The Market Outlook for the Week Ahead, or Searching for a Bottom

OK, I’ll give it to you straight.

If the American Coronavirus epidemic stabilizes at current levels of infection, the double bottom in the S&P 500 (SPX) at 2,850 will hold, down 16% from the all-time high two weeks ago.

If it gets worse, it won’t, possibly taking the index down another 8.8% to 2,600, the 2018 low. Not only have we lost the 2019 stock market performance, we may be about to lose 2018 as well.

Of course, the problem is testing kits, which the government has utterly failed to provide in adequate numbers. The president is relying on disease figures provided by Fox News and ignoring those of his own experts at the CDC. And the president told us that the governor of Washington state, the site of the first US Corona hot spot, is a “snake,” and that the outbreak on the Diamond Princess is not his fault.

It’s not the kind of leadership the stock market is looking for at the moment. It amounts to an economic and biological “Pearl Harbor” where the government slept while the disease ran rampant. Until we get the true figures, markets will assume the worst. The real number of untested cases could be in the hundreds of thousands or millions, not the 350 reported. And stock prices will react accordingly.

There is an interesting experiment going on at the Grand Princess 100 miles off the coast of San Francisco right now which will certainly affect your health. Of the 39 showing Corona symptoms, 21 were found to have the disease and 19 of these were crew.

That means ALL of the passengers who took the last ten cruises were exposed, about 30,000 people, 90% of whom are back ashore. The Grand Princess may turn out to be the “Typhoid Mary” of our age.

You can see these fears expressed in the volatility index, which hit a decade high on Friday at $55, although it closed at $42. We live in a world now were all economic data is useless, earnings forecasts are wildly out of date, and technical analysis is ephemeral at best. Airlines, restaurants, and public events are emptying out everywhere and the deleterious effects on the economy will be extreme.

That is kind of hard to trade.

The good news is that this won’t last more than a couple of months. By June, the epidemic will be fading, or we’ll all be dead. All of the buying you see now is of the “look through” kind where investors are picking up once in a decade bargains in the highest quality companies in expectation of ballistic moves upward out the other side of the epidemic.

Enormous fortunes will be made, but at the cost of a few sleepless nights over the next few weeks. The bear market will end when everyone who needs tests get them and we obtain the results.

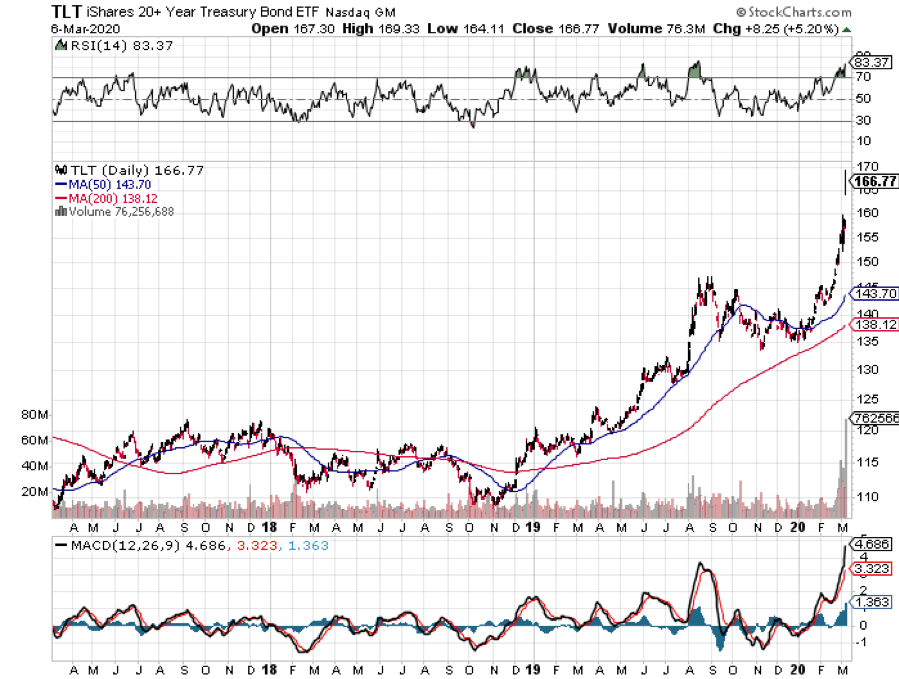

The Fed cut interest rates by 50 basis points taking the overnight rate down to 1.25%. They may cut again in two weeks. Traders were looking for some kind of global stimulus to head off a global recession. Markets are in “show me” mode and were down 300 prior to the announcement.

Quantitative Easing has become the cure for all problems. So, if it doesn’t work, try, try again? The Fed has now used up all its dry powder levitating the stocks, with the market already at a 1.00% yield for ten-year money. We need a vaccine, not a rate cut. New York schools close on virus fears.

The Beige Book says Corona is a worry, in their minutes from the last Fed meeting six weeks ago, mentioning it 48 times in yesterday’s report. No kidding? Travel and leisure are the hardest hit, and international trade is in free fall. The presidential election is also arising as a risk to the economy. Worst of all, the new James Bond movie has been postponed until November. The report only applies to data collected before February 24.

The next recession just got longer and deeper, as the Fed gives away the last of its dry powder. It’s the first time the central bank was used to fight a virus. It only creates more short selling and volatility opportunities for me down the line. Thanks Jay!

Gold ETF assets hit all-time high, both through capital appreciation and massive customer inflows. Fund values have exceeded the 2012 high, when gold futures reached $1,927. They saw 84 metric tonnes added to inventory in February. The barbarous relic is a great place to hide out for the virus. I expect a new all-time high this year and a possible run to $3,000.

Biotech & healthcare are back! Bernie’s thrashing last week in ten states takes nationalization of health care off the table for good. Biden should sweep most of the remaining states. There’s nothing left for Bernie but Michigan and Florida. Buy Health Care and Biotech on the dip!

The Nonfarm Payroll was up 273,000 in February, much higher than expectations. At least we HAD a good economy. The headline unemployment rate was 3.5%%. As if anyone cares. The only number right now that counts is new Corona infections. This may be the last good report for a while, possibly for years.

Private Payrolls were up 183,000, says the February ADP Report. No Corona virus here. Do you think companies believe this is a short-term ephemeral thing? What if they gave a pandemic and nobody came?

Mortgage Applications were up 26%, week on week, as free money keeps the housing market on fire. Don’t expect too much from the banks though. Mine offered a jumbo loan at 3.6%. Banks are not lining up to sell at the bottom.

The OPEC Meeting was desperate to stabilize prices and they failed utterly. But if they fail to deliver at least 1 million barrels a day in production slowdowns at their Friday Vienna meeting, Texas tea could reach the $30 a barrel handle in days.

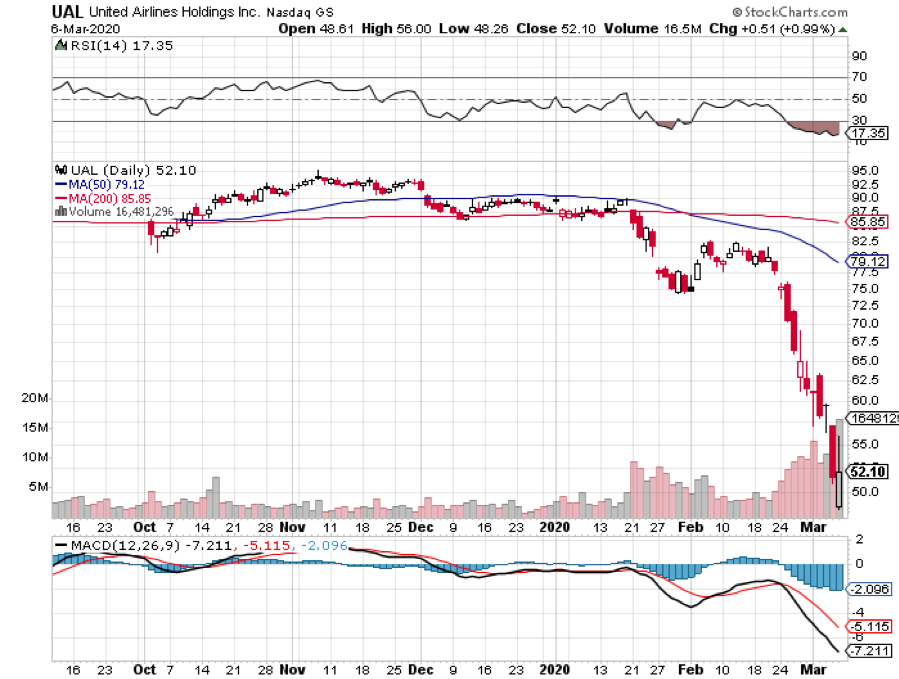

The airline industry will lose $113 billion from the virus, says IATA, the International Air Transport Association. All events everywhere have been cancelled, even my Boy Scout awards dinner for Sunday night and my flight to a wedding in April. Lufthansa just cancelled half of all it flights worldwide. Who knows where the bottom is for this industry? I bet you didn’t know that airline ticket sales account for 8% of all credit card purchases. Keeping my short in United Airlines (UAL).

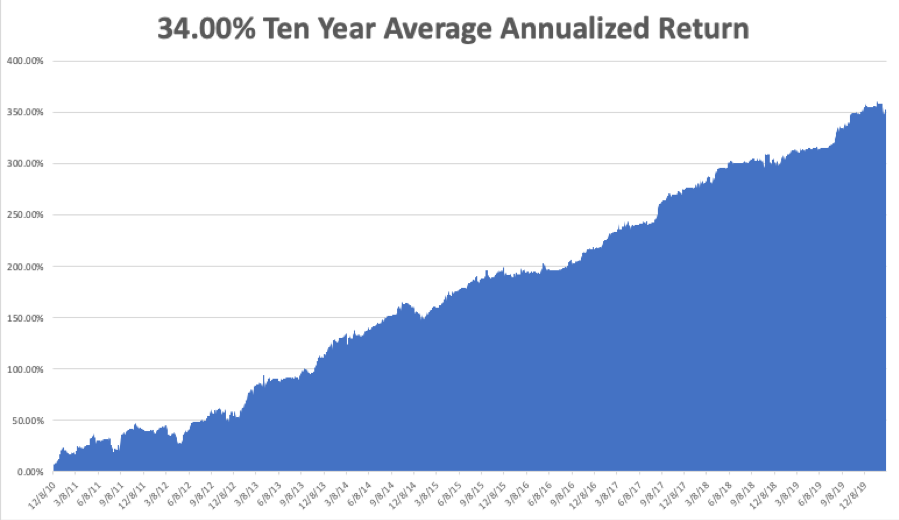

My Global Trading Dispatch performance took a shellacking, pulling back by -4.41% in March, taking my 2020 YTD return down to -7.33%. That compares to a return for the Dow Average of -16% at the Friday low. My trailing one-year return is stable at 48.44%. My ten-year average annualized profit ground back up to +34.00%.

I took my hit of the year on Friday, losing 4.4% on my bond short. A 9-point gap move has never happened in the long history of the bond market. Fortunately, my losses were mitigated by a five-point dip I was able to use to get out, a hedge within my bond position, and three short positions in Corona related-stocks, (CCL), (WYNN), and (UAL), which cratered.

All eyes will be focused on the Coronavirus still, with deaths over 3,000. The weekly economic data are virtually irrelevant now. This is usually the weakest week of the month on the data front.

On Monday, March 9 at 10:00 AM, the Consumer Inflation Expectations is out.

On Tuesday, March 10 at 5:00 AM, the NFIB Business Optimism Index is released.

On Wednesday, March 11, at 7:30 AM, the Core Inflation Rate for February is printed.

On Thursday, March 12 at 8:30 AM, Initial Jobless Claims are announced. Core Producer Price Index for February is also out.

On Friday, March 13 at 9:00 AM, the University of Michigan Consumer Sentiment Index is published. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be shopping for a cruise this summer. I am getting offered incredible deals on cruises all over the world. Suddenly, every cruise line in the world is having sales of the century.

Shall it be a Panama Canal cruise for $99, a trip around the Persian Gulf for $199, or a voyage retracing the route of the HMS Bounty across the Pacific for $299. Of course, the downside is that I may be subject to a two-week quarantine on a plague ship on my return.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader