The Market Outlook for the Week Ahead, or Sell First and Ask Questions Later

I have been learning a new language over the past few weeks (I already speak six).

And like learning any new language, it has been a bumpy road.

I remember a family dinner I had in Tuscany in 1968. The dessert was chocolate cake. I didn’t know how to say “cake” in Italian, so I made up one. I said “Questo e una cacca magnifico”. The entire table burst into laughter. Then my host told me, “You just said this is wonderful shit.”

Oops.

Investors lately have been suffering their own “cacca” moment.

The administration’s economic policies were obscure before the election but very clear now. Pain first, pleasure later….maybe. But they run a great risk that we get into the pain stage and can’t get out with a severe austerity budget during a recession. Investors' response has been to sell now and buy back later when the upside resumes, if and when that ever happens.

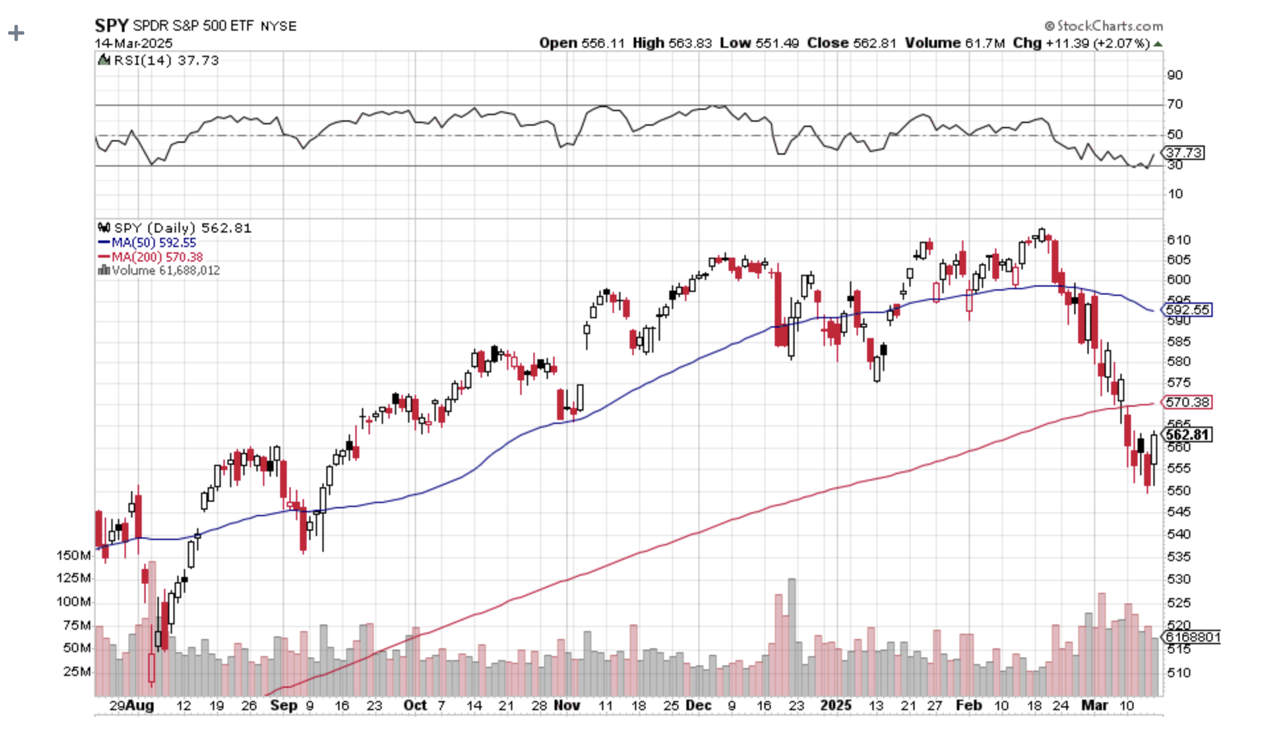

Warning: uncertain stock markets trade at big discounts, not the paltry 10% haircut we have seen so far over the past month. They drop by half. (SPY) price earnings multiples have just dropped from 22X to 20X in four weeks. 18X, where we fell to in 2018, gets you to my down 20% bear market.

Half done….half to go.

Welcome to the brave new world. A “transition” means either a “recession” or “depression,” I’m not sure which yet.

So does “disruption.”

I think that a lot of businesses are going to be committing their own errors of translation in the coming months. For example, is this a recession, or a depression? Let me know when you figure that one out.

In fact, after speaking to clients over the past week, my own vocabulary has been vastly expanded.

It turns out that if you’ve been running a successful business since the pandemic, the last thing in the world you want is for it to be disrupted.

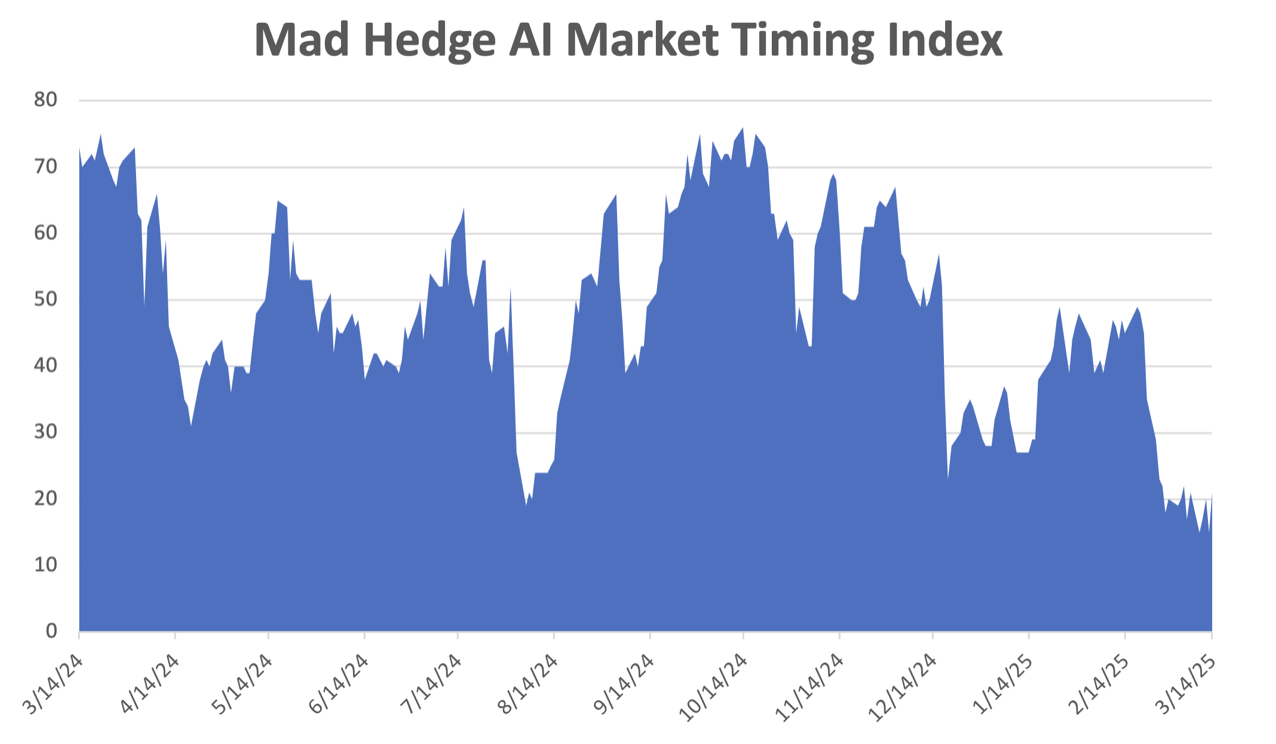

FOMO, or fear of missing out, is long gone. Fear alone is here. Sell first and ask questions later. Market sentiment is horrible and getting worse by the day.

Delta Airlines (DAL) warned us last week that sales may dramatically fall in the coming months, taking the stock down 7%. Consumers dial back discretionary spending during recessions, and at the top of that list are vacation and business travel. With that comment, you can write off the entire travel sector, including all the airlines, hotels, online travel apps, cruise lines, and rental car companies.

And other than that, how was the play Mrs. Lincoln?

And you wanted uncertainty? This is the Golden Age of Uncertainty.

The steel tariff rose from 25% to 50%, on Tuesday, then Ontario imposed a 25% duty on electricity exports to the US, then the US cut their steel tariff back to 25% and the electricity tariff went away. Every American car requires 1,000 pounds of steel and Michigan, Minnesota, and New York get the bulk of their electricity from Canada, which has abundant hydro.

An intraday trade war?

I love following anecdotal recession indicators and one is no farther than your own television set.

When CNBC runs back-to-back promotions of its own programs, it means they haven’t been able to sell those slots. Brokers greatly dial back their advertising because customers only open new accounts in rising markets, not falling ones. Greed is gone. And you see a lot of new companies ramp up ads because the price has fallen to where they can afford them. Notice the constant ads these days from eBay and Mark Cuban?

And what is the most common expression in the English language right now? “I don’t know.”

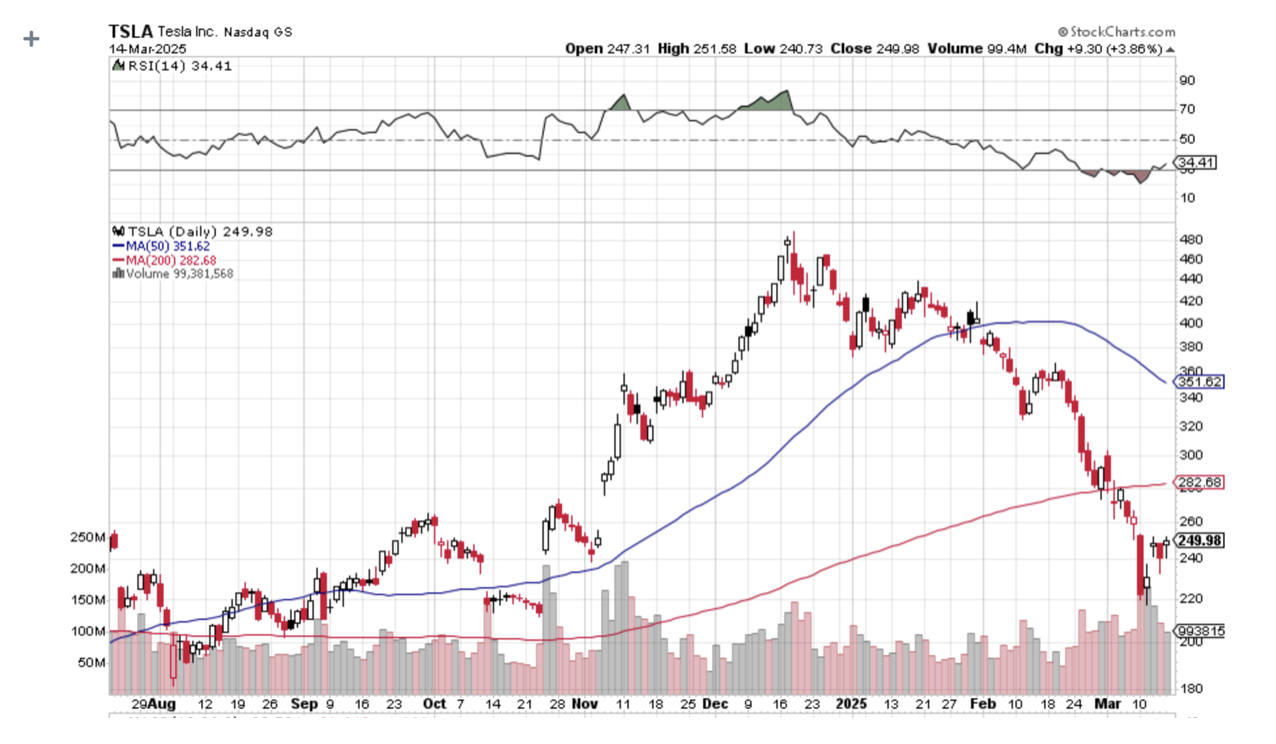

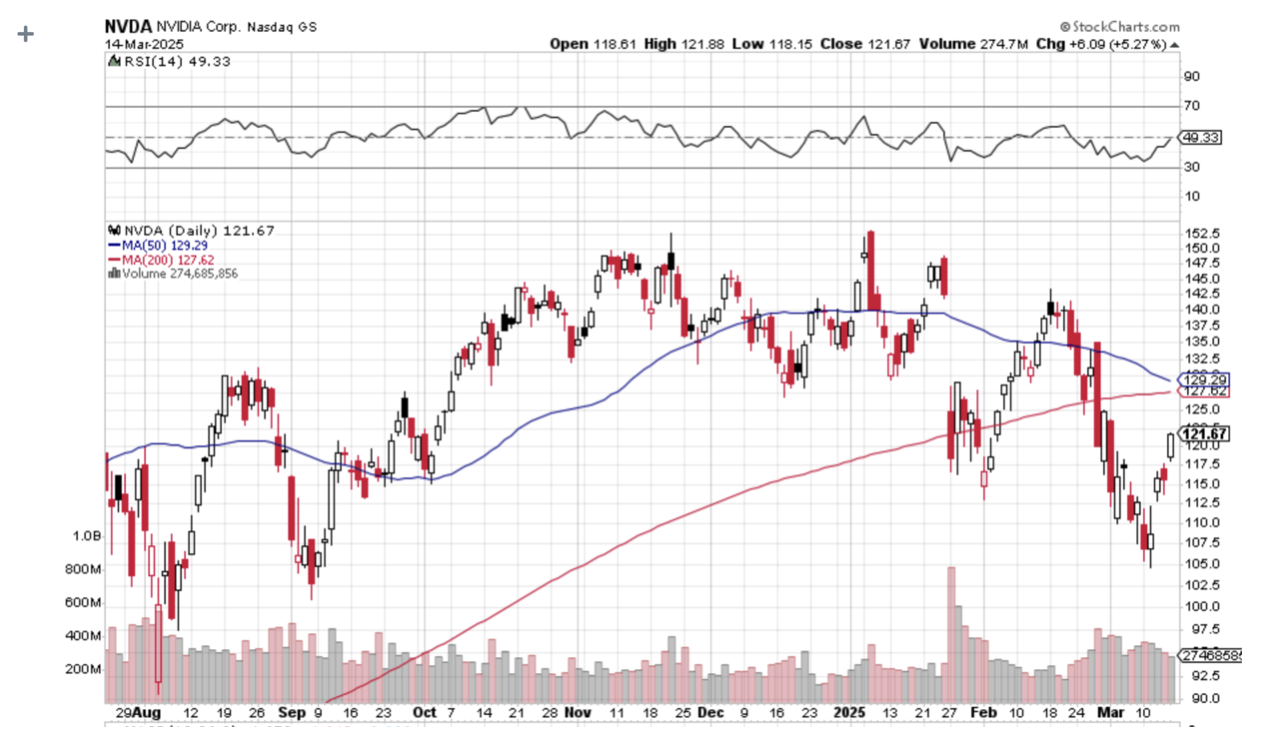

Three places to keep an eagle eye on right now for short-term market direction and risk-taking: Tesla (TSLA), Nvidia (NVDA), and the Volatility Index ($VIX). Watch the movement of these three bellwether stocks and you can guess where the rest of the market is going right now.

And just a reminder, the average recession performance of the S&P 500 (SPY) for the past 80 years is a decline of 34%. It backs my own forecast of a 20% decline looks positively bullish and the current level of a 10% pullback looks insanely optimistic.

Yes, even down here stocks are still expensive.

And here is the cruelest math of all.

The Average American now has to work an extra seven years, to get their retirement fund back to where they were at the market top on February 19, assuming a 45-year work life. With the S&P 500 now down 10%, the typical retirement fund is off 15%, since they were overweight technology stocks. That is especially true if they were just about to retire. That is unless they have been following Mad Hedge Fund Trader, in which case they are probably up on the year like I am.

How bad can it get?

The Bull Case

We are now in a recession that will probably

cost us -6% to -7% over two to three quarters like it did during the pandemic and then

ends with a $5 trillion tax cut for 2026

(SPY) down 20%-30%, and then we recover

Or

The Bear Case

No tax cut means we enter a depression

and lose 25% of GDP over 4 years

(SPY) down 60%, and then we recover

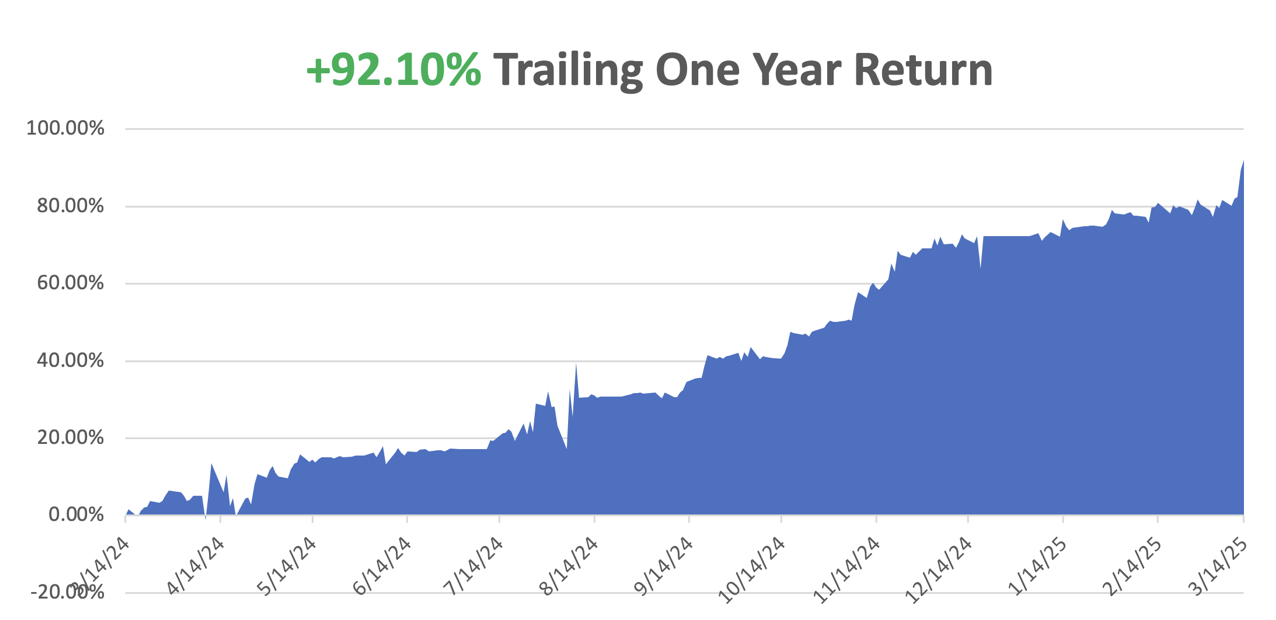

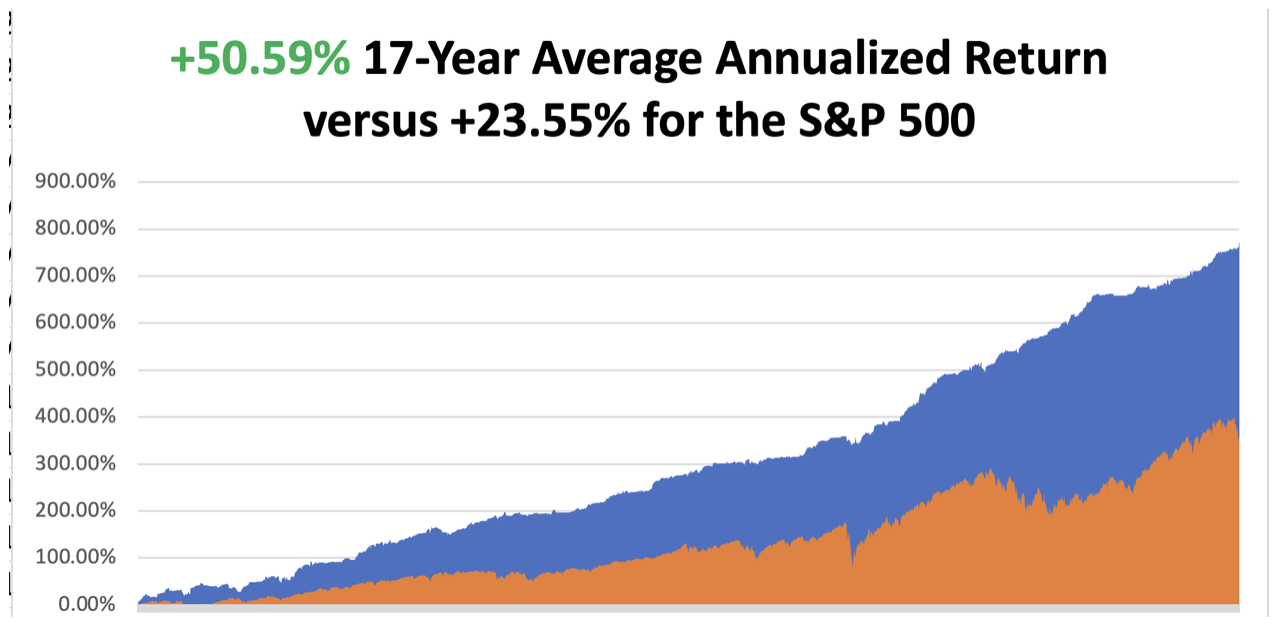

March is now up a spectacular +10.21% return so far. That takes us to a year-to-date profit of +19.68% so far in 2025. That means Mad Hedge has been operating as a perfect -2X short S&P 500 ETF since the February top. My trailing one-year return stands at a spectacular +92.10%. That takes my average annualized return to +50.59% and my performance since inception to +771.57%.

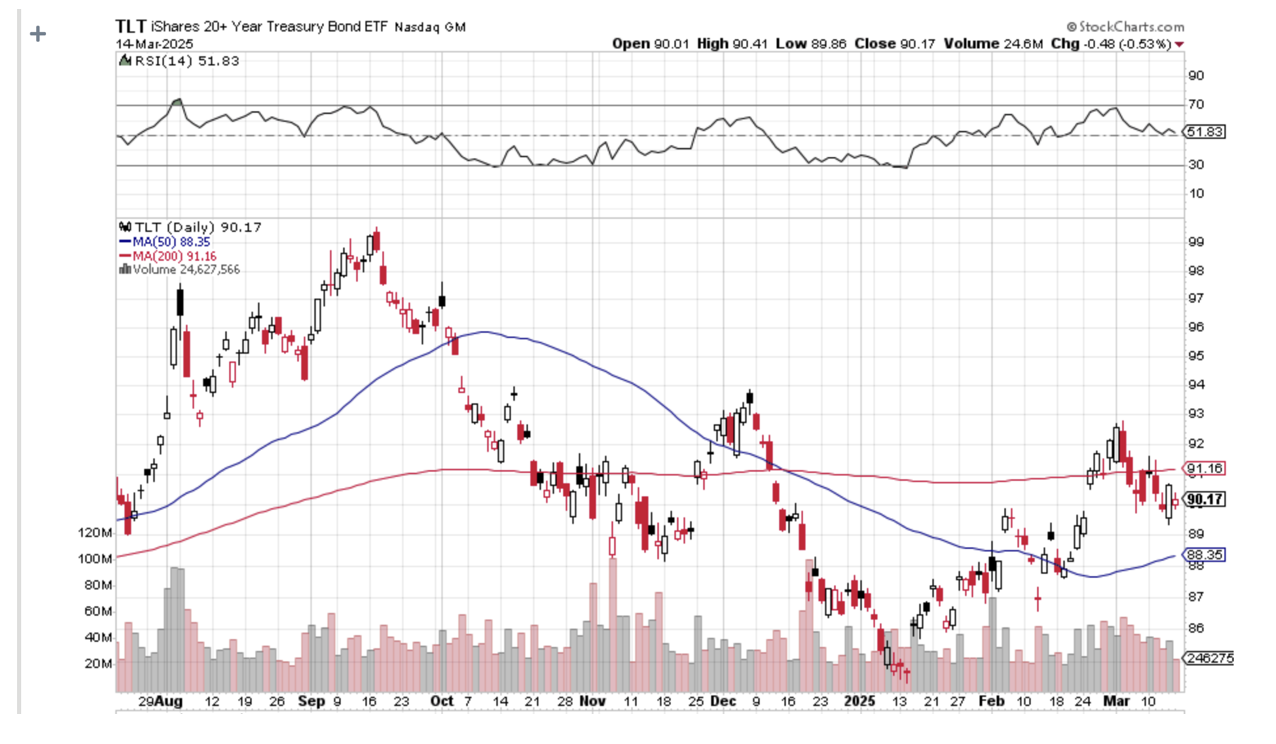

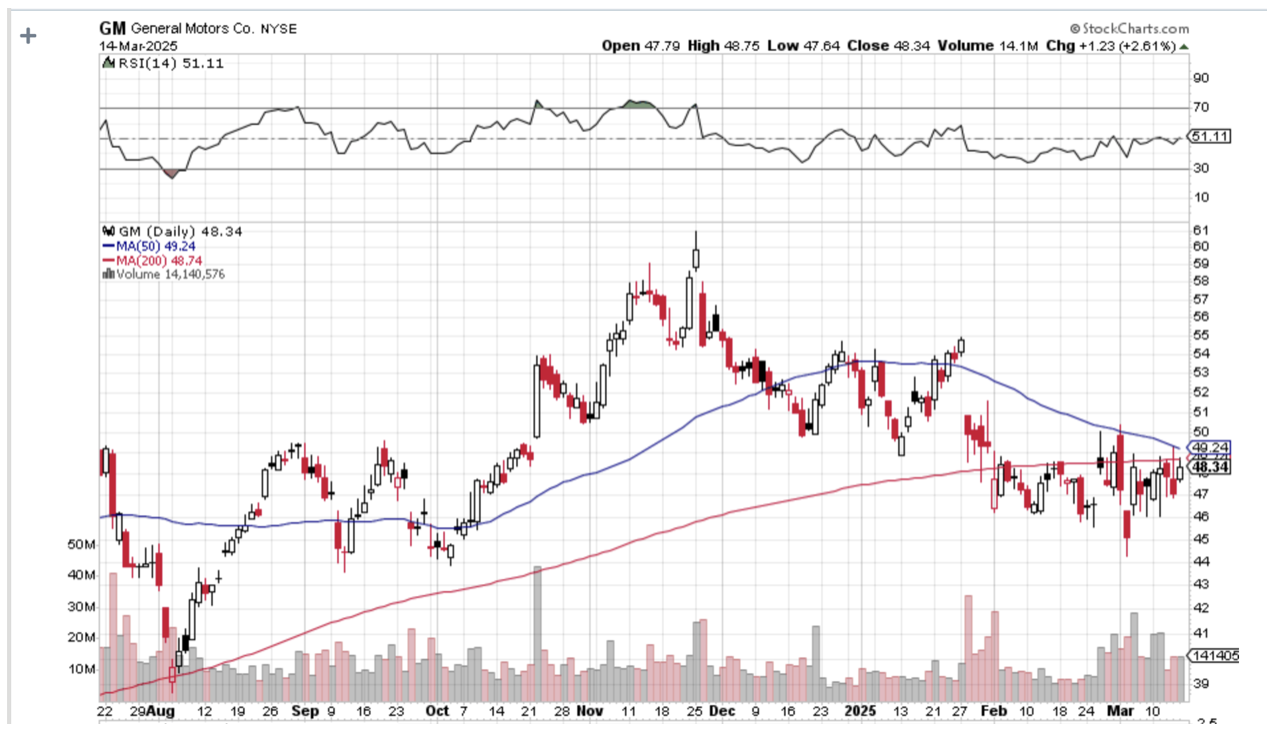

It has been another busy week for trading. I stopped out of my last longs in (IBKR) and (TSLA) for small losses. I added new short positions in (GM), (NVDA), (SH), and (TSLA). I took profits on a short position in (NVDA). I also strapped on a (TLT) trade betting that interest falls going into a recession.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

Stocks Suffer Worst Day in 3 Years but bounced off the 10% correction level at $5,550 for the (SPX). The government has abandoned Keynesianism, the principal economic model for the country for 90 years. It’s cutting spending as we head into recession. We now have a reverse hockey stick on share price valuations, with sales falling and multiples shrinking at the same time. Lower lows for everything beckon.

University of Michigan Consumer Confidence Collapses, at 57.0 versus an estimated 63.2, a four-year low. Expectations were already low, taking the Dow Average on a 300-point swoosh down, which it immediately recovered. Remember, this is a lagging indicator, and that confidence is likely much lower now.

Fed Interest Rate Cut is Back on the Table, 25 basis points on June 18, as recession fears explode. A recession will drop overnight rates to 3%, and eventually 2%.

Ceding US Leadership Will Send Stocks to Big Discounts, the guaranteed result of Trump's new foreign policies. That’s the opposite of the existing order which sent American stocks to big premiums for 80 Years. That’s why there is a massive outpouring of capital from the US to Europe causing the huge outperformance of the German stock market, up 28% YTD.

Yen Carry Trade unwind sends Japanese currency soaring, as hedge funds de-gross or reduce overall positions. That means a lot of yen buying and US dollar selling. The Japanese currency has risen by 10% against the US dollar this year.

Trump Administration to Pursue Alphabet Breakup, continuing Biden era policy. The good news? The move could enrich investors, as a breakup would double the value of the individual parts, as it did with AT&T. Buy (GOOGL) on dips.

Government to Change GDP Calculations, knocking out government spending, about a quarter of the total. The goal is to create artificially high GDP numbers and obscure the negative impact of government spending cuts. Expect multiple GDP estimates to proliferate soon from the private sector using the old model. This is against a backdrop of the sudden end of many government data services, from demographics to the weather.

Chaos Hits Economy, forcing businesses to forestall decisions and market down earnings. Job security has vaporized, forcing consumers to dial back on spending. Virtually every economic data point has rolled over and turned negative. The share buyers strike continues, with every client I have only looking to sell rallies. The Volatility Index ($VIX) hits a six-month high at $29. And we have four more years of this?

Delta Airlines Slashes Earnings Forecast, on trade wars and recession scares, taking the shares down 7%. Travel is particularly sensitive to economic slowdowns and declining discretionary spending. Cruise lines have also been hammered. For “Transition” read “Recession”. Avoid all travel plays.

Who is Sitting Pretty Now? Warren Buffet’s Berkshire Hathaway, with $335 billion in cash. Has he started buying yet? No!

US Deficit Hits New All-Time High, in February. The deficit totaled just over $307 billion for the month, nearly 2½ times what it was in January and 3.7% higher than February 2024. Five months into the government fiscal year, the national debt has grown by $5 trillion. Where are those promised savings?

Gold Hits New All-Time High, as Recession Fears Tank Interest Rates, cutting the opportunity cost of holding the Yellow Metal. Mad Hedge is already long and looking to add on dips. The central bank and Chinese retail buying continue unabated.

Tesla to Face Punitive Export Tariffs, as the trade war impact widens. Tesla warned that even with aggressive localization of the supply chain, certain parts and components are difficult or impossible to source within the United States, like large format Panasonic screens. Keep selling Telsa rallies. I’m looking for $160 by summer.

Stock Market Loses $5 Trillion in Market Value, in less than two months, a record loss. Thursday’s decline put the index’s market value down to $46.78 trillion. The decline has come in the shadow of President the expanding trade war with several of the United States’ major trading partners, with headlines about tariffs at times seeming to drive market moves. There have also been signs of slowing economic growth, with weak consumer sentiment surveys and tepid outlooks from retailers like Wal-Mart (WMT).

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, March 17, at 8:30 AM EST, Retail Sales are announced.

On Tuesday, March 18, at 8:30 AM, the Housing Starts and Building Perm are released. The Federal Reserve begins its two-day Open Market Committee Meeting.

On Wednesday, March 19, at 1:00 PM, the Federal Reserve announces its interest rate decision.

On Thursday, March 20, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the Existing Homes Sales.

On Friday, March 21, at 2:00 PM the Baker Hughes Rig Count is printed.

As for me, I was sent reeling with the passing of my old friend, comedian Robin Williams. His mother lived directly next door to my family for many years. A petite widow in her late seventies, we often looked in on her and invited her into our community social group. More than once, I came home to find my late wife chatting with her in the living room over a cup of tea.

Robin, ever the dutiful son, thanked me on many occasions. He volunteered to appear at school fundraisers for my kids. Needless to say, he was a huge hit and brought in buckets of money.

To describe Robin as a giant in his industry would be an understatement. No one could match his stream-of-consciousness outpouring of originality. I know some Disney people who worked with him on the Aladdin animated film where Robin played the genie, and he drove them nuts.

The script was just a starting point for him. You just turned him on, and it was all peripatetic improvisation after that. This forced the ultra-controlling producers to draw the animation around his monologue, no easy trick and the reverse of the usual practice.

When I attended the London premiere of Aladdin, the audience sat with there with their jaws dropped, trying to decode cultural references that were being fired at them a dozen a minute.

It was safe to say that Robin fought a lifetime battle with drug addiction. He only got out of rehab a year earlier for the umpteenth time.

His depression had to be severe. People who knew him well believed that his comedy evolved as a way of dealing with it. He used jokes as weapons to keep the demons at bay. Perhaps that is the price of true genius. In the end, it was probably genetic.

This has been reaffirmed by the many comedians I have met during my life, including Groucho Marx, Bob Hope, George Burns, Jay Leno, Chris Rock, and many others. I see Jay every year at the Pebble Beach Concourse d’Elegance vintage car show where he usually has a prime entrant, who reminds me that over the past 40 years investing in his vintage cars has done better than stocks.

Robin was a very wealthy man, at one point owning a $25 million mansion in San Francisco’s tony Pacifica district. He left behind a wife and a young child. He was at the peak of his career, with another movie coming out at Christmas, A Night at the Museum III, and a sequel to Mrs. Doubtfire in the works.

These are not normally the circumstances where one takes his own life. One can only assume that to do what he did he had to be suffering immense pain.

He will be missed.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader