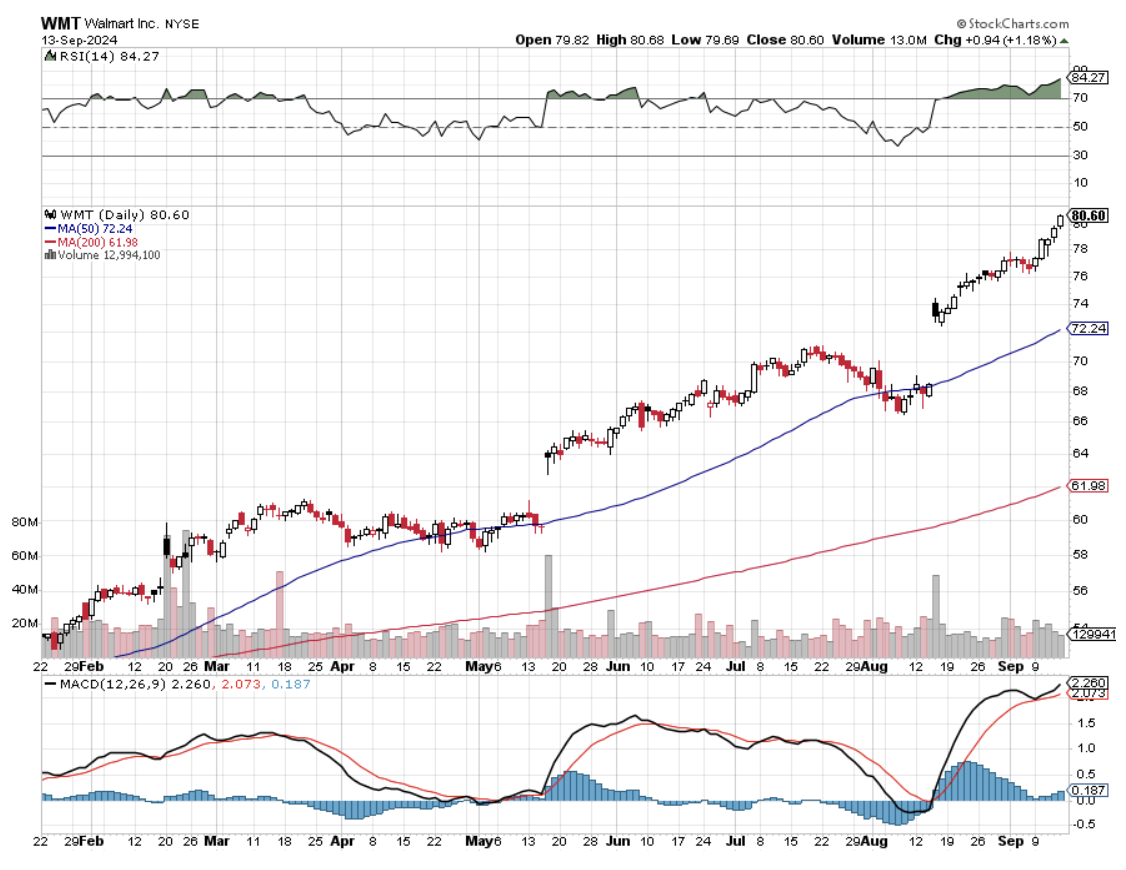

If you are wondering how this AI thing is going to work in our real world, take a look at two stocks. Walmart (WMT) was a sedentary retail stock with 3% profit margins that I never used to both with. This year, it is up 50%. That’s because they applied AI to their enormous inventory system and online sales efforts to squeeze much more profit out of the company.

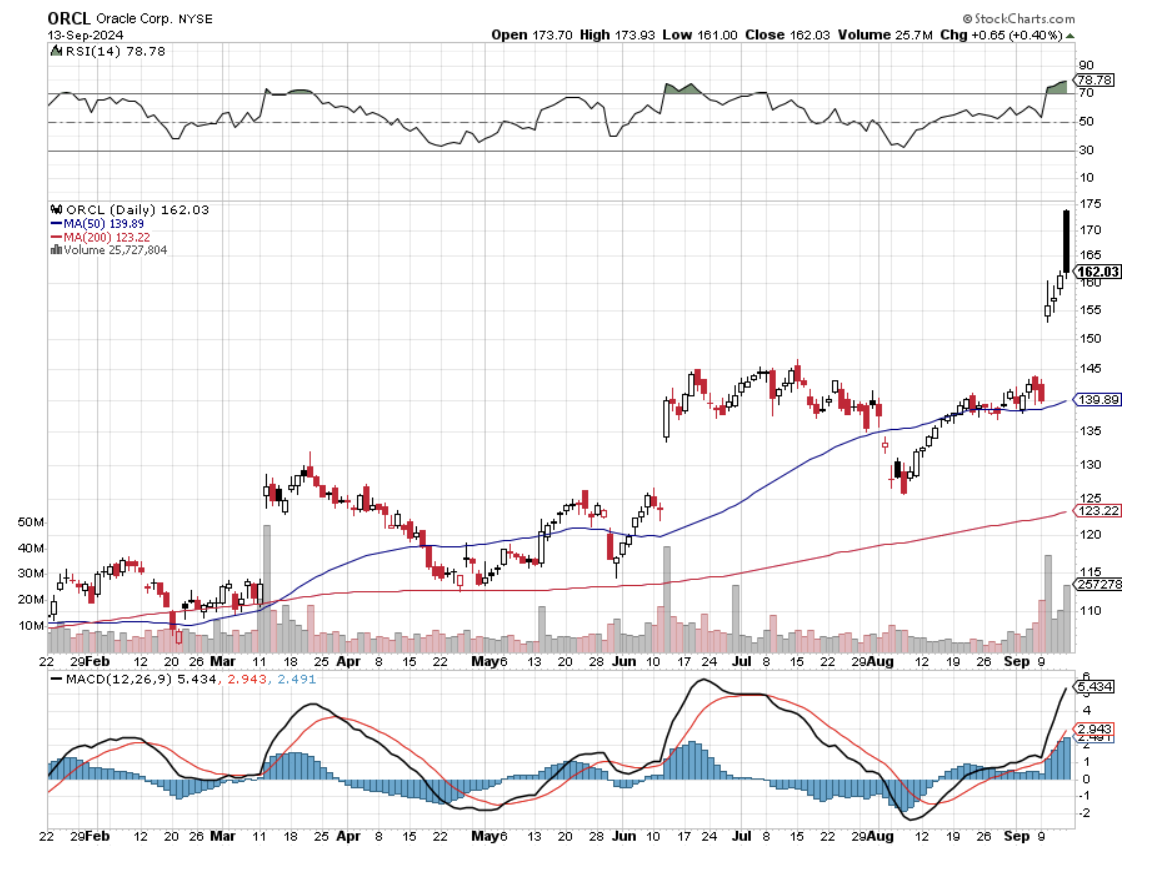

Similarly, legacy tech company Oracle (ORCL) has employed AI in upgrading its vast database network, with similar results. (ORCL) has rocketed by 32% since August. The rest of the economy is going to go this way, just as Microsoft Word, Excel, and PowerPoint did in the mid 1990’s.

If you want to know how much higher share prices, earnings growth, and GDP growth are justified, this is it.

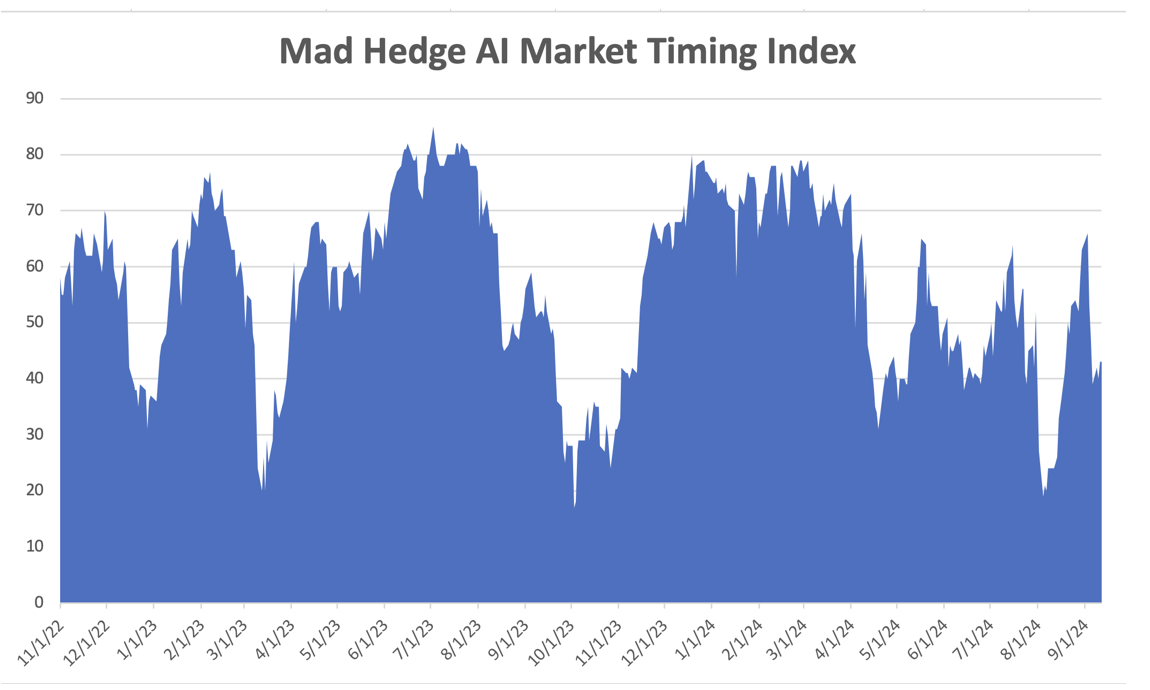

It was a great week for Mad Hedge traders, being all cash on the down days and long gold and silver on the up ones, bringing in a 4% week.

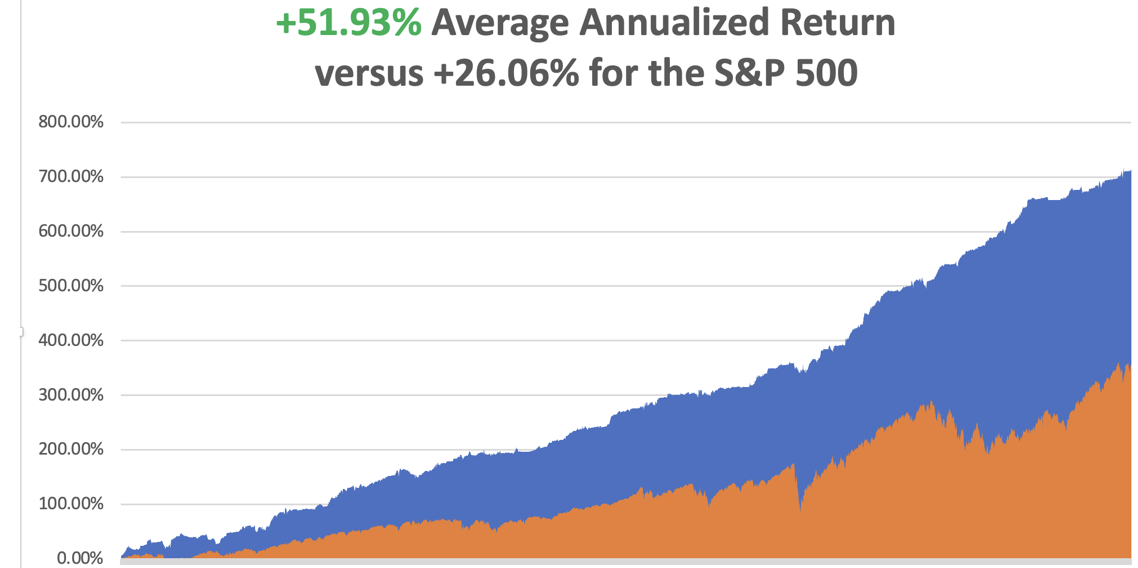

So far in September, we are up by +2.75%. My 2024 year-to-date performance is at +37.44%. The S&P 500 (SPY) is up +16.7% so far in 2024. My trailing one-year return reached +56.08. That brings my 16-year total return to +714.04. My average annualized return has recovered to +51.93%.

I piled on a double position in gold metals last week in the (GLD) and added a silver long with (WPM). I am now 30% long and 70% cash.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 47 of 66 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of +72.24%.

Try beating that anywhere.

Market Scores Biggest Turnaround in Two Years, now that the presidential debate is history, scoring an amazing 900-point intraday swing. Harris trades in alternative energy soared, while Trump's trades in crypto got killed. The market is now discounting a Harris win. Now, let’s wait for next week’s Fed action.

Core CPI Comes in Warm at 0.3% when 0.1% was expected. It was actually a good report as it took the YOY inflation rate from 2.9% down to 2.5%. But anything less than expected at these prices and the market tanks. Will interest rates now get cut only 25 basis points next week?

Another Government Shutdown is in the Works, with the House unable to pass a spending bill with a four-seat majority. The deadline is September 30. It could tank the market one more time before the election.

US Household Wealth Hits New All-Time High, or the value of American home equity at $163.8 trillion, up $1.75 trillion on the quarter. The US is the richest country in the world by far. Meanwhile, home values remained lofty amid limited inventory in the resale market. There is a shortage of 10 million homes in the US.

Gold Hits New High at $2,610 an ounce as hedge funds pour in. Seasonals for the barbarous relic are now the most positive of the year. Look for $3,000 an ounce by next year. Notice how (GLD) gaps are higher every morning, signifying that the bulk of buying is coming from Asia. Buy (GLD) on dips.

Interest Payments on National Debt Top $1 Trillion per year. The jump in debt service costs came as the U.S. budget deficit surged in August, edging closer to $2 trillion for the full year. I bet the Treasury really wants to see the Fed cut interest rates next week.

ECB Cuts Interest Rates to a 3.5% to 3.75% range. It’s now part of a global trend, with the Fed cutting next week. Buy all interest-sensitive plays like gold (GLD) and homebuilders (DHI).

Apple Launches a New Range of Products, including the iPhone 16 and new iPad. The AI is strictly entry-level and beta. The new iPhone 16 failed to excite investors, with long-expected AI features still in test mode, even as an industry-first tri-fold phone from Huawei raised the stakes in a battle to dominate the global smartphone market. Buy (AAPL) on dips.

US Refinery Demand for Crude Oil Collapses, to its lowest level since January 2019 last month, a sign of weakened refinery demand as margins have softened. Feedstocks like high-sulfur fuel oil and other heavy residues can be refined into higher-value products such as gasoline and diesel using secondary units. But loadings of those products to the Gulf Coast, America's largest refining hub, fell by a third in August from the prior month to 260,000 barrels per day (bpd). Avoid all energy plays.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy is decarbonizing, and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000, here we come!

On Monday, September 16 at 8:30 AM EST, the NY Empire State Manufacturing Index is out

On Tuesday, September 17 at 6:00 AM, the US Retail Sales are released.

On Wednesday, September 18, at 7:30 PM, Building Permits are printed. At 11:00 AM, the Fed interest rate decision is announced, followed by a press conference at 11:30 AM.

On Thursday, September 19, at 8:30 AM, the Weekly Jobless Claims are announced. We also get Existing Home Sales.

On Friday, September 20, at 2:00 PM, the 2:00 PM the Baker Hughes Rig Count is printed.

As for me, the whole Archegos blow-up reminds me that there are always a lot of con men out there willing to take your money. As PT Barnum once said, “There is a sucker born every minute.”

I’ll tell you about the closest call I have ever had with one of these guys.

In the early 2000s, I was heavily involved in developing a new, untried, untested, and even dubious natural gas extraction method called “fracking.” Only a tiny handful of wildcatters were even trying it.

Fracking involved sending dynamite down old, depleted wells, fracturing the rock 3,000 feet down, and then capturing the newly freed-up natural gas. If successful, it meant that every depleted well in the country could be reopened to produce the same or more gas than it ever had before. America’s gas reserves would have doubled overnight.

A Swiss bankers friend introduced me to “Arnold” of Amarillo, Texas, who claimed fracking success and was looking for new investors to expand his operations. I flew out to the Lone Star state to inspect his wells, which were flaring copious amount of natural gas.

Told him I would invest when the prospectus was available. But just to be sure, I hired a private detective, a retired FBI man, to check him out. After all, Texas is notorious for fleecing wanabee energy investors, especially those from California.

After six weeks, I heard nothing, so late on a Friday afternoon, I ordered $3 million sent to Arnold’s Amarillo bank from my offshore fund in Bermuda. Then I went out for a hike. Later that day, I checked my voicemail, and there was an urgent message from my FBI friend:

“Don’t send the money!”

It turns out that Arnold had been convicted of check fraud back in the sixties and had been involved in a long series of scams ever since. But I had already sent the money!

I knew my fund administrator belonged to a certain golf club in Bermuda. So, I got up at 3:00 AM, called the club Starting Desk, and managed to get him on the line. He said I had missed the 3:00 PM Fed wire deadline on Friday and the money would go out first thing Monday morning. I told him to be at the bank at 9:00 AM when the doors opened and stop the wire at all costs.

He succeeded, and that cost be a bottle of Dom Perignon Champaign, which, fortunately, in Bermuda, is tax-free.

It turned out that Arnold’s operating well was actually a second-hand drilling rig he rented with a propane tank buried underneath that was flaring the gas. He refilled the tank every night to keep sucking in victims. My Swiss banker friend went bust because he put all his clients into the same project.

I ended up making a fortune in fracking anyway with much more reliable partners. No one had heard of it, so I bought old wells for pennies on the dollar and returned them to full production. Then gas prices soared from $2/MM BTU to $17. America’s gas reserves didn’t double, they went up ten times.

I sold my fracking business in 2007 for a huge profit to start the Diary of a Mad Hedge Fund Trader.

It is all a reminder that if it is too good to be true, it usually isn’t.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader