The Market Outlook for the Week Ahead, or History is Repeating

When I was 13 years old in 1965, the week-long Watts Riots broke out in impoverished South Los Angles, killing 34. It was sparked by a police arrest for reckless driving.

While the ruins were still smoking, my dad drove me downtown to view the wreckage. Prudently, he kept his loaded Marine 1911 Browning .45 caliber automatic under a newspaper on the front seat. It looked like a war zone, with some 256 buildings burned to the ground and another 200 looted.

I have been running towards the sound of guns ever since.

Some 55 years later, we are seeing history repeat itself. However, instead of seeing the riots occur in major cities one at a time, as they did in the 1960s, we saw demonstrations and riots in 356 US cities all at the same time!

The impact on the economy, and eventually the stock market, will be immense.

As a long term follower of the structure of the US economy, what is going on now is utterly fascinating. A million connections within the economy have been severed forever and a million new ones created, which few understand.

The end result will be a far more efficient and profitable form of American capitalism. Companies are rebuilding time-tested business models in weeks. Those who can discern these new connections early will make fortunes. Those who don’t will dry up and blow away like so much dust into the ashcan of history.

Of course, the defining announcement of the week came on Friday morning with the Headline Unemployment Rate, which delivered a blockbuster FALL, from 14.7% to 13.3%, sending stock up 1,000 points. It’s proof that the stimulus is largely going into the stock market.

Economist forecasts were off by a whopping 10 million jobs, delivering the biggest miss in history. Leisure and Hospitality accounted for 1.2 million job gains, half the total.

Something doesn’t smell right here. How do you miss 10 million jobs? The streets and traffic levels tell me the real jobless rate is more like 20%. I can’t even get into my bank to deposit a check.

I believe the streets.

Look for big downward revisions, which may pose another threat to the market, and possibly a secondary crash, but not for another month.

A client told me last week that he wishes there were major market crashes more often where he could load the boat with deep out-of-the-money LEAPS which then double or triple in weeks.

He may get his wish. The faster we rise now, the greater the risk of a secondary crash which could wipe out half the recent gains.

I managed to catch the bottom of the biggest stock market rally of all time with dozens of LEAPS like with (TSLA), (DAL), (UAL), (BRKB), and (BA). I took profits all the way up and went into last week modestly “Risk On.” But the 1,000-point rally on Friday caught me totally by surprise, as it did everyone else.

I’m sorry, but I guess I’m lousy at trading those once in hundred-year events.

My saving grace has been the most aggressive, in-your-face short positions in the bond market (TLT), (TBT) in the 13-year history of this letter at the same time. It’s still a great trade. Selling short US Treasury bonds now with a 0.90% yield is the same as buying the Dow Average at 20,000….again.

Pending Home Sales collapsed 21.8% in April and off 33.8% YOY on a signed contract basis. These are the worst numbers since the data series started. The West was hardest hit, down 50%. No wonder I’ve seen so many real estate agents at the beach. We already know that a sharp rebound is underway as Millennials move to the burbs and flee Corona-infested cities. Home prices will be up this year.

Mortgage Demand is soaring as ultra-low rates spur demand. Housing will lead the recovery of the bricks and mortar economy. It will take another year before jumbo loan rates start to decline as banks avoid risk like the plague. Buy (LEN) and (KHB) on dips.

Stocks are the most overbought in 20 years since the top of the Dotcom bubble. Risk is extreme for new longs. Almost all S&P 500 stocks are trading above 50 day moving average. The technical indicators are screaming “SELL”.

Consumer Confidence is recovering as even the slightest bit of reopening looks like a lot coming off of zero. The Conference Board’s consumer confidence index rose to 86.6 this month from 85.7 in April, well up from an expected 82. Call it “green shoots”.

Used Car Prices have crashed with Hertz going bankrupt and defaults on new car loans reaching record levels. Surviving rental companies have cancelled all new car orders. Vacation travel has vaporized. Wells Fargo has ceased lending to car dealers. Time to upgrade that second car?

The greatest 50-day rally in the S&P 500 is now over, up 40% since March 23. Buyers are getting nervous and exhausted and are overdue for a pullback. But the historical six-month gain after a move like this is another 10.2% up, followed by a one-year gain of 17.3%. Over $14 Trillion in Fed and fiscal stimulus can go a long way.

US Factory Orders collapsed further, down 13% in May after a 14% crash in April. Don’t expect these numbers to decline any time soon. The stock market will never notice.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil at a cheap $34 a barrel, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

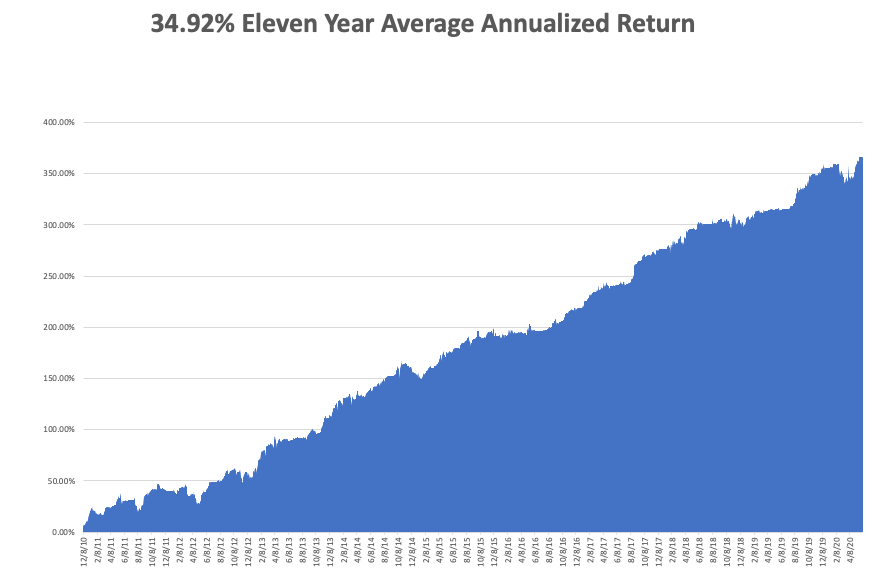

My Global Trading Dispatch performance was up modestly on the week, my downside hedges costing me money in a steadily rising but wildly overbought market. We stand at an eleven-year performance all-time high of 366.68%.

My huge short bond positions, which I have been adding to all the way down, are still delivering big profits. That’s because time decay is really starting to kick in with nine trading days left until the June expiration.

That takes my 2020 YTD return up to a lofty +10.77%. This compares to a loss for the Dow Average of -4.9%, up from -37%. My trailing one-year return exploded to a near-record 52.27%. My eleven-year average annualized profit ballooned to +34.92%.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, June 8 at 8:00 AM EST, Consumer Inflation Expectations for May are announced.

On Tuesday, June 9 at 10:30 AM EST, we learn the NFIB Small Business Optimism Index for May.

On Wednesday, June 10 at 8:15 AM EST, the US Core Inflation Rate for May is printed. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are published.

On Thursday, June 11 at 8:30 AM EST, Weekly Jobless Claims are announced.

On Friday, June 5, at 10:00 AM EST, the University of Michigan Consumer Sentiment figures are out. The Baker Hughes Rig Count follows at 2:00 PM EST.

As for me, I traveled to the local shopping mall to see how real this 2.5 million gain in jobs really exists. More than 50% of the shops were closed, several had already gone bankrupt and traffic was easily below 10% of pre-pandemic levels. Restaurants had maybe 5% of peak traffic sitting at outside tables. Mall police were there to enforce facemask rules.

Nope, not seeing any recovery here. Caveat Emptor.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader