The Market Outlook for the Week Ahead, or Gamblers Have Entered the Market

At long last, the 10% correction I have been predicting is happening. No, it wasn’t caused by the usual reasons, like a bad economic data point, an earnings disappointment, or a geopolitical event.

The market delivered the worst week since October because gamblers have entered the stock market. Perish the thought!

It turns out that if a million kids buy ten shares each of a $4 stock, they can wipe out even the largest hedge funds on their short positions. It also turns out they can wipe out their brokers, with infinite capital calls triggered by massive order flows.

If Chicago’s Citadel had not stepped in with a $1 billion bailout, Robin Hood would have gone under last week. Citadel buys Robin Hood’s order flow and is their largest customer. That’s where systemic risk enters the picture.

And it’s not like there was really any systemic risk. Markets have an inordinate fear of the unknown, and no one has ever seen a bunch of kids in a chat room like Redditt wipe out major hedge funds.

Fortunately, there are only a dozen small illiquid stocks that could be subject to such ‘buyers raids”. So, the spillover to the main market is very limited, probably no more than a week or two.

And the regulations to reign in such a practice are already in place. Whenever a broker gets more business than it can handle, it will simply shut it down. Robin Hood did that on Friday when it has limited purchases in 20 stocks to a single share, including Starbucks (STBX), Moderna (MRNA), and General Electric (GE).

What all this does is set up an excellent buying opportunity for you and me, of which there have been precious few in recent months. By ramping up the Volatility Index to $38, it is almost impossible to lose money on front month call options spreads. We are the real winners of the (GME) squeeze.

Stocks would have to fall another 10%-20% on top of existing 10%-20% declines, and that is not going to happen in 13 trading days to the February 19 options expiration with $20 trillion about to hit the economy and the stock markets. That breaks down to $10 trillion in stimulus and $10 trillion worth of global quantitative easing.

My own long, hard-won experience is that a (VIX) at $38 earns you about 20% a month in profits. Options prices are so elevated that scoring winners now is like shooting fish in a barrel. So, join the party as fast as you can.

On Friday, I was taking profits on exiting positions and shipping out new trade alerts in the best quality names as fast as I could write them. Where is that easy, laid back retirement I was hoping for!

Keep at the barbell portfolio. The big tech names are finishing up a six-month sideways “time” corrections. Their earnings are catching up with valuations at a prolific rate. The domestic recovery names have just given back 10%-20% and are ripe for another leg up. All of these are good candidates for 2023 options LEAPS.

After all, if an insurrection and the sacking of the capitol can’t take the market down more than 1%, GameStop (GME) is certainly not going to take it down more than 10%.

GameStop (GME) posted record volatility, up from $4 a month ago to $483. Even the biggest hedge funds can’t stand up to a million kids buying ten shares each at market. All single name shorts in the market are getting covered by hedge funds in fear of getting “Gamestopped”, producing a 700-point Dow rally.

Several brokers banned trading in the name and the SEC is all over this like a wet blanket. Trading is halted due to an excess of sell orders. The problem is that funds are selling real stocks to cover the losses we own, like JP Morgan (JPM) and Tesla (TSLA) and short (TLT).

In the meantime, the action has moved over the American Airlines (AA), which has soared by 50%. AMC Entertainment Holdings (AMC) saw a 400% pop, but I haven’t seen anyone rushing back into theaters to watch Wonder Woman. Blame Jay Powell for flooding the financial system with mountains of cash seeking a home. There is so much money in circulation that traders are invented asset classes to put it into. This can’t last. Buy the dip.

Here are the best short squeeze targets with the greatest outstanding short interests. GameStop (GME) tops the list with an eye-popping 139% short interest, followed by Bed Bath & Beyond (BBBY) (67%) and Ligand Pharmaceutical (LGND) (64%). National Beverage (FIZZ), The Macerich Company (MAC), and Fubo TV (FUBO) bring up the rear. These are all failed companies in some form or another, which is why hedge funds had such large short positions.

New Home Sales disappointed in December, up only 1.6% to 842,000 units. This is on a signed contract basis only. Affordability is the big issue caused by high prices. Who buys a house at Christmas anyway?

Case Shiller soared by 9.5% in November, the fastest home price appreciation in history. Phoenix (13.8%), Seattle (12.7%), and San Diego (12.3) were the big movers. Blame a long-term structural housing shortage, a huge demographic push from Millennials, near-zero interest rates, and a flight from the cities to larger suburban homes. The Pandemic is keeping millions of homes off the market.

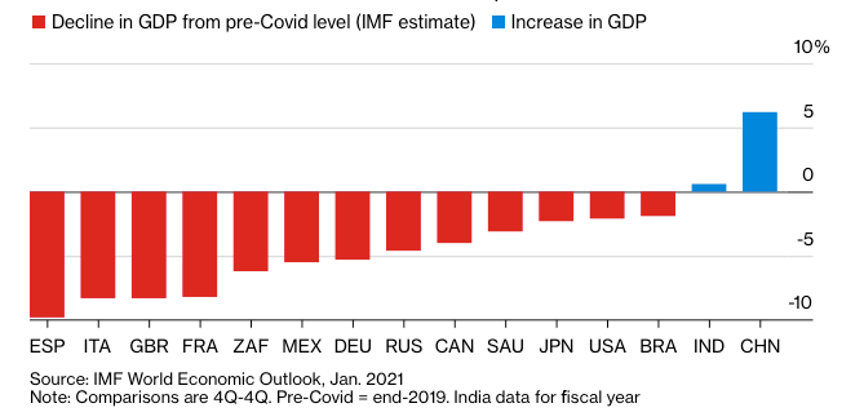

US GDP may reach pre-pandemic high by end of 2021, it the vaccine gets distributed to every corner of the nation and aggressive stimulus packages pass congress. Growth should come in at a minimum of 5% or higher this year, wiping out last year’s disaster. Keeping interest rates near zero will be a big help, as Treasury Secretary Yellen is determined to do. China and India are already there.

Share Buybacks have returned, the catnip of share prices. Q4 saw a jump to $116 billion from $102 billion in Q2, and this year, banks now have free reign to buy back their own shares. That’s still below the $182 billion seen in Q4 2019. It can only mean that share prices are rising further.

California lifts stay-at-home regulations, enabling restaurants to open after a nearly two-month shutdown. It’s the first ray of hope that the pandemic will end by summer. It will if Biden hits his 1.5 million vaccinations a day target.

Tesla posts sixth consecutive profit quarter, taking the stock down $60 in the aftermarket momentarily on a classic “buy the rumor, sell the news” move. The once cash-starved company now has an eye-popping $19.4 billion in reserves. Revenues reached a massive $10.7 billion, better than expected. Gross margins reached 19.2%. Looking for 50% annual growth for several years. Shanghai, Berlin, and Austin will make their first deliveries this year. Cash flow is at $19.4 billion, enough to build six more factories. No short sellers left here. It’s a perfect entry point for a LEAP. Buy the March 2023 $1,150-$1,200 call spread for a ten bagger.

Space X rocket carries 143 spacecraft into space. The Falcon 9 rocket set a new record with new satellites launched at once. Yes, you too can put 200kg into orbit for only $1 million. Many are from small tech startups selling various types of data. Elon Musk’s hobby, now worth $20 billion according to its government contracts, could be his next IPO. Don’t pass on this one!

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch earned a blockbuster 10.21% in January, versus a Dow Average that is now down in 2021. This is my third double-digit month in a row.

I used the market selloff to take substantial profits in my short (TLT) holdings and buy new longs in Boeing (BA) and Morgan Stanley (MS). I rolled the strikes down on my JP Morgan (JPM) long by $10.

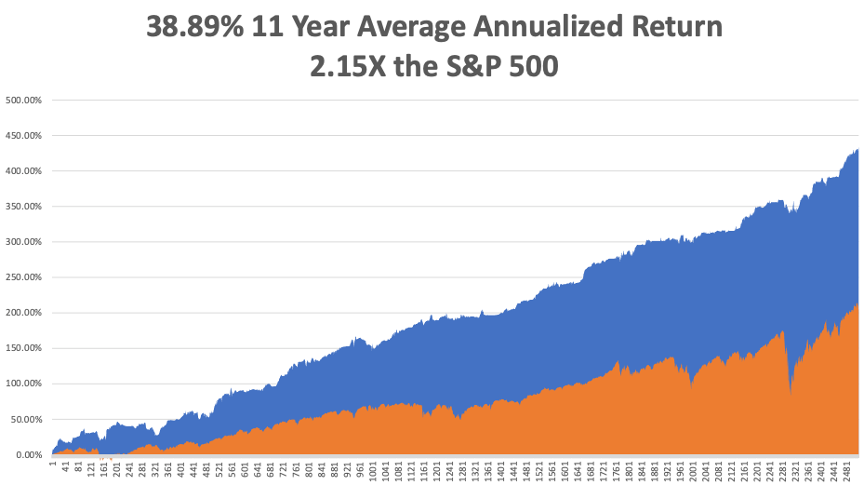

That brings my eleven-year total return to 432.76%, some 2.15 times the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.85%, a new high.

My trailing one-year return exploded to 75.28%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 91.43% since the March 20 2020 low.

We need to keep an eye on the number of US Coronavirus cases at 26 million and deaths at 440,000, which you can find here. We are now running at a staggering 3,800 deaths a day.

The coming week will be all about the monthly jobs data.

On Monday, February 1 at 9:45 AM EST, the Markit Manufacturing PMI for January is out. Caterpillar (CAT) announces earnings.

On Tuesday, February 2 at 7:00 AM, Total Vehicle Sales for January are published. Alphabet (GOOG) and Amgen (AMGN) report.

On Wednesday, February 3 at 8:15 AM, the ADP Private Employment Report is published. QUALCOMM (QCOM) reports.

On Thursday, February 4 at 9:30 AM, Weekly Jobless Claims are printed. Gilead Sciences (GILD) reports.

On Friday, February 5 at 9:30 AM, the January Nonfarm Payroll Report is announced. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I am often kept awake at night by painful arthritis and a collection of combat injuries and I usually spend this time thinking up new trade alerts.

However, the other night, I saw a war movie just before I went to bed, so of course, I thought about the war. This prompted me to remember the two happiest people I have met in my life.

My first job out of college was to go to Hiroshima Japan for the Atomic Energy Commission and interview survivors of the first atomic bomb 29 years after the event. There, I met Kazuko, a woman in her late forties who was attending college in Fresno, California in 1941 and spoke a quaint form of English from the period. Her parents saw the war and the internment coming, so they brought her back to Hiroshima to be safe.

Her entire family was gazing skyward when a sole B-29 bomber flew overhead. One second before the bomb exploded, a dog barked and Kazuko looked to the right. Her family was permanently blinded, and Kazuko suffered severe burns on the left side of her neck, face, and forearms. A white summer yukata protected the rest of her, reflecting the nuclear flash. Despite the horrible scarring, she was the most cheerful person I had ever met and even asked me how things were getting on in Fresno.

Then there was Frenchie, a man I played cards with at lunch at the Foreign Correspondents Club of Japan every day for ten years. A French Jew, he had been rounded up by the Gestapo and sent to the Bergen-Belson concentration camp late in the war. A faded serial number was still tattooed on his left forearm. Frenchie never won at cards. Usually, I did because I was working the probabilities in my mind all the time, but he never ceased to be cheerful no matter how much it cost him.

The happiest people I ever met were atomic bomb and holocaust survivors. I guess, if those things can’t kill, you nothing can, and you’ll never have a reason to be afraid again. That is immensely liberating.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader