The Market Outlook for the Week Ahead, or Back in Business

It’s a good thing I don’t rely on my Social Security Check to cover my extravagant cost of living, which is the maximum $4,555 a month. For it came within hours of coming to a halt when an agreement was passed by Congress to renew funding for another 45 days. It was almost an entirely Democratic bill, passing 335 to 91 in the House and the Senate by 88 to 9.

Unfortunately, that does put me in the uncomfortable position of delivering humanitarian aid to Ukraine right when $6.2 billion in US assistance is cut off. That was the price the Dems had to pay to get the Republicans on board needed to pass the bill. Better a half a loaf than no loaf at all. Still, I am going to have some explaining to do next week in Kiev, Mykolaiv, and Kherson. It’s a big win for Vladimir Putin.

Funding now ends on November 17, when the next crisis begins. The big question is when the markets will deliver a sigh of relief rally on Congress hitting the “snooze” button, or whether it will focus on the next disaster in November.

We’ll have to wait and see.

In the meantime, all eyes are on the market’s leading falling interest rate plays, which continue to go from bad to worse. Those include bonds (TLT), precious metals (GLD), (SLV), utilities (XLU), small-cap stocks (IWM), emerging markets (EEM), and foreign currencies (FXA), (FXE), (FXB).

Consider this your 2024 shopping list.

Ten-year US Treasury bond yields reached a stratospheric 4.70% last week a 17-year high and up a monster 0.90% since the end of June. Summer proved a fantastic time to take a vacation from the bond market.

They could easily reach 5% before the crying is all over. Perhaps this is why my old friend, hedge fund legend David Tepper, said his best investment right now is a subprime six-month certificate of deposit yielding 7.0%.

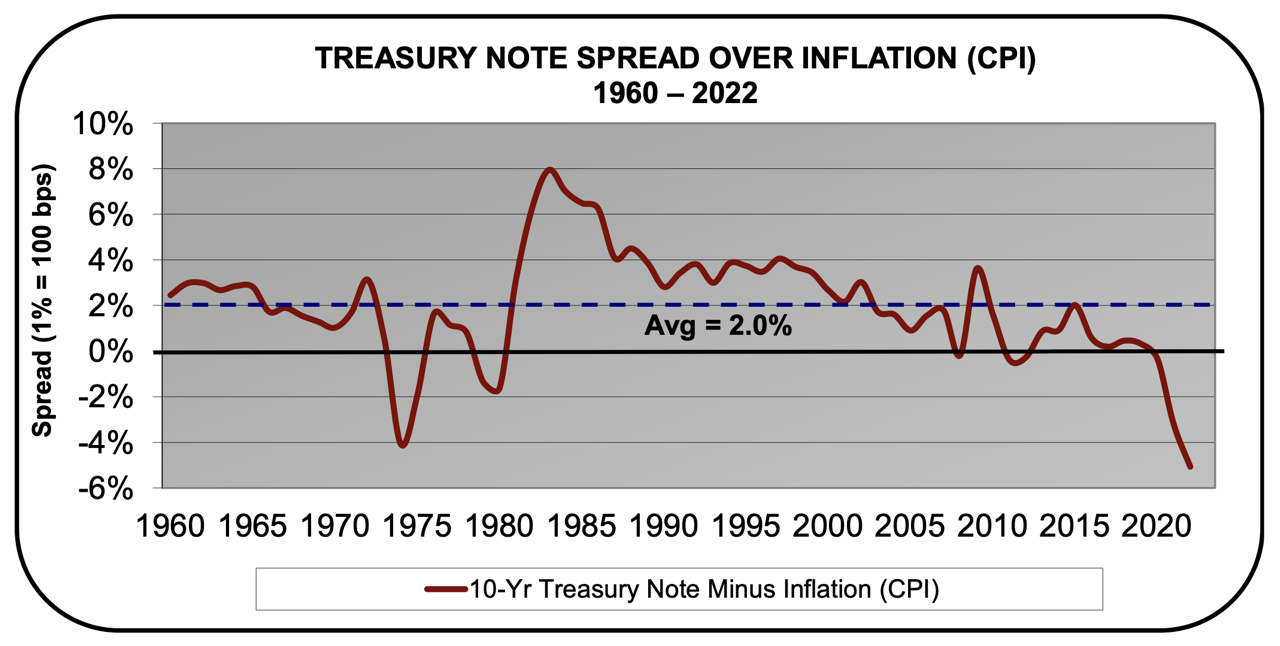

What we might be witnessing here is a return to the “old normal” when bonds spent most of their time ranging between 2%-6%. The 60-year historic average bond yield is 2% over the inflation rate (see chart below). That alone takes us to a 5.0% bond yield.

Interest rates have been kept artificially low for 15 years because no one wanted a recession in 2008 and no one wanted a recession during the pandemic in 2000. It all melded into one big decade-and-a-half period of easy money. Pain avoidance wasn’t just the universal American monetary policy, it was the global policy.

Now it’s time to pay the piper and unwind the thousands of business models that depended on free money. There will be widespread pain, as we are now witnessing in commercial real estate and private equity. Perhaps it is best to take the 5.5% bribe 90-day Treasury bond yield is offering you and stay out of the market.

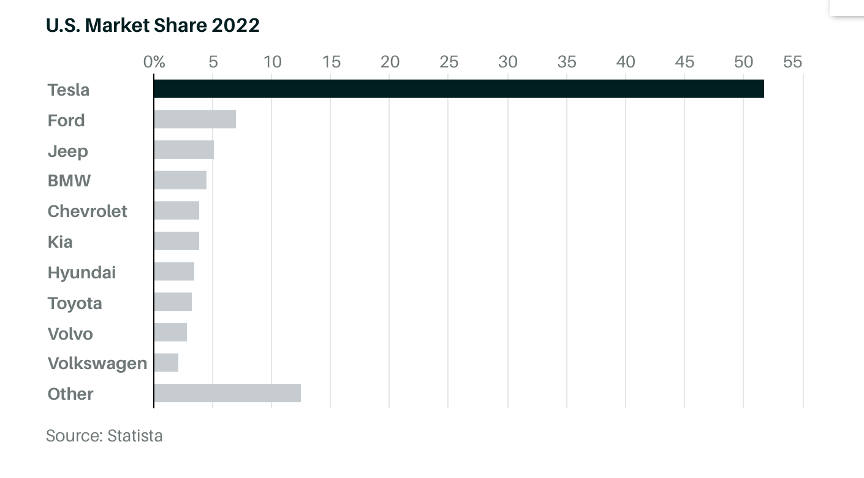

While Detroit remains mired by the UAW strike, EVs have catapulted to an amazing 8% of the new car market. They have been helped by a never-ending price war and generous government subsidies. EV sales are now up a miraculous 48% YOY and are projected to account for a stunning 23% of all California sales in Q3.

Tesla is the overwhelming leader with a 52% share in a rapidly growing market, distantly followed by Ford (F) at 7% and Jeep at 5%.

However, a slowdown may be at hand, with EV inventories running at 97 days, double that of conventional ICE cars. This could create a rare entry point for what will be the leading industry of this decade, if not the century. Buy more Tesla (TSLA) on bigger dips, if we get them.

Hedge Funds are Cutting Risk at Fastest Pace Since 2020, when the pandemic began. From retail investors to rules-based systematic traders, appetite for equities is subsiding after a 20% rally this year that’s fueled by euphoria over artificial intelligence. Fast money investors increased their bearish wagers to drive down their net leverage — a gauge of risk appetite that measures long versus short positions — by 4.2 percentage points to 50.1%, according to Goldman Sachs Group Inc.’s prime brokerage. That’s the biggest week-on-week decline in portfolio leverage since the depths of the pandemic bear market.

The Treasury Bond Freefall Continues, as long-term yields probe new highs. New issue of $134 billion this week didn’t help. Nothing can move on the risk until rates top out, even if we have to wait until 2024.

Oil (USO) Hits $95, a one-year high, as the Saudi/Russian short squeeze continues. $100 a barrel is a chipshot and much higher if we get a cold winter. Inventories at the Cushing hub are at a minimum.

The US Dollar (UUP) Hits New Highs, as “high for longer” interest rates keep powering the greenback. The buck is also catching a flight to safety bid from a potential government shutdown. It should be topping soon.

Moody’s Warns of Further US Government Downgrades, in the run up to the Saturday government shutdown. The shutdown lasts, the more negative its impact would be on the broader economy. Unemployment could soar. It would also render all US government data releases useless for the next three months.

ChatGPT Can Now Browse the Internet, according to its creator, OpenAI. Until now, the chatbot could only access data posted before September 2021. The move will exponentially improve the quality and effectiveness of AI apps, including my own Mad Hedge AI

Amazon (AMZN) Pouring $4 Billion into AI, with an investment in Anthropic, a ChatGPT competitor. (AMZN) is racing to catch up with (MSFT) and (GOOGL). Its chatbot is caused Claude 2. Amazon’s card to play here is its massive web services business AWS. The AI wars are heating up.

Hollywood Screenwriters Guild Strike Ends, after 150 days, which is thought to have cost the US economy $5 billion in output. The hit was mostly taken by Los Angeles, where 200,000 are employed. The Actor’s union is still on strike. Talk shows should be offering new content in a few days.

S&P Case Shiller Rises to New All-Time High, for the sixth consecutive month as inventory shortages drove up competition. In July, the index in increased 0.6% month over month and 1% over the last 12 months, on a seasonally adjusted basis. July’s movement reached a new high for the nationwide home index, surpassing the record set in June 2022. Chicago (+4.4%), Cleveland (+4.0%), and New York (+3.8%) delivered the biggest gains. The median home price for existing homes rose to 1.9 to $406,700 according to the National Association of Realtors (NAR). The robust housing market suggests that while some buyers pulled back due to high borrowing costs, demand continues to outweigh supply.

This is the Unit I Will be Joining at the Front in Ukraine, as made clear by their YouTube recruiting video. They asked me to assist with mine removal on territory formerly occupied by Russia. I really don’t know what I’m getting into. Improvision is key. It’s better than playing golf in retirement. Polish up your Ukrainian first.

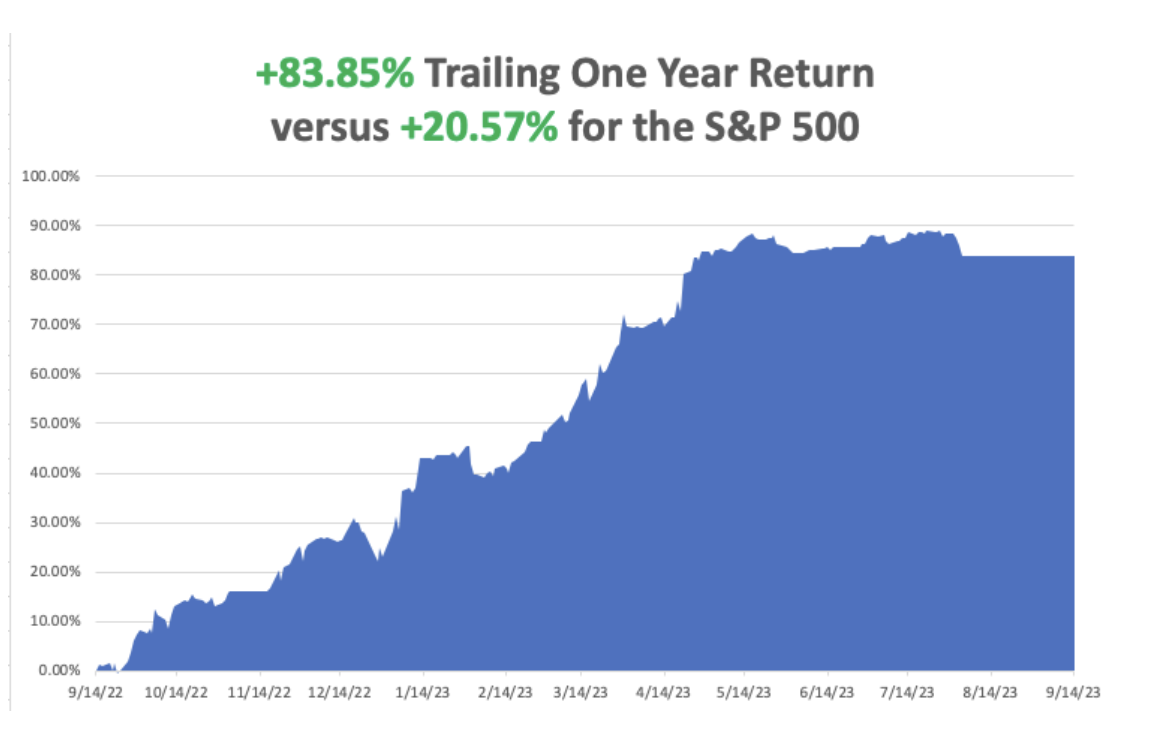

So far in August, we are down -4.70%. My 2023 year-to-date performance is still at an eye-popping +60.80%. The S&P 500 (SPY) is up +17.10% so far in 2023. My trailing one-year return reached +92.45% versus +8.45% for the S&P 500.

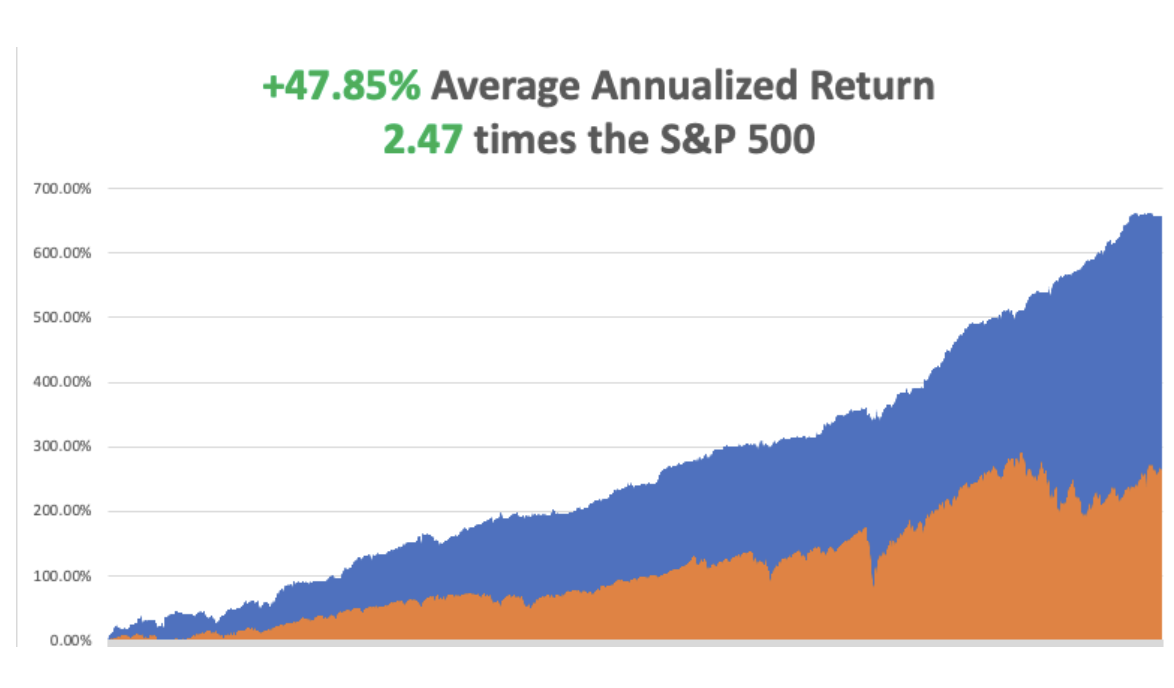

That brings my 15-year total return to +657.99%. My average annualized return has fallen back to +48.15%, another new high, some 2.50 times the S&P 500 over the same period.

Some 41 of my 46 trades this year have been profitable.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, October 2, at 8:30 PM EST, the ISM Manufacturing PMI is out.

On Tuesday, October 3 at 8:30 AM, the JOLTS Job Openings Report is released.

On Wednesday, October 4 at 2:30 PM, the ISM Services Report is published.

On Thursday, October 5 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, October 6 at 2:30 PM the September Nonfarm Payroll Report is published. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, I will try to knock out a few memories early this morning while waiting for the Matterhorn to warm up so I can launch on another ten-mile hike. So I will reach back into the distant year of 1968 in Sweden.

My trip to Europe was supposed to limit me to staying with a family friend, Pat, in Brighton, England for the summer. His family lived in impoverished council housing.

I remember that you had to put a ten pence coin into the hot water heater for a shower, which inevitably ran out when you were fully soaped up. The trick was to insert another ten pence without getting soap in your eyes.

After a week there, we decided the gravel beach and the games arcade on Brighton Pier were pretty boring, so we decided to hitchhike to Paris.

Once there, Pat met a beautiful English girl named Sandy, and they both took off to some obscure Greek island, the ultimate destination if you lived in a cold, foggy country.

That left me stranded in Paris with little money.

So, I hitchhiked to Sweden to meet up with a girl I had run into while she was studying English in Brighton. It was a long trip north of Stockholm, but I eventually made it.

When I finally arrived, I was met at the front door by her boyfriend, a 6’6” Swedish weightlifter. That night found me bedding down in a birch forest in my sleeping bag to ward off the mosquitoes that hovered in clouds.

I started hitchhiking to Berlin, Germany the next day, which offered paying jobs. I was picked up by Ronny Carlson in a beat-up white Volkswagen bug to make the all-night drive to Goteborg where I could catch the ferry to Denmark.

1968 was the year that Sweden switched from driving English style on the left side of the road to the right. There were signs every few miles with a big letter “H”, which stood for “hurger”, or right. The problem was that after 11:00 PM, everyone in the country was drunk and forgot what side of the road to drive on.

Two guys on a motorcycle driving at least 80 mph pulled out to pass a semi-truck on a curve and slammed head-on to us, then were thrown under the wheels of the semi. The motorcycle driver was killed instantly, and his passenger had both legs cut off at the knees.

As for me, our front left wheel was sheared off and we shot off the mountain road, rolled a few times, and was stopped by this enormous pine tree.

The motorcycle riders got the two spots in the only ambulance. A police car took me to a hospital in Goteborg and whenever we hit a bump in the road bolts of pain shot across my chest and neck.

I woke up in the hospital the next day, with a compound fracture of my neck, a dislocated collar bone, and paralyzed from the waist down. The hospital called my mom after booking the call 16 hours in advance and told me I might never walk again. She later told me it was the worst day of her life.

Tall blonde Swedish nurses gave me sponge baths and delighted in teaching me to say Swedish swear words and then laughed uproariously when I made the attempt.

Sweden had a National Health care system then called Scandia, so it was all free.

Decades later a Marine Corps post-traumatic stress psychiatrist told me that this is where I obtained my obsession with tall, blond women with foreign accents.

I thought everyone had that problem.

I ended up spending a month there. The TV was only in Swedish, and after an extensive search, they turned up only one book in English, Madame Bovary. I read it four times but still don’t get the ending. And she killed herself because….?

The only problem was sleeping because I had to share my room with the guy who lost his legs in the same accident. He screamed all night because they wouldn’t give him any morphine.

When I was released, Ronny picked me up and I ended up spending another week at his home, sailing off the Swedish west coast. Then I took off for Berlin to get a job since I was broke. Few Germans wanted to live in West Berlin because of the ever-present risk of a Russian invasion so there we always good-paying jobs.

I ended up recovering completely. But to this day whenever I buy a new Brioni suit in Milan they have to measure me twice because the numbers come out so odd. My bones never returned to their pre-accident position and my right arm is an inch longer than my left. The compound fracture still shows up on X-rays.

And I still have this obsession with tall, blond women with foreign accents.

Go figure.

Brighton 1968

Ronny Carlson in Sweden

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader