The Market Outlook for the Week Ahead, or How Markets Work

Last week, I spoke about the “smart” market and the “dumb” market.

Looking across asset class behavior over the last couple of years, it’s become evident, there is another major driver.

Liquidity.

Hedge fund legend George Soros was an early investor in my hedge fund because he was looking for a pure Japan play. But I learned a lot more from him than he from me.

No shocker here: it’s all about the money.

Follow the flow of funds and you will always know where to invest. If you see a sustainable flow of money into equities, you want to own stocks. The same is true with bonds.

There is a corollary to this truism.

The simpler an idea, the more people will buy it. One can think of many one or two-word easy-to-understand investment themes that eventually led to bubbles: the Nifty Fifty, the Dotcom Boom, Fintech, Crypto Currencies, and oil companies.

Spot the new trend, get in early, and you make a fortune (like me and Soros). Join in the middle, and you do OK. Join the party at the end and it always ends in tears, as those who joined crypto a year ago learned at great expense.

If I could pass on a third Soros lesson to you, it would be this. Anything worth doing is worth doing big. This is why you have seen me frequently with a triple position in the bond market, or the double short I put on with oil companies two weeks ago, clearly just ahead of a meltdown.

Which brings me back to liquidity.

There are only two kinds of markets: liquidity in and liquidity out. Liquidity was obviously pouring into markets from 2009. This is why everything went up, including both stocks and bonds. That liquidity ended on January 4, 2022. Since then, liquidity has been pouring out at a torrential rate and everything has been going down.

So, what happened on October 14, 2022?

The hot money, hedge funds, and you and I started betting that a new liquidity in cycle will begin in 2023 and continue for five, or even ten years. This is why we have made so much money in the past two months.

Notice that liquidity out cycles are very short when compared with liquidity in cycles, one to two years versus five to ten years. That’s because populations expand creating more customers, technology advances creating more products and services, and economies get bigger.

When I first started investing in stocks, the U.S. population was only 189 million, the GDP was $637 billion, and if you wanted a computer, you had to buy an IBM 7090 for $3 million. Notice the difference with these figures today: $25 trillion for GDP, a population of 335 million, and $99 for a low-end Acer laptop, which has exponentially more computer power than the old IBM 7090.

What did the stock market do during this time? The Dow Average rocketed by 54 times, or 5,400%. And you wonder why I am so long term bullish on stocks. The people who are arguing that we will have a decade of stock market returns are out of their minds.

Which reminds me of an anecdote from my Morgan Stanley days, in my ancient, almost primordial past. In September 1982, I met with the Head of Investments at JP Morgan Bank (JPM), Mr. Carl Van Horn. I went there to convince him that we were on the eve of a major long term bull market and that he should be buying stocks, preferably from Morgan Stanley.

Every few minutes he said, “Excuse me” and left the room to return shortly. Years later, he confided in me that whenever he left, he placed an order to buy $100 million worth of stock for the bank’s many funds every time I made a point. That very day proved to be the end of a decade-long bear market and the beginning of an 18-year bull market that delivered a 20-fold increase in share prices.

But there is a simpler explanation. Liquidity in markets are a heck of a lot more fun than liquidity out ones, where your primary challenge is how to spend your newfound wealth.

I vote for the simpler explanation.

Yes, this is how markets work.

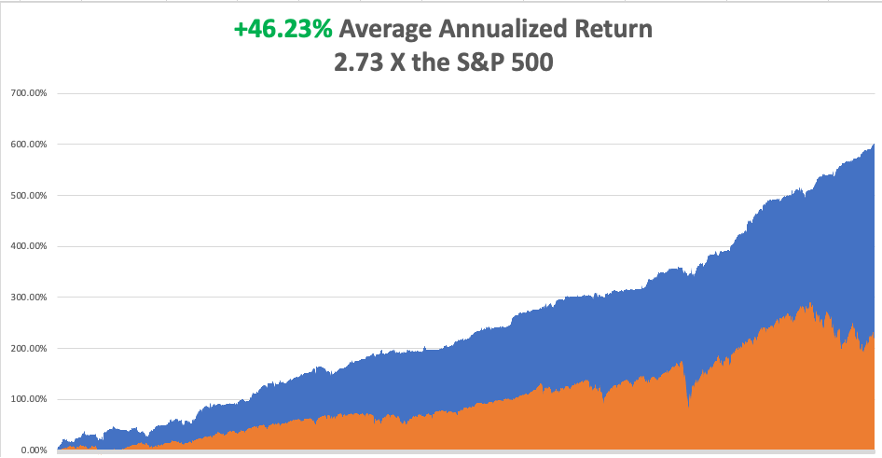

My performance in December has so far tacked on another robust +4.85%. My 2022 year-to-date performance ballooned to +88.53%, a spectacular new high. The S&P 500 (SPY) is down -17.0% so far in 2022.

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +92.92%.

That brings my 14-year total return to +601.09%, some 2.73 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +46.23%, easily the highest in the industry.

I took profits in my oil shorts in (XOM), (OXY), (SPY), and (TSLA). I am keeping one long in (TSLA), with 90% cash for a 10% long position.

Producer Prices Come in High, up 0.3% in November, driven by rising prices for services. It sets up an exciting CPI for Tuesday morning.

Emerging Markets Saw Massive Inflows in November, some $37.4 billion, the most since June 2021. Chinese technology stocks were two big beneficiaries, down 80%-90% from their highs. This could be one of the big 2023 performers if the US dollar and interest rates continue to fall. Buy (EEM) on dips.

Oil is in Free Fall, with 57 fully loaded Russian tankers about to hit the market. Nobody wants it ahead of a recession. All mad hedge short plays in energy are coming home. When will the US start refilling the Strategic Petroleum Reserve?

Turkey Blocks Russian Oil at the Straights of Bosporus, checking insurance papers, which are often turning out to be bogus. Insurance Russian tankers are now illegal in western countries. Many of these tankers are ancient, recently diverted from the scrapyard and in desperate need of liability insurance. Oil spills are expensive to clean up. Just ask any Californian.

Tesla Cuts Production in China, some 20% at its Shanghai Gigafactory for its Model Y SUV, or so the rumor goes. The short sellers are back! These are the kind of rumors you always hear at market bottoms.

US Unemployment to Peak at 5.5% in Q3 of 2023, according to a survey from the University of Chicago Business School. A tiny handful expects a higher 7.0% rate. Some 85% of economists polled expect a recession next year. After that, the Fed will take interest rates down dramatically to bring unemployment back down. No room for a soft landing here.

Home Mortgage Demand Plunges in another indicator of a sick housing market, which is 20% of the US economy. New applications are down a stunning 86% YOY despite a dive in the 30-year rate to 6.41%, but nobody is selling. Refis are now nonexistent.

Gold Continues on a Tear, hitting new multi-month highs. With interest rates certain to plummet in 2023 as the Fed reacts to a recession, Gold could be one of the big trades for next year. Buy (GLD), (GDX), and (GOLD) on dips.

Services PMI Hits New Low for 2022 at a recessionary 46.2. Nothing but ashes in this Christmas stocking. It didn’t help bonds, which sold off two points yesterday.

Demand Collapse Hits China (FXI), with US manufacturing there down 40% and many factories closing early for the New Year. Container traffic from the Middle Kingdom is down 21% over the past three months, astounding ahead of Christmas.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, December 12 at 8:00 AM, the Consumer Inflation Expectations for November is published.

On Tuesday, December 13 at 8:30 AM EST, the Core Inflation Rate for November is out

On Wednesday, December 14 at 11:00 AM EST, the Federal Reserve Interest rates decision is announced. The Press Conference follows at 11:30.

On Thursday, December 15 at 8:30 AM EST, the Weekly Jobless Claims are announced. Retail Sales for November are printed.

On Friday, December 16 at 8:30 AM EST, the S&P Global Composite Flash PMI for December is disclosed. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, in 1978, the former Continental Airlines was looking to promote its Air Micronesia subsidiary, so they hired me to write a series of magazine articles about their incredibly distant, remote, and unknown destinations.

This was the only place in the world where jet engines landed on packed coral runways, which had the effect of reducing engines lives by half. Many had not been visited by Westerners since they were invaded, first by the Japanese, then by the Americans, during WWII.

That’s what brought me to Tarawa Atoll in the Gilbert Islands, and island group some 2,500 miles southwest of Hawaii in the middle of the Pacific Ocean. Tarawa is legendary in the US Marine Corps because it is the location of one of the worst military disasters in American history.

In 1942, the US began a two-pronged strategy to defeat Japan. One assault started at Guadalcanal, expanded to New Guinea and Bougainville, and moved on to Peleliu and the Philippines.

The second began at Tarawa, and carried on to Guam, Saipan, and Iwo Jima. Both attacks converged on Okinawa, the climactic battle of the war. It was crucial that the invasion of Tarawa succeed, the first step in the Mid-Pacific campaign.

US intelligence managed to find an Australian planter who had purchased coconuts from the Japanese on Tarawa before the war. He warned of treacherous tides and coral reefs that extended 600 yards out to sea.

The Navy completely ignored his advice and in November 1943 sent in the Second Marine Division at low tide. Their landing craft quickly became hung up on the reefs and the men had to wade ashore 600 yards in shoulder-high water facing withering machine gun fire. Heavy guns from our battleships saved the day but casualties were heavy.

The Marines lost 1,000 men over three days, while 4,800 Japanese who vowed to keep it at all costs, fought to the last man.

Some 35 years later, it was with a sense of foreboding that I was the only passenger to debark from the plane. I headed for the landing beaches.

The entire island seemed to be deserted, only inhabited by ghosts, which I proceeded to inspect alone. The rusted remains of the destroyed Marine landing craft were still there with their twin V-12 engines, black and white name plates from “General Motors Detroit Michigan” still plainly legible.

Particularly impressive was the 8-inch Vickers canon the Japanese had purchased from England, broken in half by direct hits from US Navy fire. Other artillery bore Russian markings, prizes from the 1905 Russo-Japanese War transported from China.

There were no war graves, but if you kicked at the sand human bones quickly came to the surface, most likely Japanese. There was a skull fragment here, some finger bones there, it was all very chilling. The bigger Japanese bunkers were simply bulldozed shut by the Marines. The Japanese are still in there. I was later told that if you go over the area with a metal detector it goes wild.

I spend a day picking up the odd shell casings and other war relics. Then I gave thanks that I was born in my generation. This was one tough fight.

For all the history buffs out there, one Marine named Eddie Albert fought in the battle who, before the war, played “The Tin Man” in the Wizard of Oz. Tarawa proved an expensive learning experience for the Marine Corps, which later made many opposed landings in the Pacific far more efficiently and with far fewer casualties. And they paid much attention to the tides and reefs, developing Underwater Demolition Teams, which later evolved into the Navy Seals.

The true cost of Tarawa was kept secret for many years, lest it speak ill of our war planners, and was only disclosed just before my trip. That is unless you were there. Tarawa veterans were still in the Marine Corps when I got involved during the Vietnam War and I heard all the stories.

As much as the public loved my articles, Continental Airlines didn’t make it and was taken over by United Airlines (UAL) in 2008 as part of the Great Recession airline consolidation.

Tarawa is still visited today by volunteer civilian searchers looking for soldiers missing in action. Using modern DNA technology, they are able to match up a few MIAs with surviving family members every year. I did the same in Guadalcanal.

As much as I love walking in the footsteps of history, sometimes the emotional price is high, especially if you knew people who were there.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Tarawa November 1943

Broken Japanese Cannon

Armstrong 8-Inch Cannon 1900

US Landing Craft on the Killer Reef

How to Get to Tarawa

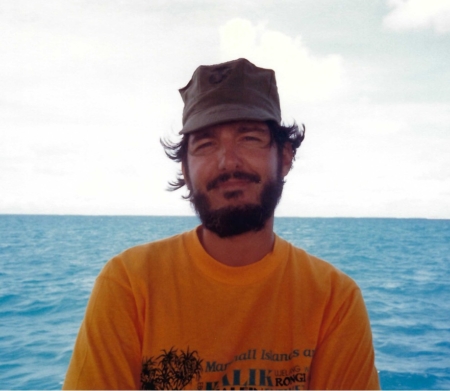

Roving Foreign Correspondent on Tarawa in 1978

Second Marine Division WWII Patch