The Market Outlook for the Week Ahead, or Here Comes the Head and Shoulders Top

I was perusing hundreds of charts over the weekend as I usually do looking for great trading insights when what I saw stunned, frightened, and gobsmacked me. A “Head and Shoulders” top is setting up for the major stock market indexes.

Take a look at the charts below and you will see it is clear as day for the Dow Average, the S&P 500, and the NASDAQ. The Russell 2000 chart shows a “Head and Shoulders” top that has already broken down into bear market territory for the stocks most sensitive to a recession.

I am normally not a big fan of technical analysis. I see it as the refuge of young and inexperienced traders who are unable or incapable of engaging in deep, meticulous, and time consuming fundamental analysis.

However, when the charts confirm what I already know is happing in the real economy, the hair stands up on the back of my neck. And that is exactly what is happening now.

To say that the China trade war has thrown the fat on the fire would be a vast understatement. Every business in the country is now taking a hard look at their business models trying to understand if they can survive a prolonged trade war or go out of business.

It turns out that you cannot manufacture ANYTHING in America without using Chinese parts. You know all of those products that claim they are 100% made in America? Many, if not most, of the parts are Chinese. Only the labor to assemble them is from the US. This has been the dirty little secret of the US economy for a long time.

While the administration is claiming these companies can easily source elsewhere, most of the needed parts are not available at the price or the volume needed to fill the gap, and many of these parts are ONLY made in China. It took 40 years to integrate the Chinese and US economies as an alternative to an endless war and the relationship is not going to be unwound overnight on a whim with a Tweet.

I am not the only one who has noticed this. JP Morgan (JPM) has dramatically cut their growth forecast from 3.2% in Q1 to a lowly 1% in Q2. The Federal Reserve itself warned that trade could demolish the recovery. You break it, you own it. Isn’t it amazing how quickly panics happen? Risk happens fast.

The president has said that trade wars are “easy to win,” but it depends on how you decline “winning.” If “winning” means that we go bankrupt slower than the Chinese, he is probably right. But we all go bankrupt nonetheless.

The impact of the trade war won’t be evident in the economic data for months. The advanced estimate of Q2 GDP won’t be released by the Bureau of Economic Analysis until July 26 (click here).

By the time the administration figures out that this war is unwinnable, we may already be solidly in recession and deep into a bear market for stocks.

And let me ask you this question. How hard do you think the Chinese are going to work to get Donald Trump reelected? They don’t have a presidential election to worry about next year. Someone else does. Better clean up that extra bedroom. The trade war isn’t staying overnight on the sofa. It is moving in as a permanent resident.

So, for the foreseeable future, I strongly advise you to sell into every substantial rally, reduce risk, and pare back your trading. Anything you keep, you have to be able to withstand a 40% drawdown. That’s what all the lead tech stocks did in December.

This is turning into the best “Sell in May and go away”. It might be the summer to take that long-postponed trip around the world. Hmmmm. That’s I’m doing.

Stocks dove last week on the trade war escalation, with technology taking the biggest hit. Fears of Chinese retaliation are rampant.

All markets are now signaling recession, with bonds up huge and everything else down huge, like all stocks, oil, commodities, and real estate. The bigger they are the harder they fall. Ten-year US Treasury yields plunged to 2.30%. It might be a good summer to take a round the world cruise.

Mad Hedge Market Timing Index plummeted to 28, from a high of 72 just weeks ago. That means stocks have more downside to go, and a solid “BUY” won’t appear for months.

No China meetings will be held for at least a month, says US Treasury Secretary Steven Mnuchin. Don’t expect any respite from this front. It seems preventing Trump’s tax returns from being released is taking up all his time. Also, the US government runs out of money at summer’s end, unless the Democratic-controlled House opens up the checkbook first.

In the cruelest move, China blocked the broadcast of the final episode of Game of Thrones, forcing fanatics to search the Internet for the final conclusion. It looks like this is going to be a no holds barred war.

Tesla finally broke $200, as fears of Chinese tariff hikes hit its parts supply. Analysts cite other “distractions” like the SEC and the margin call on Elon Musk’s leveraged long position in $500 million worth of the shares. Wait for the final capitulation. The “BUY” for (TSLA) is setting up. Electric car subsidies are to return on 2021 and the shares will soar. Expect institutions to front run this move by a year.

Some 90% of the net buying in the market now is corporate buybacks, shrinking the float of available shares by 4% this year, and more than 10% for single stocks like Apple (AAPL), Microsoft (MSFT), Cisco Systems (CSCO), and Oracle (ORCL). Buy ALL of the buyback stocks on big dips.

New Homes Sales were down 6.9%, in April. As in past cycles, they are seeing the recession first, despite ultra-low interest rates. Prices here still rising, thanks to trade war-induced rocketing materials and lumber costs.

Existing Home Sales shed 0.4%, to only 5.19 million units in April, despite year low mortgage interest rates. The good news is that inventory shrank to 4.2 months. A lot of homes are now for sale at “aspirational” prices, with sellers hanging on to last year’s prices. I don’t understand why investors are buying the homebuilder stocks, unless its anticipation of the return of SALT deductions in two years.

The Mad Hedge Fund Trader managed to hang on to new all-time highs last week, despite the horrific trading conditions.

Global Trading Dispatch closed the week up 15.72% year-to-date and is up 0% so far in May. My trailing one-year rose to +20.71%.

The Mad Hedge Technology Letter did fine, making money on longs in Microsoft (MSFT) and Amazon (AMZN). Some 10 out of 13 Mad Hedge Technology Letter round trips have been profitable this year.

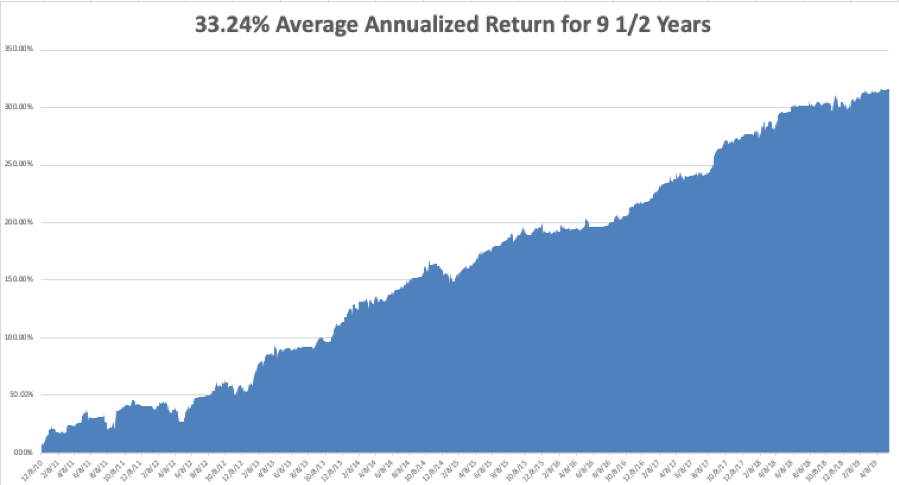

My nine and a half year profit jumped to +315.86%. The average annualized return popped to +33.24%. With the market's incredible and dangerously volatile, I am now 70% in cash with Global Trading Dispatch and 80% cash in the Mad Hedge Tech Letter.

I’ll wait until the markets enjoy a brief short-covering rally before adding any short positions to hedge my longs.

The coming week will see only one report of any real importance, the Fed Minutes on Wednesday afternoon. Q1 earnings are almost done.

On Monday, May 27 at 8:30 AM, the markets are closed for the Memorial Day holiday.

On Tuesday, May 28, 9:00 AM EST, the Case Shiller CoreLogic National Home Price Index is out.

On Wednesday, May 29 at 4:00 AM, MBA Mortgage Applications are out for the previous week.

On Thursday, May 30 at 8:30 AM, Weekly Jobless Claims are published. So is the first revision of the Q1 GDP. A second update on Q1 GDP is also published.

On Friday, May 31 at 8:30 AM, we learn the April Core Inflation.

As for me, I’ll be leading the local Memorial Day parade with my fellow veterans. I always consider myself lucky at these events because they are well attended by men with missing arms and legs and rising in wheelchairs. I am heartened by the young kids I see siting on curbs waving small American flags.

I firmly believe that the world will never see a large army war again. WWII needed 17 million men under arms, Vietnam 9 million, and the War in Iraq

2.8 million. You can see the trend. The next war will be fought by a few thousand programmers….and we will win.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader