The Market Outlook for the Week Ahead, or Entering Terra Incognita

During the Middle Ages, when explorers sought new lands and their rich treasures, large sections of their navigational charts were marked with the term “terra incognita.”

That meant what lays beyond was unknown and that they should enter only at their own risk. Often there was a picture of a dragon or a sea monster to mark the spot.

There was also often a warning that you might even sail off of the edge of the earth.

Financial markets have entered a “terra incognita” of their own recently.

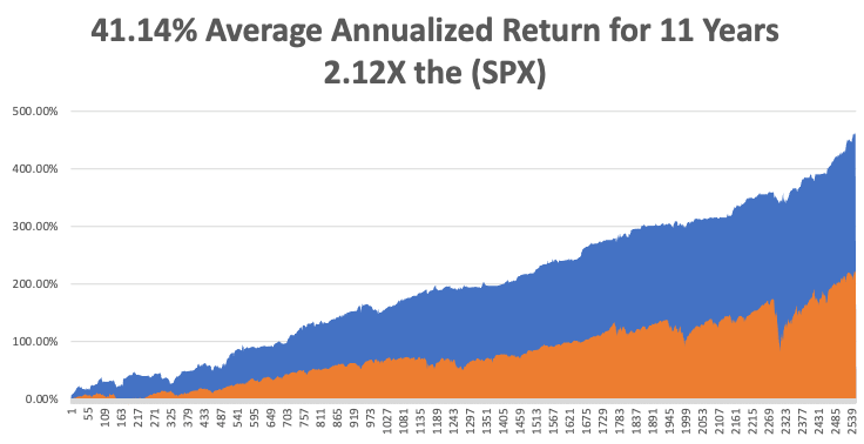

Here is the big unknown: How high can ten-year US Treasury bond yields soar when the Federal Reserve is promising to keep overnight interest pegged at 25 basis points until 2024 in the face of essentially unlimited monetary and fiscal stimulus?

So far, the answer is: more.

That is a really big question because we’ve never really been here before.

In fact, some Cassandras from the right are even predicting such a policy will cause us to sail off of the edge of the earth. The modern-day equivalent of running into dragons is inviting runaway inflation.

I can tell you from my own vast, almost immeasurable navigational experience (I am licensed by the US government) that “terra incognita” does not invite inordinate risk-taking or betting of ranches by traders or investors. Instead, they tend to sit on their hands, work on their golf swing, or update their Facebook pages.

That is what the Volatility Index (VIX) last week is essentially screaming at us by touching the $19 handle for the first time in a year.

Almost everyone I know has made more money in the markets than at any time in their lives. That is what a near doubling of the stock market in a year gets you.

And the new wealth was not attained because their intelligence and market insight have suddenly doubled, although a strong case for such can be made for readers of Mad Hedge Fund Trader.

So I used the Friday, March 19 option expiration to go into a rare 100% cash position. I really have gotten away with too much lately.

Then feeling guilty, I slapped on a single long in Tesla (TSLA), that old reliable money-maker. It’s worked for me since it was $3.50 a share. After all, a gigantic green energy infrastructure bill is about to pass in Congress. What better to own than the world’s largest EV car maker.

And what a tear it has been.

After bringing in a ballistic 66.64% profit in 2020, I reeled in another 40.38% gain in the first 2 ½ months of 2021. I did this via 40 trades which generated 38 wins and only two losses. That’s a success rate of an incredible 95%. I have to pinch myself when I read these numbers.

I am concerned because numbers any higher than this will look fake. It’s a rule of thumb in the investment business that when managers claim a 100% success rate, they are either high-frequency traders back by super-fast mainframe computers or running a scam.

So, I have been advising clients to pare back their biggest positions that became massively overweight purely through capital appreciation. Financials come to mind. JP Morgan (JPM) up 81% in three months? Sounds like a Ponzi Scheme.

So let me give you some upside targets in the bond market. We doubled bottomed in 2012 and 2016 at a 1.37% yield in the ten-year Treasury bond yield. We have already surpassed that level like a hot knife through butter.

At the depths of the 2008-2009 Great Recession, rates bottomed at 2.0% yield, which now seems within easy reach. The lowest yield we saw after the 2003 Dotcom Crash was a 3.0%.

When the upside targets in interest rates in this cycle are the lows of the previous economic cycles, that augurs pretty well for the future of stock prices. That is the guaranteed outcome of the tidal wave of cash now sweeping the global financial system.

The permabears are warning that the “Roaring Twenties” have already happened. I argued that they are only just getting started and that the indexes have another 4X of upside in them over the rest of the decade. When the last “Roaring Twenties” occurred, you didn’t sell in 1921.

It also reminds me of the huge “rip your face off” rally we saw from March 2009 to 2010. A lot of market gurus said then that was the peak. They were wrong. Today, they are driving for Uber and Lyft.

So when a talking head warns you that higher interest rates will cause the stock market to crash, just turn off the boob tube and go back to practicing your golf swing.

The Mad Hedge Summit Videos are Up, from the March 9,10, and 11 confab. Listen to 27 speakers opine on the best strategies, tactics, and instruments to use in these volatile markets. The product discounts offered last week are still valid. Start, stop, and pause the videos at your leisure. Best of all, access to the videos is FREE. Access them all by clicking here at www.madhedge.com, click on CURRENT SUMMIT REPLAYS in the upper right-hand corner, and then choose the speaker of your choice.

Ten Year Bond Yields (TLT) soar to a 1.75%, setting financials on fire and demolishing tech (QQQ). We are rapidly approaching a 2.00% yield, which could trigger a huge round of profit-taking on bond shorts, a domestic stock selloff, and a tech rally. The next great rotation may be just ahead of us.

Oil (USO) dives 8% on fears of an imminent Saudi production increase and a worsening Covid-19 outlook in Europe. Are we next with all these early reopening’s? Gone 100% cash at the close with the March quadruple witching option expiration.

A Tax Hike is next on the menu. Corporate tax rates are returning from 21% to 28% for the small proportion of companies that actually PAY tax. Raising taxes on earnings of more than $400,000. Pass through entities to get a haircut. Increasing estate taxes. You better die soon if you want your kids to stay rich. Increase in capital gains taxes over $1 million. I want my SALT deduction back! The grand negotiation begins on who needs bridges, rail lines, and subway extensions. Hint: for some reason, there have been no new federal projects started in California for the past four years and all the existing ones were cut back.

Value Stocks (IWM) are beating growth ones, reversing a decade-long trend. The Russell Value Index is up 11% this year, while growth is unchanged. It’s a total flip from last year when growth was tech-led. This could continue for years, or until the tech becomes the new value stocks. Big winners include Boeing (BA), JP Morgan (JPM), and Morgan Stanley (MS), all Mad Hedge moneymakers.

Bitcoin tops 61,000. Nothing else to say but that because there are no fundamentals. It’s up 80% in 2021 and 540% YOY. But it is becoming a good risk-taking indicator thought, and right now it is shouting a loud and clear “Risk On.”

It’s going to be All About Stock Picking for the Rest of 2021, says Morgan Stanley strategist Mike Wilson. Dragging on the index from here on will be the prospects of rising rates, tax hikes, and inflation. Mike especially dislikes small caps (IWM) which have already had a terrific run, with a 19% YTD gain. Stock picking? Boy, did you come to the right place!

Fed to hold off on rates hikes through 2023, said Governor Jay Powell after the open Market Committee Meeting. Bonds rallied a full half-point on the news and then crashed again, taking yields to a new 1.70% high. It sees inflation reaching a positively stratospheric 2.0% sometime this year, after which it will die, so nothing to do here. This is what a 100% dovish FOMC gets you. Let the games begin!

New Housing Starts Collapse, from an expected +2.5% to -10.3%, as high lumber, land, labor, and interest rates take their toll. This will only drive new home prices high at a faster rate and the little remaining supply dries up. Millennials need some place to live.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

It’s amazing how well patience can help your performance. My Mad Hedge Global Trading Dispatch profit reached a super-hot 16.89% during the first half of March on the heels of a spectacular 13.28% profit in February.

It was a tough week in the market, so I held fire and ran my seven remaining profitable positions into the March 19 options expiration. I took advantage of a meltdown in Tesla (TSLA) shares to put on my only new position of the week with a very deep-in-the-money long. That leaves me with 90% cash and a barrel full of dry powder.

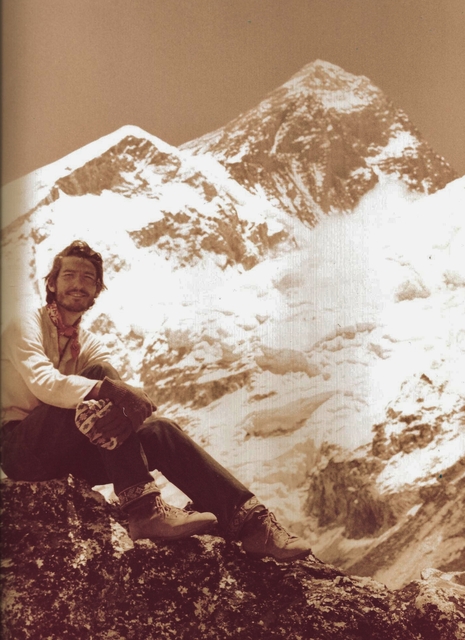

This is my fifth double-digit month in a row. My 2021 year-to-date performance soared to 40.38%. The Dow Average is up a miniscule 7.7% so far in 2021.

That brings my 11-year total return to 462.93%, some 2.12 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 41.14%.

My trailing one-year return exploded to 121.60%, the highest in the 13-year history of the Mad Hedge Fund Trader. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 29.8 million and deaths topping 542,000, which you can find here. Thankfully, death rates have slowed dramatically, but Obituaries are still the largest sector in the newspaper.

The coming week will be a boring one on the data front.

On Monday, March 22, at 9:00 AM, Existing Home Sales for February are released.

On Tuesday, March 23, at 9:00 AM, New Home Sales are published.

On Wednesday, March 24 at 8:30 AM, we learn US Durable Goods for February are printed.

On Thursday, March 25 at 8:30 AM, Weekly Jobless Claims are out. We also get the final read of US Q4 GDP.

On Friday, March 26 at 8:30 AM, US Personal Income & Spending for February are released. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I have been doing a lot of high altitude winter mountain climbing lately, and with the warm spring weather, the risk of avalanches is ever present. It takes me back to the American Bicentennial Everest Expedition, which I joined in 1976.

It was led by my old friend, instructor, and climbing mentor Jim Whitaker, who pulled an ice ax out of my nose on Mt. Rainer in 1967 (you can still see the scar). Jim was the first American to summit the world’s highest mountain. I tried to break a high-speed fall and an ice ax kicked back and hit me square in the face. If I hadn’t been wearing goggles I would have been blinded.

I made it up to 22,000 feet on Everest, to Base Camp II without oxygen because there were only a limited number of canisters reserved for those planning to summit. At that altitude, you take two steps, and then break to catch your breath.

There is a surreal thing about that trip that I remember. One day, a block of ice the size of a skyscraper shifted on the Khumbu Ice Fall and out of the bottom popped a body. It was a man who went missing on the 1962 American expedition. Everyone recognized him as he hadn’t aged a day in 15 years, since he was frozen solid.

I boiled my drinking water, but at that altitude, water can’t get hot enough to purify it. So I walked 100 miles back to Katmandu with amoebic dysentery. By the time I got there, I’d lost 50 pounds, taking my weight to 120 pounds.

Jim was an Eagle Scout, the first full-time employee of Recreational Equipment Inc. (REI), and last climbed Everest when he was 61. Today, he is 92 and lives in Seattle, WA.

Jim reaffirms my belief that daily mountain climbing is a great life extension strategy, if not an aphrodisiac.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader