The Market Outlook for the Week Ahead, or Powell’s Victory Lap

With almost all economic data now universally slowing, Fed Governor Jay Powell is limbering up to take his victory lap. That’s put inflation in full retreat and well on its way to our central bank’s 2% target by summer. Interest rate cuts are just a matter of time.

That sets up a fabulous year in 2024. While this year was mostly a hard slog, next year should be a piece of cake. I can’t wait until it starts!

That puts my 4,800 target for the end of 2023 well within range. People told me I was crazy when I made such an outlandish forecast last January 1, yet here we are.

Investors missed the mark by a mile this year because they thought the Fed's extreme moves in interest rates would trigger a recession.

It didn’t.

Those who bet on falling inflation this year were big winners. That gave the Fed permission to cancel any further rate rises. Economists were too bearish and the technical picture flipped from bearish to bullish in a heartbeat on October 26.

The kinds of moves you are seeing in the stock market, with banks and industrials turning upward, signal that we are not in a bear market, but the start of a new long-term bull one.

Stocks are looking for at least 15% gains in 2024 with earnings consistently surprising to the upside. Domestics will catch fire in the second half. Inflation will fall further than expected, well into the 2% handle, thanks to hyperaccelerating technology crushing prices.

The Fed has won the war on inflation so there is room for 10-year US Treasury bond yields to hit 3.0% next year, taking mortgage interest rates under 5.0%. That will be a shot of adrenaline for the residential real estate market.

A (SPY) target of 5,500 by the end of 2024 is entirely within reason.

It turns out that when ten-year bond yields are between 4.00% and 5.00%, stocks sport a price-earnings multiple of 20X. That allows S&P 500 earnings to hit $2.65 per share in 2025, up from today’s $2.20.

Financials (JPM), industrials (CAT), energy (XOM), and small caps (IWM) will take over market leadership sometime in 2024. The best market risk reward is here. Financials now trading in the dumps have huge multiple expansion potential.

The $240 billion in cash that left equities in 2023 will have to fight their way back in. That’s why we haven’t seen any substantial pullbacks in share prices since October. Once investors got the cash weightings they were happy with, they could never get back into stocks.

Hedge fund equity weightings are at five-year lows. Small caps have very heavy weightings in regional banks, while large banks have great capital spending plays.

Big techs, the meteoric performers of 2023, will likely take a rest sometime in Q1.

Europe and China took the big hits this year, but we didn’t. If they turn around, it will supercharge our economy….and the stock market.

Which brings me to the subject of bank stocks. Banks have had an atrocious 2023, when their shares were either flat or down big, underperforming the S&P 500 by a massive 30%. However, they are looking pretty darn attractive for 2024.

Banks now offer pretty cheap balance sheets relative to next year’s profit outlook, with many still trading at big discounts to book value. A recovering economy means new capital spending jumps, which is great for big banks. Exposure to high-risk office loans which get so much print from the financial media account for less than 5% of their loan books.

Small banks will put the March crisis behind them by recapitalizing or merging. It turns out that only a handful of banks were badly managed (no downside hedge on (TLT) holdings while they were crashing from $166 to $82!!). The survivors will build market share at higher margins.

Economic recovery also means default rates on loans ebb.

Goldman Sachs (GS) is my top pick, after being taken to the woodshed for a very expensive unwind of their poorly thought-out consumer business this year. Key Corp (KEY) is also looking good on a possible 70% earnings growth.

If you are looking for a pure small bank play, you can buy Webster Financial (WBS) based in Stamford, CT, Columbia Banking (COLB) of Tacoma, WA, or Pinnacle Financial (PNFP) from Nashville, TN.

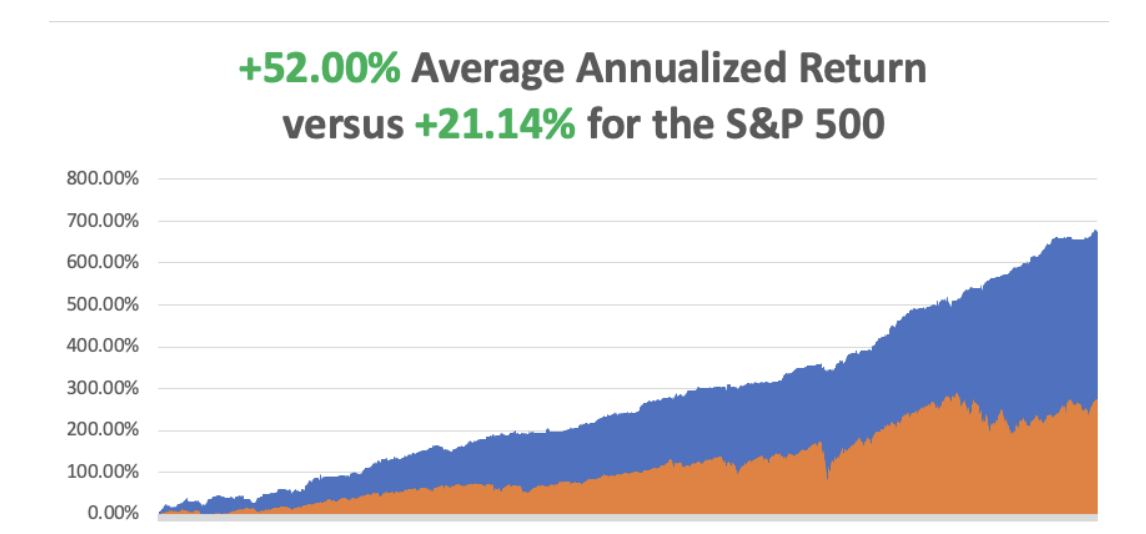

So far in December, we are down -2.85%. We’ve had a heck of a run and the market was bound to bite back sometime. My 2023 year-to-date performance is still at an eye-popping +78.86%. The S&P 500 (SPY) is up +21.05% so far in 2023. My trailing one-year return reached +75.38% versus +24.75% for the S&P 500.

That brings my 15-year total return to +676.05%. My average annualized return has exploded to +52.00%, another new high.

I am 40% invested with 60% in cash, with longs in (NLY), (BRK/B), (GOOGL), and (CAT). Last week, I got stopped out of a long in (XOM), thanks to the oil price dive, and a short in (TLT).

Some 63 of my 70 trades this year have been profitable this year.

Nonfarm Payroll Comes in Soft, in November at 199,000. The headline Unemployment Rate fell to 3.7%, near a 50-year low. Healthcare was the biggest growth industry, adding 77,000. Other big gainers included government (49,000), manufacturing (28,000), and leisure and hospitality (40,000). Average hourly earnings, a key inflation indicator, increased by 0.4% for the month and 4% from a year ago, close to expectations. It was a Goldilocks number for the Fed.

Refi Demand Rockets, as interest rates plunge to four-month lows. The rate for the popular 30-year mortgage fell back toward 7% after hitting 8% earlier this fall. Applications to refinance a home loan index increased 14% from the previous week and were 10% higher than the same week a year ago.

Exploding Sales of EVs Are Ringing the Bell for Oil, leading forecasters to speed up their projections for when global oil use will peak, as public subsidies and improved technology help consumers overcome the sometimes eye-popping sticker prices for battery-powered cars.

Panic Buying Drives Treasury Yields to 4.10%, down nearly a full percentage point in little more than a month on weakening economic data. It’s hard to believe that we drop below 4.10% but anything is possible in this market.

Uber Entered S&P 500, on December 18, taking the stock up 10% on the news. A company needs to fulfill certain criteria to be included in the S&P 500. Firstly, its market capitalization should be at least $14.5 billion. As of Dec 1, 2023, the market capitalization of UBER was $118.02 billion. Additionally, U.S. firms that meet profitability, liquidity, and share-float standards are the ones that can qualify for the S&P 500.

Pending Home Sales Collapse, dropping to the lowest level since the National Association of Realtors began tracking them in 2001. Sales were down 8.5% from October of last year. Tight supply and still-strong demand have kept pressure on home prices, which not only continue to hit new highs but appear to be accelerating in their gains. ales of homes priced above $750,000 have been increasing simply because there is more supply on the high end of the market.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, December 11, at 8:30 AM EST, the Consumer Inflation Expectations are out, one of the Fed’s favorite inflation reads.

On Tuesday, December 12 at 8:30 AM, the Consumer Price Index will be released. The Federal Reserve Open Market Committee starts a two-day meeting.

On Wednesday, December 13 at 2:00 PM, the Federal Reserve will release its interest rate decision. No change is expected. At 2:30, the Producer Price Index is out.

On Thursday, December 14 at 8:30 AM, the Weekly Jobless Claims are announced. We also get Retail Sales.

On Friday, December 15 at 2:30 PM, the October New York Empire State Manufacturing Index is published. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, it was with a heavy heart that I boarded a plane for Los Angeles to attend a funeral for Bob, the former scoutmaster of Boy Scout Troop 108.

The event brought a convocation of ex-scouts from up and down the West Coast and said much about our age.

Bob, 85, called me two weeks ago to tell me his CAT scan had just revealed advanced metastatic lung cancer. I said, “Congratulations Bob, you just made your life span.”

It was our last conversation.

He spent only a week in bed and then was gone. As a samurai warrior might have said, it was a good death. Some thought it was the smoking he quit 20 years ago.

Others speculated that it was his close work with uranium during WWII. I chalked it up to a half-century of breathing the air in Los Angeles.

Bob originally hailed from Bloomfield, New Jersey. After WWII, every East Coast college was jammed with returning vets on the GI bill. So he enrolled in a small, well-regarded engineering school in New Mexico in a remote place called Alamogordo.

His first job after graduation was testing V2 rockets newly captured from the Germans at the White Sands Missile Test Range. He graduated to design ignition systems for atomic bombs. A boom in defense spending during the fifties swept him up to the Greater Los Angeles area.

Scouts I last saw at age 13 or 14 are now 60, while the surviving dads were well into their 80s. Everyone was in great shape, those endless miles lugging heavy packs over High Sierra passes yielding lifetime benefits.

Hybrid cars lined both sides of the street. A tag-along guest called out for a cigarette and a hush came over a crowd numbering over 100.

Some things stuck. It was a real cycle of life weekend. While the elders spoke about blood pressure and golf handicaps, the next generation of scouts played in the backyard or picked lemons off a ripening tree.

Bob was the guy who taught me how to ski, cast rainbow trout in mountain lakes, transmit Morse code, and survive in the wilderness. He used to scrawl schematic diagrams for simple radios and binary computers on a piece of paper, usually built around a single tube or transistor.

I would run off to Radio Shack to buy WWII surplus parts for pennies on the pound and spend long nights attempting to decode impossibly fast Navy ship-to-ship transmissions. He was also the man who pinned an Eagle Scout badge on my uniform in front of beaming parents when I turned 15.

While in the neighborhood, I thought I would drive by the house in which I grew up, once a modest 1,800 square-foot ranch-style home to a happy family of nine. I was horrified to find that it had been torn down, and the majestic maple tree that I planted 40 years ago had been removed.

In its place was a giant, 6,000-square-foot marble and granite monstrosity under construction for a wealthy family from China.

Profits from the enormous China-America trade have been pouring into my hometown from the Middle Kingdom for the last decade, and mine was one of the last houses to go.

When I was class president of the high school here, there were 3,000 white kids and one Chinese. Today, those numbers are reversed. Such is the price of globalization.

I guess you really can’t go home again.

At the family's request, I assisted in liquidating his investment portfolio. Bob had been an avid reader of the Diary of a Mad Hedge Fund Trader since its inception and attended my Los Angeles lunches.

It seems he listened well. There was Apple (AAPL) in all its glory at a cost of $21. I laughed to myself. The master had become the student and the student had become the master.

Like I said, it was a real circle of life weekend.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Scoutmaster Bob

1965 Scout John Thomas

The Mad Hedge Fund Trader at Age 11 in 1963