The Market Outlook for the Week Ahead, or Get Ready to Sell in May

So when you are supposed to “Sell in May and go away”, what are you supposed to be doing on April 18?

Not much.

War, inflation, disease, runaway energy prices, and soaring interest rates are usually not a good backdrop for trading stocks. When the wind is blowing against me with gale-force winds instead of behind me, I tend to quit. I only like playing games that are rigged in my favor, or in yours.

Retreating to fight another day sounds like a good strategy to me because it’s much easier to dig out of a small hole than a large one. And it’s impossible to recover if you lost all your money chasing marginal low-quality trades. That 100-day cruise around the world that Cunard is offering right now looks pretty good. If the central bank says it is set on slowing the economy, believe it. The free Fed put is a distant memory.

But whatever Armageddon we are facing out there, it will be a modest one. We now have an unemployment rate of 3.6%, but there are still 11 million open jobs. That means there are more jobs in the US right now than workers, a first in history.

There are in fact several big positives the markets are ignoring right now because it is fashionable to do so. You know these supply chain problems? They’re slowly going away. You see this in falling freight rates for US truckers.

The Cass Freight Index measure of domestic shipping demand edged up a bare 0.6% in March from the month before, an unseasonable slowing of growth at the end of the quarter. From where I sit, the number of Chinese container ships at anchor in San Francisco Bay is on a definite decline.

Going into real recessions, consumers usually baton down the hatches, don their hard hats, and reign in spending. And while they tell pollsters they are worried about the economy, they act like they believe in the opposite, spending with reckless abandon. Wells Fargo (WFC) has seen spending on credit cards soaring by 33% in Q1, while it has jumped by an impressive 29% at JP Morgan (JPM).

There is also a great positive out there which is being completely ignored by the market. The pandemic is gone. Daily cases have dropped from one million to only 20,000 in two months, a record drop in the history of epidemiology. Masks are now only required at mass events like rock concerts and the San Francisco Ballet.

So I will endeavor to entertain you with my stories long enough to keep you from getting bored until trading stocks becomes the slam dunk no-brainer affair it once was. That would be in anything from 2-5 months.

Elon Musk makes $53 billion takeover bid for Twitter in a move that gobsmacked Wall Street. He made the offer in a 281-character tweet to the board of directors. His goal will be to end all censorship, which means bringing back the crazies and the violent. If they don’t accept his premium offer, then he will sell the 9.9% of shares that he already owns and the board will get sued to death by shareholders.

Inflation jumps to 8.5% YOY, a 40-year high, with half of the increase coming from gasoline prices. Stocks and bonds were up on a “buy the rumor, sell the news” move. Unless oil prices completely collapse, next month will be worse.

Producer Price Index rockets by 11.2%, an 11-year high. This is on the heels of yesterday’s red hot Core Inflation report. It makes a half-point rate hike on April 29 a sure thing.

Retail Sales jumped 0.5% in March, and up 6.9% YOY, while import prices hit an 11-year high.

Bonds hit new three-year lows, with yields soaring to 2.81% overnight. The market is transitioning from a Fed that is raising rates from a quarter point at each meeting to a half point. We may be reaching the end of this leg down, off $9.00 in weeks. Only sell the big rallies. (TLT) LEAPS holders are sitting pretty.

Mortgage Refis down 67% YOY, thanks to a 30-year fixed rate mortgage that has topped 5.0%. It looks like the loan sharks won’t be grabbing as much in fees. This market won’t recover for several years. If you didn’t refi last year at century low rates, you’re screwed.

NVIDIA downgraded from outperform to neutral and the price target was chopped from $360 to $225 by Baird & Co. It’s a bold move as (NVDA) has long been a Mad Hedge favorite and 70-bagger over the last five years. Baird cites cancellations driven by a combination of excess GPUs, or graphics processing unit in Western Europe and Asia, as well as a slowdown in consumer demand, especially in China. Slowing consumer demand for GPUs was evident in the continuing reduction in graphics card pricing. I believe any slowdowns are temporary and you should keep buying (NVDA) on dips.

Used Car Sales take a hit, as affordability becomes a major issue. Carmax just reported a 6.5% plunge in Q4. I can sell my Tesla Model X for more than I paid three years ago because it takes a year to get a new one.

Weekly Jobless Claims hit 185,000, up 18,000 from the previous week. The stock market may be worried about a coming recession but the jobs market sure isn’t.

Morgan Stanley blows away earnings. Equity trading came in a hot $3.2 billion and bond trading $2.9 billion. The shares popped 7% on the news. Buy (MS) on dips.

Mercedes breaks 600 miles range on a single charge with its EQXX prototype, driving from Stuttgart to the French Riviera. But the cost per watt is still double Tesla’s. Mercedes plans to go all-electric by the end of the decade.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

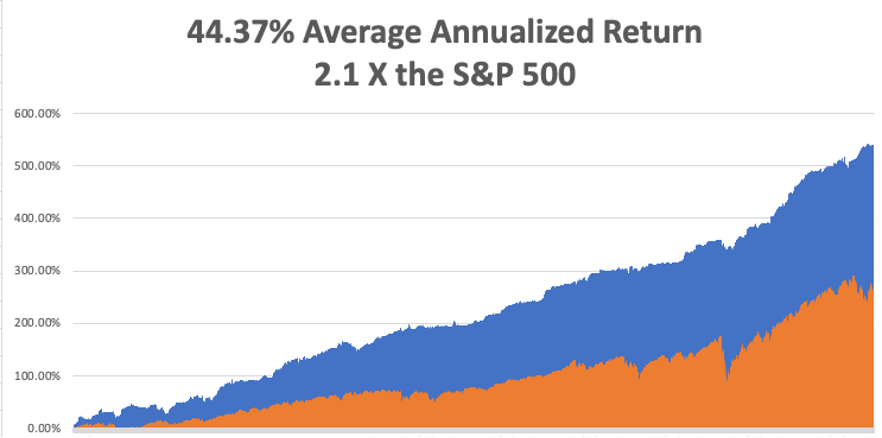

My March month-to-date performance retreated to a modest 0.38%. My 2022 year-to-date performance ended at a chest-beating 27.23%. The Dow Average is down -5.1% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 68.55%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 539.79%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.36%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 80.6 million, up only 300,000 in a week and deaths topping 988,000 and have only increased by 3,000 in the past week. You can find the data here. Growth of the pandemic has virtually stopped, with new cases down 98% in two months.

On Monday, April 18 at 7:00 AM EST, the NAHB Housing Market Index is out. Bank of America (BAC) reports.

On Tuesday, April 19 at 8:30 AM, Housing Starts for March are published. Netflix (NFLX) reports.

On Wednesday, April 20 at 8:30 AM, the Existing Home Sales for March are printed. Tesla (TSLA) reports.

On Thursday, April 22 at 7:30 AM, the Weekly Jobless Claims are printed. Union Pacific (UNP) reports.

On Friday, April 23 at 8:30 AM, the S&P Global Composite Flash PMI is disclosed. American Express (AXP) reports. At 2:00 PM, the Baker Hughes Oil Rig Count are out.

As for me, the call from Washington DC was unmistakable, and I knew what was coming next. “How would you like to serve your country?” I’ve heard it all before.

I answered, “Of course, I would.”

I was told that for first the first time ever, foreign pilots had access to Russian military aircraft, provided they had enough money. You see, everything in the just collapsed Soviet Union was for sale. All they needed was someone to masquerade as a wealthy hedge fund manager looking for adventure.

No problem there.

And can you fly a MiG29?

No problem there either.

A month later, I was wearing the uniform of a major in the Russian Air Force, my hair cut military short, sitting in the backseat of a black Volga limo, sweating bullets.

“Don’t speak,” said my driver.

The guard shifted his Kalashnikov and ordered us to stop, looked at my fake ID card and waved us on. We were in Russia’s Zhukovky Airbase 100 miles north of Moscow, home of the country’s best interceptor fighter, the storied Fulcrum, or MiG-29.

I ended up spending a week at the top-secret base. That included daily turns in the centrifuge to make sure I was up to the G-forces demand by supersonic flight. Afternoons saw me in ejection training. There in my trainer, I had to shout “eject, eject, eject,” pull the right-hand lever under my seat, and then get blasted ten feet in the air, only to settle back down to earth.

As a known big spender, I was a pretty popular guy on the base, and I was invited to a party every night. Let me tell you that vodka is a really big deal in Russia, and I was not allowed to leave until I had finished my own bottle, straight.

In 1993, Russia was realigning itself with the west, and everyone was putting their best face going forward. I had been warned about this ahead of time and judiciously downed a shot glass of cooking oil every evening to ward off the worst effects of alcohol poisoning. It worked.

Preflight involved getting laced into my green super tight gravity suit, a three-hour project. Two women tied the necessary 300 knots, joking and laughing all the while. They wished me a good flight.

Next, I met my co-pilot, Captain A. Pavlov, Russia’s top test pilot. He quizzed me about my flight experience. I listed off the names: Laos, Cambodia, Thailand, Israel, Croatia, Serbia, Bosnia, Kuwait, Iraq, and Saudi Arabia. It was clear he still needed convincing.

Then I was strapped into the cockpit.

Oops!

All the instruments were in the Cyrillic alphabet….and were metric! They hadn’t told me about this, but I would deal with it.

We took off and went straight up, gaining 50,000 feet in two minutes. Yes, fellow pilots, that is a climb rate of an astounding 25,000 feet a minute. They call them interceptors for a reason. It was a humid day, and when we hit 50,000 feet, the air suddenly turned to snowflakes swirling around the cockpit.

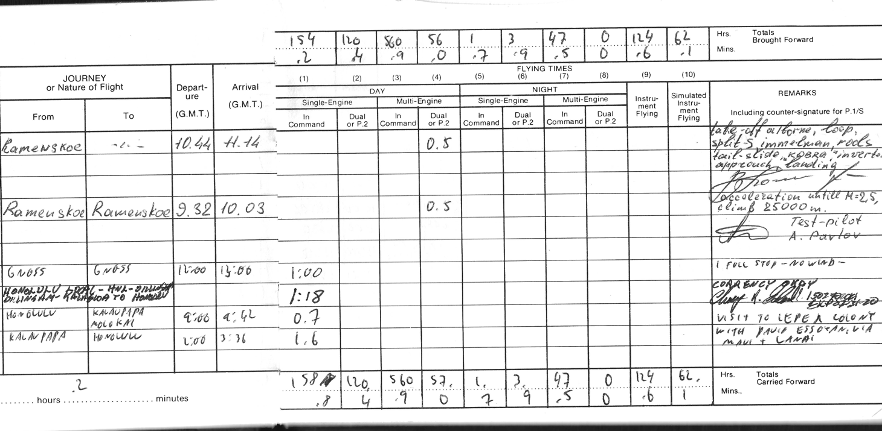

Then we went through a series of violent spins, loops, and other evasive maneuvers (see my logbook entry below). Some of them seemed aeronautically impossible. I watched the Mach Meter carefully, it frequently danced up to the “10” level. Anything over ten is invariably fatal, as it ruptures your internal organs.

Then Pavlov said, “I guess you are a real pilot, and he handed the stick over to me. I put the fighter into a steep dive, gaining the maximum handbook speed of March 2.5, or 2.5 times the speed of sound, or 767.2 miles per hour in seconds. Let me tell you, there is nothing like diving a fighter from 90,000 feet to the earth at 767.2 miles per hour.

Then we found a wide river and buzzed that at 500 feet just under the speed of sound. Fly over any structure over the speed of sound and the resulting shock wave shatters concrete.

I noticed the fuel gages were running near empty and realized that the Russians had only given me enough fuel to fly for an hour. That’s so I wouldn’t hijack the plane and fly it to Finland. Still, Pavlov trusted me enough to let me land the plane, no small thing in a $30 million aircraft. I made a perfect three-point landing and taxied back to base.

I couldn’t help but notice that there was a MiG-25 Foxbat parked in the adjoining hanger and asked if it was available. They said “yes”, but only if I had $10,000 in cash on hand, thinking this was an impossibility. I said, “no problem” and whipped out my American Express gold card.

Their eyes practically popped out of their heads, as this amounted to a lifetime of earnings for the average Russian. They took a picture of the card, called in the number, and in five minutes I was good to go.

They asked when I wanted to fly, and as I was still in my gravity suite I said, “How about right now?” The fuel truck duly back up and in 20 minutes I was ready for takeoff, Pavlov once again my co-pilot. This time, he let me do the takeoff AND the landing.

The first thing I noticed was the missile trigger at the end of the stick. Then I asked the question that had been puzzling aeronautics analysts for years. “If the ceiling of the MiG-25 was 90,000 feet and the U-2 was at 100,000 feet, how did the Russians make up the last 10,000 feet?

“It’s simple,” said Pavlov. Put on full power, stall out at 90,000 feet, then fire your rockets at the apex of the parabola to make up the distance. There was only one problem with this. If your stall forced you to eject, the survival rate was only 50%. That's because when the plane in free fall hit the atmosphere at 50,000 feet, it was like hitting a wall of concrete. I told him to go ahead, and he repeated the maneuver for my benefit.

It was worth the risk to get up to 90,000 feet. There you can clearly see the curvature of the earth, the sky above is black, you can see stars in the middle of the day, and your forward vision is about 400 miles. We were the highest men in the world at that moment. Again, I made a perfect three-point landing, thanks to flying all those Mustangs and Spitfires over the decades.

After my big flights, I was taken to a museum on the base and shown the wreckage of the U-2 spy plane flown by Francis Gary Powers shot down over Russia in 1960. After suffering a direct hit from a missile, there wasn’t much left of the U-2. However, I did notice a nameplate that said, “Lockheed Aircraft Company, Los Angeles, California.”

I asked, “Is it alright if I take this home? My mother worked at this factory during WWII building bombers.” My hosts looked horrified. “No, no, no, no. This is one of Russia’s greatest national treasures,” and they hustled me out of the building as fast as they could.

It's a good thing that I struck while the iron was hot as foreigners are no longer allowed to fly any Russian jets. And suddenly I have become very popular in Washington DC once again.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

My MiG 25 in Russia

Russian Test Pilot A. Pavlov

Entries in my Logbook (Notice visit to leper colony on line 9)

U-2 Spyplane