The Market Outlook for the Week Ahead, or Goldilocks is Back!

After a three-week vacation, sanity has returned.

In a mere 15 trading days, the stock market has leaped from “the end of the financial system as we know it” to “happy days are here again.”

It was a week that brought us a major recovery of domestic cyclicals, with banks and commodities leading and technology bringing up the rear. Market breadth is broadening and winners are outnumbering losers. The Volatility Index ($VIX) completed a round trip, from $19 to $31, then back down again to $19.

Trading volumes of banks have plummeted 90% from their peaks. The Russell 2000 was the top gaining index of the week, which is 25% made up of small financials.

I’ve always been a numbers guy and to me, hard data rules all. Earnings that were widely expected to be terrible because of the coming recession are coming in better than expected. The actual fact is that the US economy is growing at a 2.5% annualized rate, slightly below the long-term average of 3%.

No recession here!

Last week, we learned the harsh reality of the Silicon Bank failure in congressional hearings. Once venture capitalist Peter Theil started the rumors, the bad news spread like wildfire. That day, some $40 billion left the bank, withdrawn instantly through the bank’s convenient cell phone app. The next day, $100 billion was scheduled for withdrawal….which the bank didn’t have.

There was no pleading from Mr. Potter to leave your cash in the bank to help the broader community. The money left with the speed of light. If Janet Yellen had not stepped in to guarantee deposits, every small bank in the country would have been cleaned out of cash the following week.

It makes one worry about what other manifestations of modern technology our financial system is unable to cope with. AI maybe, the development of which Elon Musk called for a halt to ensure our own survival. Maybe that was AI at work at (SVB)?

I am happy to say that Mad Hedge clocked the best month in two years, up +20.85%. Every time I do this, people ask me how. Here are a few key points that were screaming at me on meltdown day on Monday, March 13, when I loaded the boat with bank stocks, call spreads, and LEAPS.

1) Trading volume in banks rose tenfold

2) All banks were being dumped indiscriminately, with the best dropping as fast as the worst

3) Some 90% of stocks were down on the day. It was a classic one-way day.

4) Key technical levels in the S&P 500 held at $3,750

5) The Volatility Index spiked to $31

6) The usual merchants of doom appeared on TV and predicted the end of the world so they could buy stocks cheaper

When the sun, moon, and planets align, I strike. The market doesn’t ask twice.

Most importantly, having spent seven days a week for 55 years studying the fundamentals and the market, I knew they in no way justified the magnitude of the crash we were getting. What the market was really giving us was a gift, the best quality stocks at huge discounts. Whenever the market offers you a gift, you take it.

I did with both hands.

I went into this crash with 80% cash, a great position of strength. That comes from not overtrading, chasing marginal trades, or taking on positions because there is nothing else to do, all beginner mistakes and own goals. I live by the philosophy that a dollar at a market top is worth $10 at a market bottom. That was certainly the case this time.

It also helped that I know the Treasury Secretary Janet Yellen well, as I was once one of her students at UC Berkeley. I was in regular contact with her office the weekend Silicon Valley crash happened, and I knew she would do the right thing.

She did.

Every time we get one of these events, Mad Hedge followers make about 20%. This time was no different.

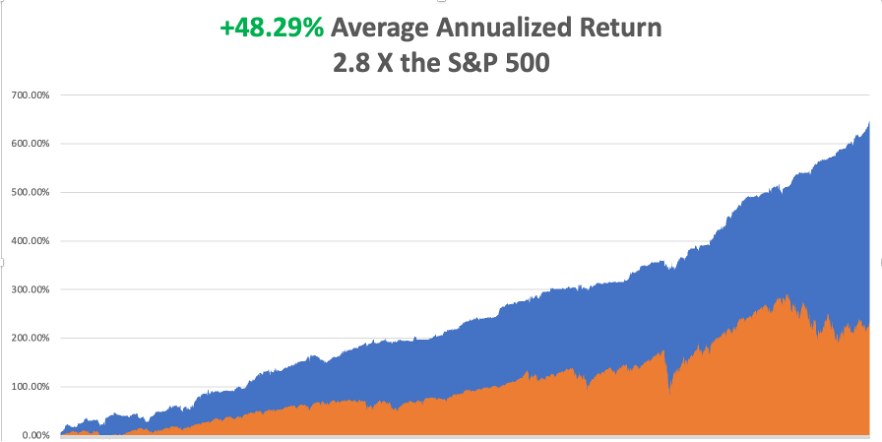

March closed out at +20.85%. My 2023 year-to-date performance is now at an incredible +46.62%. The S&P 500 (SPY) is up a miniscule +7.73% so far in 2023. My trailing one-year return maintains a sky-high +104.40% versus -22.75% for the S&P 500.

That brings my 15-year total return to +643.81%, some 2.80 times the S&P 500 (SPY) over the same period. My average annualized return has recovered to +48.29%, another new high.

I executed only three trades last week, taking profits on my bond short (TLT) and rolling it into a new long bond position, and buying Freeport McMoRan (FCX).

Silicon Valley Bank Sells to First Citizens Bancshares (FCNCA), whose shares rocketed by an incredible 72% on the news. First Citizens is buying about $72 billion worth of SVB assets from the FDIC at a discount of $16.5 billion. The FDIC gave (FCNCA) an unheard-of $70 billion line of credit to do the deal. (SVB) management sold $84 million worth of stock in the two years leading up to the bankruptcy, including $3 million by the CEO, which will almost certainly get clawed back. It certainly doesn’t pass the smell test.

Q4 GDP Comes in at 2.6% and is likely to continue at the same rate in Q1. A solid Christmas selling season was a big help. Someone forgot to tell the economy it was supposed to be in a recession. That’s down from 3.2% in Q3 2022. Maybe this is why stocks won’t go down?

Commercial Real Estate is in Trouble, says JP Morgan, falling 37% last year on a total return basis. Those pressures are set to mount as commercial real estate, already dealing with higher interest rates and fewer workers showing up at offices, deals with the regional banking fallout.

Manhattan Office Vacancies Hit Record High, a victim of the work-from-home trend and fears of a coming recession. More than 16% of a total of 470 million square feet was empty in Q1. Average rents are flat at $76.96 a square foot.

Home Ownership Premium Highest Since 2006, when compared to rentals. The spread assumes a new homeowner took out a mortgage yesterday, which few have. That’s up 71% in three years compared to annual rental growth of 6.3%. The failure of home prices to drop is part of the problem, which they won’t with a 10 million unit national structural shortage.

Europe Bans Internal Combustion Engines, from 2035. An exemption was allowed for German cars that run on carbon-neutral fuels, like hydrogen. Half of the world’s oil demand is about to disappear.

A Severe Short Squeeze in Copper is Developing, leading to a massive price spike later in 2023. A Chinese economic recovery and exploding EV growth are the reasons. Copper is the only industrial metal up this year, some 6%. The rest are all down on recession fears. Is the red metal now recession-proof? Buy (FCX) on Dips.

Lithium Prices Have Dropped by Half, in the past four months, following a ballistic 1,300% price increase in the previous two years. Australia is the world’s largest producer of lithium. China and Chile follow, thanks to cheap labor, lax regulation, and lack of environmental controls.

Alibaba to Break Up into six different companies, which may independently list sometime in the future. Such a move usually brings a doubling in value for the $255 billion Chinese tech giant and (BABA) rose 15% on the news. It also makes it easier for the government in Beijing to exert control. Avoid (BABA) as China is still not out of the woods yet.

S&P Case Shiller Loses Gains in January in their National Home Price Index, dropping from a 5.6% annual gain to only 3.8%. Prices have been dropping for seven straight months. San Francisco was down 8% YOY, while Seattle gave up 5%. Miami gained 14%, Tampa 11%, and Atlanta 8%.

AI Could be a $7 Trillion Business in ten years, according to Goldman Sachs. I think it could be more. AI is touted to be the next big shift in technology after the evolution of the internet, mobile, and the cloud. It will make every company you own more valuable. Buy (NVDA) on dips.

Solar Could Have a Big Year in 2023, driven by huge government subsidies and soaring electricity costs. The real net break-even cost against keeping your existing gas or oil-fired system is four years. Can’t afford it? Get the government to give you a 30% tax credit bolstered by Biden’s Inflation Reduction Act. I’ve taken $250,000 in such tax credits over the last eight years. (ENPH) looks like a “BUY” here off of a 47% four-month correction. All the others have already run, like (FSLR), or are too diluted by other businesses, like (GE).

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, April 3 at 7:30 AM EST, the ISM Manufacturing Index is out.

On Tuesday, April 4 at 6:00 AM, the JOLTS Job Openings Report is announced.

On Wednesday, April 5 at 7:00 AM, the ADP private Employment Report for March is printed.

On Thursday, April 6 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, April 7 at 8:30 AM the Nonfarm Payroll Report for March is released.

As for me, few Americans know that 80% of all US air strikes during the Vietnam War originated in Thailand. At their peak in 1969, there were more US troops serving in Thailand than in South Vietnam itself.

I was one of those troops.

When I reported to my handlers at the Ubon Airbase in northern Thailand for my next mission, they had nothing for me. They were waiting for the enemy to make their next move before launching a counteroffensive. They told me to take a week off.

The entertainment options in northern Thailand in those days were somewhat limited. Phuket and the pristine beaches of southern Thailand where people vacation today were then overrun by cutthroat pirates preying on boat people and would kill you for your boots.

Life was cheap in Asia in those days, especially your life. Any trip there would be a one-way ticket.

There were the fleshpots of Bangkok and Chang Mai. But I would likely contract some dreadful disease there. I wasn’t really into drugs, figuring whatever my future was, it required a brain. Besides, some people’s idea of a good time there was throwing a hand grenade into a crowded disco. So, I, ever the history buff, decided to go look for The Bridge Over the River Kwai.

Men of my generation knew the movie well, about a company of British soldiers who were the prisoners of bestial Japanese. At the end of the movie, all the key characters die as the bridge is blown up.

I wasn’t expecting much, maybe some interesting wreckage. I knew that the truth in Hollywood was just a starting point. After that, they did whatever they had to do to make a buck.

The fall of Singapore was one of the great Allied disasters at the beginning of WWII. Japanese on bicycles chased Rolls Royce armored cars and tanks the length of the Thai Peninsula. Two British battleships, the Repulse and the Prince of Wales, were sunk due to the lack of air cover with a great loss of life. When the Japanese arrived at Singapore, the defending heavy guns were useless as they pointed out to sea.

Some 130,000 men surrendered, including those captured in Malaysia. There were also 686 American POWs, the survivors of US Navy ships sunk early in the war. Most were shipped north by train to work as slave labor on the Burma Railway.

The Japanese considered the line strategically essential for their invasion of Burma. By building a 258-mile railway connecting Bangkok and Rangoon, they could skip a sea voyage of 2,000 miles in waters increasingly dominated by American submarines.

Some 12,000 Allied troops died of malaria, beriberi, cholera, dysentery, or starvation, along with 90,000 impressed Southeast Asian workers. That earned the line the fitting name: “Death Railway.”

The Burma railway was one of the greatest engineering accomplishments in human history, ranking alongside the Pyramids of Egypt. It required the construction of 600 bridges and viaducts. It crossed countless rivers and climbed steep mountain ranges. The work was all done in 100-degree temperatures with high humidity in clouds of mosquitoes. And it was all done in 18 months.

One of those captured was my good friend James Clavell, who spent the war at Changi Prison, now the location of Singapore International Airport. Every time I land there, it gives me the creeps.

Clavell wrote up his experiences in the best-selling book and movie King Rat. He followed up with the Taipan series set in 19th century Hong Kong. We lunched daily at the Foreign Correspondents Club of Japan when he researched another book, Shogun, which became a top TV series for NBC.

So I navigated the Thai railway system to find remote Kanchanaburi Province where the famous bridge was said to be located.

My initial surprise was that the bridge was still standing, not destroyed as it was in the film. It was not a bridge made of wood but concrete and steel trestles. Still, you could see the scars of allied bombing on the foundations, which tried many times to destroy the bridge from the air.

That day, the Bridge Over the River Kwai was a quiet, tranquil, peaceful place. Farmers wearing traditional conical hats made of palm leaves and bamboo strips called “ngob’s” crossed to bring topical fruits and vegetables to market. A few water buffalo loped across the narrow tracks. The river Kwai gurgled below.

Once a day, a train drove north towards remote locations near the Burmese border where a bloody rebellion by the indigenous Shan people was underway.

The wars seemed so far away.

The only memorial to the war was a decrepit turn-of-the-century English steam engine badly in need of repair. There were no tourists anywhere.

So I started walking.

After I crossed the bridge, it wasn’t long before I was deep in the jungle. The ghosts of the past were ever present, and I swear I heard voices. I walked a few hundred yards off the line and the detritus of the war was everywhere: abandoned tools, rusted-out helmets, and yes, human bones. I didn’t linger because the snakes here didn’t just bite and poison you, they swallowed you whole.

After the war, the Allies used Japanese prisoners to remove the dead for burial in a nearby cemetery, only identified by their dog tags. Most of the “coolies” or Southeast Asian workers were left where they fell.

Today, only 50 miles of the original Death Railway remain in use. The rest proved impossible to maintain, because of shoddy construction, and the encroaching jungle.

There has been talk over the years of rebuilding the Burma Railway and connecting the rest of Southeast Asia to India and Europe. But with Burma, today known as Myanmar, a pariah state, any progress is unlikely.

Maybe the Chinese will undertake it someday.

Every Christmas vacation, when my family has lots of free time, I sit the kids down to watch The Bridge Over the River Kwai. I just wanted to pass on some of my experiences, teach them a little history, and remember my old friend Cavell.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Walking the Bridge Over the River Kwai in 1976

The Bridge Over the River Kwai Today

1976 Death Railway Steam Engine

A Thai Farmer