The Market Outlook for the Week Ahead, or How to Trade the 4th Quarter

In a mere six months, the Federal Reserve has morphed from Dr. Jekyll into Mr. Hyde.

It has changed from the stock market’s best friend to its worst enemy. Not only has the punch bowl been taken away, but it has also been smashed on the floor in a thousand pieces. A regime change has taken place in risk.

Welcome to a hostile Fed, one that utterly hates the stock market and loves cash. In fact, it loves cash so much it has raised its bid for overnight money from nothing to 4.2% in only six months. It is the fastest rise in interest rates in history.

To say that conditions have changed for the stocks would be the understatement of the century. This makes stocks less valuable, especially anything connected with growth, like technology stocks, and big borrowers, such as cruise lines.

Which raises the important question of the day: How the HECK are we going to trade the stock market in Q4?

It was in September of 2020 when 34 of my clients became millionaires buying TESLA at precisely the right time…

Well, the stars have aligned once again!!!!

In my TESLA free report, I list 10 reasons I’d tell my grandmother to mortgage her house and go all in.

Go to madhedgeradio.com and download my “Tesla Takes Over the World” free report.

Let me give you the good news first.

Q4 is likely to establish the final low for the bear market in stocks for this cycle. I don’t buy the endless years of suffering or the “lost decade” theories. Technology is just evolving too fast. It really makes no difference whether that low is at (SPX) $3,600, $3,300, or even $3,000. The best entry point for stocks in a decade will soon be at hand.

Keep in mind that with an (SPX) at $3,000 the market will be down a horrific 37.5% in a year. That is a worst-case scenario. A collapse this rapid has not happened since 1929.

This is for an economy that has seen no financial stresses whatsoever, except in crypto. This time, there are no banks going under, brokers going bust, housing crashes, or other similar stresses that drove the (SPX) down 52% by 2009.

There is nowhere near the misallocation of capital and malinvestment that we saw 15 years ago. Down 37.5% sounds like a screaming bargain to me.

The early “tell” that we are approaching the end came on Friday when the Volatility Index (VIX) hit $32.31. With any luck, it could top $40 in the coming weeks. Friday, when the Dow Average was down 800 points, we saw the largest put option buying in market history.

At that point, it will be possible for me to construct positions for you that are mathematically impossible to lose money with and offer the upside potential return of 10:1.

Once a handful of other technical indicators kick in, we’re there. This is what you should be looking for:

The (VIX) tops $40

Volume spikes

Down stocks top up ones by 90:10

The put:call ratio hits 2:1

A big intraday reversal that closes higher, like down $100 for the (SPX), up $150

Technology stocks, the most volatile sector in the market, also deliver a major turnaround

We get a dramatically lower report for the Consumer Price Index (and the next one is out October 13)

The Mad Hedge Market Timing Index falls below 10

So, what to buy this time?

With the Midterm elections now only 43 days away on Tuesday, November 8, it’s time to contemplate the implications for your retirement portfolio. The play of the decade is setting up.

Let me give you the good news first.

Whoever wins, and at this point, it really could be anyone, markets will rally after the election and power on until the end of 2022, some 10%-20%. The mere fact that the election is over is a huge market positive.

That’s the easy part.

But what if the election was held today?

The polls are telling us that the Democrats could pick up 2-3 seats in the Senate. The House now looks like a 50/50 split. Control could literally hinge on a handful of battleground states.

Suburban housewives now appear to be the great deciders.

So, what happens if the Democrats keep control of both houses, and the status quo is maintained?

For a start, taxes will be going up a lot, especially for the wealthy. Carried interest might finally make the ultimate sacrifice after coming back from the dead countless times. SALT taxes might get a break, but it is not likely. Once the government gets its hands on a revenue stream, it is loath to give it up.

It’s spending where we will see some important changes. Think more of the last two years, but in larger amounts.

Support for the Ukraine War will continue. So far, the US is getting great value for money. To eliminate the major military threat to the US and Europe for only $50 billion is the deal of the century. I’d pay ten times that.

So far, the Ukrainians are doing all the dying and we only write the checks. I greatly prefer that to a Vietnam-style commitment that bleeds us white (and by the way, I did some of that bleeding). Believe me, I’m doing everything I can to help by advising the Joint Chiefs of Staff.

The real game changer will be an alternative energy bill much larger than the last $733 billion bill. The goal will be to accelerate the decarbonization of the US, and ultimately the global economy. Of course, the free market will drive this anyway. No major automaker will be building internal combustion engines after 2030. What the government can do is to make it happen fast.

A year ago, climate change was an “it might happen someday after I’m long gone” kind of possibility. After a summer of 116 degrees in California and 114 degrees in France, “someday” has become “Yikes, it’s happening now!”

The last bill was truly misnamed as the “Inflation Reduction Act.” It really should have been called the “Tesla Shareholder Enrichment Bill”. Virtually every aspect of the bill somehow impinges on Elon Musk’s creation positively, which has been an overwhelming market leader in national electrification, enhanced EV subsidies, mass construction of charging stations, solar panels, and power walls, and decarbonization.

Since I am a major shareholder in (TSLA) and have been since the shares traded at $2.35, that’s fine with me. That probably explains why the shares are in the process of engineering a major upside breakout well before the election.

It isn’t just Tesla that will cash in. There is a broadening new leadership developing for the market to replace my technology stocks. Call it the “decarbonization sector”.

It includes EVs like Tesla (TSLA) and Rivian (RIVN), commodity stocks like copper miner Freeport McMoRan (FCX), uranium stocks like Cameco (CCJ) and the Uranium ETF (URA), solar companies like First Solar (FSLR) and SunPower (SPWR), alternative utilities like NextEra Energy (NEE), the world’s largest generator of electricity from wind and the sun, and silver plays like the iShares Silver Trust (SLV) and Wheaton Precious Metals (WPM), essential for high-efficiency wiring.

I will be adding more names to this list as I find them. Watch your research inbox.

Of course, 43 days in the political world is a couple of lifetimes in the real world, so anything can happen. A boatload of October surprises is probably just around the corner.

As for me, I’m putting more of my money into Tesla.

It all raises a new risk that we haven’t dealt with before.

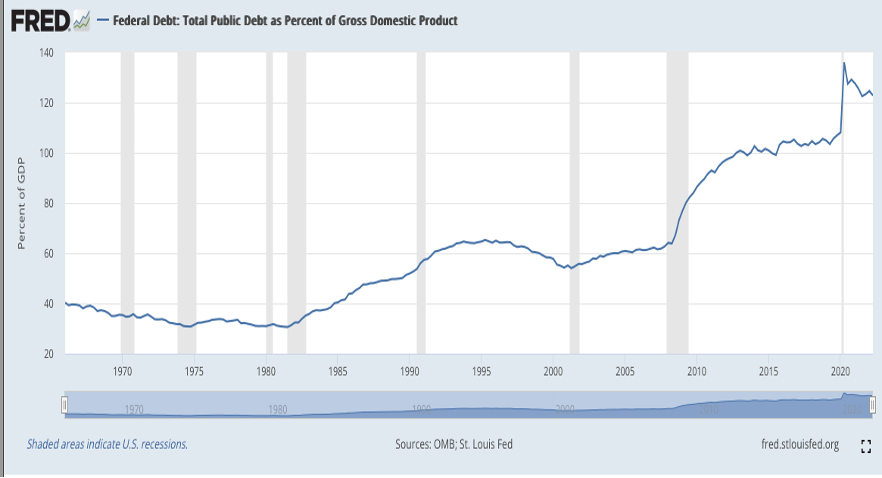

What if the US government can’t afford to pay its own debt? When the last financial crisis and recession began in 2007, the US national debt was only a paltry $9 trillion, or 60% of GDP. It has since risen to $30 trillion, or 140% of GDP. Holy smokes!

That was all well and good while interest rates were dropping from 7% to zero. What happens when rates go back up from zero to 7.0%? The cost of carry for the US Treasury more than doubles as well, taking a much bigger bite of government spending, more than it can afford.

Just thought you’d like to know.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility in market history, my September month-to-date performance maintained at +1.68%.

I used last week’s extreme volatility to add shorts in Apple (AAPL), the S&P 500 (SPY), and the United States US Treasury bond fund (TLT). That takes me to 30% long, 30% short, and 40% cash. I am holding back my cash for a truly cataclysmic market selloff.

My 2022 year-to-date performance ballooned to +61.64%, a new high. The Dow Average is down -18.48% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +72.06%.

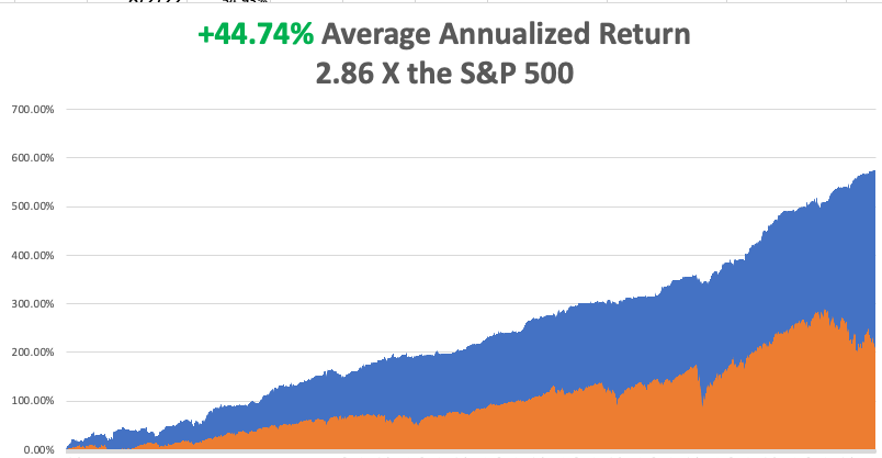

That brings my 14-year total return to +574.20%, some 2.86 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +44.74%, easily the highest in the industry.

On Monday, September 26 at 8:30 AM, the Chicago Fed National Activity Index for August is released.

On Tuesday, September 26 at 7:00 AM, the Durable Goods Index for August is out. New Home Sales are also printed.

On Wednesday, September 28 at 7:00 AM, Pending Home Sales for August are published.

On Thursday, September 29 at 8:30 AM, Weekly Jobless Claims are announced. We also learn the final report for US Q2 GDP.

On Friday, September 30 at 7:00 AM, the Personal Income and Spending are disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, I’ve found a new series on Amazon Prime called 1883. It is definitely NOT PG rated, nor is it for the faint of heart. But it does remind me of my own cowboy days.

When General Custer was slaughtered during his last stand at the Little Big Horn in 1876 in Montana, my ancestors spotted a great buying opportunity. They used the ensuing panic to pick up 50,000 acres near the Wyoming border for ten cents an acre.

Growing up as the oldest of seven kids, my parents never missed an opportunity to farm me out with relatives. That’s how I ended up with my cousins near Broadus, Montana for the summer of 1966.

When I got off the Greyhound bus in nearby Sheridan, I went into a bar to call my uncle. The bartender asked his name and when I told him “Carlat”, he gave me a strange look.

It turned out that my uncle had killed someone in a gunfight in the street out front a few months earlier, which was later ruled self-defense. It was the last public gunfight seen in the state, and my uncle hasn’t been seen in town since.

I was later picked up in a beat-up Ford truck and driven for two hours down a dirt road to a log cabin. There was no electricity, just kerosene lanterns and a propane-powered refrigerator.

Welcome to the 19th century!

I was hired as a cowboy, lived in a bunk house with the rest of the ranch hands, and was paid the princely sum of a dollar an hour. I became popular by reading the other cowboys newspapers and their mail since they were all illiterate. Every three days we slaughtered a cow to feed everyone on the ranch. I ate steak for breakfast, lunch, and dinner.

On weekends, my cousins and I searched for Indian arrowheads on horseback, which we found by the shoe box full. Occasionally, we got lucky finding an old rusted Winchester or Colt revolver just lying out on the range, a remnant of the famous battle 90 years before. I carried my own six-shooter to help reduce the local rattlesnake population.

I really learned the meaning of work and developed callouses on my hands in no time. I had to rescue cows trapped in the mud (stick a burr under their tail and make them mad), round up lost ones, and sawed miles of fence posts. When it came time to artificially inseminate the cows with superior semen imported from Scotland, it was my job to hold them still. It was all heady stuff for a 15-year-old.

The highlight of the summer was participating in the Sheridan Rodeo. With my uncle being one of the largest cattle owners in the area, I had my pick of events. So, I ended up racing a chariot made from an old oil drum, team roping (I had to pull the cow down to the ground), and riding a brahman bull. I still have a scar on my left elbow from where a bull slashed me, the horn pigment clearly visible.

I hated to leave when I had to go home and back to school. But I did hear that the winters in Montana are pretty tough.

It was later discovered that the entire 50,000 acres were sitting on a giant coal seam 50 feet thick. You just knocked off the topsoil and backed up the truck. My cousins became millionaires. They built a modern four-bedroom house closer to town with every amenity, even a big screen TV. My cousin also built a massive vintage car collection.

During the 2000s, their well water was poisoned by a neighbor’s fracking for natural gas, and water had to be hauled in by truck at great expense. In the end, my cousin was killed when the engine of the classic car he was restoring fell on top of him when the rafter above him snapped.

It all gave me a window into a lifestyle that was then fading fast. It’s an experience I’ll never forget.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader