The Market Outlook for the Week Ahead, or New All-Time Highs and New All-Time Highs

We knew the May Nonfarm Payroll Report was coming in hot when the president leaked the numbers ahead of time. He tweeted that he "Was looking forward to" the numbers hours before the official release.

Last month, when the report was weak, we heard nary a word from Twitter. Just add that to the ever-growing list of unpredictables we traders have to deal with on a daily basis.

As for myself, I was looking for robust numbers last Tuesday when I piled on an aggressive, highly leveraged short position in the bond market, right at the four months highs. When bonds collapsed my reward was a 62.50% profit in only three trading days.

In the blink of an eye, we have made back half of the drop in interest rates prompted by the Italian political crisis. Ten-year U.S. Treasury yields plunged from 3.12% all the way down to 2.75% and are now back up to 2.92%. Bonds have almost fallen three points in three days.

This trade instructs you on the merits of going outright long options instead of more conservative spreads when you expect a very sharp, rapid move in the immediate term.

The result was to take the performance of the Mad Hedge Trade Alert Service to yet another all-time high. Those who signed up at any time in the past 12 months have to be extremely happy.

After one trading day, my June return is +2.94%, my year-to-date return stands at a robust 23.31%, my trailing one-year return has risen to 59.20%, and my eight-year profit sits at a 299.78% apex.

The payroll report suggests that the nine-year economic expansion will easily growth to 10. Never mind that we are putting it all on an American Express card and that our kids are going to have to pick up the tab. For now, it's happy days.

That means my 2018 year-end forecast is alive and well for a (SPY) of 3,000. If earnings continue to grow at a 25% annual rate and you assume a modest 17.5 X, getting there is a chip shot. Next year is another story, when year-on-year growth rates fall to zero.

The jobs report came in at 223,000 versus the three-month average of 175,000, and the Headline Unemployment Rate dropped to 3.8%, a new decade low. Average Hourly Earnings rose to an inflationary 0.3%.

Retail gained 31,0000 jobs, Health Care 29,000, and Construction 25,000. Only Temporary Workers lost 7,800.

The broader U-6 "discouraged worker" unemployment rate fell to 7.6%, a 17-year low.

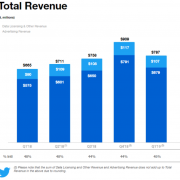

The major hallmark of the week was an upside breakout of technology. Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), and Facebook (FB) all hit historic highs.

I don't know why tech is breaking out here. Maybe the market is discounting another round of blockbuster quarterly earnings that starts in two months. Possibly the tech growth rate is accelerating at the granular level.

Perhaps there is nothing else to buy. But for whatever reason, tech is going up and I want in. Tech is the secular growth story of our generation and will remain so for the foreseeable future.

The smartest that I have done this year is to start my Mad Hedge Technology Letter in February as it added 60 hours of research into tech companies into our research mix. As a result, the readers are swimming in profits.

This coming week is nearly clueless in terms of hard data releases.

On Monday, June 4, at 10:00 AM, we get May Factory Orders.

On Tuesday, June 5, May PMI Services is announced.

On Wednesday, June 6, at 7:00 AM, the MBA Mortgage Applications come out.

Thursday, June 7, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a fall of 11,000 last week from a 43-year low.

On Friday, June 8, at 8:30 AM EST, we get the Baker Hughes Rig Count at 1:00 PM EST, which rose by only 1 last week.

As for me, I will be glued to my TV watching the local Golden State Warriors trounce the Cleveland Cavaliers. That's providing they can overcome LeBron James, who seems to be a force of nature.

Good Luck and Good Trading.

New Highs!