The Market Outlook for the Week Ahead, or It’s Time for Pain

Please don’t call me anymore.

I don’t want to hear from you, not even for a second!

I’ve deleted your email from my address book, unfriended you from Facebook, and already forgotten your telephone number.

For you have committed the ultimate sin.

You have asked me if the market is going to crash in September one too many times. This is for a market that over the last 100 years has gone up 80% of the time.

I wouldn’t mind if it were just you. But hundreds of you? Really?

Hardly an hour goes by without me getting an email, text message, or phone call telling me that you just heard from another guru saying that we are going into another Great Depression, 1929-style stock market crash, and financial Armageddon.

Enough already!

These permabear gurus have been the bane of my life for the last 54 years, even 60 years if you count the time I traded stocks in my dad’s brokerage account when I was a paper boy.

First, there was Joe Granville (RIP), the first Dr. Doom, who in 1982 predicted that the Dow Average would crater from 600 to 300. Instead, it went up 20 times to 12,000. Joe never did change his mind.

Next came one-hit wonder Elaine Gazarelli at Lehman Brothers who accurately predicted the 1987 crash, which delivered a one-day 20% haircut for the Dow. She kept on endlessly predicting crashes after that which never showed up. In the end, the Dow went up 18 times. At least Elaine’s Lehman Brothers stock went to zero.

Then we got another Dr. Doom, Dr. Nouriel Roubini, who turned bearish going into the 2008-2009 Great Recession when the Dow took a 54% hickey. Did the eminent doctor ever turn bullish? Not that I’ve heard, and the Dow went up 6X from that bottom.

So, here we are today. Fed governor Jay Powell has just suggested that he may keep interest rates higher for longer and that we may be in for some pain. That took the Dow down 1,000, with high-growth technology stocks leading the charge to the downside.

And what do I get, but an email from a subscriber saying he just heard from another guru saying that Powell’s comments confirm that we are not headed for a Roaring Twenties but a whimpering twenties, and that the Dow is plunging to 3,000.

Give me a break!

I have a somewhat different read on Powell’s comments.

Not only will they bring a PEAK in interest rates much sooner, but they also move forward the first CUT in interest rates in three years as well. That is what long term investors and hedge funds are looking for, not the last move in the current trend, but the first move in the next trend.

That’s what all the long-term money is doing, which accounts for 90% of market ownership.

That’s what the smart money is doing.

The Volatility Index (VIX) rocketed to $26 on Friday. Call me when it gets to $30. Then I might get interested.

In the meantime, the dumb money is selling.

It helps a lot that the principal drivers of Powell’s high interest rate are rolling over fast. Residential real estate is in the process of becoming a major drag on the economy. Used car have gone from an extreme shortage to a glut in two months. I never did sell that 1968 Chevy Corvair. The online jobs market has suddenly gone from bid to offered.

I am praying that Powell’s comments bring us a 4,000 Dow point selloff and a double bottom at (SPY) $362. For that will set up another 20%-30% worth of money-making opportunities by yearend.

If that happens, I am going to book the Owner’s Suite on the Queen Mary II for a Transatlantic cruise, the Orient Express, and a week at the Cipriani Hotel in Venice.

But wait!

I’ve already booked the owners suite on the Queen Mary II, the Orient Express, and the Cipriani Hotel, thanks to this summer’s Tesla (TSLA) trades.

How do you upgrade Q1 class?

I guess I’ll just have to get creative.

Fed Governor Powell pees on Stock Market Parade from the greatest possible height, giving an extremely hawkish speech at Jackson Hole. “Some Pain” is ahead. The market took the hint and sold off 1,000 points in a heartbeat ending at the lows, with technology taking the greatest hit. That puts a 75-basis point rate hike back on the table for September together with a major market correction. Have a nice flight back to DC Jay. That leaves me quite happy with my one put spread in the (SPY) and 90% cash.

Inflation is in Free Fall. It’s not just gasoline, but every product that uses energy. That has rapidly cut the prices of airline tickets, rental cars, butter, and even chicken breasts. Used cars have gone from a shortage to a glut in months. New job offers are fading rapidly. I’m looking for a 4% inflation rate by year-end….and a soaring stock market.

California Bans Internal Combustion Engine Sales by 2035. It’s a symbolic gesture because the market will move beyond them well before 13 years. Both (GM) and Ford (F) said they’re going all EV. I went all-EV in 2010 and saved a bundle.

QT Accelerates Next Thursday to $95 billion a month and you may wonder why stock markets aren’t crashing. QT will come to 1% of the outstanding $9 trillion Fed balance sheet per month and continue at that rate for the indefinite future. At that rate, the Fed balance sheet won’t be unwound until 2032. Many more factors will arrive to move stocks up or down before then. In order words, the Fed is trying to take $9 trillion out of the system with no one noticing. They may succeed.

Biden Cancels $10,000 in Student Debt per Borrower, and $20,000 for Pell Grants. Some 9 million borrowers will have their loans wiped clean. It is a positive for the economy and minimally inflationary as a lot of these college graduates went into low-paying jobs like teaching or government service. Biden is delivering for the people who voted for him. What a shocker! Too bad I already paid my loan in full. How much did a four-year education cost me? $3,000! It’s my most rapidly appreciating asset.

Pending Home Sales Dive 1% in July on a signed contract basis and are down 19.9% YOY. Only the west saw an increase. Some eight of nine months have shown declines. Homes are sitting on the market longer and sellers are pulling back. Anyone who sells now loses their 2.75% mortgage and won’t get it back.

US Vehicle Prices Hit Record High, despite soaring interest rates. The average transaction price rose to $46,259, up 11.5% YOY. Inventory shortages continue to limit sales, with August expected to reach 980,000 units, down 2.6% YOY. It makes big-ticket EVs even more competitive.

Toll Brothers Orders Plunge 60% in Q2, as demand for luxury homes vaporize. It expects to be down 15% for the full year. It could take 18 months for these dire numbers to be in the general economy. Tol (TOL) dominates in the “move up market” where prices average $1 million or more and is especially dependent on home mortgages.

New Home Sales Crash 12.6%, in July, the worst number since the Great Recession 2008 level. The housing recession is here for sure, but how bad will it get when we have a shortage of 10 million homes?

OPEC+ Maneuvers for Supply Cut to halt the dramatic 35% price decline. The futures market is discounting much greater declines, which the Saudis describe as “broken.” You are on the other side of this trade.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil prices and inflation now rapidly declining, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the market volatility (VIX) now dying, my August month-to-date performance appreciated to +4.87%.

My 2022 year-to-date performance ballooned to +59.70%, a new high. The Dow Average is down -12.8% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +73.75%.

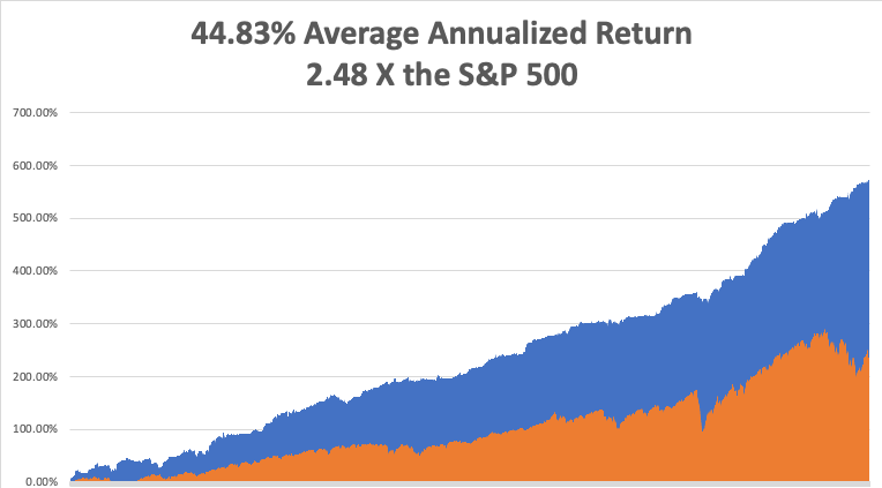

That brings my 14-year total return to +572.26%, some 2.56 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +44.83%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 94 million, up 300,000 in a week and deaths topping 1,043,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, August 29 at 8:30 AM EDT, the Dallas Fed Manufacturing Index for August is released.

On Tuesday, August 30 at 7:00 AM, the S&P Case Shiller National Home Price Index for August is out. The monthly cycle of job reports starts with JOLTS at 7:00 AM.

On Wednesday, August 31 at 7:15 AM, ADP Private Sector Employment for July is published.

On Thursday, September 1 at 8:30 AM, Weekly Jobless Claims are announced. US GDP for Q2 is released.

On Friday, September 2 at 7:00 AM, the Nonfarm Payroll Report for August is disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, back in the early 1980s, when I was starting up Morgan Stanley’s international equity trading desk, my wife Kyoko was still a driven Japanese career woman.

Taking advantage of her near-perfect English, she landed a prestige job as the head of sales at New York’s Waldorf Astoria Hotel.

Every morning, we set off on our different ways, me to Morgan Stanley’s HQ in the old General Motors Building on Avenue of the Americas and 47th street and she to the Waldorf at Park and 34th.

One day, she came home and told me there was this little old lady living in the Waldorf Towers who needed an escort to walk her dog in the evenings once a week. Back in those days, the crime rate in New York was sky high and only the brave or the reckless ventured outside after dark.

I said, “Sure, What was her name?”

Jean MacArthur.

I said, "THE Jean MacArthur?"

She answered “yes.”

Jean MacArthur was the widow of General Douglas MacArthur, the WWII legend. He fought off the Japanese in the Philippines in 1941 and retreated to Australia in a night PT Boat escape.

He then led a brilliant island-hopping campaign, turning the Japanese at Guadalcanal and New Guinea. My dad was part of that operation, as were the fathers of many of my Australian clients. That led all the way to Tokyo Bay where MacArthur accepted the Japanese in 1945 on the deck of the battleship Missouri.

The MacArthurs then moved into the Tokyo embassy where the general ran Japan as a personal fiefdom for seven years, a residence I know well. That’s when Jean, who was 18 years the general’s junior, developed a fondness for the Japanese people.

When the Korean War began in 1950, MacArthur took charge. His landing at Inchon harbor broke the back of the invasion and was one of the most brilliant tactical moves in military history. When MacArthur was recalled by President Truman in 1952, he had not been home for 13 years.

So it was with some trepidation that I was introduced by my wife to Mrs. MacArthur in the lobby of the Waldorf Astoria. On the way out, we passed a large portrait of the general who seemed to disapprovingly stare down at me taking out his wife, so I was on my best behavior.

To some extent, I had spent my entire life preparing for this job.

I had stayed at the MacArthur Suite at the Manila Hotel where they had lived before the war. I knew Australia well. And I had just spent a decade living in Japan. By chance, I had also read the brilliant biography of MacArthur by William Manchester, American Caesar, which had only just come out.

I also competed in karate at the national level in Japan for ten years, which qualified me as a bodyguard. In other words, I was the perfect after-dark escort for Midtown Manhattan in the early eighties.

She insisted I call her “Jean”; she was one of the most gregarious women I have ever run into. She was grey-haired, petite, and made you feel like you were the most important person she had ever run into.

She talked a lot about “Doug” and I learned several personal anecdotes that never made it into the history books.

“Doug” was a staunch conservative who was nominated for president by the Republican party in 1944. But he pushed policies in Japan that would have qualified him as a raging liberal.

It was the Japanese that begged MacArthur to ban the army and the navy in the new constitution for they feared a return of the military after MacArthur left. Women gained the right to vote on the insistence of the English tutor for Emperor Hirohito’s children, an American quaker woman. He was very pro-union in Japan. He also pushed through land reform that broke up the big estates and handed out land to the small farmers.

It was a vast understatement to say that I got more out of these walks than she did. While making our rounds, we ran into other celebrities who lived in the neighborhood who all knew Jean, such as Henry Kissinger, Ginger Rogers, and the UN Secretary-General.

Morgan Stanley eventually promoted me and transferred me to London to run the trading operations there, so my prolonged free history lesson came to an end.

Jean MacArthur stayed in the public eye and was a frequent commencement speaker at West Point where “Doug” had been a student and later the superintendent. Jean died in 2000 at the age of 101.

I sent a bouquet of lilies to the funeral.