The Market Outlook for the Week Ahead, or Farewell the Peace Dividend

Remember that great bull market of the Dotcom Boom? Most investors believe it was the result of combining a new Internet, cheap PCs, and the Mosaic Application which made it all work together.

But to Wall Street types usually blind to geopolitics, there was another important factor: The peace dividend paid out by the end of the Cold War. The end result was 30 years of less defense spending, lower taxes, and higher profits for corporate America.

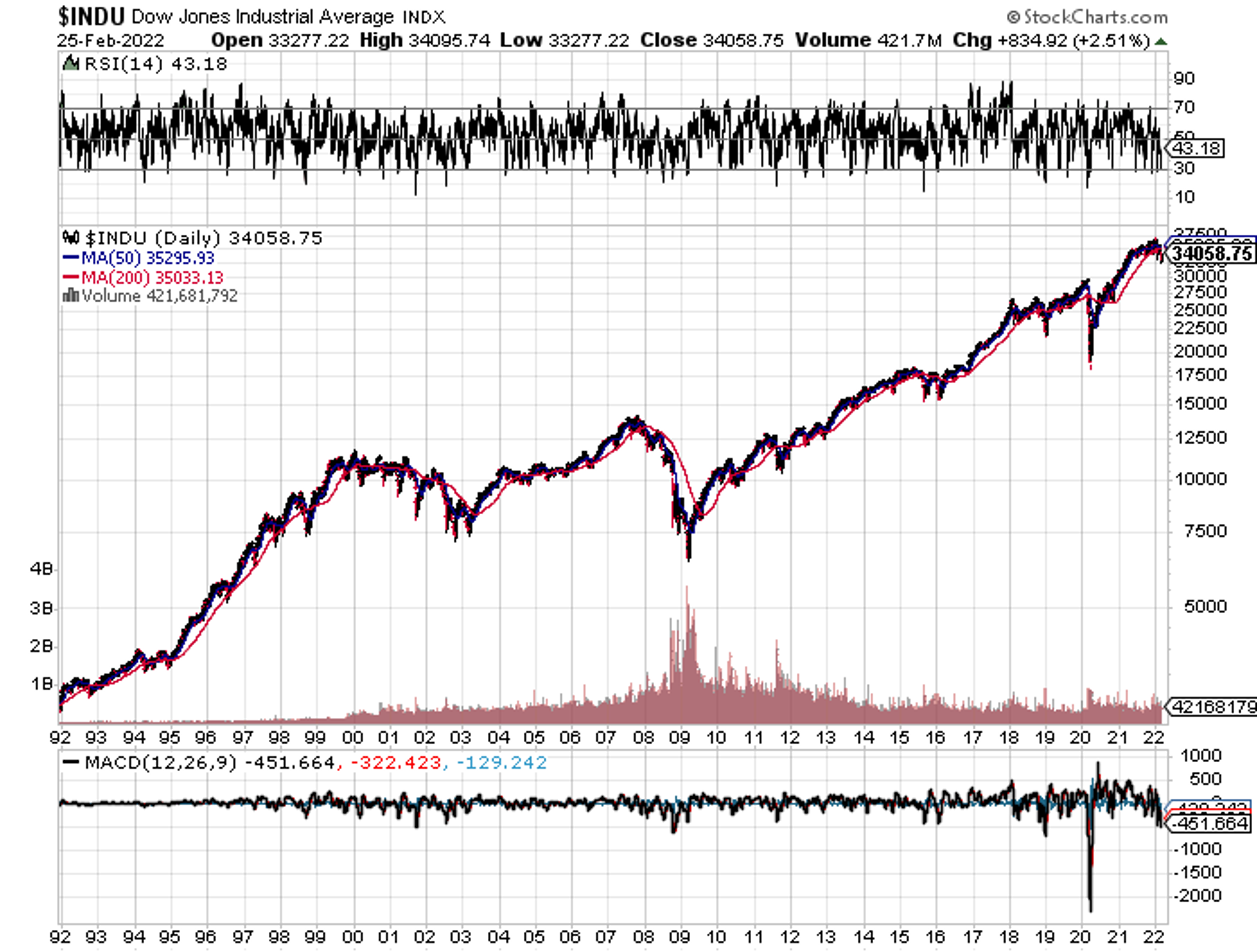

The numbers are pretty compelling. Since the Soviet Union collapsed in 1991, the Dow Average has risen from $2,875 to $34,000, a gain of 12 times. That averages out to an incredible 40% a year. Individual stocks like Monster Beverage (MNST), Tractor Supply (TSCO), and Altria (MO) appreciated a thousandfold or more.

So what happens if the Cold War resumes? Do we have to pay the money back?

In part, yes.

Not that you have to have to write a check anytime soon. But you will have to pay in the form of higher taxes for more defense spending, slower economic growth, fewer corporate profits, and a more modestly appreciating stock market. And that great multiplier of growth, globalization, just suffered a dagger through its heart.

While we have just seen one of the greatest short-covering rallies of all time, $1,800 points or 5.6% in two days, don’t think you’re back on Easy Street yet. A worst-case scenario full-scale Russian invasion of the Ukraine is in the price. So, it's back to focusing on runaway inflation and the certain multiple Fed interest rate hikes to fight it once again.

And guess what? Wars are inflationary. We are already seeing surges in the price of energy, wheat, and nonferrous metals.

So, I think I’ll stick to the short side for the time being. After all, it’s worked pretty well so far in 2022. You’ll still need to maintain some discipline here, only selling rallies.

If the US acts fast, there is an opportunity here for it to create a second War in Afghanistan for Russia. It’s certainly trying. As I write this, there are already long convoys of NATO trucks that carry ammunition and antitank missiles into the Ukraine. If you remember, it was its loss of the first one that led to the demise of the Soviet Union. I think Putin has bit off more than he expected.

For those who are maintaining core long-term portfolios, which are most of you, writing, or selling short front month out-of-the-money call options against your positions is a great idea. It will reduce your risk, lower your average cost, reduce your volatility, and bring in some extra income. Option volatilities are still high, so you can earn a pretty penny with such a strategy.

And if in case we return to happy days again, you will be taken out of your positions at higher prices with bigger profits and will think you have died and gone to Heaven.

What is the other smart trade here? If you have any energy exposure whatsoever this is a generational opportunity to get rid of it. The best-case golden scenario has happened. Even if oil goes to $125 short term, your energy stocks won’t go much higher from here.

If Russia and Saudi Arabia are trying to exit the energy business, maybe you should too.

There has been a lot of speculation about Putin’s timing of his invasion of the Ukraine. The winter, oil inventory shortages, and NATO’s half-century of underinvestment in defense were all factors.

But the most important one is being completely ignored. Putin has to unload his country’s energy resources before they become worthless, which I reckon will happen in about 20 years.

That means in two decades, some 70% of Russia’s total government revenues vaporize. The invasion of the Ukraine allows Putin to get rid of more energy faster at higher prices right now.

As my old friend, Dr. Armand Hammer used to say, “Everything boils down to oil.” (click here for the link).

Without energy, Russia has little to offer the world but a few metals and a lot of unregulated hackers. You see the same motivation in Saudi Arabia’s massive investment in alternative energy in California. And yes, they really did try to buy all of Tesla three years ago (TSLA) before the shares rose fivefold.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

With near-record volatility fading fast, my February month-to-date performance rocketed to a blistering 10.51%. It turned out to be a great month to play from the short side in size. My 2022 year-to-date performance ended at 25.10%. The Dow Average is down -6.1% so far in 2022. It is the great outperformance on an index since Mad Hedge Fund Trader started 14 years ago.

I went into the Russian invasion with 90% cash, expecting trouble. I stopped out of a long in Apple (AAPL) in a day for a small loss. The next trade I added was another short in bonds, followed quickly by a new long in Tesla (TSLA) ($700 a share? Really?). Within hours the stock was up $100!

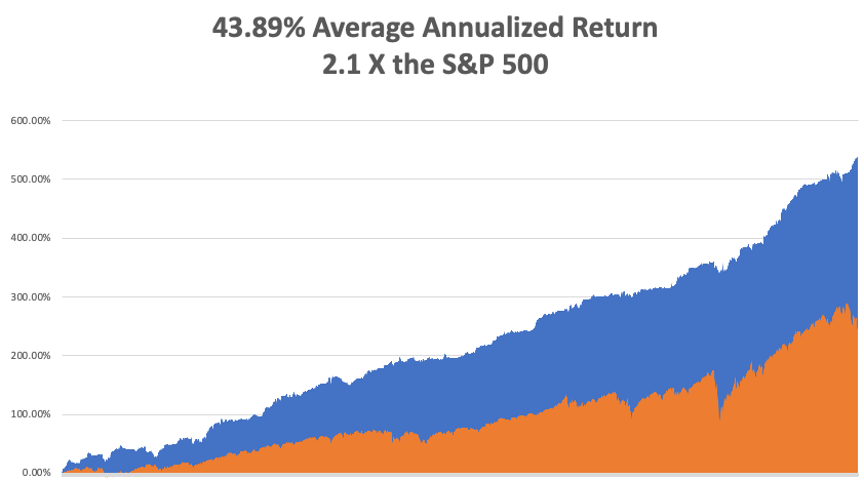

That brings my 13-year total return to 537.66%, some 2.00 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 43.89%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 79 million and rising quickly and deaths topping 950,000, which you can find here.

On Monday, February 28 at 8:00 AM EST, the president delivers the State of the Union Speech

On Tuesday, March 1 at 8:30 AM, the ISM Manufacturing Index for February is out.

On Wednesday, March 2 at 5:15 AM, the ADP Private Employment Index is released.

On Thursday, March 3 at 8:30 AM, Weekly Jobless Claims are published.

On Friday, March 4 at 8:30 AM, the February Nonfarm Payroll Report is Published. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, I’m not supposed to be alive right now. In fact, the betting in my extended family is that I would never make it past 30. But here I am 40 years after my “sell by” date and I’m having the last laugh.

There were times when it was a close-run thing. Breaking my neck in a 70 mile per hour head-on collision in Sweden in 1968 didn’t exactly help my odds. Nor did watching a land mine blow up the guy in front of me in Cambodia in 1975, showering me head to toe with shrapnel and bone fragments.

After crashing three airplanes in Italy, Austria, and France, the European Union Aviation Safety Agency certainly wishes I died at a much earlier age. So, no doubt did the tourists at the top of the Eifel Tower one day in 1987, who I just missed hitting by 100 feet (yes, I was the Black Baron).

When I was in high school, the same group of four boys met every day at recess. We were all in the same Boy Scout Troop and became lifelong friends. Since I had been to over 50 countries by the age of 16, I was considered the wild man of the bunch, the risk-taker, always willing to roll the dice. The rest lived vicariously through me. But I was also the lucky one.

For a start, I was not among the 22 from my school who died in Vietnam, 11 officers and 11 draftees. Their names are all on the Vietnam Memorial Wall in Washington DC. My work for the Atomic Energy Commission at the Nuclear Test Site gave me a lifetime draft exception on national security grounds.

But I went anyway, on my own dime, to see who was telling the truth. It turned out no one was.

The other three boys in my group played it safe, pursuing conventional careers and never took any risks.

David Wilson was the first to go. He managed a hotel in Park City, Utah for a national chain. When he was hiking in the Rocky Mountains one day, a storm blew in and he went over a cliff. They didn’t find his body for a week.

Paul Blaine went on to USC and law school. In his mid-fifties, he lost a crucial case and shot himself at his desk at his Newport Bay office. I later learned he had been fighting a lifetime battle against depression. We never knew.

Robert Sandiford spent his entire career working as a computer programmer for the city of Los Angeles. By the time he retired at 65, he was managing 40 people. He pursued his dream to buy a large RV, drive it to Alaska, and play his banjo in a series of blue grass festivals.

Robert was unfamiliar with driving such a large vehicle. Around midnight, he was driving north on Interstate 5 near Modesto, CA when he passed a semi. When he pulled back into the slow lane, he clipped the front of the truck on cruise control with a driver half asleep. The truck pierced a propane tank on the RV, blowing up both vehicles. Robert, his wife Elise, and the truck driver were all burned to death.

At least, this was the speculation by the California Highway Patrol. Robert and Elise went missing for months. We thought that maybe his RV had broken down somewhere on the Alaskan Highway and family members went there to look for him. It was only after the Los Angeles County Coroner discovered some dental records that we learned the truth.

When the bones were returned, the family had them cremated and we scattered the ashes in the Pacific Ocean off Catalina Island where we used to camp as scouts.

I have been rewarded for risk taking for my entire life, so I keep at it. Similarly, I have seen others punished for risk avoidance, as happened to all my friends. The same applies to my trading as well. The price of doing nothing is far greater than doing something, and being aggressive offers the greatest reward of all.

This summer, I am scheduled to fly an 80-year-old Supermarine Spitfire fighter aircraft over the white cliffs of Dover, of Battle of Britain fame. I am spending my evenings memorizing the 1940 operations manual just to be safe, as I always do with new aircraft.

A 70-year-old flying an 80-year-old plane, what could go wrong with that?

Oh, and I am learning the banjo too.

I’ll send you the videos.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

That’s a Heck of a Dividend