The Market Outlook for the Week Ahead, or Blunder 3.0

There is no doubt whatsoever that the stock market tried to break down last week and failed. At worst, the Dow Average double bottomed at $29,600, the same level it reached on September 28.

And even that low was a mere 800 points lower than the one we set on June 14.

And that’s how it’s going to go.

Incremental new lows, followed by violent “rip your face off” rallies on enormous volume.

Until it ends.

That happens when markets start speculating about coming interest rate cuts sometime in 2023. And remember, you’re buying stocks for not what the economy is doing today, but for how well it will be performing in six to nine months.

You’re buying the future, not the present, or heaven forbid, the past.

That means you should use these throw-up-on-your-shoes days to scale into your favorite long-term companies. When markets inevitably rally, you can either sell for a short-term profit and rewind the video once again or keep it as part of a long-term holding.

It's a nice choice to have. I’ve been doing it all year.

With some of the greatest market volatility in market history, my October month-to-date performance ballooned to +5.00%.

I used last week’s extreme volatility to roll down strike prices for Tesla (TSLA) and JP Morgan (JPM) option spreads to manage my risk. I was still able to hang on to a 40% long position and threw out a new short in the S&P 500 at the end of Thursday.

My 2022 year-to-date performance ballooned to +75.06%, a new high. The Dow Average is down -18.48% so far in 2022. With the coming Friday options expiration, I will be up +76.49%.

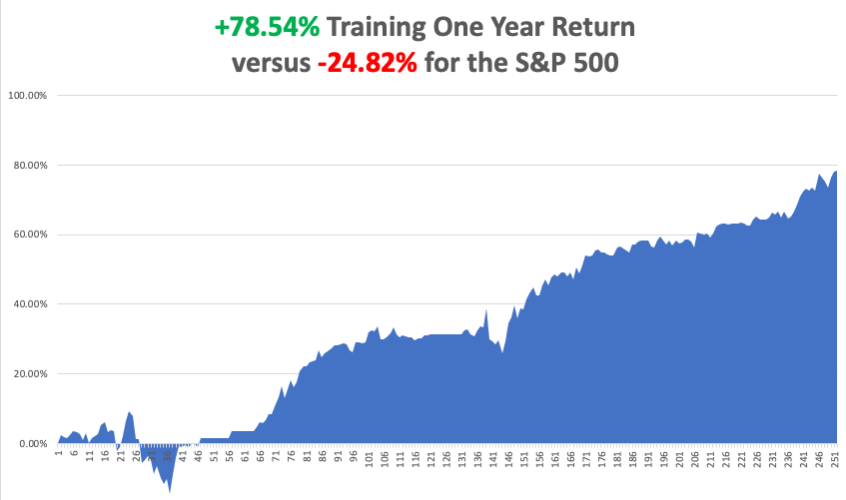

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +78.54%.

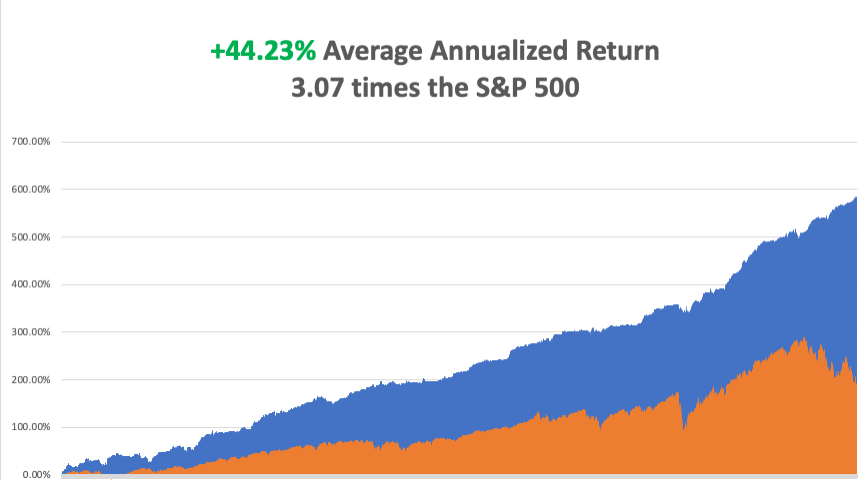

That brings my 14-year total return to +587.62%, some 3.03 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +44.23%, easily the highest in the industry.

Remember that old 60/40 equity/bond investment strategy? The idea was that whenever stocks went down, the losses would be offset by the profits from rising bonds.

This year, it delivered the worst performance in 100 years, down 34.4% year-to-date. That is the inevitable end result of a decade of zero interest rates and free money that took everything up.

So what is the best strategy you could probably employ right now? A 60/40 strategy. Even I find myself checking out bond yields these days, where I got my start in life as a trader 50 years ago. Yes, before there were stocks, there were bonds. Junk is now yielding 10%. Remember, that means a holding doubles in value every six years.

The market is clearly in a mood to throw out the babies with the bathwater. I would be remiss not to mention the recent decline of Tesla posing one of its periodic tests of the faithful, now approaching a once unheard-of price earnings multiple of 30X.

Up until September 20, Elon Musk’s creation was almost immune to the bear market.

Then Twitter (TWTR) happened.

Musk agreed to take majority control of a $44 billion company, of which Elon himself is only contributing $16 billion. He sold Tesla shares last July to fund this. But the market wiped $333 billion, or 34.6%, off the market capitalization of the company. It is a wild overreaction to the move.

This has nothing to do with Tesla itself, as the richest man in the world is buying Twitter with his own pocket change. But it is undeniable that it will be a distraction of management time.

And here is all you need to know about Tesla. Tesla is the fastest growing large company in the world. Profit margins are increasing, thanks to the recent collapse of commodity prices. Unit sales will rise by 40% this year. Every time Tesla opens a new factory at a cost of $7 billion, it generates $15 billion of profit per year, forever!

Remember also, that the stock market gets an 800-pound gorilla off its back with the end of the midterm elections on November 8. It makes no difference who wins, a major uncertainty will be gone. That much IS certain.

And what happens when the Fed keeps interest rates too low for long, then raises them too much? It lowers them again too much, igniting a monster bull market in stocks. That’s also what you’re buying down here. That's what you get when you appoint a central bank governor with a political science major rather than PhDs and Nobel Prizes in Economics like the last ones.

Call it blunder 3.0.

Consumer Price Index Rockets Up to 8.6%, up 0.4% on the month and a new 40-year high. Stocks, bonds, crypto, and currencies were crushed and the US Dollar Soared. Look for new lows in stocks. Growth really took it on the nose. Expect another month of volatility until the next CPI report comes out.

Stocks Mount Historic Rally, gaining $1,420 points, or 5% of the intraday low. Stocks were down 500 in the wake of the CPI report, then up $1,420. It was mostly hedge short covering, as most institutions are too slow to react. Still, we now have a low to trade against.

The Fed Minutes are Out, and our central bank is clearly worried about doing too little than too much, when they are doing too much. At least they did six weeks, or 4,000 Dow points ago. The inflation goal is still 2.0%. Interest rates will go higher before they go lower.

Equity Inflows Hit a Record Last Week, the third highest week since 2008. Long term investors are willing to bottom fish here, even if the final bottom isn’t found for months.

Bond Liquidity Issues Haunting the Fed, and bids dry up in an endlessly falling market. The matter has been greatly exacerbated by a Fed that is now selling $95 billion a month as part of its quantitative tightening policy. It’s becoming increasingly difficult to move big blocks of bonds in a zero-bid market. Spreads are widening and size is shrinking. The bad news is that the worst is yet to come.

You Just Got an 8.7% Raise, if you are older than 61 and collecting Social Security. That is the payment increase that kicks in from January. Fortunately, some thoughtful person eons ago tied payments to the CPI, which is now going through the roof. I’m going to Hawaii with my money, even if the increase means that Social Security goes bankrupt by 2034, when I’m 82.

PC Sales Dive 19.5% in Q3, reaching only 68 million units. It’s the steepest decline since PC data collection began 30 years ago. And you wonder why they are selling the chip stocks so aggressively. High inventories are also a big problem. Lenovo was the top seller in the world at 20.2 million units, followed by Hewlett Packard’s (HPE) 17.6 million, and Dell (DELL) at 15.2 million.

Applied Materials Cuts Estimates, in line with everyone else in the industry. The new government export restrictions will cost it $250-$500 million in the current quarter. But how much is already in the price? Buy (AMAT) on dips.

Home Financing Pours into 5/1 ARMS, which can be had for a doable 5.56%. That compares to over 7.0% for the 30-year fixed, the highest since 2006. It will be low enough to keep homebuilders on life support for a couple of years Avoid (LEN) and (KBH).

REITS are Still Getting Slaughtered, with the plunge in the bond market today to multidecade lows. The REIT Index is down 30% this year, while the (SPY) is off only 21%. Real Estate Investment Trusts do best when interest rates are low. Too many investors piled into REITS in a desperate reach for yield. There’s a great trade here someday, but not yet.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil in a sharp decline and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, October 17 at 8:30 AM, the New York Empire State Manufacturing Index for September is released.

On Tuesday, October 18 at 7:00 AM, the D for September is out.

On Wednesday, October 19 at 8:30 AM, Housing Starts and Permits for September are published.

On Thursday, October 20 at 8:30 AM, Weekly Jobless Claims are announced. At 10:00 AM, we get Existing Home Sales for September.

On Friday, October 21 at 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, it was in 1986 when the call went out at the London office of Morgan Stanley for someone to undertake an unusual task. They needed someone who knew the Middle East well, spoke some Arabic, was comfortable in the desert, and was a good rider.

The higher-ups had obtained an impossible-to-get invitation from the Kuwaiti Royal family to take part in a camel caravan into the Dibdibah Desert. It was the social event of the year.

More importantly, the event was to be attended by the head of the Kuwait Investment Authority, who ran over $100 billion in assets. Kuwait had immense oil revenues, but almost no people, so the bulk of their oil revenues were invested in western stock markets. An investment of goodwill here could pay off big time down the road.

The problem was that the US had just launched air strikes against Libya, destroying the dictator, Muammar Gaddafi’s royal palace, our response to the bombing of a disco in West Berlin frequented by US soldiers. Terrorist attacks were imminently expected throughout Europe.

Of course, I was the only one who volunteered.

My managing director didn’t want me to go, as they couldn’t afford to lose me. I explained that in reviewing the range of risks I had taken in my life, this one didn’t even register. The following week found me in a first-class seat on Kuwait Airways headed for a Middle East in turmoil.

A limo picked me up at the Kuwait Hilton, just across the street from the US embassy, where I occupied the presidential suite. We headed west into the desert.

In an hour, I came across the most amazing sight - a collection of large tents accompanied by about 100 camels. Everyone was wearing traditional Arab dress with a ceremonial dagger. I had been riding horses all my life, camels not so much. So, I asked for the gentlest camel they had.

The camel wranglers gave me a tall female, which was more docile and obedient than the males. Imagine that! Getting on a camel is weird, as you mount them while they are sitting down. My camel had no problem lifting my 180 pounds.

They were beautiful animals, highly groomed, and in the pink of health. Some were worth millions of dollars. A handler asked me if I had ever drunk fresh camel milk, and I answered no, they didn’t offer it at Safeway. He picked up a metal bowl, cleaned it out with his hand, and milked a nearby camel.

He then handed me the bowl with a big smile across his face. There were definitely green flecks of manure floating on the top, but I drank it anyway. I had to lest my host to lose face. At least it was white. It was body temperature warm and much richer than cow’s milk.

The motion of a camel is completely different from a horse. You ride back and forth in a rocking motion. I hoped the trip was short, as this ride had repetitive motion injuries written all over it. I was using muscles I had never used before. Hit your camel with a stick and they take off at 40 miles per hour.

I learned that a camel is a super animal ideally suited for the desert. It can ride 100 miles a day, and 150 miles in emergencies, according to TE Lawrence, who made the epic 600-mile trek to Aquaba in only four weeks in the heat of summer. It can live 15 days without water, converting the fat in its hump.

In ten miles, we reached our destination. The tents went up, clouds of dust rose, the camels were corralled, and the cooking began for an epic feast that night.

It was a sight to behold. Elaborately decorated huge five wide bronze platers were brought overflowing with rice and vegetables, and every part of a sheep you can imagine, none of which was wasted. In the center was a cooked sheep’s head with the top of the skull removed so the brains were easily accessible. We all ate with our right hands.

I learned that I was the first foreigner ever invited to such an event, and the Arabs delighted in feeding me every part of the sheep, the eyes, the brains, the intestines, and gristle. I pretended to love everything, and lied back and thought of England. When they asked how it tasted, I said it was great. I lied.

As the evening progressed, the Johnny Walker Red came out of hiding. Alcohol is illegal in Kuwait, and formal events are marked by copious amounts of elaborate fruit juices. I was told that someone with a royal connection had smuggled in an entire container of whiskey and I could drink all I wanted.

The next morning I was awoken by a bellowing camel and the worst headache in the world. I threw a rock at him to get him to shut up and he sauntered over and peed all over me.

The things I did for Morgan Stanley!

Four years later, Iraq invaded Kuwait. Some of my friends were kidnapped and held for ransom, while others were never heard from again.

The Kuwaiti government said they would pay for the war if we provided the troops, tanks, and planes. So they sold their entire $100 million investment portfolio and gave the money to the US.

Morgan Stanley got the mandate to handle the liquidation, earning the biggest commission in the firm’s history. No doubt, the salesman who got the order was considered a genius, earned a promotion, and was paid a huge bonus.

I spent the year as a Marine Corps captain, flying around assorted American generals and doing the odd special opp. I got shot down and still set off airport metal detectors. No bonus here. But at least I gained insight and an experience into a medieval Bedouin lifestyle that is long gone.

They say success has many fathers. This is a classic example.

You can’t just ride out into the Kuwait desert anymore. It is still filled with mines planted by the Iraqis. There are almost no camels left in the Middle East, long ago replaced by trucks. When I was in Egypt in 2019, I rode a few mangy, pitiful animals held over for the tourists.

When I passed through my London Club last summer, the Naval and Military Club on St. James Square, who’s portrait was right at the front entrance? None other than that of Lawrence of Arabia.

It turns out we were members of the same club in more ways than one.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

John Thomas of Arabia

Checking Out the Local Camel Milk

This One Will Do

Traffic in Arabia